Best Crypto Exchanges And Apps Of April 2024

Choosing the optimal crypto exchange isn't an easy task. To address this, we conducted comprehensive testing of all major crypto exchanges, organizing them based on our proprietary blockdyor score for clarity and informed decision-making.

After conducting extensive testing of the main exchanges for over a year, we are finally prepared to rank the best crypto exchanges and apps based on our proprietary metric, the blockdyor Score. This metric evaluates the security functions and features of each exchange comprehensively.

Given the volume of exchanges reviewed, in this guide we'll focus only on those implementing standard KYC verification processes. This means users must undergo identity verification by submitting documents before buying or selling Bitcoin or other cryptocurrencies.

While KYC verification processes enhance security, they come with tradeoffs. While they simplify usage, most of the times they imply custodial solutions. Hence, it's advisable to practice self-custody by periodically transferring your coins off exchanges.

Best Crypto Exchanges and Apps of April 2024

This list isn't about favoritism toward any particular exchange; rather, it's the result of thorough testing across various metrics (more on that after the list).

Bitfinex

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bitfinex | 🇪🇺 + more | 0.20% / 0.10% | ⭐⭐⭐⭐ 72/100 |

Why We Chose It

Bitfinex stands as one of the oldest and most established cryptocurrency exchanges, offering a wide set of features. Its comprehensive platform includes spot trading, leverage trading, peer-to-peer trading, lending services, and innovative withdrawal options. Users can withdraw cryptocurrencies like Bitcoin via the main network, Lightning network, or Liquid network, offering an ideal solution to save on fees, especially during periods of high mempool congestion.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Attractive trading fees | ❌ Past instances of regulatory missteps and fines |

| ✅ Comprehensive trading features including margin trading, derivatives, and advanced order types | ❌ Not available in the USA |

| ✅ User-friendly demo trading and mobile app for novice traders |

Overview

Bitfinex, a veteran in the cryptocurrency exchange arena, offers a comprehensive suite of trading options and features, catering to both beginners and seasoned traders. With services ranging from spot trading to margin accounts, and a customizable interface, Bitfinex stands as one of the largest exchanges globally, renowned for its low fees and extensive liquidity.

While Bitfinex has faced regulatory challenges due to its association with the Tether stablecoin, it continues to thrive, constantly evolving to meet the demands of the dynamic crypto landscape. Despite its past controversies, its commitment to providing low fees and top-notch services makes it a preferred choice for traders worldwide.

However, potential users should exercise caution and conduct thorough research into Bitfinex's history and ongoing regulatory issues before engaging with the platform.

Full Review

👉 Click here to open an account on Bitfinex and get a 6% rebate fee.

Kraken

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Kraken | 🇺🇸🇨🇦🇪🇺 + more | 0.26% / 0.16% | ⭐⭐⭐⭐ 62/100 |

Why We Chose It

Kraken has achieved widespread availability across numerous countries, making it accessible to users worldwide. Renowned for its impeccable security record, Kraken has never experienced a hack throughout its years of operation. Moreover, it has consistently kept pace with the evolving crypto landscape by introducing an increasingly diverse range of investment tools.

Kraken offers two main platforms: Kraken Pro, favored by experienced traders due to its low trading and withdrawal fees, and the Kraken "classic", which provides a simpler interface with also convenient dollar-cost averaging (DCA) options. With its broad reach spanning the USA, Canada, Europe, Asia, and beyond, Kraken stands out as a versatile solution suitable for traders of all levels.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ More than 120 coins supported | ❌ Higher fees when not using Kraken Pro |

| ✅ Simple user interface | |

| ✅ High liquidity exchange |

Overview

Kraken, established in 2011, is a San Francisco-based crypto exchange offering over 110 coins and 270 trading pairs. With a focus on security, it provides user-friendly platforms catering to both beginners and experts. Kraken's diverse funding options include fiat deposits and direct crypto purchases.

Fees vary depending on the platform, with Kraken Pro offering lower transaction fees. Kraken remains a popular choice for its reliability, staking opportunities, and advanced trading features. However the higher fees on the standard platform are drawbacks to consider. Overall, Kraken is suitable for traders seeking security and a wide range of crypto options.

Full Review

👉 Click here to open an account on Kraken and get started in minutes with as little as $10.

OKX

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| OKX | 🇪🇺 + more | 0.10% / 0.08% | ⭐⭐⭐ 60/100 |

Why We Chose It

Originally known as OKEx, OKX is a cryptocurrency and derivatives exchange headquartered in Malta. Noteworthy for its significantly lower fees, rapid transactions, robust features, OKX appeals to users with a deeper understanding of the crypto landscape.

It offers several functionalities, including copytrading, earning, loaning, Web3 wallet services, and a unique feature - demo trading. This platform is for those looking to expand their crypto experience and explore more investment opportunities.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low trading fees, with most trades incurring 0.08% or less | ❌ Currently inaccessible to users in the United States |

| ✅ Generous high-interest staking options | ❌ Limited liquidity for some cryptocurrencies |

| ✅ Effortless acquisition of cryptocurrency via credit/debit card, bank account, or digital wallet | ❌ Mixed feedback from previous users |

Overview

OKX is a versatile cryptocurrency exchange offering a range of services for buying, selling, and trading various digital assets. With support for multiple cryptocurrencies and diverse funding methods like credit cards, bank accounts, and mobile wallets, OKX provides easy access to the crypto market. Users can also earn rewards through staking and saving features.

Established in 2017 by Star Xu, OKX boasts a global user base spanning over 100 countries, but it's currently unavailable in the United States due to regulatory constraints. Despite this limitation, OKX offers a comprehensive suite of services, including spot trading, margin borrowing, staking, savings, and more. For those seeking a consolidated platform for their crypto activities, OKX presents a compelling option.

Full Review

👉 Click here to open an account on OKX and get a 10% discount on fees with the BLOCKDYOR code.

Binance

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Binance | 🇪🇺 + more | 0.10% / 0.10% | ⭐⭐⭐ 60/100 |

Why We Chose It

Binance quickly ascended to popularity as the largest crypto exchange by trading volume. It boasts an extensive selection of cryptocurrencies and features, including trading, leveraged trading, P2P trading, copy trading, trading bots, and the innovative Binance Card.

With very low trading fees and their Lite and Pro interfaces, Binance is for the needs of both novice and experienced users alike.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low trading fees, with most trades incurring 0.10% or less | ❌ Currently inaccessible to users in the United States |

| ✅ Easy to use Lite Version | ❌ Recent developments with the former CEO |

| ✅ High Liquidity |

Overview

Binance, founded in 2017 by Changpeng Zhao, stands as the foremost cryptocurrency exchange globally, offering a vast array of digital assets exceeding 500 cryptocurrencies. Operating across 180 countries, Binance serves as a hub for spot and margin trading, staking, lending, and the Binance Visa Card.

With a commitment to user-friendly interfaces and stringent security measures, Binance caters to both beginner and seasoned traders. Its competitive fee structure, coupled with robust security protocols, solidifies its position as a preferred platform in the crypto market. Despite regulatory challenges in certain jurisdictions, Binance maintains its dominance, evidenced by its large trading volumes and global reach.

The exchange's innovative features, including peer-to-peer trading, derivatives, and decentralized finance (DeFi) services, highlight its commitment to fostering financial inclusion and empowerment within the cryptocurrency ecosystem. As the industry evolves, Binance continues to adapt and innovate, driving forward the adoption and accessibility of cryptocurrencies worldwide.

Full Review

👉 Click here to register on Binance and get a 100 USDT cashback voucher.

Coinbase

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Coinbase | 🇺🇸🇨🇦🇪🇺 + more | 0.60% / 0.40% | ⭐⭐⭐ 60/100 |

Why We Chose It

Coinbase stands as one of the oldest and most widely accessible crypto exchanges globally, owing to its robust regulatory compliance. Established in 2012, Coinbase has continuously evolved, achieving significant milestones such as being the first (and currently the only) crypto exchange listed on the NASDAQ. Furthermore, in 2024, it emerged as the primary custodian for the Spot Bitcoin ETFs.

Offering two distinct interfaces, Coinbase caters to a diverse user base. The standard interface, simply known as Coinbase, provides a user-friendly experience suitable for beginners. Conversely, Coinbase Pro, formerly known as GDAX, targets advanced users seeking a more nuanced approach to trading, with features tailored to meet the demands of experienced traders.

Pros & Cons

| Advantages | Disadvantages |

|---|---|

| ✅ Easy to use | ❌ Might be unstable in some moments |

| ✅ Available in many countries | ❌ The trading and exchange fees may be higher compared to other exchanges |

| ✅ The website offers a specialized platform for advanced traders called Coinbase Pro |

Overview

Coinbase is a leading cryptocurrency exchange renowned for its extensive selection of digital assets, user-friendly interface, and educational resources. It caters to both novice traders and experienced investors with its intuitive platform and advanced trading features. Notably, Coinbase prioritizes security, boasting robust measures that have cemented its position as one of the largest exchanges globally.

With over 3000 listed cryptocurrencies and more than 150 trading pairs, Coinbase provides ample opportunities for diversification. It supports various fiat currencies and operates in over 100 countries, offering accessibility to users worldwide. Additionally, Coinbase's minimum deposit requirement is low, starting at $2 or €1.99.

While Coinbase's fees may be slightly higher compared to some competitors, its range of services justifies the cost. The platform's commitment to security, user-friendly interface, and extensive asset selection make it a preferred choice for many cryptocurrency enthusiasts.

Full Review

👉 Click here to open an account on Coinbase and get a €/£/$10 bonus.

Uphold

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Uphold | 🇺🇸🇨🇦🇪🇺🇬🇧 + more | 0.00% / 0.00% | ⭐⭐⭐ 59/100 |

Why we chose it

Uphold stands out among exchanges with its unique interface, diverging from the conventional model to prioritize user-friendliness. Its adoption of a spread model over commission-based fees simplifies comprehension, particularly for beginners.

Additionally, Uphold's availability in the USA, Europe, and the UK positions it as a widely accessible and regulated solution, conducive to mass adoption. Offering access to over 250 cryptocurrencies, Uphold is esteemed by a diverse range of users globally.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Not just crypto, but also commodities | ❌ Variable spread |

| ✅ Cross-asset trading | ❌ Lacks Pro functions |

| ✅ Earn rewards with crypto staking | ❌ Metals trading is not available for European customers |

Overview

Uphold is not your typical crypto exchange; it offers a versatile platform where users can easily buy, sell, and trade a wide range of assets, including cryptocurrencies, precious metals, and traditional currencies.

What sets Uphold apart is its unique cross-asset trading functionality, allowing users to seamlessly trade between different types of assets.

Alongside its diverse market portfolio, Uphold provides additional financial services such as the Uphold Card, Staking, and Fee-free Payments. With a wide range of supported assets, over 250 cryptocurrencies, and availability in the USA, Europe, and the UK, Uphold caters to the needs of both individuals and businesses, offering a comprehensive platform for managing financial assets with ease and efficiency.

Full Review

👉 Click here to open an account on Uphold and start trading with zero fees.

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

Bybit

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bybit | 🇪🇺 + more | 0.10% / 0.10% | ⭐⭐⭐ 58/100 |

Why We Chose It

Bybit swiftly rose to prominence as a major player in the cryptocurrency derivatives trading sector. While it does provide spot crypto trading and entry-level solutions, its extensive array of tools suggests it caters predominantly to advanced users.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Up to 100x leverage on crypto | ❌ Not available in the U.S. |

| ✅ Advanced tools supported by great technology | ❌ Crypto derivatives can be risky |

| ✅ Risk-free test environment to learn and experiment | ❌ Unregulated |

Overview

Bybit stands out in the cryptocurrency exchange landscape due to its specialization in derivatives trading, complemented by an array of advanced trading tools. Prioritizing security and operational reliability, Bybit ensures minimal downtime for its global user base, surpassing 10 million users worldwide. Notably, Bybit is headquartered in Dubai, United Arab Emirates, and operates under the regulations of the British Virgin Islands.

Offering spot, derivatives, and options trading, Bybit empowers traders with leverage of up to 100:1, facilitating diverse crypto product access and market trend capitalization. Founded in 2018 by Ben Zhou, Bybit swiftly gained traction, capturing 10% of the global BTC volume within its first year. The platform's commitment to innovation is evident through partnerships with prestigious entities like Borussia Dortmund and Oracle Red Bull Racing.

Despite its absence in the United States and regulatory adherence to the British Virgin Islands, Bybit's extensive suite of products and dedication to security positions it as a premier choice for advanced traders globally.

Full Review

👉 To register on Bybit and get up to 5,030 USDT in bonuses, click here.

KuCoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| KuCoin | 🇪🇺 + more | 0.10% / 0.10% | ⭐⭐⭐ 57/100 |

Why We Chose It

KuCoin is a cryptocurrency platform renowned for its emphasis on altcoins, often referred to as "hidden gems." Alongside offering a robust automated trading solution and a KuCoin card to spend crypto, the platform boasts various additional features.

Since its inception, KuCoin has burgeoned into one of the foremost exchanges worldwide, boasting significant trading volume and amassing a vast user base exceeding 10 million individuals across over 200 nations. However, despite its widespread global presence, KuCoin is not accessible to residents of the United States due to a lack of licensing to operate within the country.

Overview

KuCoin has grown rapidly as a global cryptocurrency exchange, attracting over 10 million users across 200 countries. However, it's inaccessible to US residents due to regulatory restrictions, posing withdrawal risks during regulatory actions. Despite limitations, KuCoin offers diverse features like altcoin trading and the KuCoin card. It emphasizes security with encryption and 2FA but requires KYC for all users. The platform provides a user-friendly interface, various altcoin options, and multiple fiat onramps. Though KuCoin faced a major security breach in 2020, it remains compliant with regulations and enhances security measures. Overall, KuCoin provides a comprehensive trading experience, but users should remain cautious and informed about regulatory and security issues.

Full Review

👉 Click here to open an account on KuCoin and get a 20% discount on trading fees.

Young Platform

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Young Platform | 🇪🇺 + more | 0.20% / 0.20% | ⭐⭐⭐ 57/100 |

Why We Chose It

Accessible in select European countries, Young Platform has gained recognition for its excellent educational resources and diverse range of altcoins. It primarily caters to crypto beginners, with a focus on buy-and-hold strategies or spot trading (Pro app is also available). Additionally, it offers staking options for users interested in earning rewards with altcoins.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Wide selection of cryptocurrencies | ❌ Mandatory KYC |

| ✅ Easy to use interface | ❌ Limited availability in certain regions |

| ✅ Recurring crypto purchase feature | ❌ Limited regulatory information |

Overview

Young Platform is an Italian cryptocurrency exchange catering primarily to English, French, and Italian-speaking users across Europe. Offering a user-friendly experience, it facilitates buying, selling, and trading cryptocurrencies against traditional currencies like Euros. Beyond being just an exchange, Young Platform provides educational resources for crypto newcomers and innovative apps rewarding users for various activities. For seasoned traders, it offers an advanced exchange with tools for informed decision-making. Despite concerns about its native token's value decline, Young Platform remains a versatile platform. It supports over 250 cryptocurrencies, provides fiat onramps/offramps, and offers specialized platforms for different trading needs. Positive reviews and commitment to user satisfaction indicate a promising platform for European crypto enthusiasts.

Full Review

👉 Click here to open an account on Young Platform.

BitMEX

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bitmex | 🇪🇺 + more | 0.0750% / 0.0200% | ⭐⭐⭐ 56/100 |

Why We Chose It

BitMEX is dedicated to professional traders often explore advanced strategies like leveraged contracts, margin trading, and derivatives to maximize gains in the crypto markets and it's actually the best of it. Thanks to their taker/maker fees very low, it's a great options for crypto traders.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ High Leverage: Offers high leverage, up to 100x. | ❌ Limited Cryptocurrency Options: BitMEX primarily supports Bitcoin derivatives. |

| ✅ Advanced Trading Features: Provides advanced trading tools, including futures and perpetual contracts. | ❌ Complex Interface: Interface may be overwhelming for beginners. |

| ✅ Liquidity: Generally has high liquidity, enabling large trades. | ❌ No Fiat Trading: BitMEX does not support direct fiat trading; users must buy crypto first. |

Overview

BitMEX, founded in 2014 by Arthur Hayes, offers a platform for professional traders to employ advanced strategies like leveraged contracts, margin trading, and derivatives in the crypto markets. Despite its global accessibility, BitMEX is not available to residents of the United States and select other countries. It provides a straightforward onboarding process, with no minimum deposit or deposit fees. With low taker/maker fees, BitMEX is an attractive option for crypto traders seeking optimal trading conditions. The platform specializes in derivatives trading, offering perpetual contracts, futures contracts, and predictions contracts. Additionally, BitMEX facilitates spot trading, simplifying the process of acquiring cryptocurrencies directly within the platform. It features unique functionalities such as Buy Crypto and Convert, enabling users to purchase cryptocurrencies and convert between different assets. Guilds on BitMEX offer benefits like lower fees and rewards for members. Despite facing legal scrutiny, Arthur Hayes remains a prominent figure in the crypto industry, emphasizing the platform's commitment to disrupting traditional finance systems and promoting cryptocurrency adoption.

Full Review

👉 Click here to join BitMEX and receive a 10% fee discount for the first six months.

Gemini

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Gemini | 🇺🇸🇨🇦🇪🇺 + more | 0.40% / 0.20% | ⭐⭐⭐ 56/100 |

Why We Chose It

Founded by the Winklevoss twins, Gemini is one of the oldest platforms in the cryptocurrency industry. Despite facing challenges with the Gemini Earn crypto asset lending program, the platform has persevered and maintained its reputation for excellence. Gemini caters to both beginners and professional traders, offering a user-friendly experience and a Pro version app for advanced users. It is recognized as one of the largest exchanges in both Europe and the USA. While Gemini's customer support could be improved, it remains a top choice for individuals seeking a reliable and reputable cryptocurrency exchange.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Security | ❌ Limited Altcoins |

| ✅ User-Friendly Interface | ❌ No Phone Support |

| ✅ Regulatory Compliance | ❌ Mixed Customer Reviews |

Overview

Gemini, established in 2014 by the Winklevoss Twins, is a reputable cryptocurrency exchange based in New York, USA. The platform has earned trust in the crypto industry by prioritizing regulatory compliance and security measures. With a user-friendly interface and support for over 30 cryptocurrencies, Gemini offers trading, staking, and investment services to users in 60+ countries, including all 50 U.S. states. While enforcing strict KYC verification, it ensures reliability and safety, attracting both beginners and experienced traders. Gemini's features include a derivatives trading platform, staking services, and the Gemini Credit Card, allowing users to earn cryptocurrency rewards on everyday purchases. The exchange's transparent fee structure and 24/7 customer support contribute to its appeal. Available on iOS and Android, Gemini's mobile app extends trading capabilities to smartphones, providing convenience and accessibility to users on the go.

Full Review

👉 Click here to sign up for Gemini and trade at least $100 to get free crypto.

Nexo

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Nexo | 🇪🇺 + more | 0.40% / 0.30% | ⭐⭐⭐ 55/100 |

Why We Chose It

Nexo is not just a crypto exchange but a comprehensive financial platform offering borrowing capabilities, a crypto rewards card, and other unique features. With over 5 million users across 200 countries, Nexo navigates global markets, though certain products are restricted in regions like the US due to regulatory considerations. Despite limitations, Nexo maintains a strong value proposition with stringent security, zero-fee trading, and over 60 cryptocurrencies available for borrowing.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Earn Interest | ❌ Limited Geographic Availability |

| ✅ Instant Crypto Credit Line | ❌ Risk of Volatility With Leveraged Products |

| ✅ Nexo Card and Cashback |

Overview

Nexo, established in 2018, is more than a crypto exchange; it's a multifaceted financial platform offering borrowing capabilities and a crypto rewards card. However, certain products face restrictions in regions like the US due to regulatory complexities. Despite limitations, Nexo distinguishes itself with stringent security measures, zero-fee trading, and access to over 60 cryptocurrencies for borrowing. Notably, Nexo prioritizes regulatory compliance, adhering to KYC protocols for user verification. The platform's commitment to innovation and user-centric services has contributed to its resilience in navigating both favorable and challenging market conditions.

Full Review

👉 Click here to join Nexo and get up to 0.5% in crypto rewards on your purchase. Sign up now.

Bitstamp

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bitstamp | 🇺🇸🇨🇦🇪🇺 + more | 0.40% / 0.30% | ⭐⭐⭐ 45/100 |

Why We Chose It

Although one of the oldest exchanges, Bitstamp remains a viable option, albeit lacking certain features found on other platforms. Nevertheless, for those seeking to buy and profit from a select range of cryptocurrencies, Bitstamp reliably fulfills its purpose. Its longevity and favor among OG investors attest to its enduring reliability.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Intuitive interface | ❌ Limited selection of supported cryptocurrencies (54 options) |

| ✅ Competitive fee structure | ❌ Limited staking options (maximum rate of 4.5% APR, only two currencies available, not available to US-based clients) |

| ✅ Over a decade of experience in cryptocurrency exchange | ❌ No leverage trading or lending options |

Overview

Bitstamp, founded in 2011, stands out as a user-friendly cryptocurrency exchange offering low fees, catering to both novices and seasoned traders. Despite not supporting all cryptocurrencies, its review details help in determining suitability. With offices in Luxembourg, the UK, USA, Singapore, and a New York base, Bitstamp serves over 4 million global users. Supporting trading in 80+ cryptocurrencies, it boasts competitive fee structures. Offering diverse trading options via its intuitive web interface, advanced trading platform, and mobile app, Bitstamp prioritizes user experience. Security-wise, the exchange safeguards 98% of assets in offline cold storage, supplemented by crime insurance. Two-factor authentication and address whitelisting further enhance security. Its tiered fee structure, employing the maker-taker model, adjusts fees based on trading volume. Bitstamp supports various funding methods like bank transfers, card purchases, and direct crypto deposits. Despite mixed Trustpilot reviews, Bitstamp remains a significant player in the cryptocurrency exchange landscape, continually refining its offerings to meet user needs.

Full Review

How To Choose The Best Crypto Exchange

For those looking for the optimal, most cost-effective, and secure method to purchase Bitcoin or other cryptocurrencies, using a crypto exchange is paramount. While alternative avenues such as peer-to-peer transactions or ATMs are available, exchanges offer a more convenient and reliable option, particularly for frequent traders.

Crypto exchanges, particularly those with Know Your Customer (KYC) protocols mentioned in this guide, typically feature significantly lower fees compared to peer-to-peer alternatives. However, this convenience often comes at the expense of privacy, as users are required to submit personal identification information for transactions.

Regulated exchanges, such as those highlighted here, offer the utmost security and compliance standards for obtaining crypto assets. Yet, there are additional compelling reasons to opt for these platforms:

- Accessibility: Crypto exchanges facilitate buying and selling through web-based or mobile applications, ensuring convenient access for users across devices.

- Diverse Offerings: Many exchanges not only support Bitcoin but also offer a wide array of tokens and commodities, enabling investors to diversify their portfolios.

- Security Measures: Leading exchanges prioritize security by storing user funds in multisignature cold storage vaults, bolstering the safety of assets. Some even provide periodic proof of reserves for added transparency.

- Regulatory Compliance: The majority of exchanges adhere to KYC/AML regulations and other financial standards, with some holding banking licenses. This regulatory framework minimizes the risk of fraudulent activities, although it's essential to remain cautious given historical instances of crypto bankruptcies.

By selecting a reputable and regulated crypto exchange, users can navigate the cryptocurrency market with confidence, leveraging the benefits of accessibility, diversity, security, and compliance.

How to Register for a Crypto Exchange

Signing up for an exchange is a straightforward process, not much different from opening a brokerage or bank account. In fact, it's often faster and simpler. Before proceeding, ensure you have an identification document handy, such as your driver's license or passport, and access to a device with a webcam or smartphone, as you may be required to take a photo of your document or use a facial recognition system.

Here are the general steps every investor should follow:

- Account Registration: Begin by opening an account. Typically, you'll need to provide your email and choose a password. Afterward, you'll receive a confirmation email to verify your ownership of the provided email address. Some exchanges may also require the use of a two-factor authentication (2FA) app like Google Authenticator or Authy. Enter all required information and securely store your login credentials, perhaps using a password manager like Bitwarden. Alternatively, consider solutions like the Black Seed Ink Cold Wallets for storing passwords offline.

- Personal Information: Next, you'll be prompted to provide personal details, such as your name, address, phone number, and in some cases, a scan or photo of your passport or driver's license.

- Verification Process: Once you've submitted your information, you'll need to wait for the verification process to complete. This could take minutes, hours, or even days, depending on the exchange. Once verified, you'll gain full access to the exchange's features.

- Account Funding: After verification, it's time to fund your account. You can do this by depositing fiat currency or cryptocurrency, depending on your preference.

How We Rate The Exchanges

You might ask yourself what is the criteria used for creating the list of the crypto exchanges up here. It's very simple, we created a blockdyor Score, which we used to evaluate every single exchange: KYC or Non-KYC and we filtered just the KYC exchanges offering diverse altcoins.

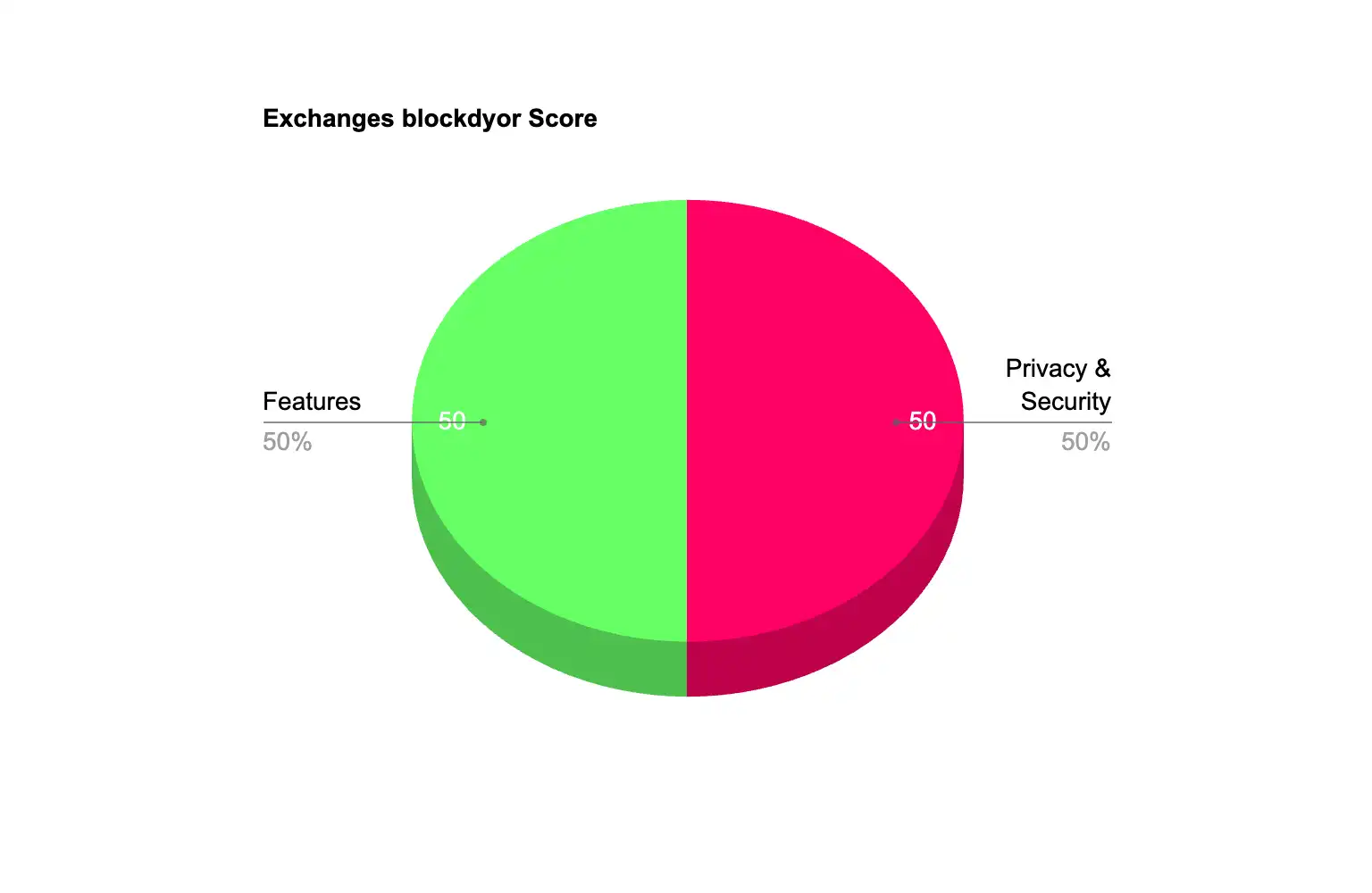

These metrics can be broadly categorized into two main groups: Privacy & Security and Features.

These two categories have sub categories. For example, under features there are Fees, Withdrawal methods supported. And under security you will find the presence or not of the KYC process or the non custodial features and more. The higher the score in these categories, the better the exchange performs. Let's deep dive into the list.

The blockdyor score is a composite evaluation of a crypto exchange based on two main categories: Privacy & Security and Features. Each category is further broken down into specific features, and each feature is assigned a score out of a predetermined maximum score. The higher the score in these categories, the better the exchange performs. Let's deep dive into the list. Let's deep dive into the list.

- Privacy & Security (50 points max):

- Non-KYC: Indicates whether the exchange enforces Know Your Customer (KYC) procedures for every user.

- Non-Custodial: Determines whether the exchange is non-custodial, meaning the users own the private keys and/or can withdraw their funds independently.

- Peer To Peer: Indicates whether the exchange offers peer-to-peer trading.

- Decentralization: Determines whether the exchange is centralized or decentralized.

- Encryption: Evaluates the level of encryption used for confidential data transfers.

- TOR Connection: Indicates whether it's possible to connect to the exchange using TOR.

- Open Source: Determines if some software used by the exchange is open source.

- 2FA: Evaluates whether the exchange offers two-factor authentication.

- Features (50 points max):

- User-Friendly UX: Assesses the ease of use of the exchange's user interface.

- Fiat Onramp/Offramp: Determines the availability of fiat currency deposit and withdrawal methods.

- Taker Fee: Evaluates the fee charged for market orders.

- Maker Fee: Evaluates the fee charged for limit orders.

- Withdrawal Fee: Assesses the fee for withdrawing funds from the exchange.

- Customer Service: Evaluates the availability and responsiveness of customer support.

- Documentation: Assesses the availability and comprehensiveness of documentation on the exchange's official website.

- Altcoins: Determines the variety of alternative cryptocurrencies supported by the exchange.

- Lightning Network Withdrawal/Deposit: Indicates whether the exchange supports Lightning Network for Bitcoin withdrawals and deposits.

- Liquid Network Withdrawal/Deposit: Determines whether it's possible to withdraw or deposit Bitcoin using the Liquid Network.

At blockdyor, we meticulously examined each exchange featured in this article, arranging them based on their blockdyor Score. This approach enables us to craft impartial and thorough reviews, empowering you to make informed investment decisions.

Our team rigorously assessed numerous exchanges and compiled extensive data points to identify our top recommendations. These selections were made considering 18 weighted criteria, such as KYC enforcement (weighted 10%), non-custodial features (weighted 10%), taker/maker fees (weighted 10%), peer-to-peer availability (weighted 5%) and more.

Each feature is rated and contributes to the overall blockdyor Score, which provides an objective measure of the exchange's performance in terms of privacy, security, and features. The final blockdyor score reflects the cumulative assessment of these factors, helping users make informed decisions about the exchange's suitability for their needs.

Bottom Line

Although our current selection focuses solely on KYC-compliant exchanges, future guides will explore additional exchange categories, including Bitcoin-only platforms and P2P-exclusive exchanges. This initial compilation serves as a strong foundation for entering the world of cryptocurrency trading.

Many of these companies have established themselves over several years and are recognized as leaders in the industry, offering sophisticated solutions for buying, selling, lending, borrowing, and more. Embrace this starting point with confidence, as these exchanges represent the pinnacle of excellence in the crypto sphere, ensuring a seamless and advanced experience for all users.