KuCoin Review: Fees, Features and Regulation

KuCoin is a cryptocurrency exchange that offers a wide range of digital assets for trading. It was founded in 2017 and has quickly grown in popularity, with over 11 million customers worldwide.

KuCoin is a cryptocurrency exchange with a global reach spanning over 200 nations, +700 coins and +1200 trading pairs and offers a diverse array of features that may appeal to seasoned traders.

Before starting, it must be noted that the platform operates without the license from any of the regulatory bodies, including those in Europe and the United States.

However, this is not uncommon within the realm of crypto exchanges, as many choose to operate outside the purview of official oversight.

In this article, we will deep dive into this exchange and its trading platform. We will examine its features, costs, coins offerings, debit card integration, its well-known trading bots and other additional components.

👉 Click here to open an account on KuCoin and get a 20% discount on trading fees.

| DESCRIPTION | DETAILS |

|---|---|

| 🌐 Website | kucoin.com |

| 🏙️ Location | Seychelles |

| 📅 Year Founded | 2017 |

| 💰 Primary Token | KCS (KuCoin Token) |

| 📈 Listed Crypto | Over 600 |

| 💱 Trading Pairs | Over 1200 |

| 💵 Supported FIAT | USD, EUR, GBP, CAD, JPY |

| 🌍 Supported Countries | Worldwide |

| 💰 Minimum Deposit | Varies depending on the deposit method |

| 💸 Deposit Fees | Varies depending on the deposit method |

| 💰 Daily Buying Limit | Varies depending on verification level |

| 💱 Transaction Fees | Maker/Taker Fees starting at 0.0125%-0.1% and reducing with trading volume |

| 💸 Withdrawal Fees | Varies depending on the withdrawal method |

| 📱 Mobile App | iOS & Android |

| 💬 Customer Support | Email and Live Chat. |

KuCoin overview

Founded in 2017 by Micheal Gan, KuCoin is a cryptocurrency exchange with its headquarters in the tropical paradise of Seychelles.

Since its establishment, it has flourished into one of the most prominent exchanges globally, with respect to trading volume and has amassed a vast user base of over 10 million individuals, spanning across over 200 nations.

Despite its global reach, KuCoin's accessibility to United States residents is restricted, as it is not in possession of a license to operate within the country.

Thus, opening an account with KuCoin may pose certain hazards, such as the possibility of being unable to withdraw assets in the event of regulatory crackdown by United States authorities.

KuCoin Quick Review

If you're short on time to go through the entire review, check out this concise summary highlighting key aspects of the exchange. At the conclusion of the brief overview, a secure link is provided for opening an account on KuCoin.

| Category | Feature | Score |

|---|---|---|

| 🔐 Privacy & Security (22/50) | ||

| 🕵️ Non-KYC | The exchange enforces the KYC to every user | 1/10 |

| 🔐 Non-Custodial | The exchange is fully custodial, users can withdraw their funds | 2/10 |

| 👥 Peer To Peer | The exchange offers P2P trading | 5/5 |

| 🌐 Decentralization | The exchange is centralized | 1/5 |

| 🔒 Encryption | The exchange encrypts all confidential data transfers | 5/5 |

| 🌐 TOR Connection | It's not possible to connect to the exchange with TOR | 1/5 |

| 📂 Open Source | Some software used by the exchange is open source | 2/5 |

| 📱 2FA | The exchange offers two-factor authentication | 5/5 |

| 🚀 Features (35/50) | ||

| 🖥️ User-Friendly UX | KuCoin interface isn't very easy to use | 2/5 |

| 💵 Fiat Onramp/Offramp | Fiat onramp and offramp methods are many | 5/5 |

| 💸 Taker Fee | From 0.1% (No KCS bonus, Class A Market) it decreases as the trading volume increases and by holding KCS token | 5/5 |

| 💸 Maker Fee | From 0.1% (No KCS bonus, Class A Market) it decreases as the trading volume increases and by holding KCS token | 5/5 |

| 💸 Withdrawal Fee | For BTC (Bitcoin Network) the commission is 0.0005 BTC | 3/5 |

| ☎️ Customer Service | Available via chat and ticket | 3/5 |

| 📚 Documentation | Plenty of documentation on the official website | 5/5 |

| 🚮 Altcoins | Several altcoins supported | 5/5 |

| ⚡ Lightning Network Withdrawal/Deposit | The exchange doesn't support the possibility to withdraw/deposit Bitcoin using the lightning network | 1/5 |

| 💧 Liquid Network Withdrawal/Deposit | Not possible to withdraw or deposit Bitcoin with the liquid network | 1/5 |

| 🧱blockdyor Score (57/100) |

👉 Click here to open an account on KuCoin and get a 20% discount on trading fees.

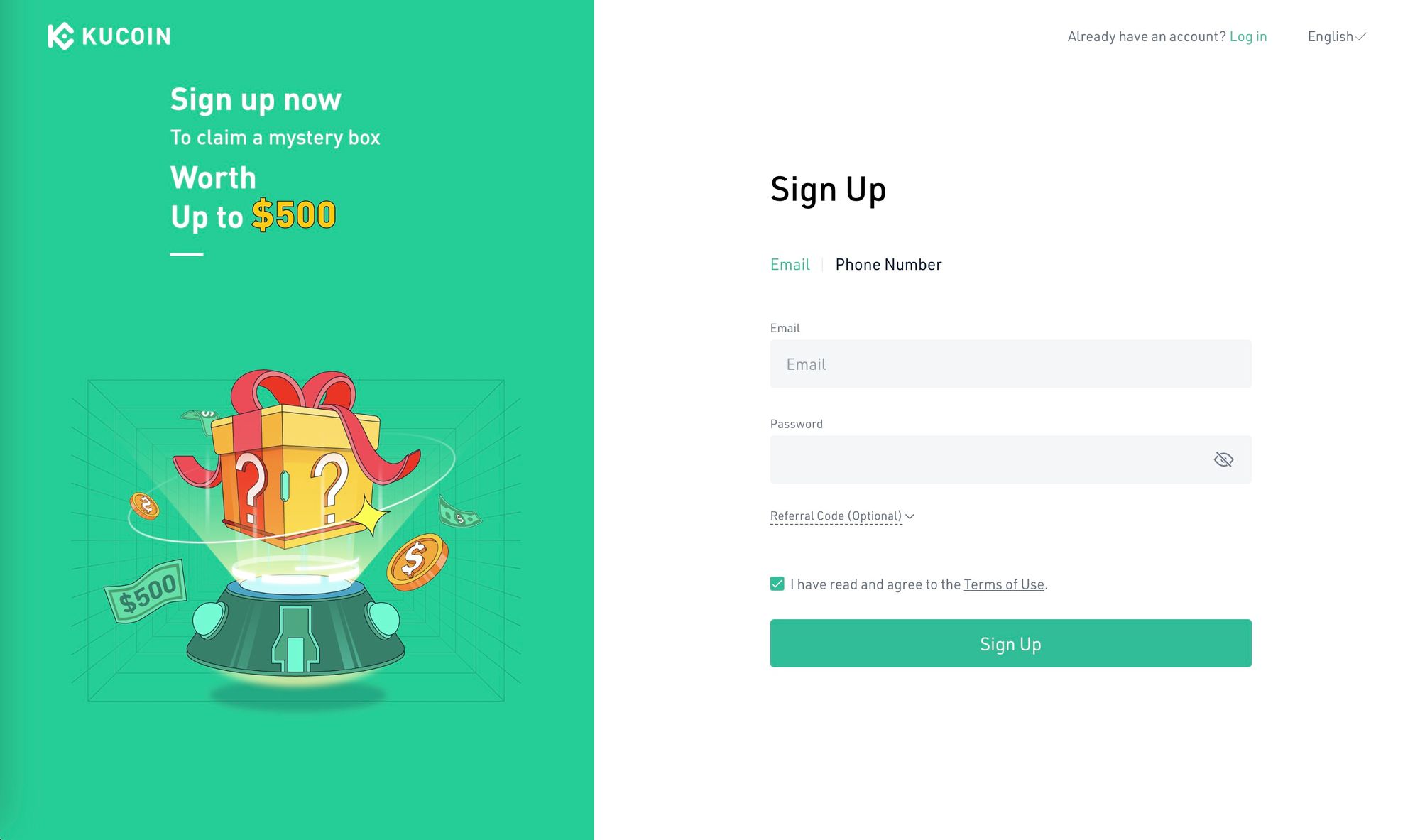

Setting up a KuCoin Account

Opening a KuCoin account is a simple process that can be completed in a few steps.

- Go to the KuCoin website, www.kucoin.com, and click on the "Sign up" button located at the top right corner of the page.

👉 Click here to open an account on KuCoin and get a 20% discount on trading fees.

- Enter your email address (or your phone number) and create a strong password that includes a mix of capital and lowercase letters, as well as numbers.

- After submitting the registration form, you will receive an activation email from Kucoin.

- Check your email inbox and click on the activation link to activate your Kucoin account.

- For added security, it is important to enable two-factor authentication (2FA) using Google Authenticator. This will provide an extra layer of protection for your account.

By following these steps, you will have successfully opened a KuCoin account and can begin buying and selling cryptocurrencies on the exchange. Remember to keep your account information and login credentials secure at all times.

KYC

KuCoin is one of the major exchanges to not require an user verification (KYC) to use most of the functions. Users are able to utilize the platform's functionalities and execute transactions without the need for verified accounts.

However, it should be noted that unverified accounts are subject to a daily withdrawal limit of 1BTC.

Additionally, while it is possible to deposit and withdraw cryptocurrency without KYC verification, access to fiat currency and P2P transactions may be restricted.

Furthermore, in the event of a detected fraudulent transaction, the user may be requested to provide identification verification.

KuCoin Funding Methods

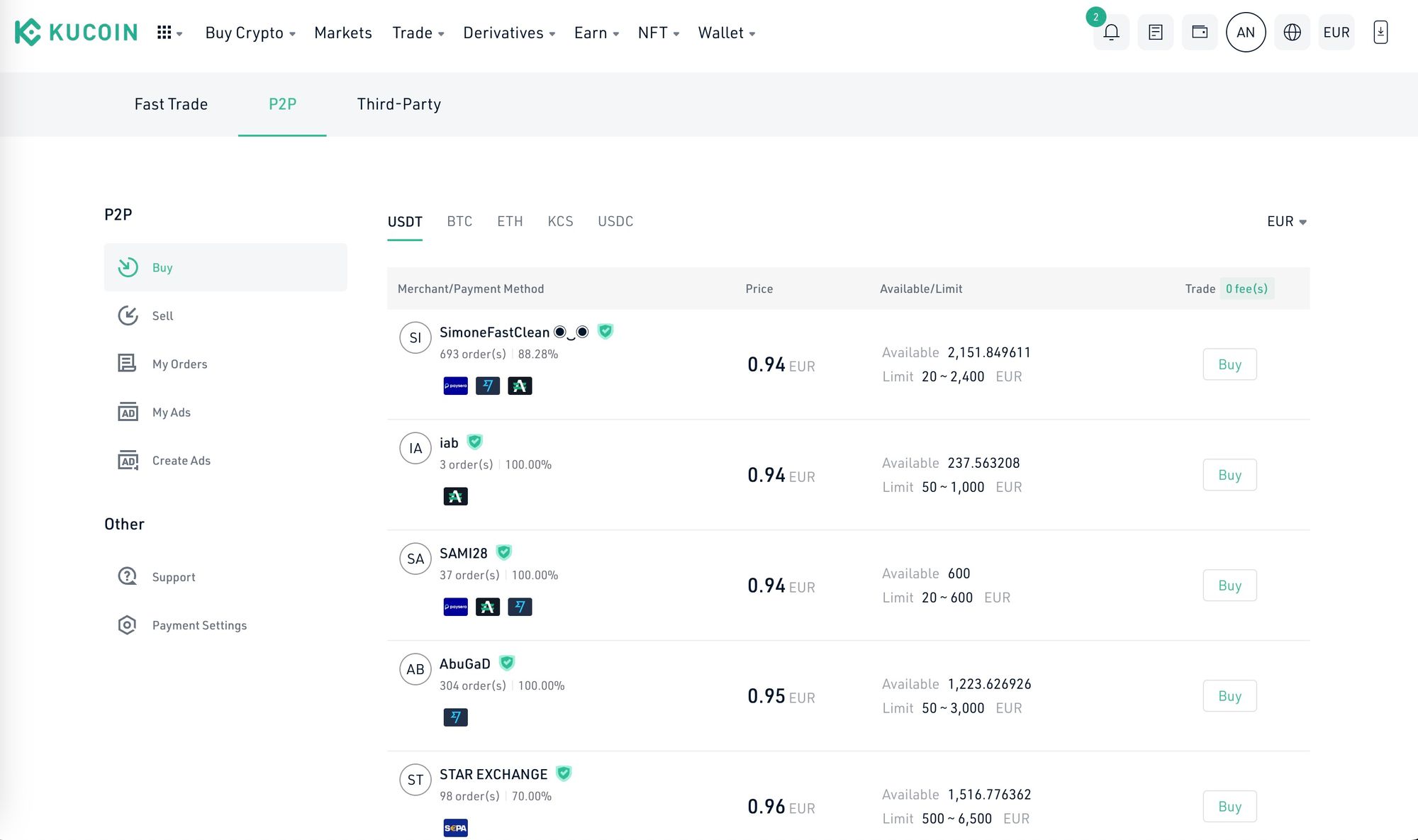

It is possible to make deposits and withdrawals on KuCoin utilizing either fiat currency or cryptocurrency.

- Fiat deposits: at the time of writing, the platform does not permit the utilization of fiat for deposits, however, once rectified, it will be possible to effectuate deposits through the following methods: SEPA, incurring a fee of 0.70, Visa/Mastercard, with a fee of 3.80%.

- Crypto Deposits: Depositing cryptocurrency on KuCoin can be accomplished by transferring it directly from your personal wallet. The platform accepts an almost endless array of coins, including Tether (USDT), Bitcoin (BTC), Ethereum (ETH), KuCoin Token (KCS) among many others.

KuCoin offers a plethora of alternative methods for deposit, such as Fast Trade, P2P, and Third-Party options.

This presents a distinct advantage, as it enables individuals to deposit and withdraw even if traditional fiat options are temporarily unavailable. For instance, one can deposit funds through Apple/Google Pay and withdraw through Revolut or Wise, among other possibilities.

Is KuCoin Safe?

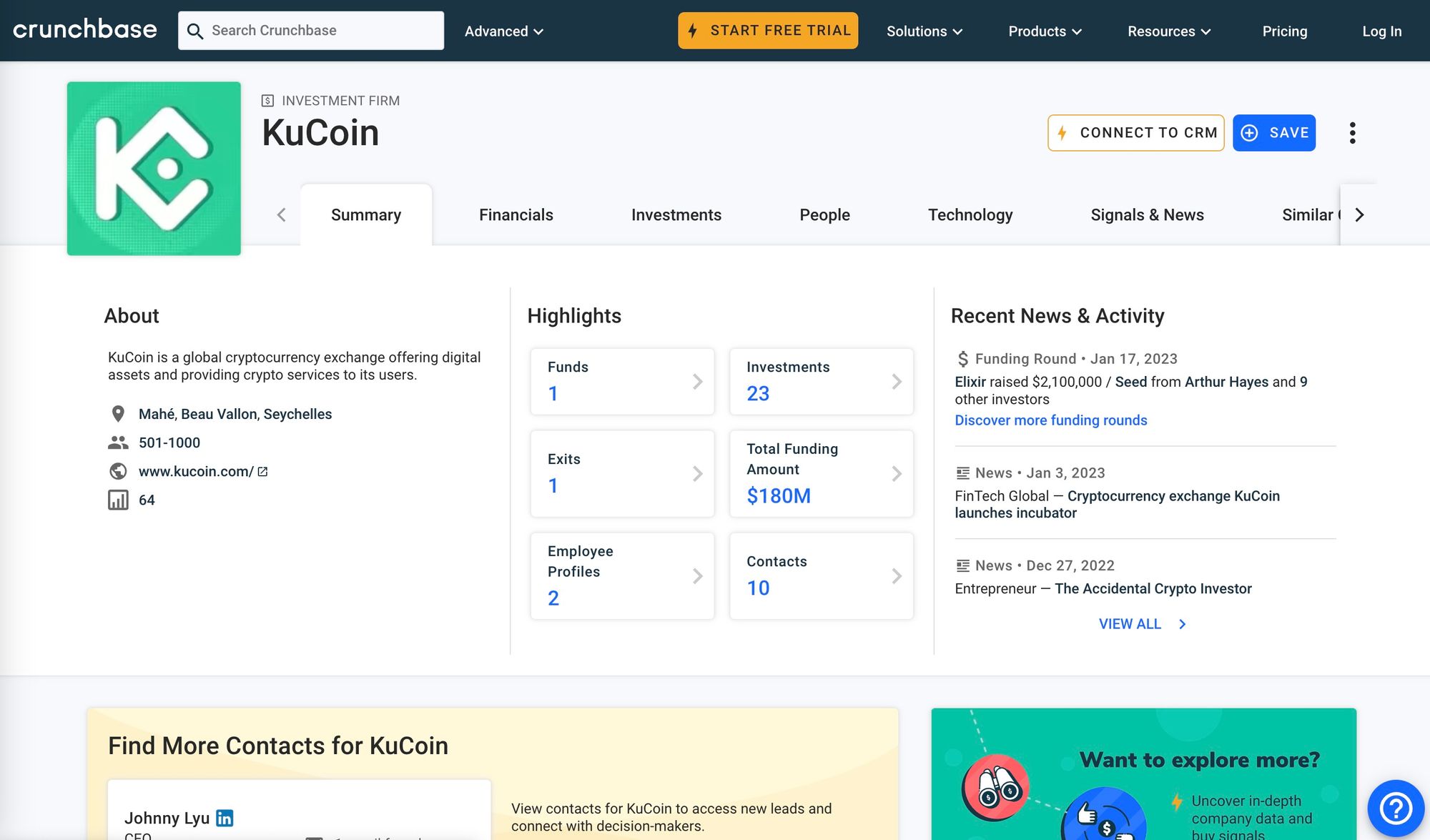

According to Crunchbase, KuCoin, is based in the Seychelles and owned by MEK Global Limited (MGL). The exchange adhere to regulatory protocols such as Anti Money Laundering (AML) and Know Your Customer (KYC), thereby ensuring a secure trading environment.

The company, which has its origins in the Seychelles and is headquartered in Hong Kong, subsequently shifted its base to Singapore. However, the precise location of its physical office and personnel remains uncertain (or better: decentralized), as is the case with many cryptocurrency exchanges.

In 2020, KuCoin experienced a significant security breach, in which hackers made off with an estimated $280 million worth of cryptocurrency from users' hot wallets.

While the assets were ultimately protected by an insurance fund, the incident serves as a stark reminder of the ongoing risks associated with digital asset trading.

Despite attempts to uncover information regarding the specifics of this insurance fund, the only information that could be gleaned pertained to a different insurance fund, specifically designated for futures trading, which serves to mitigate the impact of unfilled liquidation orders before they are subject to automatic deleveraging.

KuCoin Software

KuCoin offers a user-friendly trading platform for both beginner and experienced crypto investors.

To start trading, you need to deposit funds into the KuCoin wallet. After that, you can open the 'Trade' menu and select either 'Spot' or 'Margin' exchange to view live crypto charts.

The charting software and tools are provided by Tradingview. You can draw lines and add indicators to the live price charts.

The order book and recent trades window on the right-hand side helps you to quickly see all the prices that people are willing to buy and sell the selected cryptocurrency.

You can enter an order using the order entry box at the bottom. Finally, click the 'Buy' or 'Sell' button to place the trade.

The iOS and Android apps let you do pretty much the same things as the desktop app. They are very up to date and comprehensive.

KuCoin Features

KuCoin is a crypto trading platform that offers several functions to its users.

These include:

- Spot trading, where investors can trade crypto with a variety of tools;

- Margin trading which allows them to magnify profits with leverage;

- Trading bot pro feature that enables users to earn passive profits without monitoring the market;

- Convert feature which allows for easy trading.

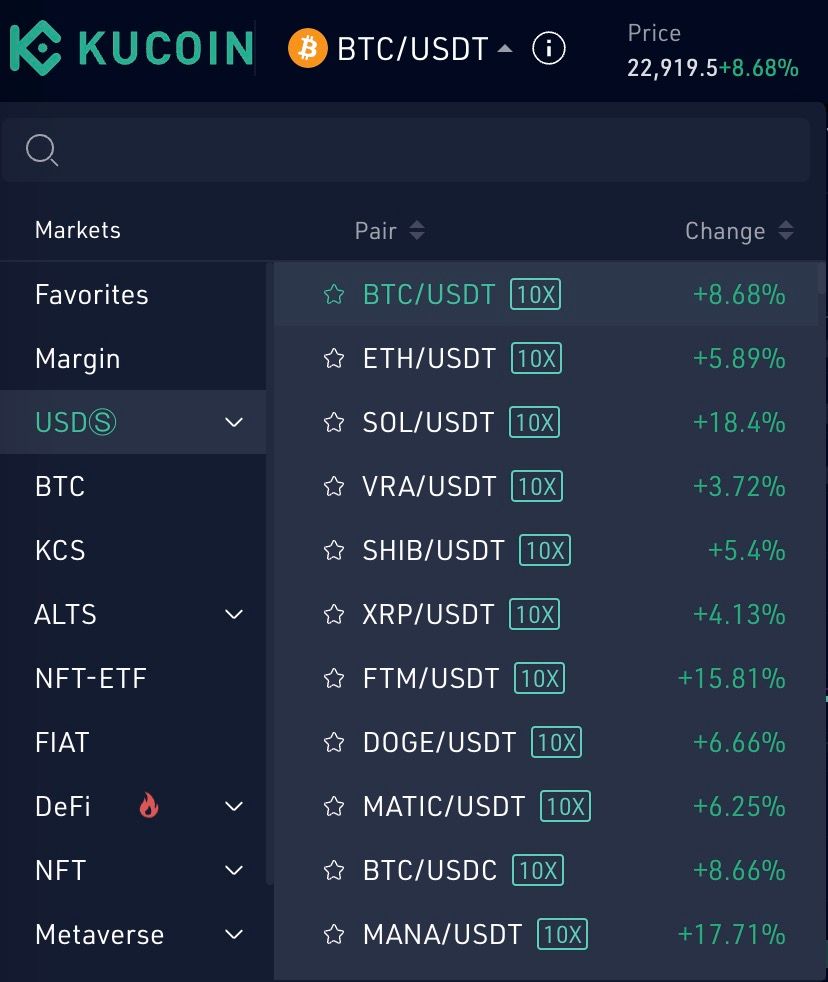

Spot Trading

Spot trading on KuCoin refers to the buying and selling of cryptocurrencies on the exchange at the current market price.

This is the most common form of trading and allows traders to take advantage of short-term price fluctuations in the market.

KuCoin provides its users with a user-friendly interface and a variety of tools, such as real-time market data, technical indicators, and charting tools, to help them make informed trading decisions.

Additionally, the exchange offers a wide range of trading pairs, including major cryptocurrencies, stablecoins, and DeFi tokens, giving traders a diverse range of assets to choose from.

Overall, spot trading on KuCoin is a convenient and efficient way for traders to participate in the crypto market.

Margin Trading

KuCoin has a special way of trading called margin trading. This type of trading allows you to use more money than you have in your account.

It is like borrowing money to trade. This way, you can make bigger profits, but also bigger losses.

You can use margin trading on KuCoin with leverage up to 10 times, which means you can trade with 10 times the amount of money you have in your account.

KuCoin has over 220 different pairs to trade with margin trading, with BTC, ETH, USDC, and USDT as the base currency.

It also has a special way to protect your trade with Take-Profit and Stop-loss orders. Take-Profit helps you to close your trade when you make a good profit, Stop-loss helps you to close your trade when you are losing to prevent bigger losses.

Futures Trading

KuCoin has a way of trading called futures trading. It's like making a deal to buy or sell a specific amount of cryptocurrency at a specific price at a later time. With KuCoin, you can trade with leverage up to 100x.

KuCoin has two types of futures: one type is the delivery futures, where you can buy or sell the cryptocurrency at a specific price at a specific time in the future. The other type is the perpetual futures, where you can buy or sell the cryptocurrency at a specific price but it never expires.

You can trade with over 110 different coins on KuCoin. KuCoin is a great choice for serious crypto traders because it offers a lot of trading pairs, a nice interface and low fees. Additionally, it also has features that help you manage the risks and make a profit in both up and down markets.

Futures Brawl

KuCoin has introduced a new feature called Futures Brawl, which is designed to help new traders learn about futures trading in a fun and interactive way.

It's like a game where traders can compete with other users from around the world by buying or selling futures contracts. The goal is to experience futures trading and make profits.

Leveraged Tokens

KuCoin Leveraged Tokens are special assets you can trade on KuCoin. They allow you to make more profit by betting that the price of a certain cryptocurrency will go up or down.

For example, if the price of Bitcoin goes up by 1%, the price of BTC3L will go up by 3% and the price of BTC3S will go down by 3%. Unlike margin trading or futures trading, you don't need to put up collateral or keep the margin to hold leveraged tokens and there is no risk of liquidation.

However, it's important to be aware that leveraged tokens can be very volatile in price and traders should be careful with their investments.

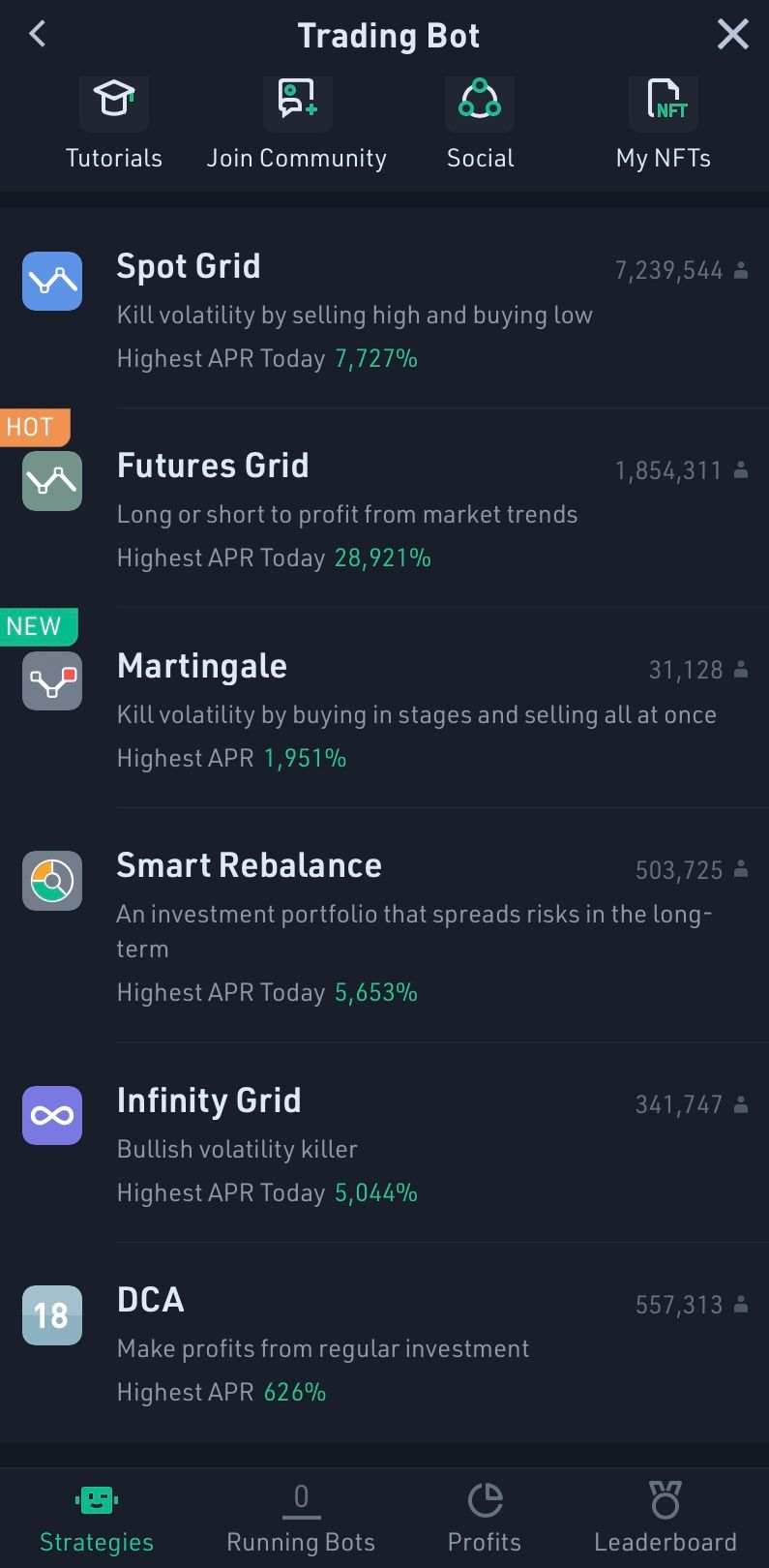

Trading Bots

KuCoin has a special feature called trading bots, which are like robots that automatically make trades for you.

These bots can help you make trades consistently and according to your own strategy.

KuCoin has some of the best trading bots compared to other exchanges, especially for beginners who want to use existing bots or create their own.

Some examples of trading bots that can be used on KuCoin are:

- Spot Grid: A tool that helps reduce volatility by buying when the price goes down and selling when it goes up

- Futures Grid: A tool that helps buy low and sell high in the crypto futures market

- Smart Rebalance: A tool that helps automatically buy low and sell high while keeping the balance of your portfolio

- Dollar-Cost-Averaging: A tool that helps you invest a little bit at a time to reduce the effect of market volatility

- Infinity Grid: A tool that helps you automatically buy low and sell high with no limit.

Convert

Convert is a feature on KuCoin that makes it easy to exchange one cryptocurrency for another without the need for complicated steps or understanding complex fee structures.

You can easily make the exchange with just one click and there are no hidden fees, you pay exactly what you see.

Earn

KuCoin has a feature called Earn that helps users make money from their cryptocurrency investments. It offers several ways to earn money, including flexible savings and staking for more than 50 different coins. There are different options to choose from, with different levels of risk and different terms.

- KuCoin Savings: You can deposit your coins into a savings account and earn a return on your investment, with a rate of 5-8% APR. You can take your money out at any time;

- Staking: You can earn rewards by holding certain coins that use a system called Proof-of-Stake;

- Promotions: KuCoin runs special offers sometimes, where you can earn more money with the Earn feature. These offers are limited and have a limit on how many people can participate;

- Burning Drop: Similar to staking, you can earn rewards by holding certain coins and participating in the Burning Drop program, which gives you more rewards the more coins you hold.

All these options are designed to help you earn passive income from your crypto investments without needing to actively trade or monitor the market.

Lending

KuCoin, like other platforms like BlockFi, Hodlnaut, and Nexo, now has a feature that lets you earn money by lending your cryptocurrency to others.

When you're not trading on KuCoin, you can lend your assets to others and earn up to 30% in interest per year. This feature is called KuCoin Lending, and it's great for users who want to earn a steady return on their assets without taking on a lot of risk.

This feature is available for over 100 different coins such as Bitcoin, Ethereum, Cardano and Tether among others.

KuCard

KuCard is a new way to pay for things using crypto. It's a debit card, but instead of using money, you use crypto. You can register for a KuCard for free and get 1,000 USDT as a bonus.

With KuCard, you can make real-time payments with crypto at any store that takes Visa, no need to change crypto to money first. You can also get cashback on your purchases and set custom limits for your spending. KuCard supports Apple Pay and Google Pay for easy use.

To get a KuCard, you need to have a KuCoin account, verify your identity and be a resident of a supported country. KuCard currently supports USDT, BTC, and KCS and more will be added soon. It's free to use and there are no annual fees, but you may be charged a trading fee for crypto to fiat conversion when you spend with KuCard.

KuCard is supported in most countries of Europe and United Kingdom.

KuCoin Wallet

The KuCoin Wallet is a safe (audited by Hacken) and simple non-custodial crypto wallet that can store multiple tokens including BTC, ETH, USDT, USDC, BNB, and more. It gives users the ability to create a decentralized Web 3.0 account quickly and easily send, receive, and store tokens.

With the KuCoin Wallet it's possible to trade, lend, play games, publish contents, and purchase NFT collections.

KuCoin Fees

KuCoin boasts some of the most competitive trading fees in the industry, with a base rate of 0.1% for both market makers and takers in spot trading. Additionally, it offers deep liquidity for its extensive array of supported cryptocurrencies.

The platform offers a diverse range of trading options, including spot and derivatives trading, leveraged token trading, and trading bot trading, and is known for providing access to some of the most traded products.

To further optimize the trading experience, KuCoin allows users to become VIPs and to reduce their trading fees by holding and paying for transaction fees in KCS tokens.

KuCoin employs a graduated fee structure for its maker and taker fees, which fluctuates based on both the trading volume and the specific trading product utilized. To provide greater clarity, the fees can be broken down into the following categories:

- Fees for spot trading;

- Fees for futures trading;

- Fees for leveraged token trading;

- Fees for trading bot usage;

It is worth noting that KuCoin's fees are among the most competitive in the industry, and it maintains a high level of liquidity for its vast array of supported cryptocurrencies.

Spot Trading Fees

KuCoin has an impressive collection of over 1,200 spot markets, featuring support for more than 700 diverse cryptocurrencies.

These offerings are classified into three distinct groups - Class A, Class B, and Class C - based on a variety of factors, including trading volume.

Additionally, KuCoin offers tiered trading fee structures for users that engage in high-volume transactions or hold substantial amounts of the platform's native token, KCS.

This division results in 12 levels of classification, with the base level being the starting point.

In regards to Class A cryptocurrencies, KuCoin imposes a standard spot trading fee of 0.1% for both market makers and market takers at the base level.

However, as users progress through the tiers, both maker and taker fees decrease, with the uppermost five levels even providing a rebate to market makers for providing liquidity.

Example of Spot Market Class A Fees

| Trading Fee Level | Min KCS Holding Last 30-Day | or | Spot Trading Volume Last 30 Days | or | Futures Trading Volume Last 30 Days | Maker/Taker | Maker/Taker Fees When Paying With KCS (15% Discount) | 24h Withdrawal Limit |

|---|---|---|---|---|---|---|---|---|

| LVO | 0 | or | <50 | or | <200 | 0.1% /0.1% | 0.08% /0.08% | 200 |

| LV5 | 40000 | or | >=2000 | or | >=3000 | 0% /0.07% | 0%/0.056% | 500 |

| LV8 | 70000 | or | >=15000 | or | >=20000 | -0.005%/ 0.045% | 0.005% / 0.036% | 1000 |

| LV12 | 150000 | or | >=80000 | or | >=160000 | -0.005%/0.025% | -0.005%/0.02% | 3000 |

When transitioning to Class B and Class C digital currencies, the standard rate for KuCoin spot trading for both market makers and takers is a minimal 0.16% and 0.24%, respectively.

Example of Spot Market Class B Fees

| Trading Fee Level | Min KCS Holding Last 30-Day | or | Spot Trading Volume Last 30 Days | or | Futures Trading Volume Last 30 Days | Maker/Taker | Maker/Taker Fees When Paying With KCS (15% Discount) | 24h Withdrawal Limit |

|---|---|---|---|---|---|---|---|---|

| LV0 | 0 | or | <50 | or | <200 | 0.2%/0.2% | 0.16%/0.16% | 200 |

| LV5 | 40000 | or | >=2000 | or | >=3000 | 0%/0.14% | 0%/0.112% | 500 |

| LV8 | 70000 | or | >=15000 | or | >=20000 | -0.005%/-0.09% | -0.005%/0.072% | 1000 |

| LV12 | 150000 | or | >=80000 | or | >=160000 | -0.005%/-0.05% | -0.005%/0.04% | 3000 |

As one progresses through the different levels, the trading fees significantly decrease, ultimately culminating in the highest tier users receiving remuneration for contributing liquidity to the markets.

Example of Spot Market Class C Fees

| Trading Fee Level | Min KCS Holding Last 30-Day | or | Spot Trading Volume Last 30 Days | or | Futures Trading Volume Last 30 Days | Maker/Taker | Maker/Taker Fees When Paying With KCS (15% Discount) | 24h Withdrawal Limit |

|---|---|---|---|---|---|---|---|---|

| LV0 | 0 | or | <50 | or | <200 | 0.3%/0.3% | 0.24% /0.24% | 200 |

| LV5 | 40000 | or | >=2000 | or | >=3000 | 0%/0.21% | 0%/0.168% | 500 |

| LV8 | 70000 | or | >=15000 | or | >=20000 | -0.005% /0.135% | -0.005%/ 0.108% | 1000 |

| LV12 | 150000 | or | >=80000 | or | >=160000 | -0.005%/ 0.075% | -0.005% /0.06% | 3000 |

In the three tables above it's possible to find four main levels: the initial level, the Level 5 (where the maker fee is eliminated), Level 8 (where market makers are compensated by KuCoin) and the highest VIP level, Level 12.

It is also noteworthy that when utilizing KCS tokens to pay for trading fees, all users will be entitled to a 15% reduction.

Additionally, for those interested in utilizing margin trading on the KuCoin spot market, the calculation for interest is contingent upon the principal amount, the daily interest rate and the actual duration of the loan.

Futures Trading Fees

When it comes to the trading of futures, KuCoin offers a comprehensive range of trading pairs all conveniently housed under a singular Class A roof.

The variation in trading fees is solely dependent upon one's status as a market maker or market taker, as well as their VIP level.

| Trading Fee Level | Min KCS Holding Last 30-Day | or | Spot Trading Volume Last 30 Days | or | Futures Trading Volume Last 30 Days | Maker/Taker | 24h Withdrawal Limit |

|---|---|---|---|---|---|---|---|

| LV0 | 0 | or | <50 | or | <200 | 0.02% /0.06% | 200 |

| LV5 | 40000 | or | >=2000 | or | >=3000 | 0% /0.04% | 500 |

| LV8 | 70000 | or | >=15000 | or | >=20000 | -0.003% / 0.032% | 1000 |

| LV12 | 150000 | or | >=80000 | or | >=160000 | -0.015% / 0.03% | 3000 |

Deposit/withdrawal Fees

Depositing funds on an exchange platform can be done through two main methods: fiat and crypto.

Fiat Deposit/withdrawal Fees

For fiat deposits, the platform typically supports a number of different currencies, such as Euro (EUR), US Dollars (USD), Japanese Yen (JPY). Within the Euro deposit option, there are different payment methods available, such as SEPA and Visa/MasterCard.

SEPA offers instant processing of large deposits, with a fee of 0.70 EUR. On the other hand, Visa/MasterCard offers fast processing of deposits, but with a fee of 3.80%.

Crypto Deposit/withdrawal Fees

KuCoin prides itself with a no deposit fees. Withdrawal fees, however, are subject to variation based on the specific cryptocurrency in question.

The disparity in withdrawal fees amongst various cryptocurrencies is owing to the network fee necessitated for transmitting a transaction to the intended recipient, which is influenced by factors such as the speed and popularity of the blockchain in question.

For instance, blockchain networks such as Ethereum, which are known for their low processing speeds and high demand, tend to have higher withdrawal fees, whereas those that boast faster processing speeds and greater throughput generally have much lower withdrawal fees.

KuCoin accepts deposit/withdrawal with hundreds of cryptos, in the table down here you can find the most popular ones:

| Coin | Fee | Min Amount |

|---|---|---|

| BTC | (0.0005 + Amount * 0%) BTC | 0.001 BTC |

| USDT ERC20 | (25 + Amount * 0%) USDT | 50 USDT |

| USDT TRC20 | (1 + Amount * 0%) USDT | 2 USDT |

| ETH | (0.005 + Amount * 0%) ETH | 0.01 ETH |

| XRP | (0.5 + Amount * 0%) XRP | 20.5 XRP |

| SOL | (0.01 + Amount * 0%) SOL | 0.5 SOL |

Cryptocurrencies available on KuCoin

KuCoin presents a plethora of over 700 distinct digital assets and over 1200 pairs to its clients, enabling them to engage in the purchase, sale, and exchange of an expansive array of cryptocurrencies.

Those in search of a broad array of options may find this exchange particularly appealing. A partial listing of the various cryptocurrencies currently offered on KuCoin includes: Bitcoin (BTC), Dogecoin (DOGE), Binance Coin (BNB), Ethereum (ETH), Polkadot (DOT), Shiba Inu (SHIB), and XRP (XRP).

KuCoin offers a plethora of supported coins, enabling investors to diversify their portfolios by allocating investments among a diverse array of crypto-assets, including stablecoins, DeFi tokens, and exotic altcoins.

Furthermore, the exchange boasts a wide array of altcoin trading pairs, each with commendable trading volumes, making it an ideal destination for day traders and scalpers.

Additionally, KuCoin's global accessibility is further enhanced by the ability for new investors to fund their accounts using 39 distinct fiat currencies, such as USD, GBP, EUR, and THB.

KuCoin Alternatives

KuCoin has the great advantage of the P2P marketplace, that helped it to get a blockdyor score of 59 of 100, however, it's not accessible to some countries like USA and Canada. So for alternatives we choose platforms available in those countries, which excels in regulation and low costs.

| KuCoin | Kraken | Bitstamp | |

|---|---|---|---|

| 🧱 blockdyor Total Score | 57/100 | 62/100 | 45/100 |

| 🕵️ Non-KYC | No | No | No |

| 🔐 Non-Custodial | No | No | No |

| 👥 P2P | Yes | No | No |

| 💵 Fiat Onramp/Offramp | Yes | Yes | Yes |

| 💸 Taker/Maker Fees | From 0.10%/0.10% | From 0.26%/0.16% | From 0.40%/0.30% |

Kraken: this solution stands out as a compelling alternative to KuCoin, boasting lower fees and an arguably superior user interface. Notably, it incorporates interesting features such as the ability to withdraw Bitcoin (BTC) using the Lightning Network, particularly advantageous during periods of elevated fees on the main chain. For a more in-depth analysis, delve into our comprehensive Kraken Review.

Bitstamp, an established broker with a lengthy track record, has earned a reputation for its high resilience in the market. However, it cannot beat the insanely low commissions offered by KuCoin. Explore further insights in our detailed Bitstamp Review by clicking in the link.

KuCoin Pros & Cons

| KuCoin Pros | KuCoin Cons |

|---|---|

| A well-known exchange with millions of users | Higher fees when buying crypto from third party |

| Many coins to trade with good liquidity | Not available for traders in the USA |

| Good for serious traders and investors | No direct withdraw cash to a bank (must use P2P) |

| Easy to use mobile app | Not regulated in any nation |

| Low trading fees and discounts for KuCoin token holders | |

| Useful trading bots | |

| KYC is not mandatory |

Bottom line

KuCoin is a reputable and well-known crypto exchange with a large user base worldwide. It offers a wide range of coins to trade with deep liquidity, making it highly suitable for serious crypto investors and day traders.

The platform is user-friendly with a modern and responsive mobile app for 24/7 trading, and it offers low trading fees with discounts for KuCoin token holders. Furthermore, it offers useful trading bots.

However, it has some downsides such as lack of license from any regulatory bodies and it's not available for traders in the United States, also it doesn't allow direct withdrawal of cash to a bank, only P2P option available.

KuCoin Evaluation

With a blockdyor Score of 57 out of 100, KuCoin stands out as a KYC exchange featuring remarkably low trading fees, a diverse selection of cryptocurrencies, and P2P capabilities.

Reputation: KuCoin, unfortunately, is not accessible in the USA, Canada, and several other nations, posing a significant challenge for customers in these regions who must seek alternative platforms.

Technology: The exchange boasts a plethora of features, bots, and strategies, catering to the needs of even the more experienced traders.

Customer Service: KuCoin provides responsive and supportive customer service primarily through chat and tickets.

Fees: While KuCoin offers low trading fees, the withdrawal fees are relatively high.

Ease of Use: KuCoin's platform is not particularly user-friendly, resembling that of Binance. The interface may seem overwhelming at first, and beginners might find it more accessible to start with the app, which offers fewer options compared to the desktop web app.