Spot Bitcoin ETFs: What Are They And How Do They Work?

In this Spot Bitcoin ETFs complete guide we'll analyze what they are and how they work. Also we'll have a look at how to invest in them, their costs, and their implications for bitcoin.

The Spot Bitcoin ETFs have been a long-awaited development since July 1, 2013, when Cameron and Tyler Winklevoss, the founders at Gemini, started the process by filing for the first Bitcoin Trust in the US.

Over a decade later, after much anticipation, the approval of a Bitcoin Exchange-Traded Fund (ETF) marks a significant milestone. Initially, the idea faced skepticism from regulatory bodies like the SEC, which oversees securities markets and safeguards investors, citing concerns about investing in an unregulated asset within an unregulated market.

However, on January 10, 2024, Chair Gary Gensler's approval of the bitcoin spot ETF, outlined in a Statement on the Approval of Spot Bitcoin Exchange-Traded Products, finally materialized the original vision of the Winklevoss twins after more than a decade.

What Is An ETF?

An ETF, or Exchange-Traded Fund, is a pooled investment security that mirrors the price movements of an underlying asset or group of assets. Like traditional stocks such as Apple or Google, ETFs are traded on stock exchanges and can be bought and sold with the click of a button.

One of the key advantages of ETFs is their accessibility, offering investors a straightforward way to invest in specific asset classes or sectors. Often, the cost of investing in an ETF is lower than directly purchasing the underlying asset. However, with Bitcoin is cheaper just buying directly the underlying asset, as there are no fees for "hodling", while with the ETFs there are annual costs. More on that later.

Introduced in the early 1990s, ETFs gained popularity due to their cost-effectiveness, efficiency, and ease of trading. The first ETF in the USA, the Standard & Poor's Depositary Receipts (SPDR), launched in 1993, tracked the S&P 500 stock index, enabling investors to access a broad market index through a single financial product.

Since their inception, ETFs have evolved to encompass a wide range of assets and indexes, becoming a favored investment tool for institutional and individual investors alike.

Unlike mutual funds, which trade once a day, ETF prices fluctuate throughout the trading day as they are bought and sold. ETFs can include various investments such as stocks, commodities, or bonds, with some focusing on U.S. holdings while others offer international exposure.

Additionally, ETFs typically feature low expense ratios and reduced broker commissions compared to individual stock purchases.

ETFs Types

The world of Exchange-Traded Funds (ETFs) offers a diverse array of options tailored to various asset classes, investment strategies, and market exposures. Here's a glimpse into the multifaceted nature of ETFs:

Passive vs. Active Strategies

ETFs can be broadly classified into two categories: passive and actively managed. Passive ETFs seek to mirror the performance of specific indices, whether broad-based benchmarks like the S&P 500 or niche-focused sectors or themes. Conversely, actively managed ETFs involve skilled portfolio managers making strategic decisions about the composition of the fund's holdings, potentially aiming to outperform the market but typically incurring higher management fees.

Fixed-Income ETFs

Bond ETFs offer investors exposure to the fixed-income market, providing regular income streams based on the performance of underlying bonds. These ETFs encompass various types of bonds, including government, corporate, and municipal bonds, offering investors diversification within the fixed-income space without the need for individual bond selection and management.

Equity ETFs

Equity ETFs comprise baskets of stocks tracking specific industries, sectors, or geographic regions. These funds provide investors with diversified exposure to equity markets, enabling them to capitalize on broad market trends or sector-specific opportunities while benefiting from the liquidity and cost-effectiveness inherent in ETF investing.

Sector-Specific ETFs

Sector ETFs focus on specific industries or sectors of the economy, such as technology, healthcare, or energy. By tracking the performance of companies within a chosen sector, these ETFs allow investors to target areas of growth or strategic importance, facilitating tactical allocation decisions within their portfolios.

Commodity ETFs

Commodity ETFs provide exposure to various commodities, including precious metals, energy resources, and agricultural products. These funds offer investors a convenient way to participate in commodity price movements without the complexities associated with physical commodity ownership, serving as both a diversification tool and a hedge against inflation or market volatility.

Currency ETFs

Currency ETFs track the performance of currency pairs, allowing investors to gain exposure to foreign exchange markets. These ETFs serve multiple purposes, including speculation on currency price movements, portfolio diversification, and hedging against currency risk for international investments.

Cryptocurrency ETFs

Cryptocurrency ETFs represent a relatively new addition to the ETF landscape, offering investors exposure to digital assets like Bitcoin. These funds come in various forms, including spot ETFs holding physical bitcoins and futures-based ETFs using derivatives to track cryptocurrency price movements, providing investors with regulated access to the burgeoning cryptocurrency market.

Inverse and Leveraged ETFs

Inverse ETFs aim to profit from declines in underlying assets by shorting stocks or using derivatives, offering investors a way to hedge against market downturns or capitalize on bearish market sentiments. On the other hand, leveraged ETFs seek to amplify returns on the underlying investments, potentially offering enhanced gains but also carrying increased risk due to leverage.

How Does A Spot Bitcoin ETF Works?

A Bitcoin ETF operates on the same fundamental principles as traditional ETFs, but with a focus solely on Bitcoin (BTC). It offers both private and institutional investors an easy way to join the Bitcoin market without having to deal with the complexities of managing digital currencies.

Consider a Bitcoin ETF like the one offered by Vaneck or Blackrock, which operates as spot ETFs. In the context of ETFs, "spot" denotes that for every share of the ETF, there exists a corresponding quantity of actual bitcoins securely held on behalf of investors. These bitcoins are owned collectively by the investors of the Bitcoin ETF, and they underpin the value of the ETF shares traded on the exchange.

Here's how it works: When investors purchase shares in a Bitcoin ETF, they effectively acquire a proportional stake in the pool of bitcoins held by the ETF. The value of their shares is directly tied to the current market value of these bitcoins. Notably, investors retain the flexibility to redeem their shares for dollars at any point, reflecting the liquidity and accessibility inherent in ETF investments.

For traditional or large institutional investors, a Bitcoin ETF represents a significant advancement in integrating digital assets into conventional investment portfolios. It offers a familiar investment vehicle through which to gain exposure to the emerging cryptocurrency market. Importantly, it circumvents the challenges and risks associated with establishing a digital wallet, navigating cryptocurrency exchanges, and ensuring a reasonably secure storage of assets.

This additional layer of security and regulatory oversight could prove particularly appealing to investors who have previously hesitated to venture into the realm of Bitcoin investment. By leveraging the structure and familiarity of ETFs, a Bitcoin ETF bridges the gap between traditional finance and the innovative world of digital currencies, paving the way for broader adoption and participation in the Bitcoin ecosystem.

Bitcoin ETFs Complete List

| Name | Ticker | Fee | Exchange |

|---|---|---|---|

| iShares Bitcoin Trust | IBIT | 0.25% | Nasdaq |

| Fidelity Wise Origin Bitcoin Trust | FBTC | 0.25% | СВОЕ |

| ARK 21Shares Bitcoin ETF | ARKB | 0.21% | СВОЕ |

| Bitwise Bitcoin ETP Trust | BITB | 0.20% | NYSE |

| Invesco Galaxy Bitcoin ETF | BTCO | 0.39% | СВОЕ |

| VanEck Bitcoin Trust | HODL | 0.25% | СВОЕ |

| Valkyrie Bitcoin Fund | BRRR | 0.49% | Nasdaq |

| Franklin Bitcoin ETF | EZBC | 0.29% | СВОЕ |

| Wisdomtree Bitcoin Trust | BTCW | 0.30% | СВОЕ |

| Hashdex Bitcoin ETF Strategy Change | DEFI | 0.90% | NYSE |

| Grayscale Bitcoin Trust | GBTC | 1.5% | NYSE |

I'll begin by presenting the recently approved spot ETFs, listing them based on their inflows during the initial months following publication. This order reflects their perceived importance in the market.

I'll place the Grayscale Bitcoin Trust (GBTC) at the end of the list, as it previously held a significant amount of BTC before its transition from a closed-end trust to a "classic" spot ETF.

iShares Bitcoin Trust (IBIT)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Blackrock | iShares Bitcoin Trust | IBIT | 0.25% | Nasdaq |

BlackRock, with its iShares Bitcoin Trust (IBIT), is without any doubt the leader of the pack in the realm of bitcoin ETFs. BlackRock, an American multinational investment company, holds the distinction of being the world's largest asset manager, boasting a staggering $10 trillion in assets under management.

Headquartered in New York City, BlackRock maintains a global presence with 70 offices across 30 countries, serving clients in over 100 countries. As the manager of the iShares group of exchange-traded funds (ETFs), BlackRock, alongside The Vanguard Group and State Street, is recognized as one of the Big Three index fund managers.

In June 2023, BlackRock made waves by filing an application with the United States Securities and Exchange Commission (SEC) to launch a Spot Bitcoin Exchange-Traded Fund (ETF). Prior to this move, such an endeavor was deemed nearly "impossible" to gain approval from the SEC. BlackRock's bold initiative paved the way for the eventual approval of a bitcoin ETF, a development that may not have materialized without their intervention.

Despite the Bitcoin ETF being somewhat unconventional for the typical BlackRock investor, it is poised to emerge as one of the most successful offerings in the bitcoin ETF (and also ETFs in general) landscape for years to come.

Fidelity Wise Origin Bitcoin Trust (FBTC)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Fidelity | Fidelity Wise Origin Bitcoin Trust | FBTC | 0.25% | CBOE |

Based in Boston, Fidelity caters to customers via over 200 Investor Centers across the U.S. and 13 regional sites globally, including India and Ireland.

While not among the largest players in the ETF realm presently, the company boasts trillions of dollars in assets overall. Leveraging this substantial base, Fidelity aims to introduce crypto offerings to its existing clientele.

Renowned worldwide, Fidelity stands as a well-recognized entity in the financial management sphere. This reputation is poised to attract assets, a distinct advantage over some other issuers listed, which may lack such widespread recognition.

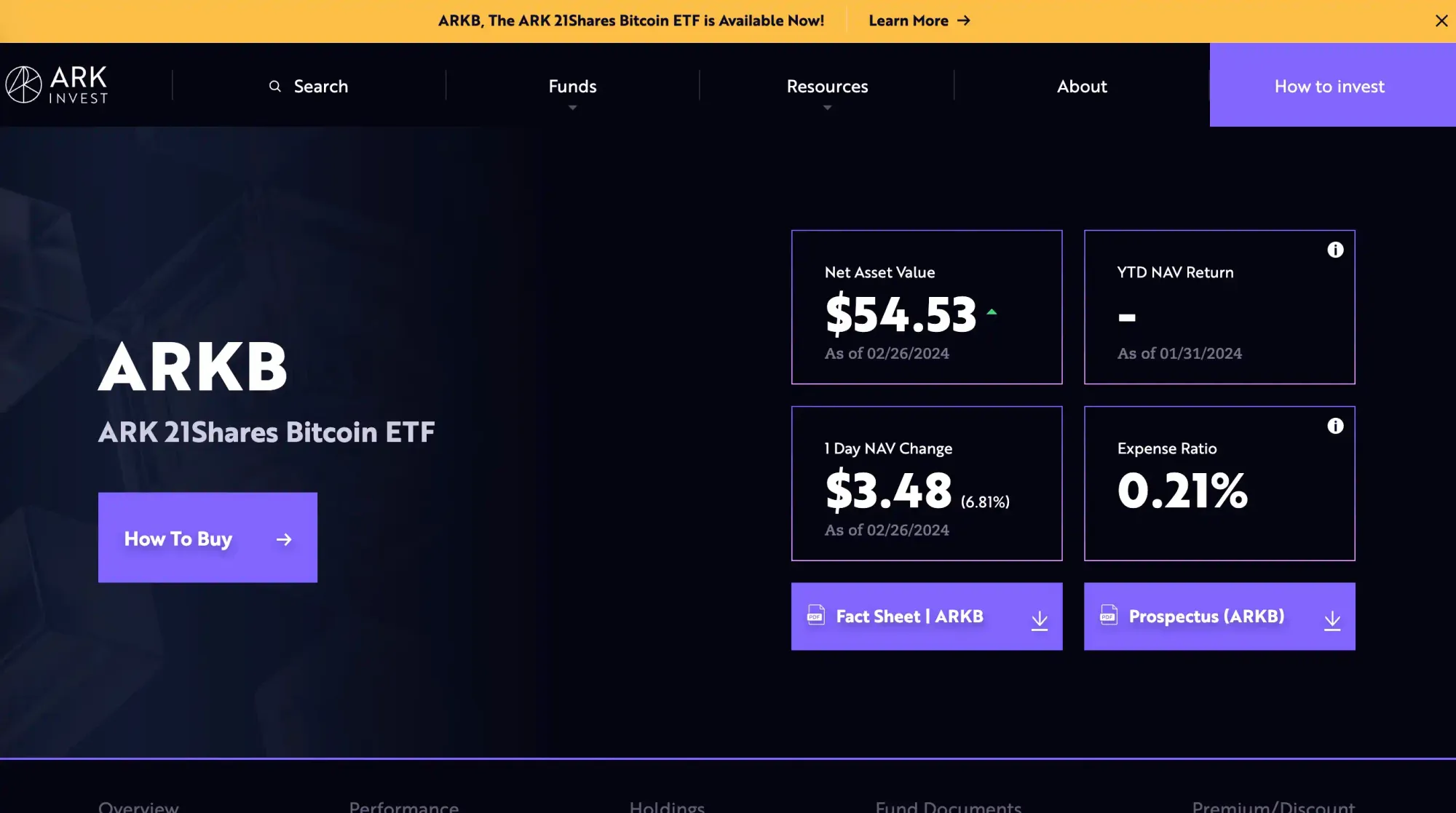

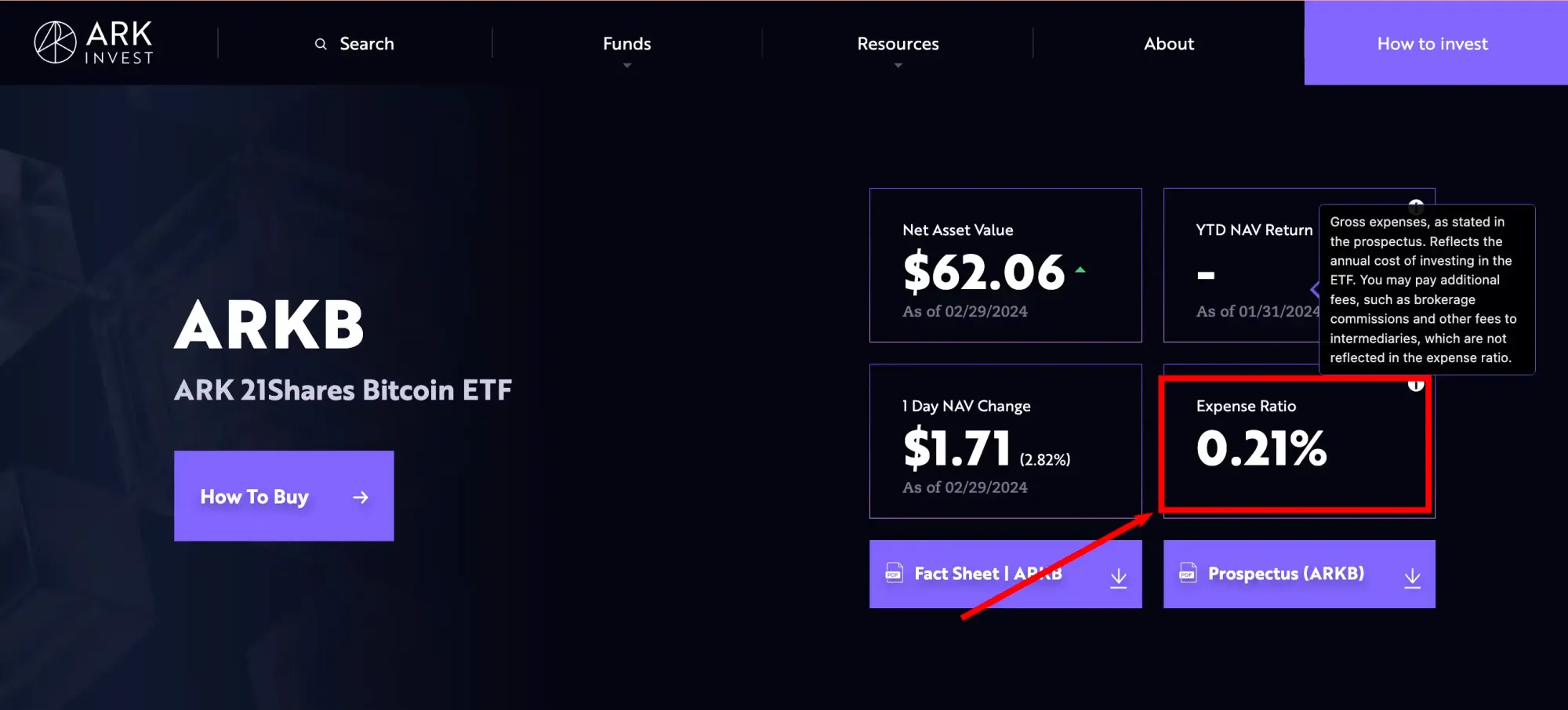

ARK 21Shares Bitcoin ETF (ARKB)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| ARK | ARK 21Shares Bitcoin ETF | FBTC | 0.21% | CBOE |

Cathie Wood founded ARK as an investment adviser in January 2014 with a singular focus on disruptive innovation. Recognizing the evolving landscape where technology blurs traditional sector boundaries, Cathie realized the inadequacy of conventional research methods in tracking innovative companies.

ARKB aims to mirror the performance of bitcoin, using the CME CF Bitcoin Reference Rate – New York Variant, adjusted for expenses and other liabilities of the Trust.

With its disruptive innovation ethos, a bitcoin ETF aligns perfectly with ARK's investment basket, offering a quite low expense ratio of 0.21% in this domain. Notably, ARK typically charges 0.75% for its funds, making this ETF a very interesting choice.

While ARK has faced some challenges in recent years, notably due to questionable performances, the launch of this new ETF from a true bitcoiner like Cathie Wood, presents an intriguing opportunity. They also recently a Chainlink Proof of Reserve to increase transparency of their ETF.

It will be fascinating to observe investor sentiment towards participating in ARK's innovative ventures once again.

Bitwise Bitcoin ETF Trust (BITB)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Bitwise | Bitwise Bitcoin ETF Trust | BITB | 0.20% | NYSE |

Bitwise is one of the most popular crypto index fund manager, trusted by thousands of financial advisors, family offices, and institutional investors to invest in the main crypto assets. It has already a track record of more than six years with quite interesting performances, and offers a wide range of index and active solutions across ETFs, managed accounts, private funds, and hedge fund strategies.

Renowned for their comprehensive client support, expert research, and deep industry access, Bitwise has a team of over 60 professionals with backgrounds from BlackRock, Millennium, Google, and more. Backed by top institutional investors, Bitwise has been featured in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal, with offices in San Francisco and New York.

Bitwise specializes in crypto-only products, particularly in Bitcoin, offering the Bitwise Bitcoin ETF Trust with a competitive fee rate of 0.20%, which can be reduced to 0.00% with the fee waiver. This ETF stands out as a compelling choice for investors seeking expertise in the crypto market.

Moreover, Bitwise demonstrates its commitment to the crypto community by pledging to donate 10% of profits from their Bitcoin ETF Trust (BITB) to three non-profit organizations supporting Bitcoin open-source development: Brink (Bitcoin Core), OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund. These annual donations, untied to any conditions, will continue for at least the next decade.

Invesco Galaxy Bitcoin ETF (BTCO)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Invesco | Invesco Galaxy Bitcoin ETF | BTCO | 0.39% | CBOE |

Based in Atlanta, Georgia, Invesco is a popular American independent investment management company with branch offices in 20 countries worldwide. Its common stock is part of the S&P 500 index and is traded on the New York Stock Exchange.

Operating under various brand names such as Invesco, Trimark, Invesco Perpetual, WL Ross & Co, and Powershares, Invesco is a significant player in the financial industry.

Compared to WisdomTree, Invesco holds a stronger position in terms of size and market presence. With its extensive reach and brand recognition, Invesco may have a better chance of attracting assets to its Invesco Galaxy Bitcoin ETF (BTCO). However, I find that they lack standout features compared to other issuers.

While the fee waiver is a positive aspect, the post-waiver fee of 0.39% places them towards the lower end of the bitcoin ETF spectrum. Considering investors' sensitivity to fees in the ETF space, this could pose a challenge for Invesco in garnering significant investor interest.

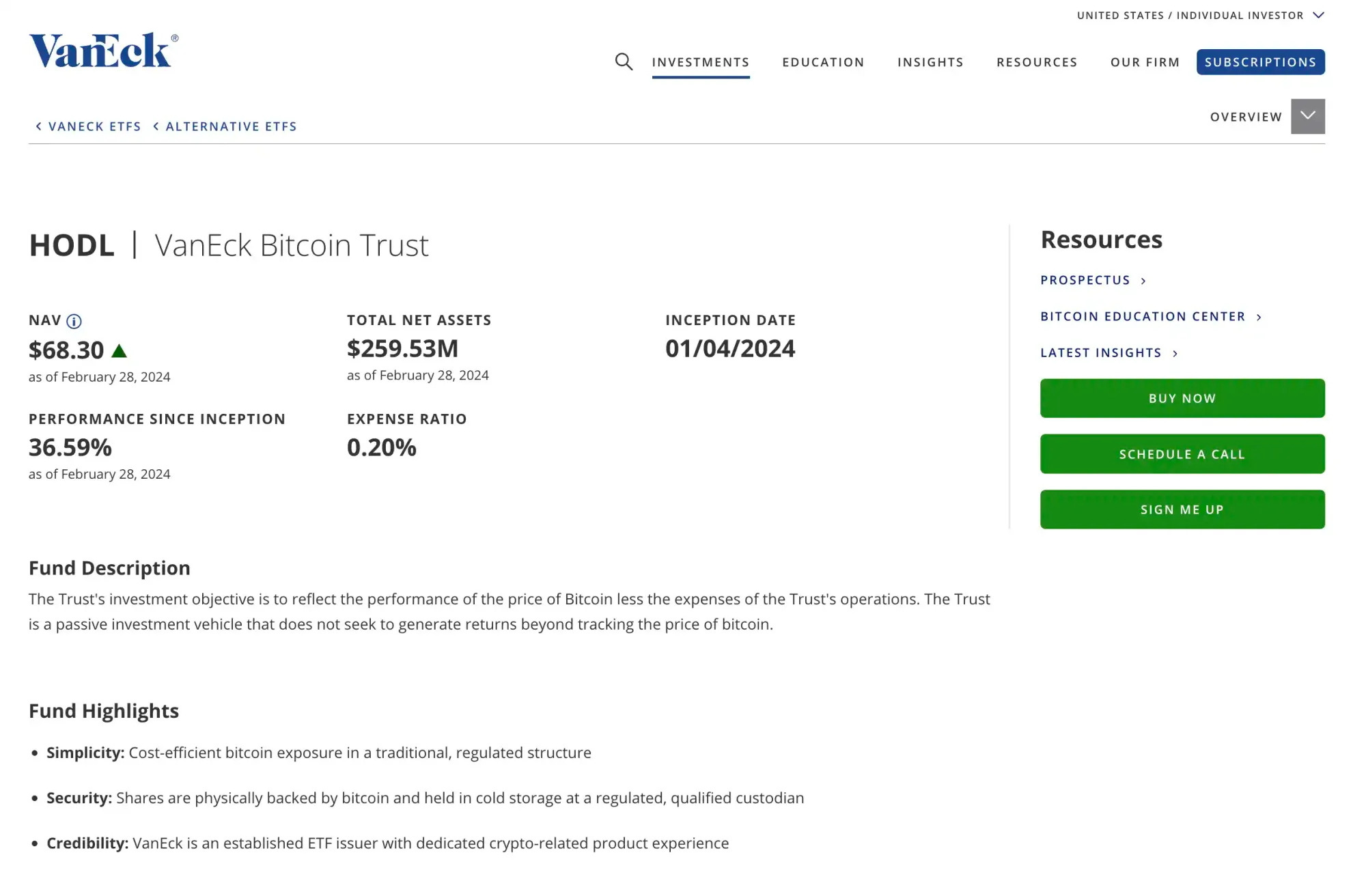

VanEck Bitcoin Trust (HODL)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| VanEck | VanEck Bitcoin Trust | HODL | 0.25% | CBOE |

VanEck, headquartered in New York City, is an American investment management firm primarily focused on issuing exchange-traded fund (ETF) products, with additional offerings in mutual funds and separately managed accounts for institutional investors. Renowned for its pioneering approach to investing in foreign growth stocks and gold, VanEck has made significant contributions to the financial landscape.

The firm gained attention with its spot Bitcoin ETF, called VanEck Bitcoin Trust and represented by the ticker HODL, and garnered praise for its innovative initiative to allocate 5% of BTC ETF profits to Bitcoin Core Developers, accompanied by an initial $10,000 donation to Bitcoin Brink, a subsidiary of Bitcoin Core.

As one of the earliest ETF issuers to venture into the bitcoin ETF space, VanEck enjoys some degree of name recognition. However, despite this advantage, the potential for success may be tempered by factors such as the relatively high fee associated with its offerings.

Valkyrie Bitcoin ETF (BRRR)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Valkyrie | Valkyrie Bitcoin ETF | BRRR | 0.39% | Nasdaq |

The Valkyrie Bitcoin ETF (BRRR), is a pioneering investment vehicle offered by Valkyrie Investments, a firm based in Nashville. Valkyrie stands at the forefront of bridging traditional finance with the rapidly evolving digital asset industry, leveraging a deep understanding of blockchain technology and a history of launching successful investment products across conventional markets.

The leadership at Valkyrie comprises seasoned veterans from the financial industry, with extensive experience gained from prestigious institutions such as Guggenheim Partners, Ernst & Young, Chicago Mercantile Exchange, and The World Bank.

Despite being an early entrant into the market, Valkyrie's bitcoin futures ETF, currently the fourth largest (excluding a 2x bitcoin futures ETF), has not managed to outpace BITO. Moreover, newer ETFs from VanEck and ProShares have surpassed Valkyrie's offering in terms of size. This disparity raises concerns about Valkyrie's competitiveness against larger issuers like BlackRock, Fidelity, and ARK, particularly as these companies prepare to launch their own bitcoin ETFs concurrently.

The observation that Valkyrie may attract only modest assets and face challenges in competing with industry giants is understandable, especially considering its relatively high fee (0.39%) compared to competitors. This dynamic underscores the importance for Valkyrie to differentiate itself and enhance its value proposition to investors in order to maintain its position in the evolving landscape of digital asset investment.

Franklin Bitcoin ETF (EZBC)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Franklin Templeton | Franklin Bitcoin ETF | EZBC | 0.29% | СВОЕ |

Franklin Templeton is a renowned American multinational holding company. Established in New York City in 1947 as Franklin Distributors, Inc., it has since evolved into a global investment firm with a strong presence in the financial industry. Listed on the New York Stock Exchange under the ticker symbol BEN in homage to Benjamin Franklin, the company's namesake, Franklin Templeton has been headquartered in San Mateo, California, since 1973.

While Franklin Templeton is recognized for its traditional approach to asset management, particularly in mutual funds, its foray into ETFs is relatively nascent. Among the bitcoin ETFs, EZBC may not enjoy widespread investor awareness. However, the recent reduction of its fee from 0.29% to 0.19% significantly enhances its appeal to investors, positioning it as a more attractive investment option in the evolving landscape of digital assets.

WisdomTree Bitcoin Trust (BTCW)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| WisdomTree | WisdomTree Bitcoin Trust | BTCW | 0.30% | СВОЕ |

The WisdomTree Bitcoin Trust (BTCW) offers investors an opportunity to gain exposure to the price movements of bitcoin, net of expenses and liabilities, by holding bitcoin directly. The fund's objective is to track the price of bitcoin as closely as possible.

To determine its daily share value, the fund relies on an independently calculated value derived from the aggregation of executed trade flow from major bitcoin spot exchanges. This process ensures transparency and accuracy in valuing the fund's shares.

While WisdomTree is a prominent player in the ETF market, currently ranking #9 in total assets, venturing into the realm of bitcoin ETFs may seem somewhat unconventional for the company. WisdomTree's existing ETF lineup primarily focuses on sectors such as cybersecurity, cloud computing, and artificial intelligence. However, the majority of its U.S. ETF assets are allocated to broad-based stock and bond ETFs. Thus, the introduction of a bitcoin ETF represents a diversification of its product offerings and an expansion into the rapidly evolving cryptocurrency space.

Hashdex Bitcoin ETF (DEFI)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Hashdex | Hashdex Bitcoin ETF | DEFI | 0.90% | NYSE |

Established in 2018, Hashdex stands as a trailblazer in the global realm of crypto asset management, dedicated to democratizing access to the crypto ecosystem and fostering pathways to prosperity. With a trusted track record managing over $542 million in client assets (as of Jan 25, 2024), Hashdex offers simple and secure products tailored to innovative investors seeking to participate in the burgeoning crypto economy.

Committed to mainstreaming crypto opportunities, Hashdex has forged strategic partnerships, including with Nasdaq, to develop the Nasdaq Crypto Index (NCI) and Nasdaq Crypto Index Europe (NCIE), serving as reliable benchmarks for the dynamic crypto asset class on a global scale. In a landmark move in 2021, Hashdex introduced the world's first crypto index ETF, facilitating access to crypto investments for a broad spectrum of investors.

Similar to Bitwise, Hashdex boasts specialized expertise in the crypto sphere, providing them with a competitive edge. However, the notable drawback lies in their fee structure, which may deter potential investors. Despite their pioneering efforts, Hashdex may face challenges in gaining recognition among mainstream investors, especially considering the availability of alternative options with lower fees exceeding half a percent, presenting more appealing alternatives elsewhere.

Grayscale Bitcoin Trust (GBTC)

| Company | Name | Ticker | Fee | Exchange |

|---|---|---|---|---|

| Grayscale | Grayscale Bitcoin Trust (GBTC) | DEFI | 1.50% | NYSE |

Grayscale Investments, a subsidiary of Digital Currency Group, is a leading American digital currency asset management company established in 2013, headquartered in Stamford, Connecticut. Initially launching a bitcoin trust that year, Grayscale Bitcoin Trust (OTCQX: GBTC) became the first publicly traded bitcoin fund in the United States when it began trading over-the-counter on the OTCQX market in 2015.

With the recent approval of the spot ETFs, the Grayscale fund witnessed significant outflows and price suppression due to its process of conversion from a closed-end trust structure to public spot ETF and high 1.5% commission fee, prompting many investors to transition their investments to alternative ETFs, such as those offered by BlackRock and Fidelity.

Before the advent of spot ETFs, GBTC attracted substantial investment as the primary bitcoin investment option. While bitcoin futures ETFs had minimal impact, spot bitcoin ETFs, particularly those from major players like BlackRock and Fidelity, pose a more significant challenge.

Given its substantial holdings of over 400,000 BTC and comparatively higher management fee of 1.5%, continued outflows from the GBTC ETF are anticipated as investors seek lower-fee alternatives. Moreover, the recent court approval allowing the sale of $1.3 billion in GBTC shares by the bankrupt crypto firm Genesis Global Holdco further complicates the fund's outlook.

While Grayscale's Bitcoin fund remains a major player in the field, its future success compared to competitors like BlackRock and Ark is uncertain. Monitoring its performance alongside developments in the ETF landscape is advisable.

Are The ETFs Good For Bitcoin?

ETFs offer a straightforward method to invest in Bitcoin, addressing the complexity associated with Bitcoin technical aspects. Traditionally, entering the Bitcoin space required a deep understanding of concepts like self-custody, which can be daunting for many. Some individuals lack the time or willingness to comprehend these intricacies or to use exchanges like Kraken or Coinbase.

At blockdyor, we advocate for self-custody, encouraging the use of hardware wallets to truly control Bitcoin as both a currency and a store of value. We emphasize the importance of holding "real" Bitcoin that can be withdrawn and self-custodied, allowing individuals to truly embody the concept of a sovereign individual.

ETFs open new avenues, enabling private and institutional investors from prestigious investment banks like Blackrock to allocate significant portions of their wealth into Bitcoin, potentially totaling billions. This influx of capital could usher in a new era of price discovery for Bitcoin.

However, ETFs may not be exclusively beneficial for Bitcoin. There are certain nuances to consider. Let's delve into them.

Unconfiscatability

When held in your personal self-custody device, Bitcoin is considered unconfiscatable—a bearer asset that you control entirely with your own private keys. You could even dispose of all your hardware wallets and rely solely on your memory to retain access to your Bitcoin, even in death. This represents a profound level of empowerment: the ability to protect your bitcoin by any means. Potentially, you can even take your Bitcoin to the grave.

However, the same cannot be said for ETFs. ETFs function as investment instruments rather than payment networks. They operate within a permissioned, closed-source system, often associated with legal entities subject to jurisdictional regulations.

This centralized structure exposes them to the risk of confiscation. Can a government seize your precious funds stored on an open-source, pseudonymous network like Bitcoin? Conversely, can they target the holdings of national pension and hedge funds invested in ETFs? While ETFs may contribute massively to the meteoric rise in Bitcoin's value and awareness in the general public, they also present a potential double-edged sword in the future.

Paper Bitcoin

No matter how many times we revisit this reality, one thing remains certain: ETF holders do not possess any actual Bitcoin—just paper representations of it. We might observe on-chain data using tools like Arkham or review the regularly published proof of reserves from certain ETFs like ARK, but it ultimately doesn't carry much weight. The crucial point is that you don't have control over your private keys. Instead, it's the ETF firms that retain custody of them.

It's essentially akin to keeping your coins in a custodial exchange; there's no comparison to having Bitcoin securely stored in cold storage. We're not all cut from the same cloth, and with each market cycle, individuals gain new insights. The rule is simple: Not your keys, not your Bitcoin—no exceptions.

Yet, it's also true that ETFs provide a convenient avenue for those who prefer to approach Bitcoin as a commodity. Importantly, investing in ETFs doesn't impede individuals' ability to self-custody their Bitcoin holdings.

This cycle is different because the bitcoin etf people can’t swap to alt coins

— Crypto Tea (@CryptoTea_) February 27, 2024

In some respects, investing in Bitcoin ETFs offers advantages over using custodial crypto exchanges, where the focus often shifts to promoting various altcoins. With ETFs, there's no temptation to swap Bitcoin for other cryptocurrencies like Cardano or Dogecoin. Instead, investors can only sell their ETF shares for dollars—an aspect that may be viewed as advantageous in certain scenarios.

Can The ETFs Change Bitcoin?

There has been speculation about large ETF funds like BlackRock exerting decision-making power over the Bitcoin network, potentially leading to a hard fork after acquiring a significant percentage of the total Bitcoin supply. While ETFs such as those offered by BlackRock may impact supply by rapidly accumulating Bitcoin, amassing more coins does not equate to controlling the network.

The Bitcoin network is decentralized, making it unlikely for a government or investment company to influence it. The network is governed by its code, nodes, and miners. Attempts to change block dimensions, as highlighted in Jonathan Bier's book "The Blocksize Wars," have shown that Bitcoin nodes hold influence over miners. For instance, the User Activated Soft Fork (UASF) demonstrated that node operators can signal for a soft fork without miner signaling.

While major players may attempt to initiate a hard fork like Bitcoin Cash or Unlimited, it is likely to fail if deemed detrimental to Bitcoin by the network. ETFs emerged due to market demand, reflecting the desire of some investors to profit from Bitcoin without necessarily understanding its underlying principles. However, investing in ETFs may lead some individuals to grasp the essence of Bitcoin and eventually acquire actual bitcoins. Overall, for Bitcoin in general, the benefits of the Bitcoin ETFs outweigh the drawbacks.

ETFs might be the "Gradually"

In recent years, numerous nations have shown increasing interest in Bitcoin. Canada, for instance, has witnessed the emergence of ETFs over several years, albeit without much fanfare. Similarly, there's been a notable arms race in middle eastern countries to establish Bitcoin mining facilities.

In the Bitcoin community, the phrase "Gradually, then Suddenly" is often used to describe the price growth, suggesting that eventually, the price of BTC will skyrocket abruptly. However, despite significant upward pressure in recent months, the rise of Bitcoin has felt more "gradual".

Nonetheless, the looming Bitcoin FOMO (Fear of Missing Out) is palpable, with ETFs playing a significant role in fueling this sentiment. Every recent month or so, there's news of governments or funds planning to acquire "millions of bitcoins." While this notion may seem fantastical, it's impractical in reality. Purchasing one millions whole bitcoins in a single day is virtually impossible. It took the whole new spot Bitcoin ETFs months to get even half of it.

However, buying at this level could be perceived as desperate. Alternative, and possibly dubious, methods to accumulate such a large volume of bitcoins include coercing entities like MSTR and GBTC to release their coins, spreading significant fear, uncertainty, and doubt (FUD) to induce hodlers to sell, manipulating Coinbase into fractionalizing bitcoins, leveraging the futures market, investing in miners, and bolstering hash rate. It's conceivable that a combination of these strategies may be employed.

Where To Invest In The Bitcoin Spot ETFs?

Investing in Bitcoin ETFs has become much simpler for the average investor who may not be interested in self-custody or holding physical bitcoins.

With spot ETFs, buying them is akin to purchasing shares in any other ETF or security. While they are not available for trading 24/7 like traditional Bitcoin, they can usually be traded intraday.

Spot Bitcoin ETFs are accessible through various traditional platforms offering stocks, retirement planning, and auto-investing services. Most ETFs are traded on platforms like Nasdaq or Cboe, allowing investors to buy ETF shares without the need to understand Bitcoin or self-custody.

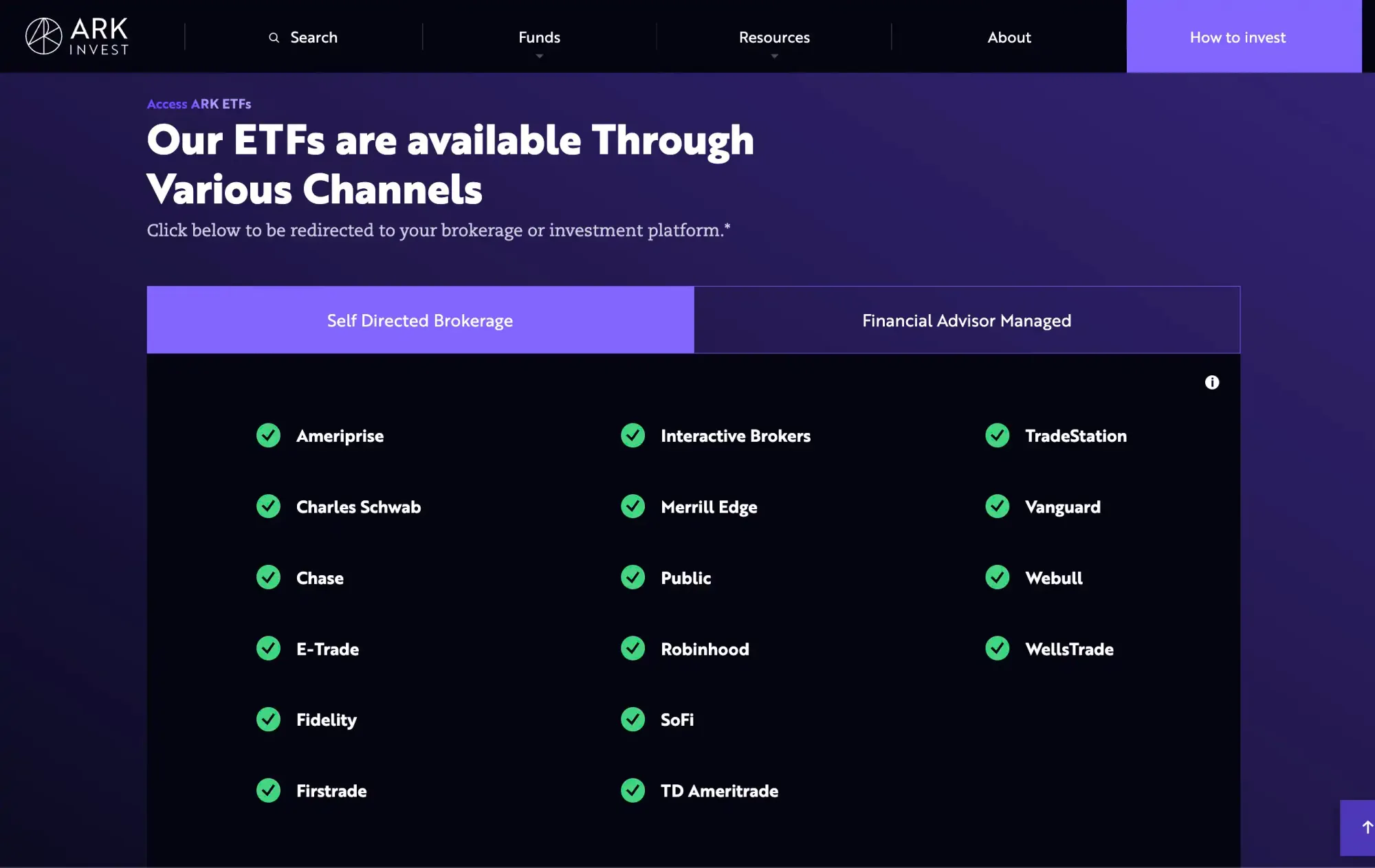

For instance, Ark Invest's Bitcoin Spot ETF may not be directly available on their website. However, investors can trade the ETF through various channels such as investment advisers, broker-dealers, and other financial services.

Options for Investing in Spot Bitcoin ETFs:

- Self-Directed Brokerage: Fidelity, Robinhood, Chase, Vanguard, and others.

- Financial Advisor Managed: Fidelity, Merrill Lynch, Morgan Stanley, Wells Fargo, and others.

How to Invest in Spot Bitcoin ETFs

- Open a Brokerage Account: Choose a suitable brokerage account, ensuring it accepts customers residing in your country.

- Fund the Account: Deposit funds from another brokerage or regular bank account to cover the cost of ETF shares, fees, and commissions.

- Search for Available ETFs: Browse the available ETFs on the platform, focusing on those with high volume and reasonable fees.

- Select the Best Bitcoin ETF: Compare options based on fees, volume, and issuer reputation to align with your investment goals.

- Place an Order: Buy ETF shares using a market order for quick execution or a limit order to specify the desired price.

- Monitor Your Investment: Track the progress of your investment periodically, adjusting as needed over time.

Bitcoin Spot ETFs Fees

Investing in a Bitcoin Spot ETF differs significantly from holding actual Bitcoin in your wallet and practicing self-custody, which entails no annual costs and carries no maintenance expenses since you are essentially your own bank. Conversely, investing in a Bitcoin Spot ETF involves fees, comprising various costs that will be subtracted annually.

For example, an ETF company faces expenses such as manager salaries, custodial services, and marketing costs as part of its regular operations. These costs are deducted from the Net Asset Value (NAV).

Consider an ETF with a stated annual expense ratio of 0.25%, similar to the majority of Bitcoin spot ETFs. On a $100,000 investment, the expected expense to be paid over the year amounts to $250. If the ETF precisely returns 0% for the year, the investor would see their $100,000 investment decrease to $99,750 over the year.

The net return that the investor receives from the ETF is determined by subtracting the stated expense ratio from the total return earned by the fund. If the ETF returns 50%, the NAV would increase by 49.75%, representing the total return minus the expense ratio.

Alternatives to the Bitcoin Spot ETFs

The ETFs represent a groundbreaking asset class, offering simplicity and potentially serving as an entry point into Bitcoin investment. However, Bitcoin transcends mere commodity status; it is currency. Here are key methods to invest directly or indirectly in Bitcoin, bypassing the need for a spot Bitcoin ETF:

- Direct Purchase: Acquire Bitcoin directly through various means. While buying from individuals with cash is feasible, it entails risk. Safer options include online exchanges of different types: peer-to-peer (P2P) platforms like Peach Bitcoin, centralized exchanges without identification requirements such as Relai, or those with identification like Kraken. Due to the potential bankruptcy of exchanges, safeguard your investment through self-custody, moving ASAP coins to hardware wallets like Blockstream Jade or Bitbox02 for secure private key storage.

- Invest in Bitcoin Stocks: Another way for Bitcoin exposure is investing in companies that incorporate Bitcoin into their treasuries, accumulating significant BTC holdings over time. A prime example is MicroStrategy (MSTR), known to move approximately 1.5 times more in alignment with Bitcoin's performance, based on available data.

Spot Bitcoin ETFs Pros & Cons

We've already covered some of these points, but here's a quick overview of the pros and cons of Bitcoin Spot ETFs.

| Pros | Cons |

|---|---|

| ✅ Easy Bitcoin access for traditional investors | ❌ No ownership of actual Bitcoins |

| ✅ Exposure to Bitcoin's price without technical expertise | ❌ Regulatory oversight |

| ✅ Portfolio diversification with Bitcoin alongside traditional assets | ❌ ETF fees may erode returns |

| ✅ Liquid trading on traditional brokerage platforms during market hours | ❌ Concentrated holdings may lead to market instability |

| ✅ Tax advantages compared to directly owning Bitcoin | ❌ Management fees |

| ✅ Institutional investment potential, enhancing market liquidity | |

| ✅ Transparency and regulatory oversight inspire investor confidence |

Bottom Line

Investing in the Spot Bitcoin ETFs offers a simplified entry point into the world of cryptocurrency, providing an accessible way to gain exposure to the digital asset.

While ETFs may present advantages in terms of convenience and ease of use, it's essential to recognize that Bitcoin embodies more than just a commodity—it represents a revolutionary form of decentralized money.

Investing in a Spot Bitcoin ETF, although straightforward and appealing, requires relinquishing direct ownership of Bitcoin as a bearer asset. Additionally, investors must pay annual fees to the fund managers. Therefore, before committing to investment, it's crucial to carefully evaluate all associated risks, including these factors.