Crypto Bankruptcies 2024: The Biggest Crypto Exchange Collapses

Understanding crypto bankruptcies is vital. Opt for self-custody by using cold storage to protect your coins. Avoid potential losses and industry troubles.

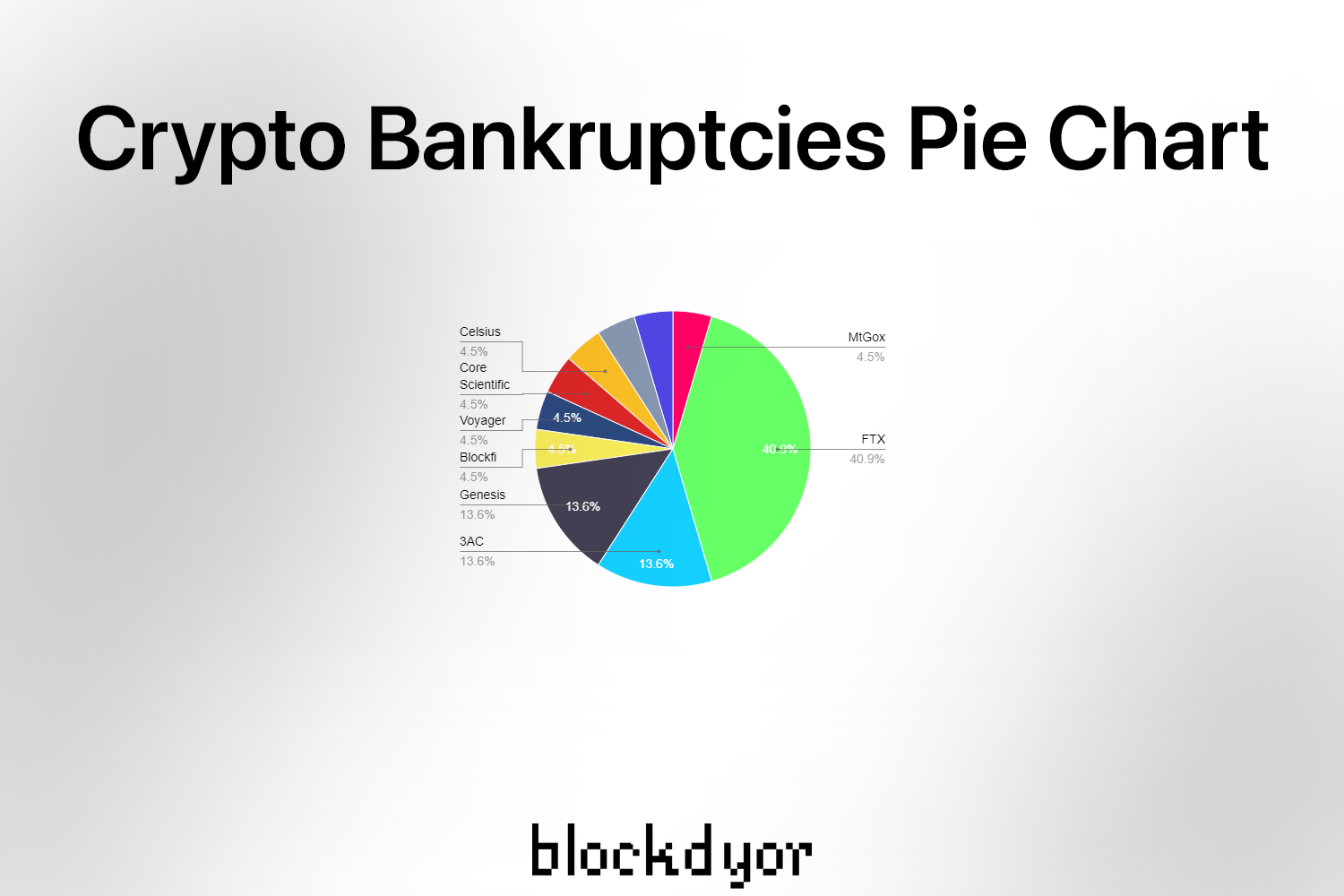

Crypto Bankruptcies are becoming normality in the turbulent world of crypto markets. Black swan events have wreaked havoc over the years, defying predictability. Trust, a crucial element in any financial system, is still an vague concept within the crypto realm. Despite meticulous research and expert analysis, disastrous investments seem unavoidable.

After almost 15 years, the cryptocurrency industry traces its origins back the innovative bitcoin whitepaper in late 2008, now grown into a huge market cap sector. However, the journey has been far from smooth sailing, as the most horrifying black swan events have periodically emerged, obliterating years of progress in a matter of days.

Throughout the history, numerous crypto companies have met their demise due to massive hacks, fraud, and mismanagement, resulting in the loss of billions of dollars in investor funds and causing layoffs within the industry.

In this comprehensive guide, we will list into the most significant crypto bankruptcies that have occurred from the early days of the industry up until the present moment.

Mt. Gox, 2014

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Mt. Gox | Chapter 15 | 850,000 BTC | 200,000 BTC | No |

Mt. Gox, headquartered in Tokyo, stood as the pioneering crypto exchange and likely marked the most significant crypto exchange collapse not just in Bitcoin's, but also in the whole cryptocurrency's history. Its magnitude becomes apparent when considering that at its peak, the exchange facilitated over 70% of the entire global Bitcoin transactions.

With its rising popularity, Mt. Gox attracted the attention of hackers. In the initial breach, hackers obtained credentials to steal bitcoins to their own addresses. Subsequently, flaws in the network protocol resulted in the loss of several thousand more bitcoins.

Customers began expressing discontent due to difficulties encountered while attempting to withdraw their funds during the months leading up to early 2014. However, the situation took a devastating turn in February of that year, when the exchange suffered a major hack, resulting in the loss of a staggering 850,000 bitcoins. This incident led the company to declare bankruptcy. Fortunately, with the intervention of certain authorities, they managed to recover 200,000 BTC.

In November 2021, Mr. Kobayashi, the trustee for Mt. Gox, introduced a rehabilitation strategy that involved the registration and reimbursement process for various creditors. Although some creditors completed the registration procedure, the vast majority of investor funds remained irretrievable, leaving a substantial portion of investors with significant losses.

FTX, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| FTX | Chapter 11 | $9 billion | Underway | No |

When it failed, FTX was one of the biggest up and coming crypto exchanges, ranked among the top-five by trading volume. It suddenly encountered a major financial crisis that culminated in insolvency and the inability to honor customer withdrawal requests. Consequently, on November 11, 2022, the exchange found itself compelled to file for Chapter 11 bankruptcy in the United States.

FTX's troubles started when a news report in November revealed substantial liabilities of $8 billion linked to Alameda Research, a closely associated crypto trading firm. Notably, Alameda Research held a considerable portion of its equity in FTT, the native token of the FTX exchange, which proved to be relatively illiquid. The ripple effect ensued when Binance, the world's largest cryptocurrency exchange, divested its FTT holdings, causing a sharp decline in the token's value and triggering a cascade of events.

Recognizing the impending turmoil, customers rushed to withdraw an astonishing $6 billion from FTX within a mere 72 hours, overwhelming the exchange's ability to accommodate such a massive outflow. Further investigation uncovered that FTX had been channeling customer funds to Alameda Research for high-risk trading ventures, a move that backfired significantly when Alameda's investments incurred substantial losses, exacerbating FTX's financial strain.

The bankruptcy filing underscored the exchange's incapacity to fulfill customer withdrawals, ultimately leading to the demise of what was once a thriving platform. Presently under new leadership, FTX is endeavoring to salvage whatever funds remain in their possession, with the primary aim of satisfying customer withdrawals to the best possible extent.

For a brief period, there was a glimmer of hope when Binance expressed interest in rescuing FTX by signing an acquisition agreement in November. Regrettably, Binance later opted out of the deal after conducting due diligence, further compounding FTX's dire situation.

Three Arrows Capital, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Three Arrows Capital | Chapter 15 | $3.5 billion | Undergoing | No |

During its existence, Singapore-based cryptocurrency hedge fund Three Arrows Capital stood as a dominant force among the industry, boasting an impressive AUM exceeding $10 billion.

However, its downfall can be attributed to the collapse of UST, a prominent stablecoin project, in which 3AC had invested approximately $500 million, ultimately resulting in a total loss.

Adding to their predicament, 3AC held leveraged positions across DeFi protocols, which faced liquidation following significant drops in the prices of BTC and ETH.

The firm had previously borrowed funds from renowned crypto entities such as Blockchain.com, Voyager Digital, Genesis, and BlockFi, all of which were adversely affected by Three Arrows Capital's bankruptcy. Reports suggest that the total debt owed by 3AC amounts to a substantial $3.5 billion.

Genesis, 2023

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Genesis | Chapter 11 | $3.4 billion | Undergoing | Yes |

In January 2023, the cryptocurrency lending firm Genesis made a significant impact on the financial landscape when it filed for Chapter 11 bankruptcy in a Manhattan court. The company, which operated as a subsidiary of the renowned Digital Currency Group, endured a tumultuous year in 2022.

The troubles for Genesis began in June 2022 when it disclosed a substantial loan loss, involving an undisclosed counterparty, which was later revealed to be Three Arrows Capital, a prominent crypto hedge fund. Unfortunately, Three Arrows Capital itself faced financial difficulties and filed for bankruptcy in July 2022.

As the year progressed, the cryptocurrency market faced a series of challenges, and by November 2022, two major players in the industry, FTX and its sister company Alameda Research, collapsed. Genesis, having a significant sum of approximately $175 million in assets locked on the now-defunct FTX exchange, found itself deeply impacted by this catastrophe. Additionally, Genesis had a lending arrangement with Alameda, which added to its financial strain.

Amidst the chaos caused by the FTX collapse and the broader challenges faced by the cryptocurrency world, Genesis faced a crisis of its own. The company had to suspend redemptions at its lending unit, further exacerbating the situation.

Finally, on January 19th, 2023, Genesis formally sought protection through Chapter 11 bankruptcy, seeking to restructure its operations and financial obligations. The following day, the company presented an extensive 83-page bankruptcy plan in an effort to navigate through the difficulties it faced and find a path to financial recovery. The fallout from Genesis's bankruptcy sent ripples throughout the cryptocurrency industry, highlighting the risks and uncertainties faced by players in this rapidly evolving sector.

BlockFI, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Blockfi | Chapter 11 | $1.3 billion | Undergoing | Yes |

In November, the crypto lending platform BlockFi faced a severe financial crisis and subsequently filed for Chapter 11 bankruptcy. The company's fate was intertwined with the collapse of FTX, which occurred in the same month and had a significant impact on BlockFi's operations.

The situation took an unexpected turn when BlockFi disclosed that it owed a staggering $275 million to FTX US. Furthermore, the company had lent out more than $1 billion of its clients' funds to FTX and its sister trading firm, Alameda. This high exposure to the now-collapsed FTX and its affiliated entities had severe repercussions on BlockFi's financial stability.

Amidst the mounting debt and financial obligations, BlockFi acknowledged owing a substantial $1.3 billion to its 50 largest creditors. On the other hand, the company held $257 million in available cash. However, due to the severity of the situation, BlockFi made the difficult decision to halt customer deposit withdrawals, further compounding the challenges faced by its clients.

Voyager Digital, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Voyager Digital | Chapter 11 | $1.3 billion | Undergoing | No |

In a shocking turn of events, Voyager Digital, a prominent U.S.-based cryptocurrency exchange, faced a devastating financial crisis that ultimately led to its declaration of bankruptcy. The situation unfolded when 3AC, an entity with significant financial ties to Voyager, defaulted on an astounding $660 million debt owed to the exchange.

The troubles began to surface at the start of July when Voyager decided to suspend withdrawals temporarily. However, the exchange sought to reassure the public by stating its intention to continue its operations despite this setback.

In an attempt to mitigate its exposure to the mounting debts left by 3AC, Voyager utilized $75 million from a 15,000 BTC revolving loan provided by Alameda Research. This move was aimed at offsetting the financial repercussions caused by 3AC's inability to repay its substantial debts.

During this challenging time, Voyager disclosed that it held approximately $137 million in cash and cryptocurrencies in its reserves. Nevertheless, these reserves were not sufficient to withstand the significant default by 3AC, which subsequently filed for bankruptcy. As a result, the hopes of Voyager to recover the amount owed by 3AC were severely dashed.

The dire financial situation left Voyager with a staggering debt of over $1.3 billion, owed to approximately 100,000 creditors. The fallout from this bankruptcy sent shockwaves throughout the cryptocurrency community, underscoring the inherent risks and complexities associated with crypto exchanges and their interconnected relationships with other entities within the industry.

Core Scientific, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Core Scientific | Chapter 11 | $1.3 billion | Undergoing | Yes |

In December 2022, Core Scientific, one of the prominent Bitcoin mining firms, faced a significant financial setback and filed for Chapter 11 bankruptcy. The dramatic decline in the price of Bitcoin throughout 2022 rendered the mining operations unprofitable for Core Scientific, leading to substantial losses for the publicly-traded company.

Prior to seeking bankruptcy protection, Core Scientific experienced substantial financial challenges, reporting losses of hundreds of millions of dollars, including a staggering $435 million in the three months leading up to September 2022.

Despite the financial turmoil, Core Scientific disclosed assets worth $1.4 billion and liabilities amounting to $1.3 billion, owed to approximately 1,000 to 5,000 creditors. In response to its financial crisis, the company opted for a prepackaged bankruptcy approach, which involved engaging in negotiations with creditors ahead of formal bankruptcy proceedings. Unlike many other companies facing bankruptcy, Core Scientific's debt was primarily owed to institutional investors rather than retail creditors. As part of its restructuring efforts, the company successfully arranged for many lenders to convert their debt into equity, allowing for a potential pathway to recovery.

Remarkably, even amidst the bankruptcy proceedings, Core Scientific continued to participate in Bitcoin mining operations. Despite its financial struggles, the company remained a significant player, contributing 10% of the total computing power on the Bitcoin network.

Celsius, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Celsius | Chapter 11 | $1.2 billion | None | No |

Celsius, a once-thriving crypto lending and staking platform, faced a devastating liquidity crisis that eventually led to its descent into bankruptcy. The ongoing crypto bear market played a significant role in this unfortunate turn of events, exerting immense pressure on the platform's financial stability.

Adding to the woes, the Luna-UST crash further exacerbated the situation for Celsius, pushing the firm deeper into financial distress and making it increasingly challenging to recover.

The community began to notice signs of trouble when Celsius abruptly halted all user withdrawals, leaving its users concerned and uncertain about the platform's future. To compound matters, millions of dollars were transferred from Aave to FTX by the firm, raising questions and concerns among stakeholders about the reasons behind this unexpected move.

Celsius's reliance on leveraged holdings in various DeFi protocols proved to be a precarious decision during the severe bear market. As the market conditions worsened, these leveraged holdings faced liquidation, leading to significant losses for the platform. The lack of adequate risk hedging strategies further exacerbated the financial strain, leaving Celsius vulnerable and unable to secure its funds effectively.

In the face of mounting financial difficulties, Celsius was compelled to acknowledge a substantial balance-sheet deficit, with bankruptcy court records indicating a potential shortfall of up to $1.2 billion. This staggering deficit left the platform in an untenable position, with limited options for recovery and survival.

Bittrex (USA), 2023

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Bittrex (US branch) | Chapter 11 | between $500 million to $1 billion | None | No |

In a dramatic turn of events, Bittrex, a well-established cryptocurrency exchange, brokerage, and clearing agency, faced a major legal setback when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the company for operating without the appropriate license. After years of operation in the U.S., Bittrex's activities came under scrutiny, leading to legal action by the regulatory authority.

As a consequence of the SEC lawsuit and the uncertainty surrounding its operations in the U.S., Bittrex made the difficult decision to cease all activities within the country. The effective date of this cessation was April 30, 2023, marking the end of its services to U.S. customers.

However, despite the discontinuation of operations in the U.S., Bittrex intended to continue its services outside of the country through its subsidiary company, Bittrex Global. This move was seen as an attempt to preserve its business operations and cater to international clients.

Unfortunately, the company's legal woes and the subsequent termination of its U.S. operations took a heavy toll on its financial standing. On the 8th of May, 2023, Bittrex filed for bankruptcy, revealing staggering liabilities of between $500 million to $1 billion. This massive debt burden affected over 100,000 creditors who had entrusted their funds and assets to the exchange.

Babel Finance, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Babel Finance | Chapter 11 | $280 million | None | No |

Babel Finance, a prominent Hong Kong-based crypto lender, faced a distressing liquidity crisis triggered by the ongoing bear market. The company's precarious financial situation was compounded by unhedged positions in proprietary trading accounts, leading to significant losses.

The losses incurred from these unsecured positions forced the liquidation of trading accounts, resulting in the unfortunate depletion of a substantial amount of assets, including 8,000 BTC and 56,000 ETH. In total, the company reported a staggering loss of approximately $280 million in customer funds.

The primary cause of Babel Finance's collapse has been attributed to the inadequacy of its risk management practices. Insufficient risk hedging strategies left the company vulnerable to the volatile and unpredictable nature of the cryptocurrency market, ultimately leading to its financial downfall.

In an effort to address its financial challenges and seek a path to recovery, Babel Finance has outlined a plan to convert $150 million in creditor debt into convertible bonds, aiming to raise $300 million in capital. Additionally, the company anticipates securing $200 million in revolving credit.

Hodlnaut, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Hodlnaut | Judicial Management | $193 million | None | Paused |

Hodlnaut, a notable crypto lender, finds itself in a challenging position as it has been placed under interim judicial management by the Singapore Court for creditor protection. The company took this step amid difficult market conditions, which compelled them to pause user withdrawals temporarily. The primary objective behind this measure was to stabilize liquidity and safeguard assets while seeking a viable long-term solution to its financial troubles.

In a surprising move, Hodlnaut withdrew its application for a license from the Monetary Authority of Singapore (MAS) after initially receiving in-principle approval from the central bank in March. As a consequence, the platform halted token swaps and deposits, further complicating the situation for its users.

However, specific details regarding the amount owed to creditors and the precise reasons for halting operations have not been disclosed publicly. The lack of information on these critical aspects has left stakeholders, investors, and users uncertain about the full extent of Hodlnaut's financial difficulties and the prospects of their funds.

Quadriga CX, 2019

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Quadriga CX | Canadian Bankruptcy and Insolvency Act (BIA) | $190 million | $40 million | No |

In 2019, QuadrigaCX, a Canadian cryptocurrency exchange, faced a significant setback when its founder and CEO, Gerald Cotten, died in misterious circumstances in December 2018. Cotten's demise occurred in India due to complications from Crohn’s Disease. As the sole custodian of the exchange's cold wallets, which held the majority of Quadriga's crypto assets, his untimely death rendered those funds inaccessible, leading to the exchange's declaration of bankruptcy.

The aftermath of Cotten's passing revealed troubling issues within QuadrigaCX. Ernst & Young, the professional services firm tasked with investigating the exchange after his death, reported a concerning lack of controls and oversight. Notably, QuadrigaCX lacked a formal bank account or accounting system, and it appeared to operate solely from an encrypted laptop owned by Cotten. Additionally, another co-founder was discovered to have a history of identity theft charges in the US, having been deported to Canada and trying to conceal their past through multiple name changes.

Even prior to Cotten's demise, QuadrigaCX was grappling with financial difficulties. However, the inability to access the cold wallets became the decisive factor that led to the declaration of bankruptcy on February 5, 2019. At the time of the bankruptcy, QuadrigaCX owed its customers nearly $190 million in both fiat and cryptocurrency. Unfortunately, following the bankruptcy announcement, all customer accounts were frozen, depriving them of access to their funds.

FCoin, 2020

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Fcoin | Chapter 11 | $130 million | None | No |

FCoin was a Singapore-based cryptocurrency exchange that made a remarkable entry into the market, boasting a peak trading volume that surpassed that of industry giants like Huobi, OKX, and Binance combined. Its success was attributed to its innovative business model called "transaction mining," which offered incentives to traders by rewarding them with native tokens based on their trading activity.

However, FCoin's rapid growth was met with a major setback in July 2018 when nearly 10,000 BTC were withdrawn from the platform, triggering panic among investors. Following this incident, the exchange's performance began to falter, leading to a decline in user activity.

In an attempt to bolster its native token's value, FCoin decided to burn a staggering 720 million of its tokens in February 2018. The move initially appeared to be successful, as the price of the native token, FT, experienced a short-lived surge. However, this success was short-lived, as the exchange suddenly and mysteriously shut down.

The unexpected shutdown left users in a state of distress, as FCoin failed to pay investors a significant sum of 13,000 BTC, which amounted to roughly $125 million. With no resolution or relief provided to users, the exchange's sudden closure has left investors and traders in limbo for over two years.

Zipmex, 2022

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Zipmex | Moratorium | $53 million | None | Yes |

Zipmex, a prominent Thai cryptocurrency exchange, found itself in a dire financial situation after facing a significant $53 million default from two major players in the industry, Babel Finance, and Celsius. This default led the exchange to take the step of filing for debt relief in Singapore, seeking a resolution for its financial challenges.

As a result of these circumstances beyond its control, Zipmex had to take the difficult decision of pausing user withdrawals. However, in a subsequent move, the exchange resumed withdrawals for some altcoins, aiming to provide relief to its users and restore confidence in its operations.

In an effort to address its financial crisis and seek a path to recovery, Zipmex sought creditor protection from the Singapore court. The court granted the exchange a three-month period of protection, during which it can engage with authorities and devise a strategy to manage its exposure to the crisis caused by Babel Finance and Celsius.

Zipmex's legal team, represented by the Asset Protection Group, has been actively working to protect the firm's interests. The exchange's various entities have filed five motions for moratoriums on legal actions, seeking a breathing space to navigate through the challenging financial landscape and find a sustainable solution to its financial woes.

The Rock Trading, 2023

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| The Rock Trading | Judicial Management | +$20 million | Undergoing | No |

The Rock Trading, an Italian cryptocurrency exchange founded by Andrea Medri and Davide Barbieri in 2011, has been embroiled in a significant financial scandal. Investigations into the platform revealed a massive hole in its funds, amounting to over €20 million.

Starting in February, the exchange ceased allowing users to withdraw their assets, causing alarm among users and leading to attempts to recover their funds. The situation worsened when the president of The Rock Trading resigned, and users initiated a class action against the platform.

As investigations unfolded, it came to light that the company had mismanaged its assets. The internal files of The Rock Trading showed that the company used an omnibus account, a single hot wallet that pooled all customers' assets. This lack of segregation meant that it was impossible to ascertain the amount of assets owned by each user without consulting the company's accounting.

Furthermore, evidence emerged that The Rock Trading recklessly used clients' assets without their knowledge for various transactions. The platform failed to regularly reconcile the balance of the hot wallet with the internal ledger, leading to clients' cryptocurrencies being used for transactions in favor of third parties.

The scale of the hole in the platform's funds is substantial, with potentially defrauded users totaling 18,689, who deposited cryptocurrencies and fiat currencies worth tens of millions of euros and other currencies. Despite the significant shortfall, the exact whereabouts of these assets remained unknown.

The situation has sparked a legal battle, with judicial liquidation being requested for The Rock Trading.

Blockchain Global, 2021

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Blockchain Global | Voluntary Administration | $15 million | None | No |

Blockchain Global (BGL), the parent company of the now-defunct Australian Crypto Exchange (ACX), faced a grim financial situation that eventually led to its bankruptcy. The collapse of the administration left BGL with a staggering debt of over $15 million (USD).

The heart of the financial crisis was tied to ACX, the crypto trading platform operated by BGL. ACX faced legal troubles as it abruptly shut down in February 2020, leaving a group of 94 investors disgruntled and seeking compensation. The investors filed a lawsuit against ACX, leading the case to be taken up by the Victoria Supreme Court. In response, the court issued a freeze order on 117.33 Bitcoin, valued at approximately $7.1 million, which was owned by both BGL and ACX Tech, the operators of ACX.

As the legal proceedings continued, BGL and ACX Tech were compelled to disclose the full extent of their assets, both within Australia and abroad. This led to the revelation of the corporation's financial situation, prompting BGL to take the step of filing for voluntary administration. This decision was taken in light of the mounting debt of $15 million owed to creditors.

Cryptopia, 2019

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| Cryptopia | Chapter 15 | $16 million | $7 million | No |

Cryptopia, a digital asset exchange based in New Zealand, met a tragic fate as it fell victim to a massive cyberattack that eventually led to its bankruptcy. The exchange was undergoing unscheduled maintenance when hackers struck, stealing more than $16 million from its wallets.

The attack on Cryptopia was executed in a strategic manner. Hackers first targeted two of the exchange's core wallets, draining funds from them. Subsequently, they moved on to exploit over 75,000 secondary wallets, further increasing the scale of the theft.

Despite extensive investigations, the exact reason for the hack remains elusive. While some suspect that Cryptopia may have orchestrated an exit scam by framing it as a security breach, others point fingers at the exchange for its alleged negligent storage practices, which provided the hackers with unauthorized access to the funds.

In response to the devastating incident, Cryptopia initiated a claims process to reimburse its creditors for their losses. Grant Thornton, an auditing firm, assessed the exchange's financial situation and revealed that it owes a total of $4.2 million to its creditors.

ACX, 2020

| Exchange Name 🏛️ | Bankruptcy Type 💼 | Total Deficit Amount 💸 | Recovery Status 🔄 | Platform Operational? 🚀 |

|---|---|---|---|---|

| ACX | Voluntary Administration | $15 million | None | No |

ACX, once hailed as Australia's most liquid bitcoin exchange, faced a devastating turn of events that led to its abrupt shutdown and the loss of approximately 10 million in user funds. The exchange's collapse left users stunned and concerned about the safety of their assets.

The troubles for ACX became apparent in January 2020 when the exchange unexpectedly ceased operations, raising serious doubts about its financial stability. The discovery of an empty hot wallet only added to the growing concerns surrounding the exchange's solvency. To make matters worse, users discovered that ACX's Australian offices were shut down, leaving them with limited avenues for seeking answers or assistance.

Despite numerous attempts to contact the organization through emails and phone calls, users were met with silence for weeks. The lack of communication further fueled suspicions about the exchange's intentions and raised accusations of an exit scam orchestrated by ACX.

The situation worsened when Blockchain Australia, an industry organization, took action by suspending ACX from its board. The suspension came after reports of missing funds from the exchange's wallets, further cementing the suspicions of an orchestrated scam.

Despite clinging to hope through ACX's parent company, Blockchain Global, all hopes were eventually dashed when Blockchain Global itself collapsed in 2021. This event left users without any recourse and their funds lost, exacerbating the impact of ACX's sudden shutdown and suspected malfeasance.

Bottom line

The numerous crypto bankruptcies serve as a critical lesson for anyone considering registering and holding funds on exchanges for an extended period. Regardless of your perception of an exchange's safety, it is crucial to exercise caution because no exchange is immune to risks, especially centralized ones, as they are custodial. Entrusting your funds to such platforms means relinquishing control of your private keys, and they can vanish without warning.

The failures of various exchanges and lenders due to hacking, mismanagement, or other reasons are alarming. You might wonder, how can you protect yourself from such risks? Firstly, consider buying Bitcoin and other cryptocurrencies using decentralized and peer-to-peer exchanges like AgoraDesk. By doing so, you can preserve your privacy and avoid linking your coins to your identity.

Moreover, opting for non-custodial solutions such as peer-to-peer (p2p) exchanges helps you steer clear of traditional crypto exchanges and the various risks associated with them. Presently, there are no crypto exchanges that offer FDIC (Federal Deposit Insurance Corporation) protections.

Most importantly, take the step of moving your coins off exchanges and onto a hardware wallet like the Blockstream Jade. This ensures that your private keys are always offline and solely in your possession, significantly reducing the risk of unauthorized access and potential losses.

👉 Click here to get the Blockstream Jade. Use coupon code BLOCKDYOR to get a 10% off at checkout.