12 Best Bitcoin-Only Exchanges And Apps Of 2024

Choosing the best bitcoin exchange isn't an easy feat. To solve this, we tested all major bitcoin-only exchanges, organizing them based on our proprietary blockdyor score for clarity and informed decision-making.

It's quite confusing, after registering on a crypto exchange, to find a ton of altcoins or even copies of the real Bitcoin, like Bcash or BSV. This kind of cluttered user experience is basically a form of deception that make beginners to start in the worst possible way, with buy fake forks (or better: failed copies) of Bitcoin or other altcoins with a doubtful utility.

I decided to create this updated guide with all those web-based (or app) exchanges that are laser-focused on the real Bitcoin (BTC). However, if you still prefer exchanges that offers Bitcoin + altcoins, you can find a guide here.

Best Bitcoin-Only Exchanges And Apps Of 2024

The list includes both those exchanges/apps that enforce KYC but also all those solutions that don't. However, there is an higher possibility that the non-KYC/soft-KYC solutions are positioned higher in the rankings, because in our blockdyor Score, a proprietary metric we use to asses the quality of a platform, we give an higher score on solutions that don't enforce KYC (more on that after the list).

- 🥇 Hodl Hodl

- 🥈 Agoradesk

- 🥉 Bisq

- 🎖️ Robosats

- 🎖️ Bull Bitcoin

- 🎖️ Vexl

- 🎖️ Peach Bitcoin

- 🎖️ Relai

- 🎖️ Pocket Bitcoin

- 🎖️ Swan

- 🎖️ River

- 🎖️ 21bitcoin

Hodl Hodl

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Hodl Hodl | 🇪🇺🇨🇦 + more | 0.30% / 0.30% | ⭐⭐⭐⭐⭐ 95/100 |

Why We Chose It

With over 7 years of experience, Hodl Hodl offers a unique Bitcoin-only, non-custodial, peer-to-peer solution. It stands out as one of the best exchanges to buy/sell Bitcoin using various currencies and payment methods while ensuring maximum privacy through a non-KYC structure. Hodl Hodl is non-custodial: it does not hold user funds; instead, it uses a multisig escrow system, providing high security for every transaction.

Not just trading, but Hodl Hodl also serves as a peer-to-peer lending solution, enabling users to lend or borrow funds anonymously on their own terms. When utilizing this service, Hodl Hodl generates a distinctive multisig escrow address, ensuring high security for all the trades.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low fees | ❌ Not available in the USA |

| ✅ Easy to use | ❌ No web based or mobile apps |

| ✅ Many offers for several currencies/payment methods |

Overview

Hodl Hodl was founded in 2016, and is one of the first p2p Bitcoin-only exchange platform. It offers direct trading without a middleman. It works both on the Bitcoin on-chain and Lightning Network, allowing users to buy and sell Bitcoin safely. One interesting aspect is its avoidance of holding user funds, instead it uses a multisig escrow system for transactions, ensuring heightened security.

The platform accepts various payment methods and currencies, letting users fast and secure transactions over multisig smart contracts, while users retain control over their escrow keys. Hodl Hodl has gained traction among privacy-conscious traders due to its emphasis on anonymity, global P2P trades without KYC/AML requirements, low fees (0.6% shared equally between trade parties), and security provided by multisig contracts.

Hodl Hodl offers also P2P lending services, allowing users to (anonymously) lend or borrow funds on their terms, further expanding its utility. With its commitment to security, anonymity, and user control, Hodl Hodl provides a reliable platform for Bitcoin enthusiasts worldwide.

Full Review

👉 Sign up on Hodl Hodl now for a lifetime discounted trading fee of just 0.45%.

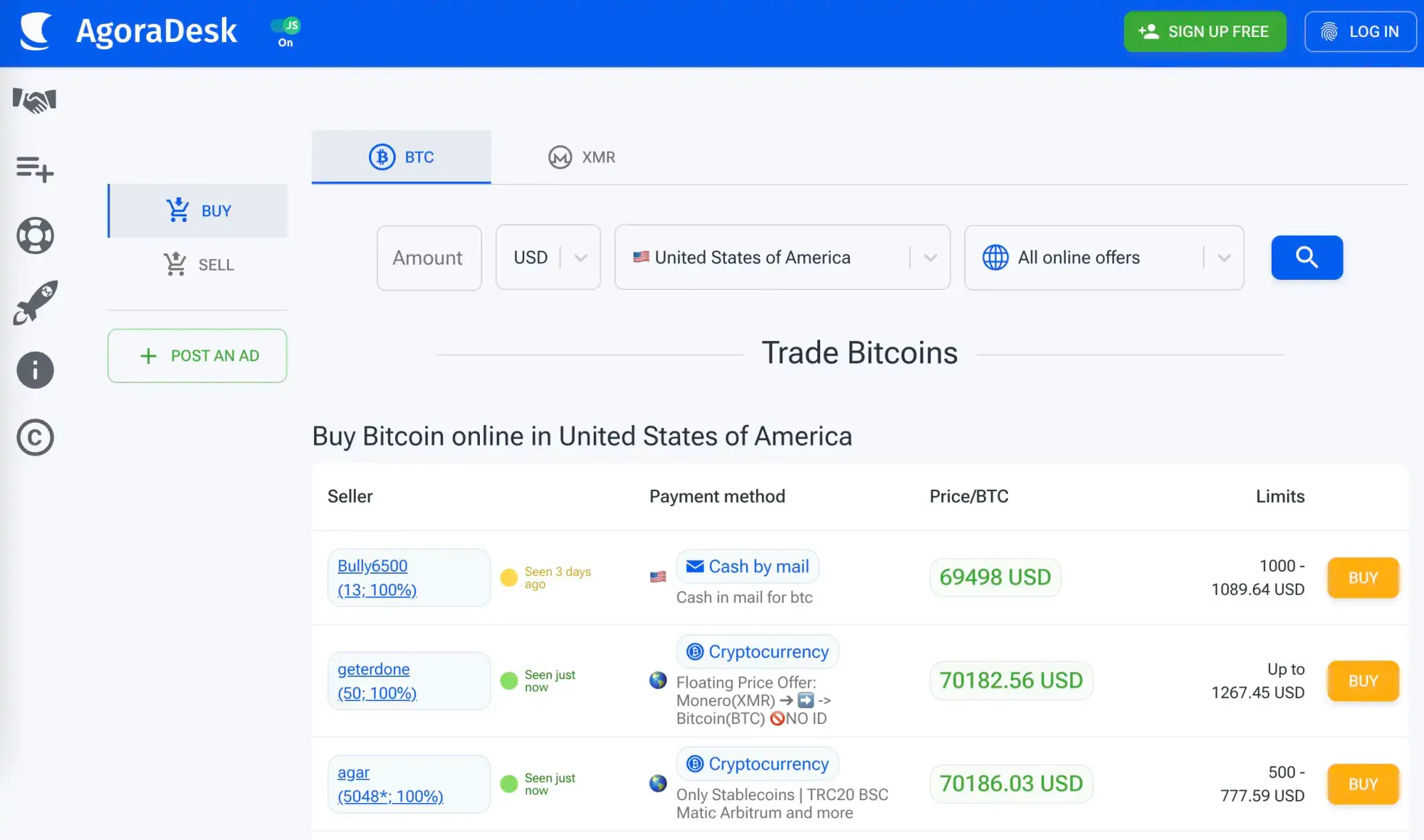

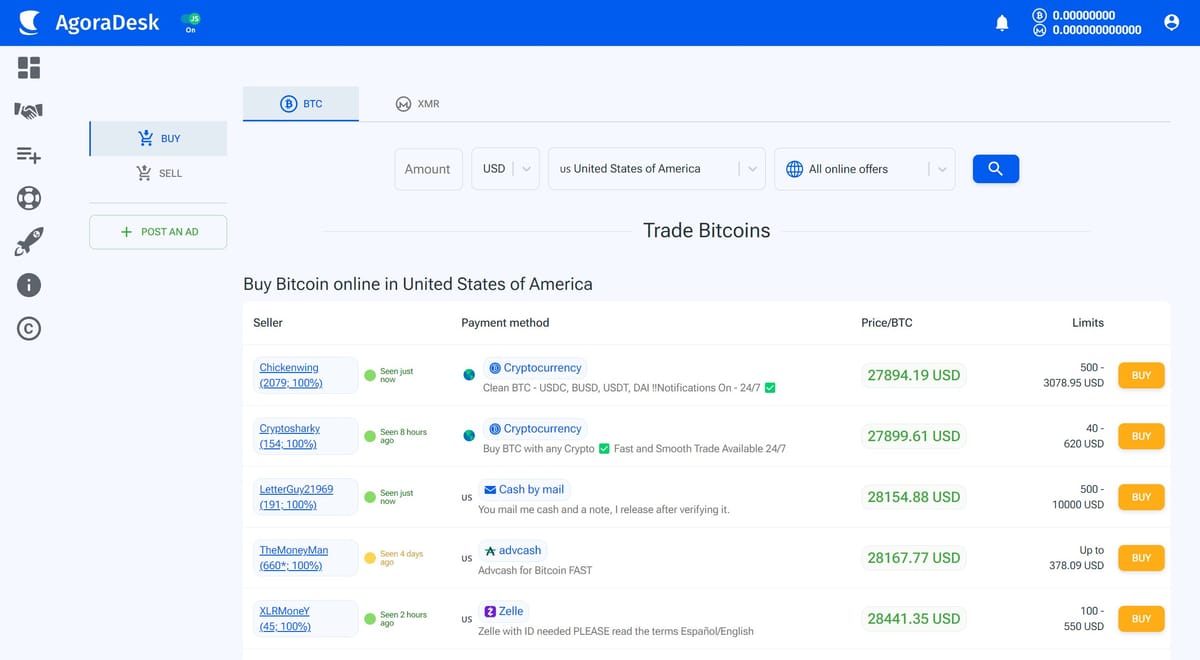

Agoradesk

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Agoradesk | 🇺🇸🇨🇦🇪🇺 + more | 0.00% / 1.00% | ⭐⭐⭐⭐⭐ 88/100 |

Why We Chose It

Agoradesk stands out from the crowd thanks to a Bitcoin-exclusive, non-KYC, non-custodial, peer-to-peer trading platform, letting users to buy anonymously BTC using a wide array of payment methods. The payments methods accepted vary from popular online wallets like Revolut, PayPal, credit/debit cards, and bank transfers to unconventional options like gift cards and even Cash by Mail, accessible globally, including within the USA.

The trades are secured with an arbitration bond. This let's users have an high level of security during transactions. Also, Agoradesk is easy to start with, by removing the need for a security deposit when making purchases. This means that, in order to buy bitcoin, you don't need to actually have bitcoin in advance. This combination of security and user-friendly features positions Agoradesk as a reliable and convenient platform for Bitcoin trading.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low taker fees | ❌ Maker fees are higher |

| ✅ Easy to use | |

| ✅ Available in the US |

Overview

AgoraDesk was founded in 2019 by the team behind LocalMonero. This exchange provides a peer-to-peer platform for secure and private Bitcoin trading, without the need for any type of identification over the KYC/AML. The platform let's users do seamless transactions, ensuring privacy and anonymity.

AgoraDesk has a user-friendly interface similar to the one of LocalBitcoins, targeting to both novice and experienced traders. AgoraDesk has fair fees, with free registration and transactions within the platform.

The platform is available all over the world and accepts various payment methods. Its arbitration standards and fast customer support further enhance the trading environment. Thanks to their user privacy and censorship resistance, AgoraDesk is definitely a reliable platform for Bitcoin enthusiasts worldwide.

Full Review

👉 To sign up for free on AgoraDesk, click here.

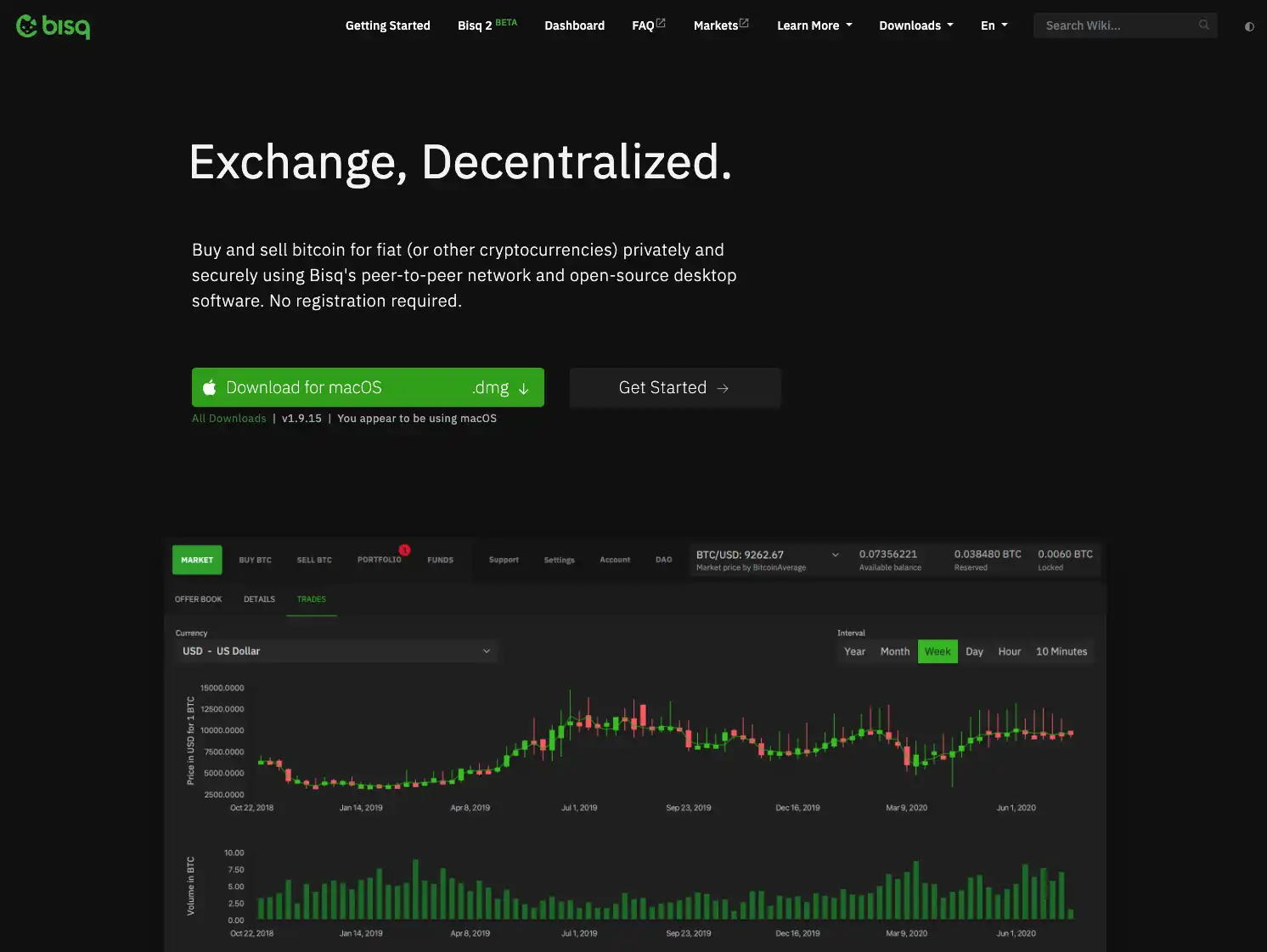

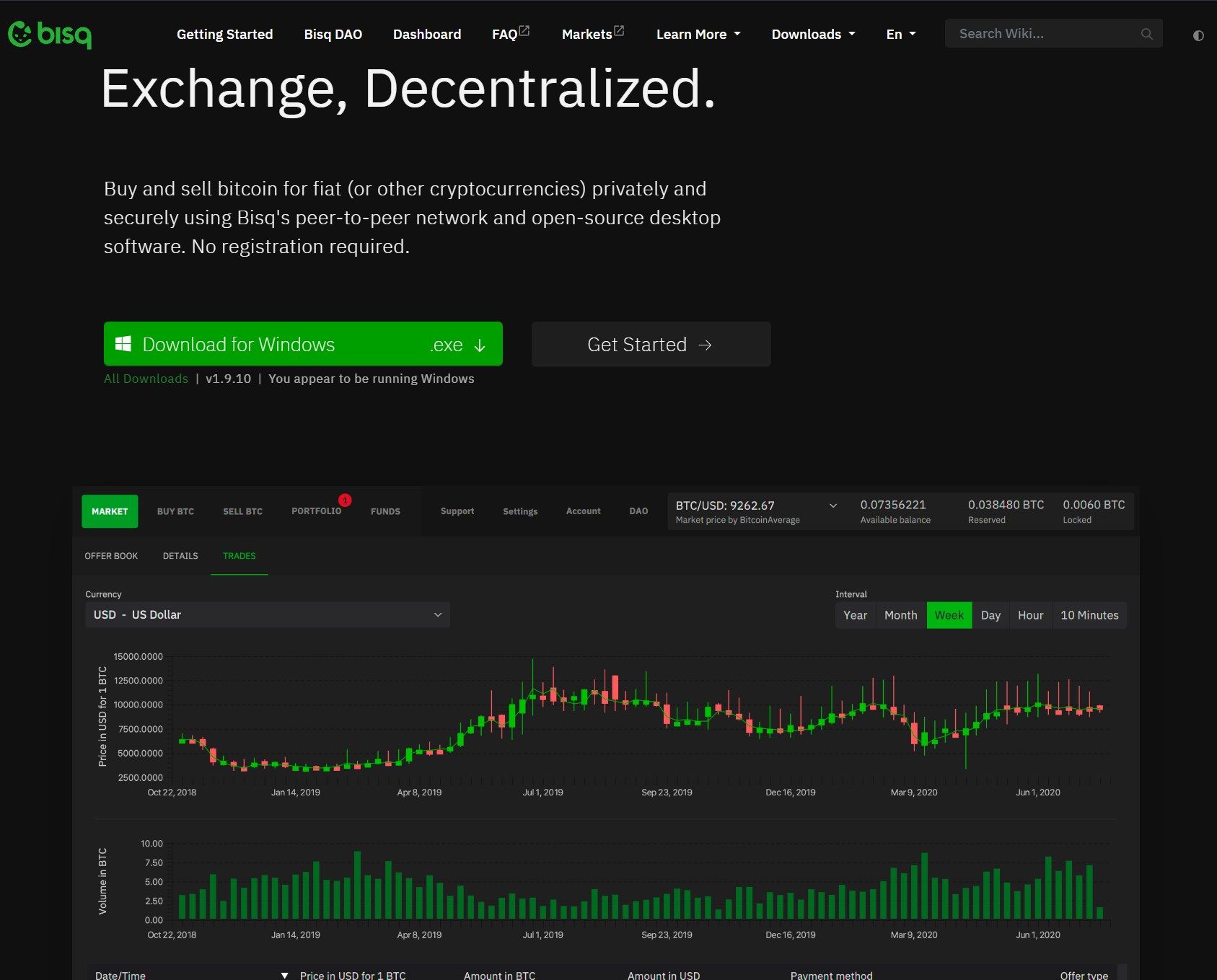

Bisq

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bisq | 🇺🇸🇨🇦🇪🇺 + more | 1.15% / 0.15% | ⭐⭐⭐⭐⭐ 87/100 |

Why We Chose It

Bisq is one of the the most used Bitcoin-only solutions for both buying and selling the pioneering cryptocurrency with the maximum anonymity. However, getting started to use it can be intimidating at first.

It's important to understand that, due to the Bitcoin security deposit requirement, every user must actually have in advance some Bitcoin to engage in transactions, which may lower the usability of this exchange. While more suitable with intermediate/advanced users, this aspect serves as a tradeoff for accessing a genuinely decentralized client with no KYC requirements and a various range of payment methods.

Also, Bisq is evolving with a new version, Bisq 2, introducing a simplified approach called "Bisq Easy." This version doesn't have any security deposits, albeit at the expense of some security, in favor of enhanced user-friendliness.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low maker fees | ❌ Taker fees are higher |

| ✅ High privacy | ❌ Too complex for beginners |

| ✅ The new Bisq Easy is the right direction | ❌ Security deposit needed |

Overview

Bisq is a world-famous decentralized peer-to-peer (P2P) exchange known for its longevity and effective privacy features. First of all, with Bisq you can only connect over TOR, for added security. With Bisq, users can seamlessly trade Bitcoin for national currencies or other cryptocurrencies, all without the need for KYC procedures. You can install on your computer running Windows, Linux, and Mac, Bisq empowers users with full control over their funds through its non-custodial wallet system.

Anonymity and security are paramount on Bisq and they are enhanced by features like end-to-end encryption and Tor-only connectivity. It sets itself apart as one of the few truly decentralized exchanges, offering users a say in its governance through a DAO structure.

Despite its advanced structure, Bisq remains a pillar for those valuing privacy and decentralization in their trading experience. With its commitment to open-source principles and community-driven governance, Bisq exemplifies the bitcoin ethos.

Full Review

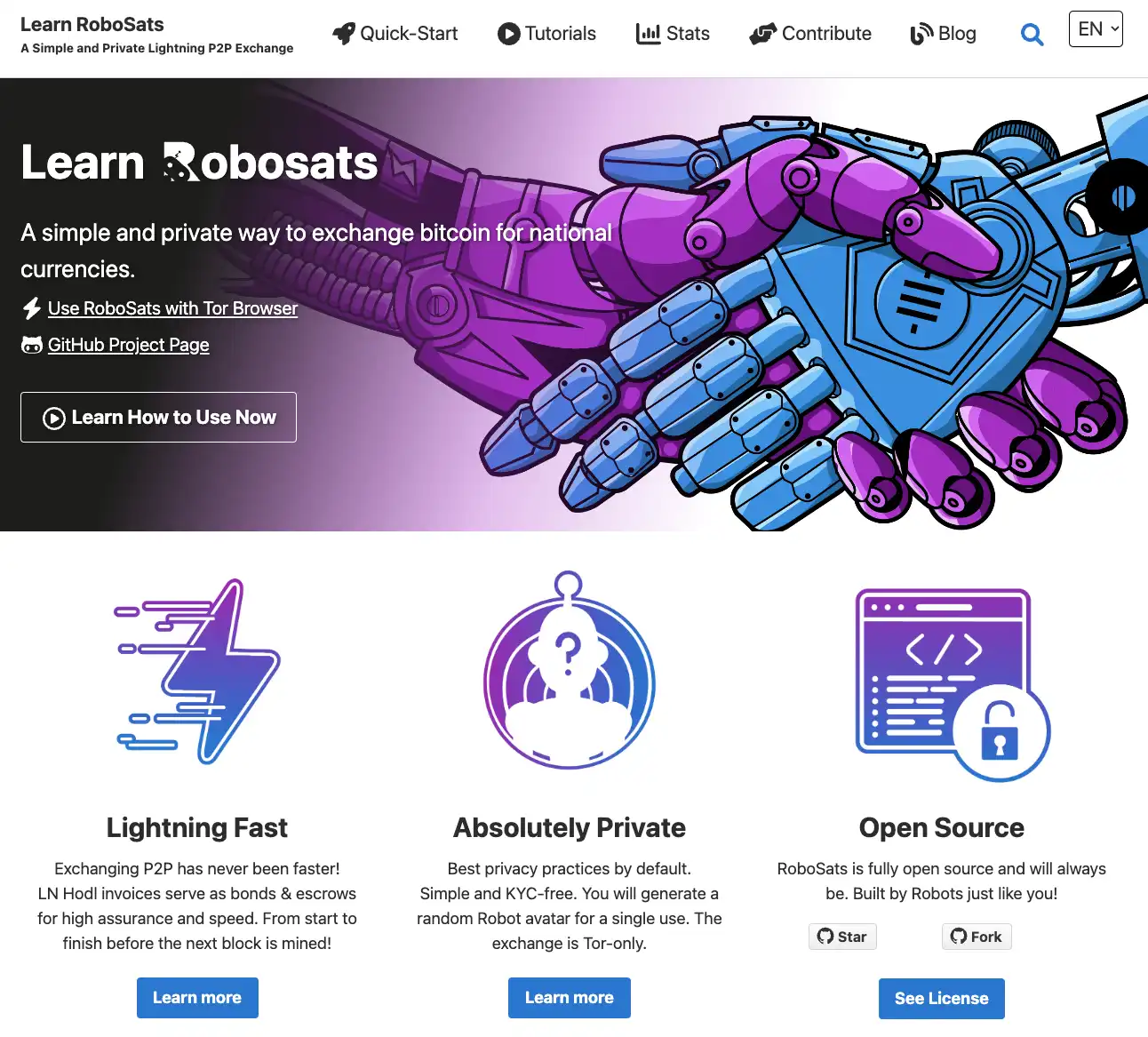

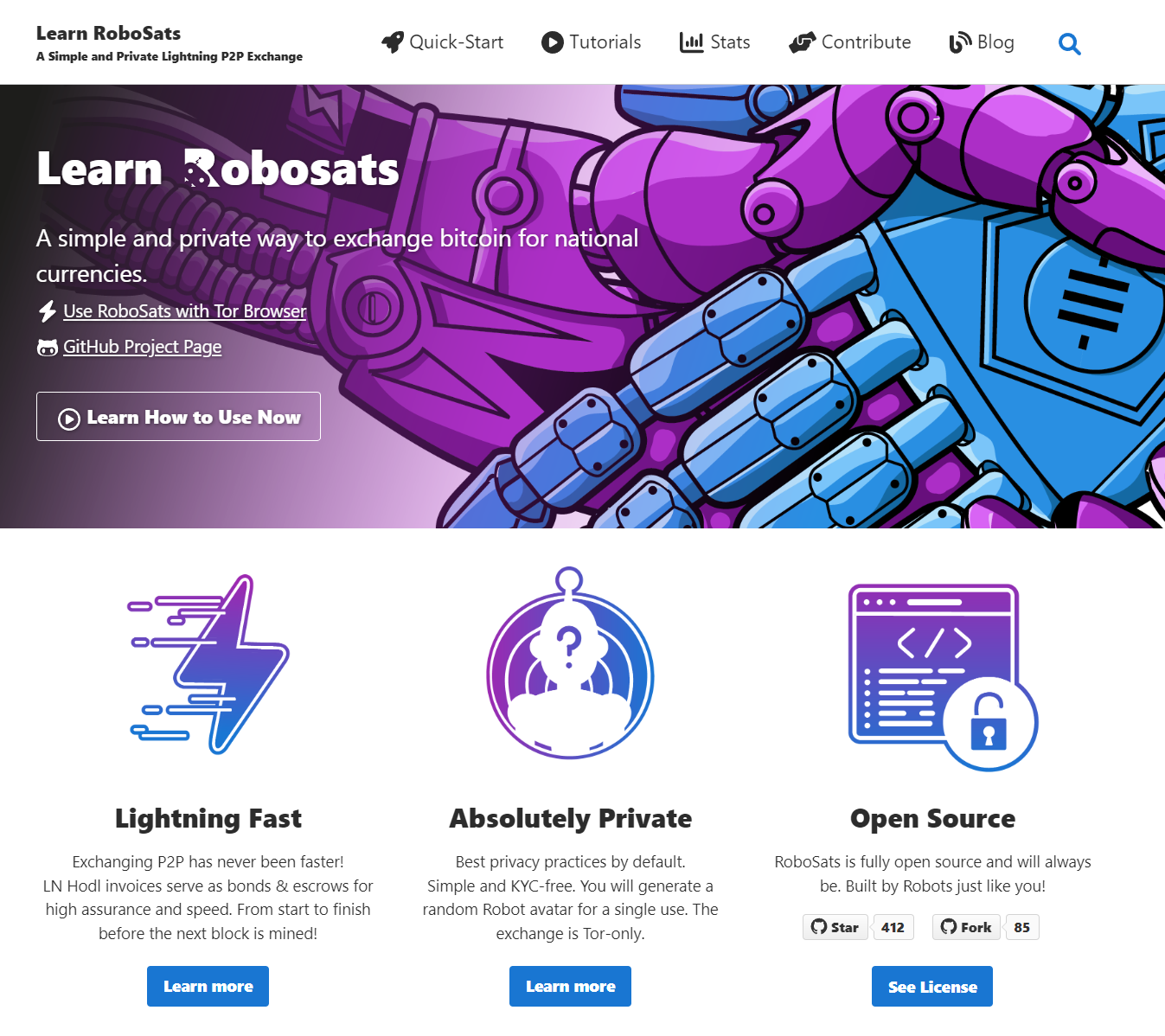

Robosats

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Robosats | 🇺🇸🇨🇦🇪🇺 + more | 0.175% / 0.025% | ⭐⭐⭐⭐⭐ 87/100 |

Why We Chose It

Robosats is an open-source peer-to-peer Bitcoin exchange, where users can buy and sell Bitcoin with very high privacy features. In fact, with the Lightning Network integration and exclusive TOR connectivity to the exchange, users can transact with utmost anonymity. Additionally, Robosats offers the unique option of self-hosting on personal nodes like Citadel or Umbrel, increasing even more user control and decentralization.

While Robosats may not offer the user-friendliness of centralized exchanges, its emphasis on privacy and minimal fees provides significant advantages to users. By prioritizing privacy and decentralization, Robosats empowers individuals to engage in Bitcoin transactions with confidence, knowing their financial activities remain confidential and secure.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Super-low fees | ❌ Lightning only |

| ✅ Quick payments | ❌ For advanced users |

| ✅ Secure, Run it on your own node |

Overview

RoboSats, founded in 2022, is a non-KYC, non custodial, peer-to-peer Bitcoin trading exchange. Is different from centralized exchanges, because the transactions on Robosats happen directly between users on the platform. Robosats acts as a guarantor through its robust escrow system, ensuring the safety of every trade.

As it operates exclusively with Bitcoin and the Lightning Network, Robosats excels in this domain and stands as one of the pioneering platforms in the peer-to-peer sector.

Offering very low fees (taker/maker 0.175%/0.025%), Robosats offers its exchange across all over the world (it's decentralized) and provides accessibility only over TOR and the option to run directly from a personal node. This decentralized approach renders Robosats an unstoppable application, accessible worldwide.

Full Review

Bull Bitcoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bull Bitcoin | 🇨🇦🇨🇷 | 0% / 0% | ⭐⭐⭐⭐ 78/100 |

Why We Chose It

Bull Bitcoin is one of the top-tier platform for Canadians to buy Bitcoin. But it's not just that: it's also an excellent solution for spending Bitcoin, with their Bylls Service. This solution allows users to pay others or settle bills using Bitcoin, effectively letting transactions by selling Bitcoin directly.

Bull Bitcoin also supports bitcoin 2nd-layer like Lightning and sidechains such as the Liquid Network: these solutions are ideal to avoid using the main-chain in a high fee environment. Despite offering low fees, with zero taker/maker commissions, it's important to note that there's a premium on the Bitcoin price, as expected. Nonetheless, Bull Bitcoin provides a very good user experience for both buying and spending Bitcoin, making it a versatile option for btc enthusiasts in Canada.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Pay bills with BTC | ❌ Only available in Canada (and Costa Rica) |

| ✅ Longstanding Presence | ❌ No smartphone apps |

| ✅ Bitcoin Only |

Overview

Bull Bitcoin is one of the best exchanges for residents in Canada looking not just to buy Bitcoin discreetly and securely, but also to spend it. Founded in 2015 and headquartered in Montreal, Bull Bitcoin offers a range of purchase methods, including no-KYC options using cash at Canadian post offices and traditional methods like Interac e-transfer and wire transfer. It works as non-custodial exchange (it doesn't hold users funds), as it prioritizes user privacy and security.

To start buying btc over Bull Bitcoin, users can deposit in their accounts via several Canadian bank transfer options without incurring any deposit fees. After adding their Bitcoin address, users can buy Bitcoin directly, with the option for recurring purchases (a good way to DCA). Bull Bitcoin also integrates the Lightning and L-BTC on the Liquid Network, providing additional flexibility for users.

Led by CEO and Founder Francis Pouliot, Bull Bitcoin has gained recognition for its dedication to a Bitcoin-exclusive vision. Its comprehensive features, user-friendly interface, and commitment to privacy and security make it a standout choice for Canadians interested in acquiring Bitcoin.

Full Review

👉 Click here to join Bull Bitcoin and receive an exclusive $20 bonus.

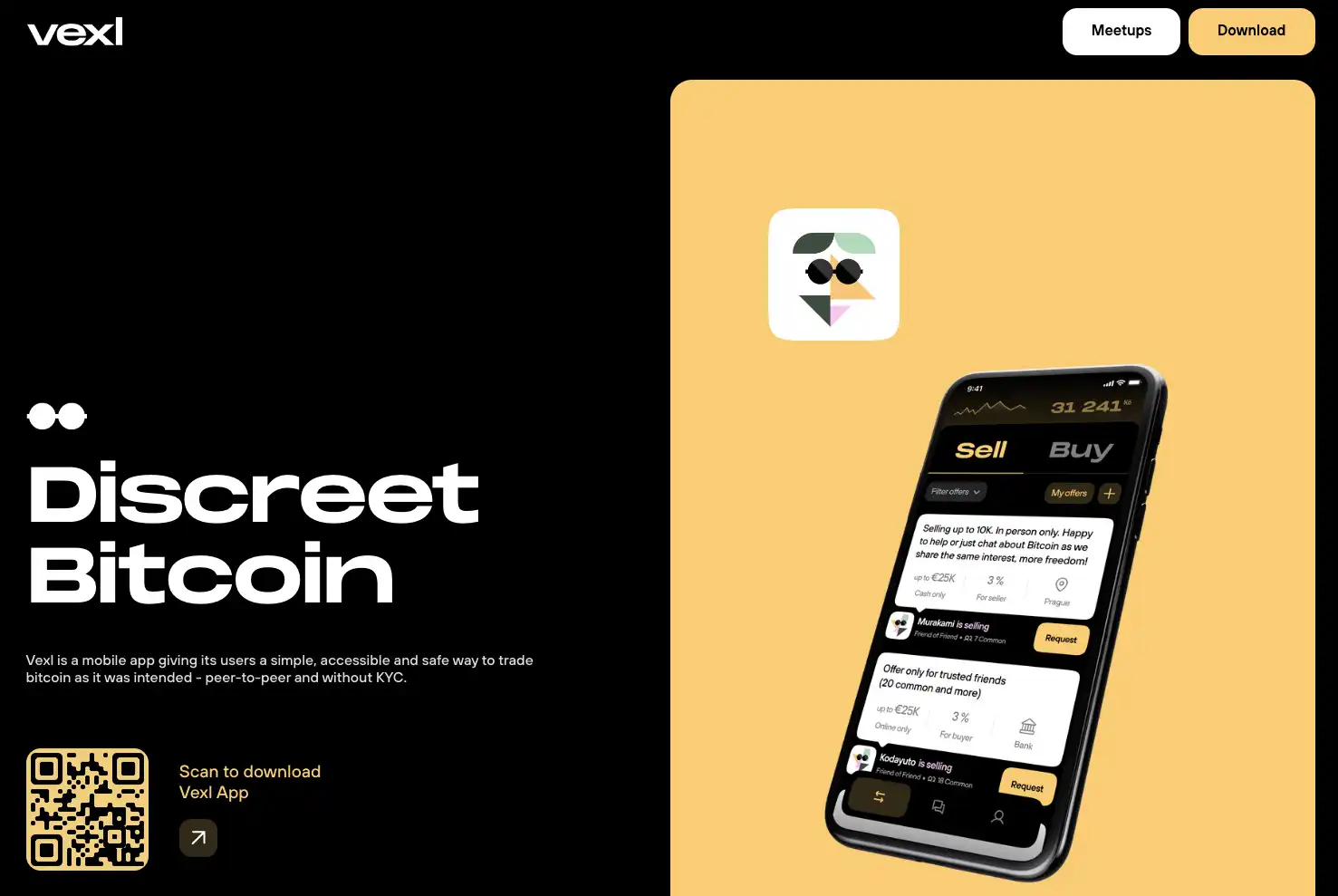

Vexl

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Vexl | 🇺🇸🇨🇦🇪🇺 + more | 0% / 0% | ⭐⭐⭐⭐ 77/100 |

Why We Chose It

Vexl has an adversarial look at the current status of bitcoin exchanges. In fact, unlike conventional platforms, it operates as a non-KYC, peer-to-peer (P2P) exchange without integrating a security escrow. Instead, it scans your phone's address book (no problem: it won't store your infos) to connect you with trusted contacts and their networks, letting users do Bitcoin p2p trades typically involving cash, bank transfers, or other online payment methods.

Born as a true alternative to KYC exchanges, Vexl prioritizes privacy-conscious individuals. It offers a valid solution for finding bitcoiners near you interested in buying or selling Bitcoin, fostering direct and secure transactions without the need for extensive personal information disclosure.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Original and different | ❌ No escrow |

| ✅ Open source | ❌ No specific Online Payments methods in the filtering tool |

| ✅ No KYC | ❌ iOS app needs Testflight to be downloaded |

Overview

Vexl is a Bitcoin peer-to-peer trading app that revolutionizes the way users buy and sell cryptocurrency. Launched in 2021 and based in Prague, Czech Republic, Vexl has a unique view on bitcoin p2p trading, focusing on privacy and social connectivity.

It's quite different from traditional exchanges. Vexl, in fact, doesn't ask for the Know Your Customer (KYC) verification. Instead, it uses your phone's address book to connect you with trusted contacts (and the contacts of your contacts basically). This innovative feature makes possible that users can engage in transactions with individuals they know and trust, increasing the safety of the app.

Vexl's platform is quite easy to use, with a minimalist interface that puts in first line the most important infos. It offers several trading pairs, including BTC/USD or BTC/EUR, and supports multiple fiat currencies. With features like groups and the marketplace, users can easily find trading opportunities within their social circle.

Full Review

Peach Bitcoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Peach Bitcoin | 🇪🇺🇨🇭 + more | 2% / 2% | ⭐⭐⭐⭐ 74/100 |

Why We Chose It

Peach Bitcoin is a peer-to-peer, non-KYC Bitcoin-only app available in Switzerland and Europe, famous for its usability and extensive array of offers within its marketplace. Trades done on the platform benefit from a secure escrow service, ensuring peace of mind for all parties involved. Moreover, Peach Bitcoin offers a unique conference mode, easing connections with new buyers and sellers at Bitcoin conferences.

Available on iOS and Android, the app features an integrated wallet for seamless transactions. Additionally, users have the option to add their cold storage addresses, but first they need to sign a message to verify they are the true owners. This feature makes the self-custody process easier, increasing user control over their assets.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ No KYC | ❌ USD Not Supported |

| ✅ Intuitive and easy to use | ❌ High fees (2%) |

| ✅ Escrow system | ❌ iOS version needs an invitation |

Overview

Peach Bitcoin fills the void left by Localbitcoins' closure, offering a peer-to-peer marketplace for buying and selling Bitcoin and other cryptocurrencies.

Founded in 2022 and based in Neuchâtel, Switzerland, it emphasizes user privacy and control with non-custodial wallet integration. The platform supports various fiat currencies and unconventional payment methods like Amazon Gift Cards, enabling seamless fiat onramp and offramp transactions. With a user-friendly mobile app available on iOS and Android, Peach Bitcoin ensures accessibility for users worldwide.

Despite concerns about fees and decentralization, it stands out for its commitment to non-KYC transactions and self-custody options, making it an attractive choice for those seeking privacy-centric cryptocurrency trading solutions.

Full Review

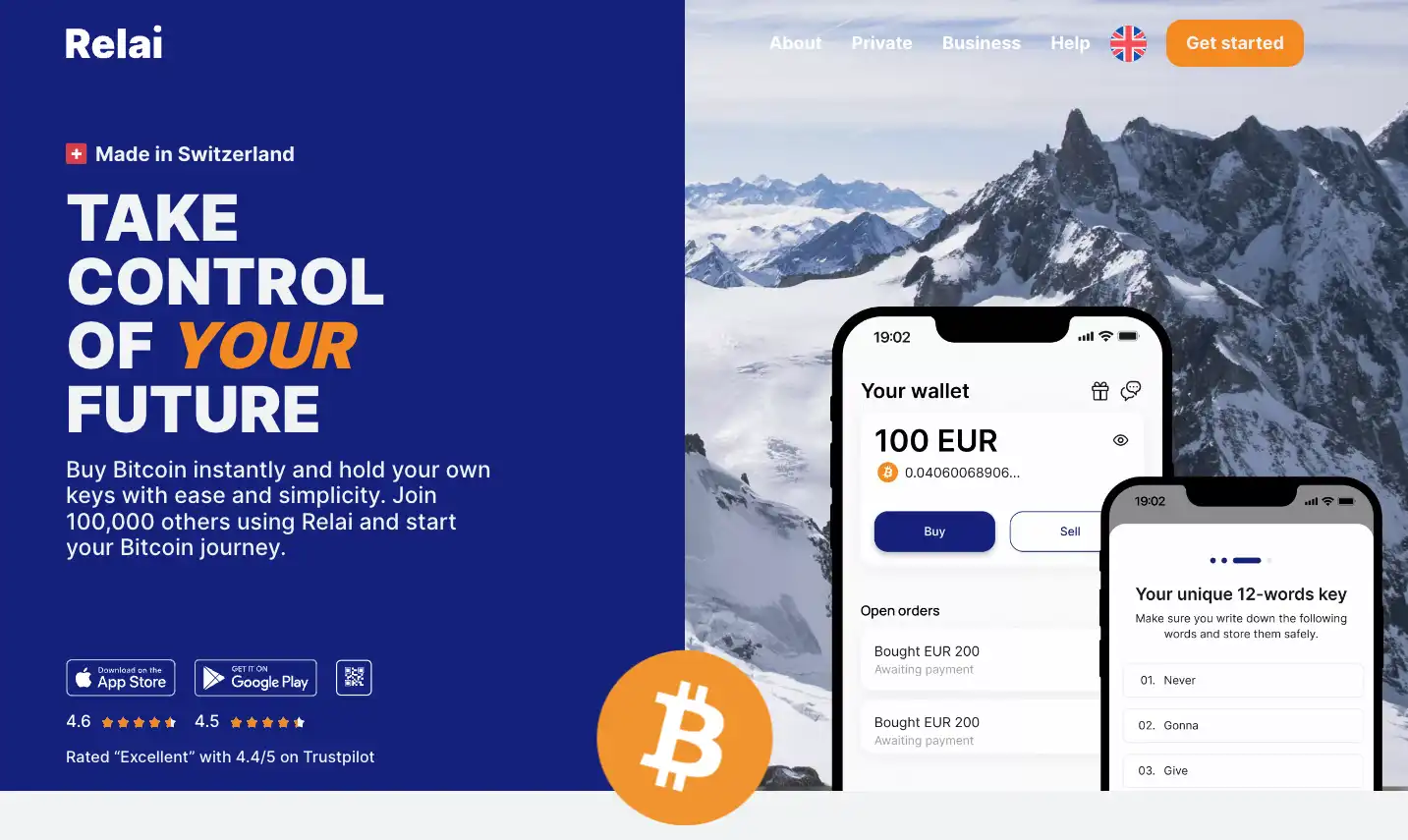

Relai

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Relai | 🇪🇺🇨🇭 + more | 2.5% / 2.5% | ⭐⭐⭐⭐ 72/100 |

Why We Chose It

Relai is a bitcoin-only app that let's you buy/sell and even practice self-custody. It works on a non-custodial basis, with "soft-KYC" requirements on transactions up to 1000 EUR/CHF daily. Basically, you won't be asked an ID if you trade less than 1k euro/chf a day.

When you buy, the coins are transferred during the day to Relai's integrated non-custodial wallets, from where users can later consolidate to their preferred cold storage wallets. Alternatively, users have the option to send funds directly to cold storage after signing a message with their keys. This flexibility extends to selling Bitcoin as well. Relai's fee structure is reasonable, and users can further reduce fees by applying the code BLOCKDYOR.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Easy-to-use app | ❌ Uncertainty about exporting 12-word seed phrase |

| ✅ Soft-KYC for user privacy | ❌ Higher fees for recurring buys |

| ✅ Secure non-custodial wallet | ❌ Limited availability outside Europe, UK, and Switzerland |

Overview

Relai is getting quite popular in europe with their Bitcoin-only service, mixing functions of both peer-to-peer and centralized platforms. Based in Switzerland, it serves most European Union nations, offering interesting advantages that sets it apart from competitors. Users benefit from no-KYC trading for amounts up to 950 EUR daily and 100,000 EUR annually.

While categorized as a "soft-KYC" exchange, Relai doesn't force you for an ID verification. It's a great solution for Bitcoin enthusiasts, particularly those interested in Dollar-Cost Averaging (DCA) over the long term, owing to its low fees and seamless fiat-to-Bitcoin conversion process.

You can download the Relai app on iOS and Android apps, with a focus to simplicity and user privacy, ensuring transactions are tied to self-custodial wallets through mnemonic phrases. This approach simplifies access to funds while maintaining security, offering users a straightforward pathway to accumulate Bitcoin holdings.

Full Review

👉 Click here to join Relai. Use code BLOCKDYOR to lower the fees by 20%.

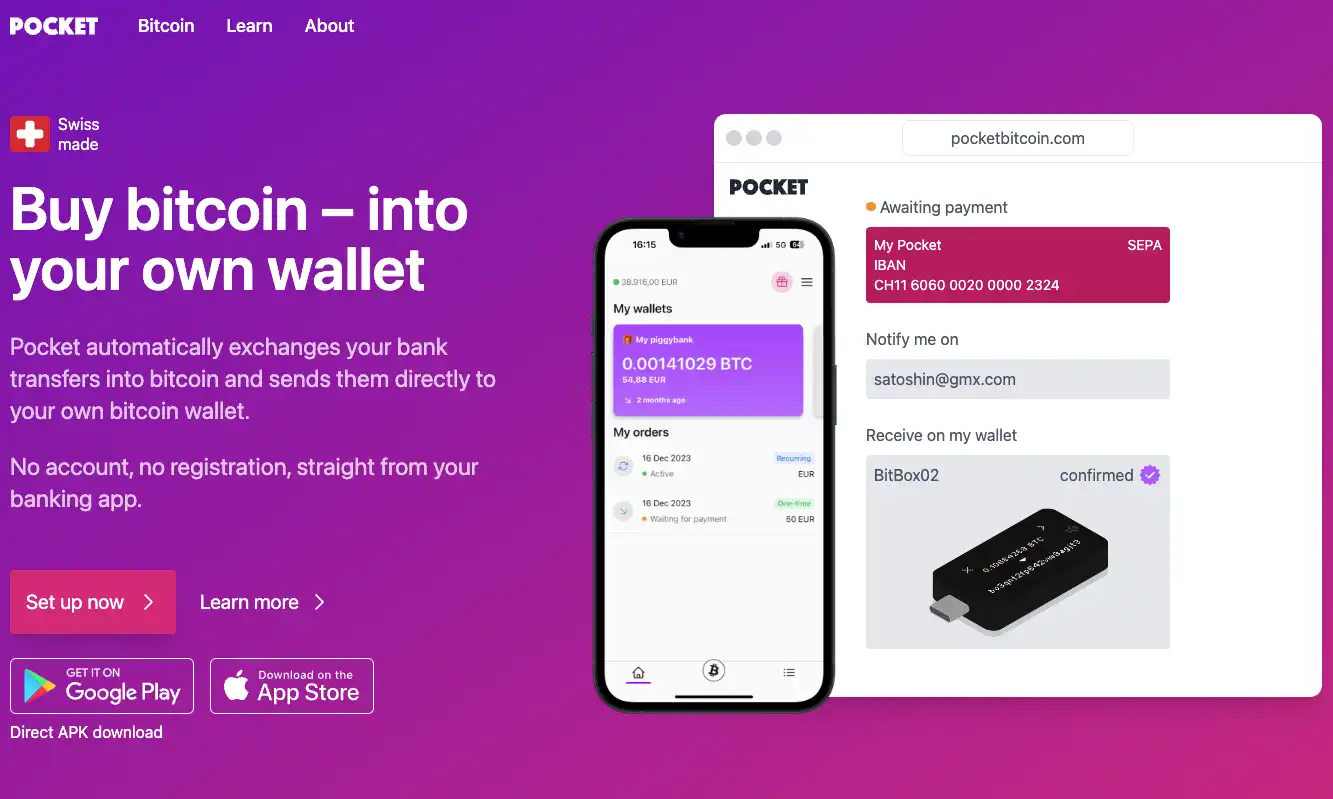

Pocket Bitcoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Pocket Bitcoin | 🇪🇺🇨🇭 + more | 1.5% / 1.5% | ⭐⭐⭐⭐ 71/100 |

Why We Chose It

Pocket Bitcoin is an easy to use fiat-to-Bitcoin exchange via bank transfer in a soft-KYC way, with the funds that are directly deposited into your personal Bitcoin wallet. There is not even the need to create an account, everything is done automatically, even the recurring purchases.

It's an excellent option for those prioritizing self-custody and solely interested in accumulate Bitcoin without intentions to sell for fiat.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low fees | ❌ No selling BTC |

| ✅ Kraken quotes | ❌ To receive BTC you must sign a message with your private key |

| ✅ Vast Hardware wallet support |

Overview

Pocket Bitcoin is a web-based and iOS/Android service that revolutionized the process of purchasing Bitcoin with fiat currency (EUR or CHF) directly from your bank account, and seamlessly depositing it into your software/hardware wallets.

Offering a completely non-custodial UX, Pocket Bitcoin ensures the security of your transactions by transferring your purchased Bitcoin directly to your specified Bitcoin address. Users have the flexibility to input their Bitcoin address or effortlessly connect their hardware wallets. Notably, Pocket Bitcoin does not require KYC/AML verification or the creation of an account; all that's needed is a simple bank transfer to the provided Pocket Bitcoin account.

This simple approach prioritizes user privacy and convenience. With features like recurring payments and instant transactions upon payment receipt, Pocket Bitcoin simplifies the Bitcoin purchasing experience for users across Europe.

Full Review

👉 Click here to join Pocket Bitcoin and get € 5.00 in free BTC with the code BLOCKDYOR.

Swan

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Swan Bitcoin | 🇺🇸 + more | 0.99% / 0.99% | ⭐⭐⭐⭐ 66/100 |

Why We Chose It

Swan is one of the most famous US Bitcoin-only, buy-only, exchanges with KYC protocols to date. Offering a non-custodial platform, Swan caters to a wide range of users with diverse products including collaborative custody, IRA options, and more.

From its inception, Swan has remained true to itself to being exclusively Bitcoin-focused, continuously enhancing its services and recently expanding into a mining division. For individuals in the US who are comfortable with the KYC policy, Swan is to this day one of the top-tier solutions available, providing a comprehensive suite of services tailored to meet various Bitcoin investment needs.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ User-Friendly Interface | ❌ Swan Personal Not Available in Europe |

| ✅ Easy Bitcoin Accumulation | ❌ No "Sell" Option, Focused on Savings |

| ✅ Strong Sense of Community | ❌ There is a "Locking Period" for the Bitcoin buys |

Overview

Swan Bitcoin offers a direct approach to accumulating Bitcoin, with an easy solution for users looking to buy and hodl the coin. Unlike traditional exchanges, Swan Bitcoin operates without a sell button, focusing only on facilitating the purchasing of Bitcoin with ease and security. Positioned as a savings account for Bitcoin, the platform enables users to convert fiat currency, like dollars, into Bitcoin, providing a hedge against inflation and capitalizing on Bitcoin's finite supply.

Swan Bitcoin is focused on encouraging self-custody, empowering users to manage their Bitcoin independently while also offering custodial services through trusted partnerships. With a user-friendly interface and a commitment to Bitcoin-only operations, Swan Bitcoin caters to a diverse range of users, from beginners to high net worth individuals and businesses.

Whether through lump-sum purchases or recurring buys, Swan Bitcoin gives the users flexible options to suit individual preferences and investment strategies. With a focus on security, accessibility, and tailored solutions, Swan Bitcoin stands out as a reliable platform for navigating the world of Bitcoin accumulation.

Full Review

👉 Click here to join Swan Bitcoin and get $10 of free Bitcoin in your account.

River Financial

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| River Financial | 🇺🇸 + more | 1.20% / 1.20% | ⭐⭐⭐⭐ 61/100 |

Why We Chose It

River is a KYC platform tailored for Bitcoin-only transactions. It allows users to purchase Bitcoin with no fees on recurring orders and a low 1.20% fee on lump-sum purchases. You can also sell Bitcoin for fiat. The platform is very well done, offering a web app along with iOS and Android apps.

With its focus on security, full reserve custody, and smooth integration with the Lightning Network, River provides a strong solution for both new and seasoned Bitcoin investors.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ User-friendly interface | ❌ Limited availability outside the USA |

| ✅ 100% full reserve custody | ❌ Does not support certain US states like New York, Nevada, and Idaho |

| ✅ Wide range of payment methods | ❌ Fees (and spread) may be higher compared to some other platforms |

Overview

River Financial offers a streamlined gateway into the world of Bitcoin investment, catering to both novice enthusiasts and seasoned investors alike. Founded in 2019 and based in San Francisco, the platform's focus on Bitcoin-only transactions ensures a laser-sharp dedication to the pioneering cryptocurrency. With a user-friendly interface accessible via web or mobile, River facilitates secure transactions with 100% full reserve custody, instilling confidence in users' dealings.

The platform's standout feature is Dollar Cost Averaging (DCA), allowing users to invest in Bitcoin regularly without incurring fees, smoothing out the effects of market volatility. Furthermore, River's integration of the Lightning Network enables instant global transactions, while Target Price Orders automate transactions based on specified price points.

Despite its simplicity, River Financial packs a punch with diverse features like self-custody automation, inheritance planning, and the innovative River Link for easy Bitcoin transfers. While limited to the United States for now, River Financial's commitment to accessibility, security, and innovation cements its position as a leading Bitcoin exchange.

Full Review

👉 Click here to join River Financial and earn up to $100 in bonus Bitcoin when you buy.

21bitcoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| 21bitcoin | 🇪🇺🇨🇭 + more | 1.49% / 1.49% | ⭐⭐⭐ 54/100 |

Why We Chose It

21Bitcoin is an austrian app designed for buying and selling Bitcoin while adhering to KYC regulations. It operates exclusively through its app interface, offering a straightforward user experience. Users can easily add their own addresses and set up automatic transfers to self-custody.

Despite the mandatory KYC verification, the platform boasts low fees, providing users with various options for Bitcoin transactions. It prioritizes security and allows for the transfer of coins to non-custodial wallets, enhancing user control over their assets.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Regulated in Europe | ❌ Higher fees than traditional exchanges |

| ✅ Easy to use | ❌ No web app |

| ✅ Fees are fair | ❌ KYC is mandatory |

Overview

21bitcoin stands out as a user-centric app designed to simplify the process of buying and selling bitcoin. Launched in 2022 by Daniel Winklhammer and Dominik Seibold, this Austrian-based platform focuses exclusively on the EUR/BTC trading pair, providing a streamlined experience for users seeking to enter the Bitcoin market.

Available solely on iOS and Android devices, 21bitcoin boasts a minimalist interface, free of altcoins, ensuring a clear focus on Bitcoin transactions. Its user-friendly design caters to both novice and experienced investors alike. Backed by FIOR Digital GmbH and registered by the Austrian Financial Market Authority, the platform prioritizes security and regulatory compliance.

With a minimum deposit of €15 and low transaction fees starting from 1.49%, 21bitcoin offers accessibility and affordability. Users can seamlessly purchase Bitcoin via SEPA instant transfers, tapping into an automated savings plan for recurring purchases. Security measures include secure storage of Bitcoin assets and robust regulatory oversight.

Full Review

👉 Click here to download the 21bitcoin app and get a 13% fee discount on Bitcoin purchases.

How To Choose The Best Bitcoin Exchange

For having the best experience, in terms of safety, usability and fees when it comes to buying/selling Bitcoin, choosing the right Bitcoin exchange is quite important. Choosing a Bitcoin-only exchange is the first step to "cut the noise" and go quickly in the right direction.

But why prefer Bitcoin-only exchanges over those offering multiple altcoins? The reason is simple: Bitcoin-focused platforms tend to steer clear of dubious schemes and low-value altcoins, which are prevalent in mixed exchanges. While it's true that forgoing altcoins can pose a challenge to the revenue stream of a Bitcoin-only exchange, the long-term benefits in terms of trustworthiness, integrity, and popularity outweigh the short-term gains.

Bitcoin exchanges, especially those implementing Know Your Customer (KYC) protocols as outlined in this guide, typically offer lower fees compared to peer-to-peer alternatives. However, this convenience often comes at the cost of privacy, as users must disclose personal identification details for transactions.

In this guide, we cover both KYC and non-KYC platforms. Generally, non-KYC platforms receive higher marks for privacy since they don't require personal information. There are also platforms with soft-KYC policies, where using wire transfers might inadvertently disclose some personal data. However, these platforms often strike a good balance between privacy and convenience.

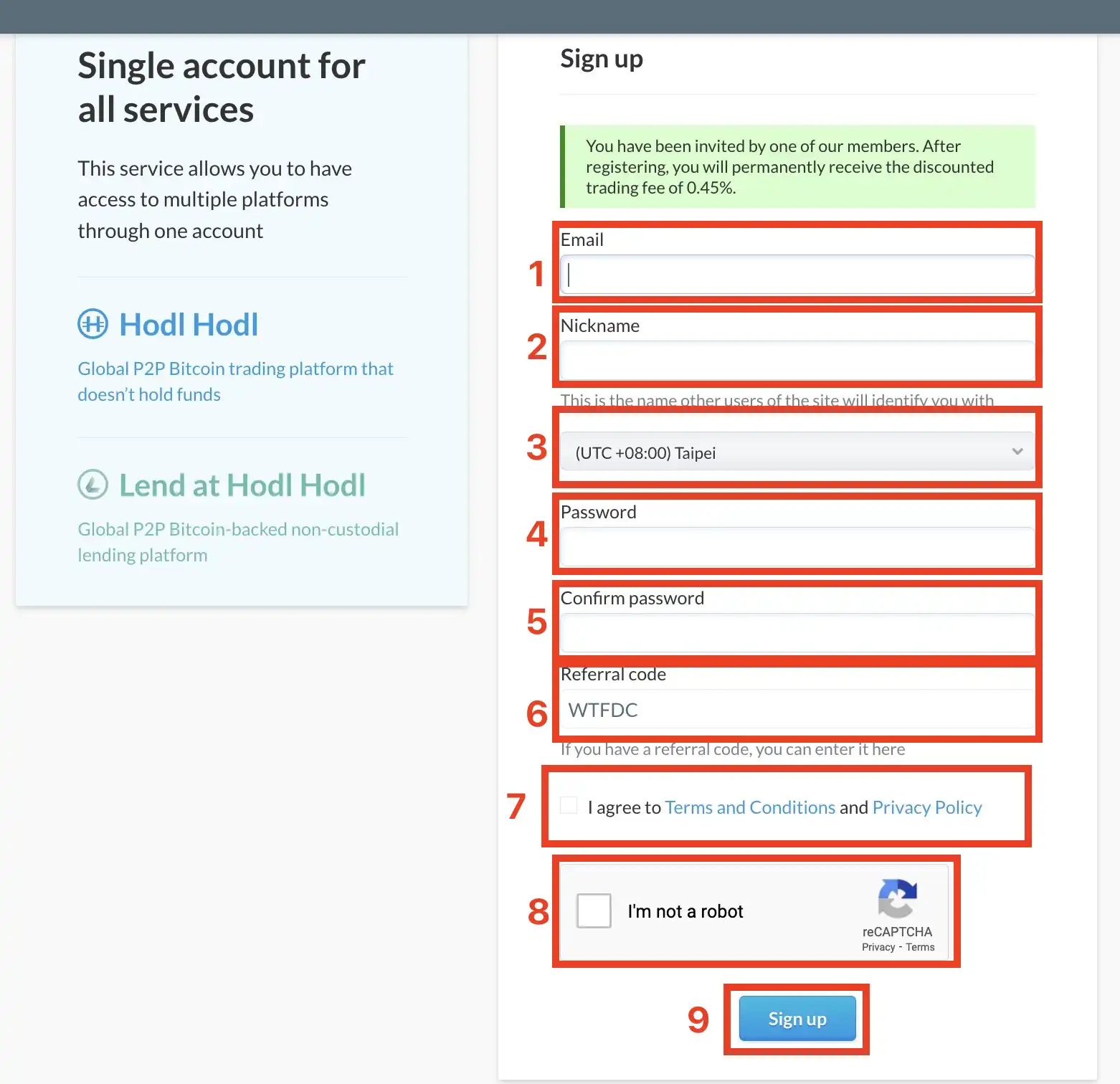

How to Register for a Bitcoin Exchange

Signing up for a Bitcoin exchange is quite easy as opening every other service on the internet. Actually, registering to a non-KYC Bitcoin exchange is even quicker and simpler since they usually don't even require your personal information. Sometimes you don't even need to create an account!

But usually, all they need is your email and a password for future logins. Take Hodl Hodl, for example; to begin, just click the link below for a fee discount.

👉 Sign up on Hodl Hodl now for a lifetime discounted trading fee of just 0.45%.

Following that, you'll need to provide a few details:

- Email (1)

- Nickname (2)

- Timezone (3)

- Password (4)

- Confirm Password (5)

- Referral Code (keep it as "WTFDC") (6)

- Agree to Terms and Conditions (7)

- Complete the Captcha (8)

- Click on Sign Up (9)

Once completed, check your email to confirm registration. After confirmation, you'll gain access to the Bitcoin exchange platform, enabling you to start buying and selling Bitcoin.

How We Rate The Exchanges

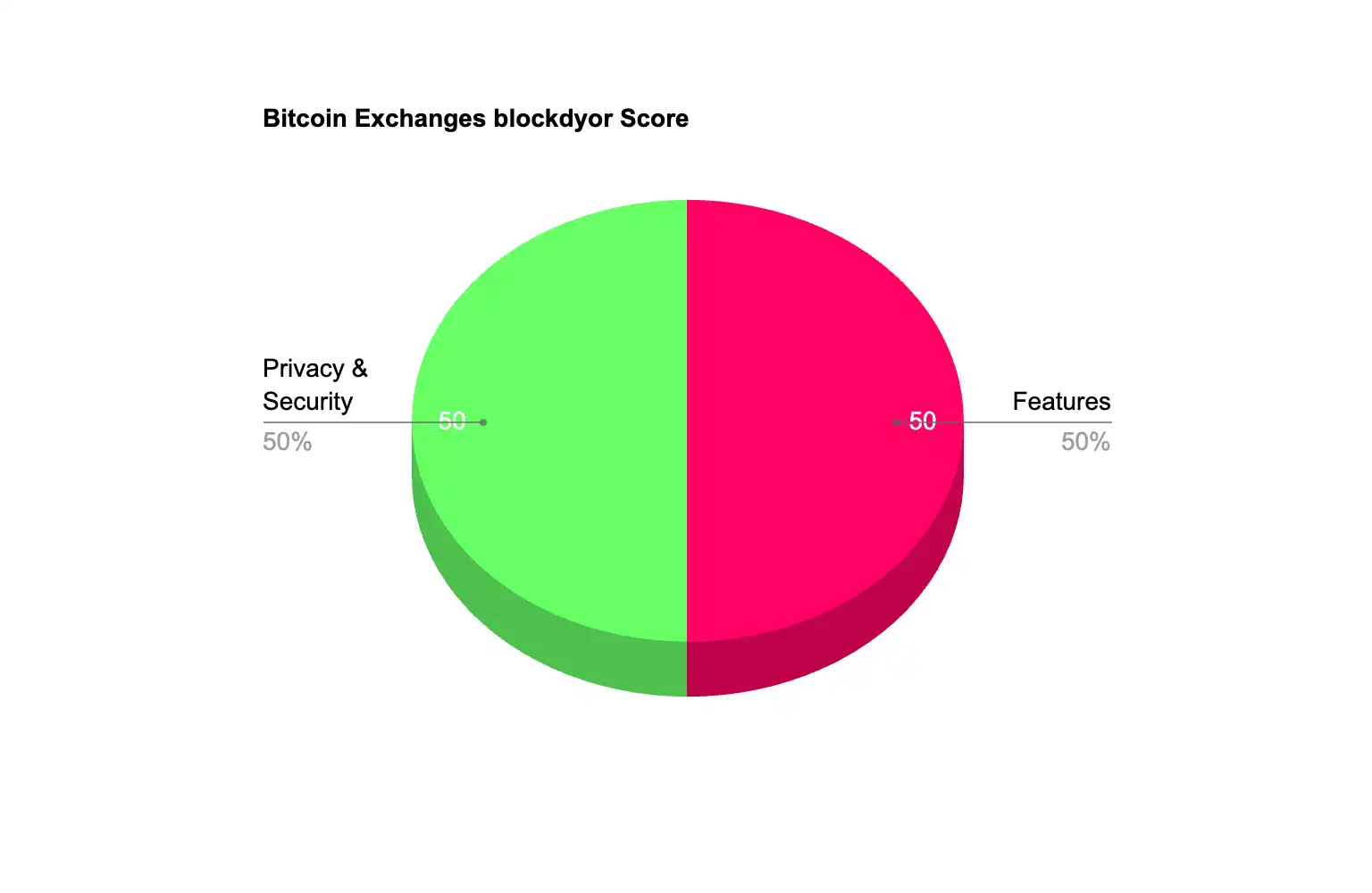

You might ask yourself what is the criteria used for creating the list of the Bitcoin exchanges in this guide. It's very simple: we created a blockdyor Score, which we used to evaluate every single exchange: regardless if it's a KYC or Non-KYC. In this case we are just showing bitcoin-only exchanges.

These metrics can be broadly categorized into two main groups: Privacy & Security and Features.

These two categories have sub categories. For example, under features there are Fees, Withdrawal methods supported. And under security you will find the presence or not of the KYC process or the non custodial features and more. The higher the score in these categories, the better the exchange performs. Let's deep dive into the list.

The blockdyor score is a composite evaluation of a bitcoin exchange based on two main categories: Privacy & Security and Features. Each category is further broken down into specific features, and each feature is assigned a score out of a predetermined maximum score. The higher the score in these categories, the better the exchange performs. Let's deep dive into the list. Let's deep dive into the list.

- Privacy & Security (50 points max):

- Non-KYC: Indicates whether the exchange enforces Know Your Customer (KYC) procedures for every user.

- Non-Custodial: Determines whether the exchange is non-custodial, meaning the users own the private keys and/or can withdraw their funds independently.

- Peer To Peer: Indicates whether the exchange offers peer-to-peer trading.

- Decentralization: Determines whether the exchange is centralized or decentralized.

- Encryption: Evaluates the level of encryption used for confidential data transfers.

- TOR Connection: Indicates whether it's possible to connect to the exchange using TOR.

- Open Source: Determines if some software used by the exchange is open source.

- 2FA: Evaluates whether the exchange offers two-factor authentication.

- Features (50 points max):

- User-Friendly UX: Assesses the ease of use of the exchange's user interface.

- Fiat Onramp/Offramp: Determines the availability of fiat currency deposit and withdrawal methods.

- Taker Fee: Evaluates the fee charged for market orders.

- Maker Fee: Evaluates the fee charged for limit orders.

- Withdrawal Fee: Assesses the fee for withdrawing funds from the exchange.

- Customer Service: Evaluates the availability and responsiveness of customer support.

- Documentation: Assesses the availability and comprehensiveness of documentation on the exchange's official website.

- Altcoins: Determines the variety of alternative cryptocurrencies supported by the exchange.

- Lightning Network Withdrawal/Deposit: Indicates whether the exchange supports Lightning Network for Bitcoin withdrawals and deposits.

- Liquid Network Withdrawal/Deposit: Determines whether it's possible to withdraw or deposit Bitcoin using the Liquid Network.

At blockdyor, we tested every bitcoin exchange featured in this article, ordering them based on their blockdyor Score. This enables us to create objective, impartial and thorough reviews, letting you to make informed investment decisions.

Our team rigorously assessed numerous exchanges and compiled extensive data points to identify our top recommendations. These selections were made considering 18 weighted criteria, such as KYC enforcement (weighted 10%), non-custodial features (weighted 10%), taker/maker fees (weighted 10%), peer-to-peer availability (weighted 5%) and more.

Each feature is rated and contributes to the overall blockdyor Score, which provides an objective measure of the exchange's performance in terms of privacy, security, and features. The final blockdyor score reflects the cumulative assessment of these factors, helping users make informed decisions about the exchange's suitability for their needs.

Bottom Line

In this guide, we focused exclusively on bitcoin-only exchanges, whether they implement KYC procedures or not, presenting our top picks. While not all of the exchanges we recommend are accessible in every country, we've made it easy to see if they are available in your area by including flags representing the nations where they operate.

These companies have solidified their positions over many years and are considered as industry leaders in the bitcoin space, providing great solutions for buying, selling, lending, borrowing, and more. You can begin your journey with confidence, as these exchanges represent the absolute excellence in the bitcoin sphere, delivering easy yet sophisticated experiences for users from all over the world.