Unit Of Account: What It Is And How It Works

Explore the Unit of Account Guide for insights into its role in measuring value. Discover the crucial characteristics—scarcity, durability, acceptability, portability, divisibility, and fungibility—that define an effective unit.

In the world of economics, the term Unit of Account plays a crucial role in measuring the value of goods, services, and various transactions. This guide aims to break down the concept into simple terms, helping you grasp its significance and application.

What is a Unit of Account?

At its core, a Unit of Account is like a universal measuring stick for determining the value of things we buy and sell.

Imagine it as a common language that everyone agrees upon to express the worth of goods and services.

Why is it Important?

Having a standard measure makes it simpler to compare the value of different items. For instance, think of comparing the price of a phone and a laptop. A Unit of Account helps us assess and decide on our purchases.

It enables people to budget and plan financially. By knowing the value of various assets in the same unit, such as currency, we can make informed decisions about our expenses, savings, and investments.

Money as a Unit of Account

Most commonly, the Unit of Account is associated with money, which serves as the standard measure in our daily transactions.

National currencies like the US dollar, euro, or British pound act as Units of Account, allowing us to make sense of the value of goods and services.

Characteristics of a Good Unit of Account

For something to function effectively as a Unit of Account, it needs a few key qualities. Let's have a look at them.

- Scarcity: It denotes a limited supply of currency relative to goods and services, ensuring value retention. An essential economic principle, scarcity safeguards against devaluation and is exemplified by commodities like gold with finite quantities.

- Durability: Is a currency's ability to withstand wear, crucial for prolonged use. Modern fiat currencies, crafted from durable materials, exemplify resilience in circulation, preserving stability as a reliable Unit of Account.

- Acceptability: Signifies widespread recognition and willingness to use a currency. Widely accepted currencies, like the USD, streamline transactions globally, enhancing usability and reinforcing their role as a Unit of Account.

- Portability: It reflects a currency's ease of transport. Digital currencies, notably Bitcoin, demonstrate superior portability, transcending geographical barriers and enabling seamless transactions, essential for a global Unit of Account.

- Divisibility: The ability to break down the unit into smaller parts facilitates transactions and makes value comparisons more accurate.

- Fungibility: Units of the same currency should be interchangeable, ensuring that one dollar is equivalent to another. This interchangeability simplifies trade and transactions.

| Items | Stability | Durability | Limited Supply |

|---|---|---|---|

| 🪙 Gold | High | High | No |

| 🥈 Silver | Moderate | Moderate | No |

| 🏡 Real Estate | Moderate | Low | Variable |

| 🎨 Art and Collectibles | Variable | Variable | Variable |

| ₿ Cryptocurrencies (Bitcoin) | Low | Variable | Yes |

Bitcoin as a Unit of Account

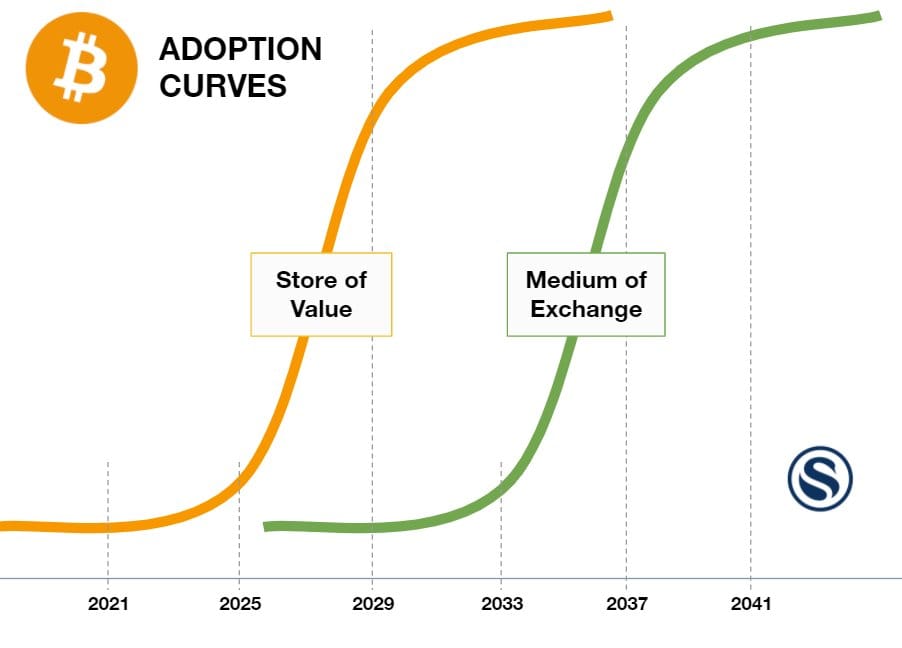

The advent of cryptocurrencies, notably Bitcoin, has brought a fresh perspective to the concept of a Unit of Account. Bitcoin, works as a decentralized digital currency, and challenges traditional notions of money.

Bitcoin's Standout Feature

At the core of Bitcoin's uniqueness is its capped maximum supply of 21 million coins. This sets it apart from traditional fiat currencies, which can be endlessly printed. The limited supply aims to eliminate inflationary pressures, providing a stable foundation for a reliable Unit of Account.

Bitcoin's immunity to inflation makes it a potential contender for a consistent Unit of Account. This predictability instills confidence in businesses and individuals, facilitating more reliable long-term financial planning.

The fixed supply of Bitcoin may encourage more responsible economic decisions. Governments often resort to printing more money for funding, but Bitcoin's design eliminates this temptation. Policymakers would need to explore alternative methods for managing economic growth.

If Bitcoin achieves global acceptance as a reserve currency, it could streamline international trade. The need for currency exchanges would diminish, reducing the risks associated with currency fluctuations and simplifying cross-border transactions.

Challenges

Despite its potential, Bitcoin is still in its early stages. Overcoming challenges and gaining broader acceptance are crucial steps for it to be recognized as a consistent Unit of Account. As the cryptocurrency matures, its role in economic transactions may become more established.

Bitcoin's potential as a reliable Unit of Account marks a transformative prospect in the financial landscape. Its decentralized nature and resistance to traditional economic pressures could reshape how we measure and assess value in the digital age.

Conclusion

In summary, a Unit of Account is the backbone of economic transactions, providing a standardized way to measure value.

Whether it's dollars, euros, or even emerging cryptocurrencies, understanding this concept empowers individuals and businesses to navigate the complex world of economics more confidently.