Store Of Value: What Does It Mean?

In this guide, I will illustrate the concept of "Store of Value" and highlight the optimal solutions for preserving and storing your value over time.

During a recent interview on CNBC, Larry Fink, the CEO of BlackRock, commented on the introduction of the first Bitcoin Spot ETFs on Wall Street. He expressed the view that "Bitcoin is an asset class that protects you."

What he meant by this statement is quite evident. Essentially, Bitcoin can be classified as an asset, comparable to Gold, designed to preserve its value over time. In contrast to traditional currencies like fiat or other assets and commodities susceptible to the erosive effects of inflation, Bitcoin is seen as a safeguard against such value erosion. A store of value.

What Does "Store Of Value" Mean?

The term "store of value" refers to a commodity, asset, or fiat currency capable of maintaining its value over an extended period without significant depreciation. Among the general public, precious metals like Gold are often regarded as reliable stores of value due to their enduring presence over thousands of years, with their value remaining relevant to this day.

A store of value is essentially something that can be stored, retrieved, and exchanged in the future without experiencing substantial loss of value. Ideally, it would be desirable if the stored value increases over time. Evaluating a good store of value involves envisioning a scenario where an object is purchased, kept for 10, 50, or 100 years, and its worth remains the same or even appreciates upon retrieval.

Metals such as Gold, Silver, and Platinum are considered enduring stores of value due to their perpetual marketability. Similarly, U.S. T-Bonds, from an investment perspective, are recognized for retaining their value.

In some countries like Turkey, the erosion of the Lira's value has led some to consider flasks of detergent as a reliable store of value to protect their purchasing power, as these items can endure over time. In contrast, holding flasks of milk is seen as a poor store of value due to its rapid expiration, causing a loss of value. Although even detergent has an expiration date, its non-consumable nature and practical timeframe for use make it a viable store of value.

Ultimately, determining whether a physical asset qualifies as a store of value depends on specific circumstances or the perceived existence of a fundamental demand.

Examples of Store Of Value

In this section, we'll outline several widely used stores of value, introducing a newcomer gradually gaining market share each year.

Currency

In theory, a robust and stable currency within a thriving economy can effectively serve as a store of value. For citizens to trust and choose to preserve their wealth in a specific currency, the nation's economic stability is crucial.

A dependable currency encourages individuals to actively participate in labor, trade, savings, and expenditures using that particular currency.

Conversely, a currency that fails to function as a reliable store of value undermines incentives for earning, spending, and saving, thereby complicating trade involving that currency.

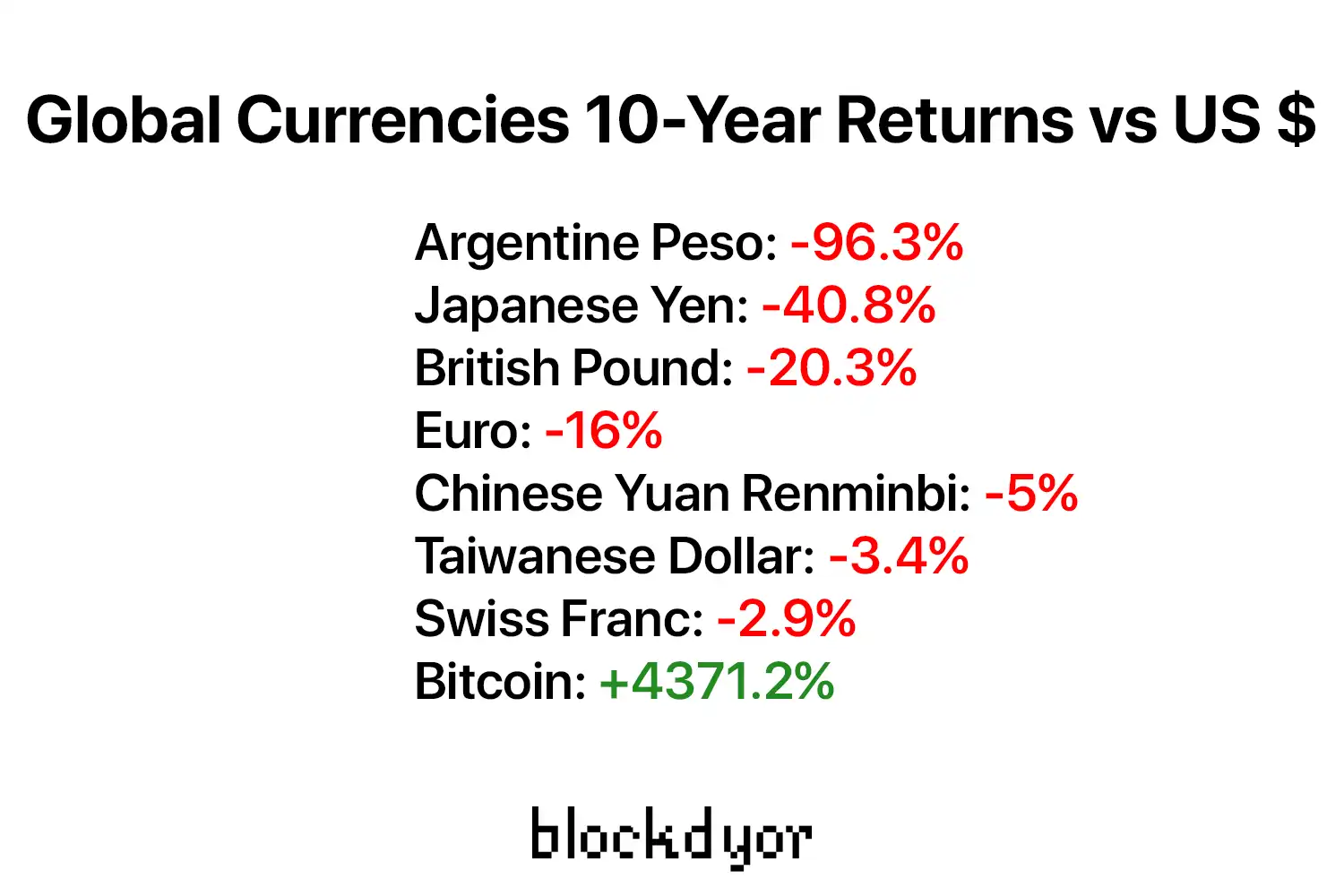

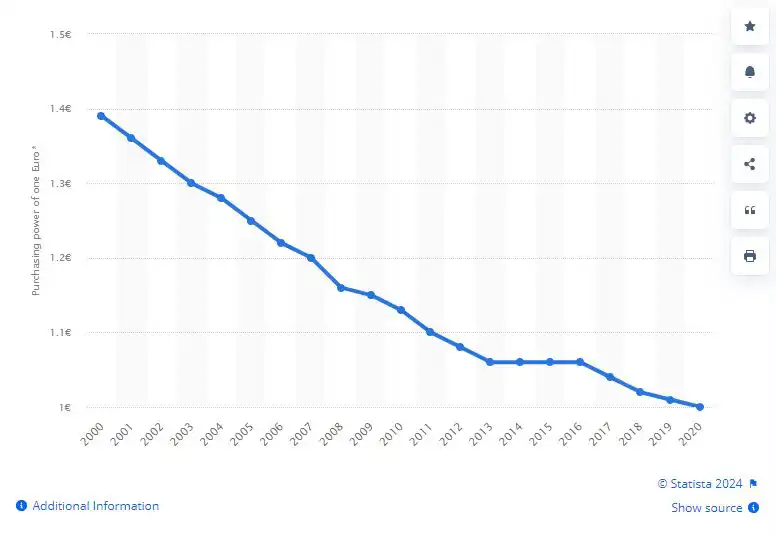

Most of fiat currencies, are derived from governmental decree rather than tangible backing, so they lack a direct link to physical reserves, making them vulnerable as stores of value. Described as "soft money," they depend on government-set price stability targets, leading to a gradual erosion of value through inflation.

The absence of intrinsic value and susceptibility to government policies make fiat currencies unreliable for preserving wealth.

Commodities

In bygone eras, numerous economies relied on precious metals such as gold and silver to underpin their currencies due to these metals' ability to retain value over time. Despite the high costs associated with transportation and exchange for various denominations, their enduring value made them attractive for such purposes.

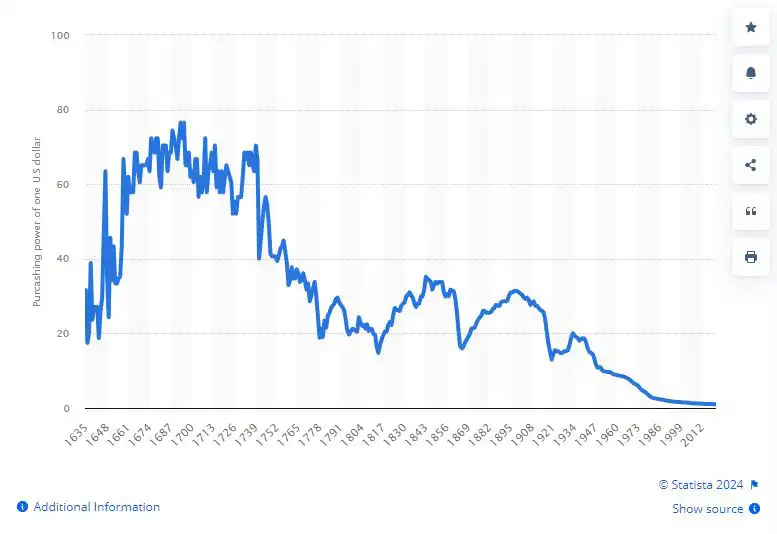

The United States adhered to a gold standard, allowing dollars to be exchanged for specific amounts of gold. This arrangement persisted until 1971, when President Richard Nixon made the pivotal decision to abolish the Gold Standard. This move was aimed at granting the Federal Reserve more authority.

Subsequently, the United States transitioned to using a fiat currency, a form of legal tender declared by the government but not tied to any commodity of intrinsic value. Since that pivotal moment, the U.S. has operated with a fiat currency system.

Cryptocurrencies

Cryptocurrency, particularly Bitcoin, emerges as the contemporary contender among various store-of-value options. Bitcoin, engineered with meticulous precision, adheres to a rule established by Satoshi Nakamoto – a cap of 21 million bitcoins, offering a transparency that contrasts with uncertainties surrounding the available quantities of traditional valuables like Gold or Silver.

Unlike physical commodities, Bitcoin's digital nature ensures perpetual preservation without decay or deterioration. Although there are associated costs, such as mining fees for transaction verification, the process is nearly instantaneous, with a confirmation time of 10 minutes per block multiplied by six blocks. Notably, Bitcoin operates in a censorship-resistant environment, devoid of intermediaries, and transaction verification merely requires access to a Bitcoin node.

Bitcoin's design aims for perfection in every aspect of a currency. Through the concept of digital scarcity, it seeks to emulate the inherent properties of tangible materials within the digital realm. Bitcoin stands as a form of de-virtualization, diverging from legal representations (as seen in fiat money) to embody a tangible fraction of objectively measurable real-world work through the process of mining.

By removing centralization, Bitcoin sacrifices a degree of efficiency due to decentralization, yet not to the extent of reverting to the past like the gold standard. It successfully navigates the digital landscape while concurrently de-virtualizing the currency, transforming it into a digital object attained through the tangible proof-of-work mining process.

What Makes A Good Store Of Value?

Having access to a reliable store of value is crucial for long-term prosperity. For instance, if you produce 10 bottles of milk daily but only require one for daily survival, the ability to store the value of the surplus 9 bottles allows you to accumulate savings progressively.

Over time, this accumulation enables you to invest in more cows, perhaps even acquire a farm, and consequently generate hundreds, if not thousands, of bottles of milk daily.

However, attempting to store milk for extended periods isn't advisable due to its tendency to decay over time. This highlights the unsuitability of milk as a store of value. Essentially, throughout history, humanity has discerned what makes a good or bad store of value, and not everything proves effective in preserving value over time.

For an item to be considered a good store of value, it should possess the following characteristics:

- Stability of Value: A good store of value should maintain relatively stable purchasing power over time. It shouldn't be subject to extreme volatility or unpredictable fluctuations in value.

- Durability: The item should be durable and resistant to deterioration or decay over time. This ensures that its value is preserved over the long term.

- Divisibility: A store of value should be easily divisible into smaller units without losing its inherent value. This divisibility allows for flexibility in transactions.

- Portability: The item should be easily transportable or transferable, facilitating its use in various locations and situations. Portability enhances its utility as a store of value.

- Recognizability: The store of value should be easily recognizable and accepted as valuable by a wide range of people. Recognizability contributes to its liquidity and usability.

- Uniformity: Uniformity ensures that each unit of the item is the same as every other unit, guaranteeing consistency in value and making it interchangeable.

- Limited Supply: A good store of value often has a limited or controlled supply (scarcity), preventing inflationary pressures that could erode its value over time.

- Fungibility: Each unit of the item should be interchangeable with any other unit of the same type and value. This characteristic supports its use as a medium of exchange.

- Resistance to Counterfeiting: The item should be difficult to counterfeit or reproduce fraudulently. This protects the integrity of the store of value and maintains trust in its authenticity.

- Acceptability: The item should be widely accepted as a medium of exchange or store of value within a community or across communities. Acceptability is crucial for its functionality in transactions.

Historically, precious metals like gold and silver have often been considered good stores of value due to their possession of many of these characteristics. In the modern context, cryptocurrencies like Bitcoin are also considered by some as potential stores of value due to their true limited supply and decentralized nature.

| Items | Stability | Durability | Limited Supply |

|---|---|---|---|

| 🪙 Gold | High | High | No |

| 🥈 Silver | Moderate | Moderate | No |

| 🏡 Real Estate | Moderate | Low | Variable |

| 🎨 Art and Collectibles | Variable | Variable | Variable |

| ₿ Cryptocurrencies (Bitcoin) | Low | Variable | Yes |

Money As A Store Of Value

Throughout human history, the concept of money as a store of value has undergone various transformations. From rare shells adorning the beaches to colored beads cherished by primitive societies, the intrinsic value of these items evolved beyond mere aesthetics. They transitioned from objects of beauty to mediums of exchange, gaining acceptance as a form of currency. What elevated their status was their limited availability, dictated by nature's constraints – a scarcity that bestowed upon them the ability to retain value over time.

In contemporary times, the notion of money as a store of value has become increasingly entwined with fiat currencies, where governments can arbitrarily print more money, leading to concerns of inflation. Fiat currencies lack the inherent scarcity that historical forms of money possessed, and their value is subject to the whims of central authorities. This departure from the natural constraints that once defined money as a store of value has fueled the quest for alternatives.

This changed with the introduction of Bitcoin, a decentralized cryptocurrency that operates on the principles of blockchain technology and proof of work. In the realm of Bitcoin, the scarcity that defines traditional forms of money is not a product of rarity but a result of a sophisticated algorithmic mechanism. Bitcoin's supply is systematically controlled through a process that requires miners to solve complex mathematical puzzles, a mechanism known as proof of work.

Unlike fiat currencies, Bitcoin cannot be arbitrarily created. The process of mining demands substantial computational power and energy expenditure. The difficulty of mining adjusts dynamically, ensuring a predictable and fixed rate of new Bitcoin issuance. This deliberate design mirrors the historical concept of money as a store of value based on scarcity. Bitcoin's supply is not subject to the discretionary decisions of a central authority, mitigating the risk of inflation and manipulative monetary policies.

Moreover, Bitcoin's proof of work serves a dual purpose. Beyond the distribution of new coins, it safeguards the integrity of the cryptocurrency network. It prevents the malicious act of double-spending, reinforcing the immutability and security of transactions. This distinctive feature not only provides a secure foundation for Bitcoin but also aligns with the historical understanding of money as a trustworthy and immutable medium of exchange.

Bitcoin's decentralized nature also addresses issues related to identity. In a world where legal identities can be manipulated or controlled, Bitcoin's distribution is based on objective criteria – the energy expended in the proof-of-work process. This decentralized approach ensures a fair and transparent allocation of the cryptocurrency without relying on traditional identity verification methods.

While the adoption of Bitcoin is touted as a return to the fundamentals of sound monetary policy, it is not without its challenges. The cryptocurrency faces potential regulatory cooptation, technical vulnerabilities, and uncertainties that could undermine its role as a disruptor of traditional financial systems. Vigilance and adaptability are crucial to navigating these challenges and maintaining the principles that underpin Bitcoin's appeal.

In essence, Bitcoin represents a paradigm shift in the concept of money as a store of value. It reintroduces scarcity, security, and decentralization into a financial landscape dominated by fiat currencies. The rise of Bitcoin signifies not just a technological innovation but a reimagining of the very essence of money – a return to principles that have historically defined its value and resilience as a store of wealth.

Bottom Line

In conclusion, the essence of a store of value lies in its ability to uphold or enhance purchasing power, determined by the principles of supply and demand. While skeptics may still view Bitcoin as an experiment, its brief existence has demonstrated its adherence to fundamental monetary properties, establishing it as a reliable store of value.

The forthcoming challenge for Bitcoin lies in establishing itself as a recognized unit of account, a milestone that would further solidify its status as a transformative force in the financial landscape.