BitMEX Review 2024: Pros, Cons And How It Compares

In this BitMEX review, we aim to address the question: is it the best professional cryptocurrency trading platform? Let's dig deeper into the details to find out.

What Is BitMEX?

It's not always about just buying Bitcoin and storing it in cold storage; professional traders often explore advanced strategies like leveraged contracts, margin trading, and derivatives to maximize gains in the crypto markets.

BitMEX, founded in 2014 by Arthur Hayes—the youngest African American crypto billionaire to date, who transitioned from an investment banking career—provides a platform for precisely these activities.

👉 Click here to join BitMEX and receive a 10% fee discount for the first six months.

| FEATURE | DESCRIPTION |

|---|---|

| 🌐 Website | bitmex.com |

| 🏙️ Location | Mahe, Seychelles |

| 📅 Year Founded | 2014 |

| 💰 Primary Token | BMEX |

| 📈 Listed Crypto | Bitcoin and 30+ cryptocurrencies |

| 💱 Trading Pairs | XBTUSD, ETHUSD, XBTUSDT, SOLUSD, ETHUSDT & more |

| 💵 Supported FIAT | N/A |

| 🌍 Supported Countries | Worlwide except USA & other nations |

| 💰 Minimum Deposit | No minimum deposit |

| 💸 Deposit Fees | No deposit fees |

| 💰 Daily Buying Limit | N/A |

| 💱 Trading Fees | Taker/Maker (XBT) from 0.0750% / from 0.0200% |

| 💸 Withdrawal Fees | No withdrawal fees (Network fees may apply) |

| 📱 Mobile App | Available for iOS and Android |

| 💬 Customer Support | 24/7 customer support available through live chat, email, telephone |

How BitMEX Works

BitMEX, short for Bitcoin Mercantile Exchange, is a peer-to-peer trading platform specializing in leveraged contracts traded in Bitcoin.

Originally a margin trading platform, it has expanded to offer spot trading as well. BitMEX is known for its simplicity, transparent pricing, and deep liquidity.

The exchange has a mobile app, providing traders with the flexibility to trade on the go.

BitMEX Features

Derivatives Trading

BitMEX is primarily a derivatives trading platform, allowing users to trade various crypto instruments, including leveraged contracts (up to x100), perpetual contracts, and other derivative products. The most important derivatives on BitMEX are:

- Perpetual Contracts: Contracts without expiry, trading close to the underlying reference index price.

- Futures Contracts: Agreements to buy or sell an asset at a predetermined price and time in the future.

- Predictions Contracts: Potentially allowing users to speculate on market movements or outcomes.

Spot Trading

This involves the direct buying and selling of actual cryptocurrencies in the spot market. Traders can exchange cryptocurrencies at the current market price, facilitating straightforward transactions without the use of leverage or derivatives.

Buy Crypto

This feature simplifies the process of acquiring cryptocurrencies directly within the BitMEX platform. Users can potentially use fiat currency to purchase various cryptocurrencies available on the platform, providing a seamless onboarding process for new users.

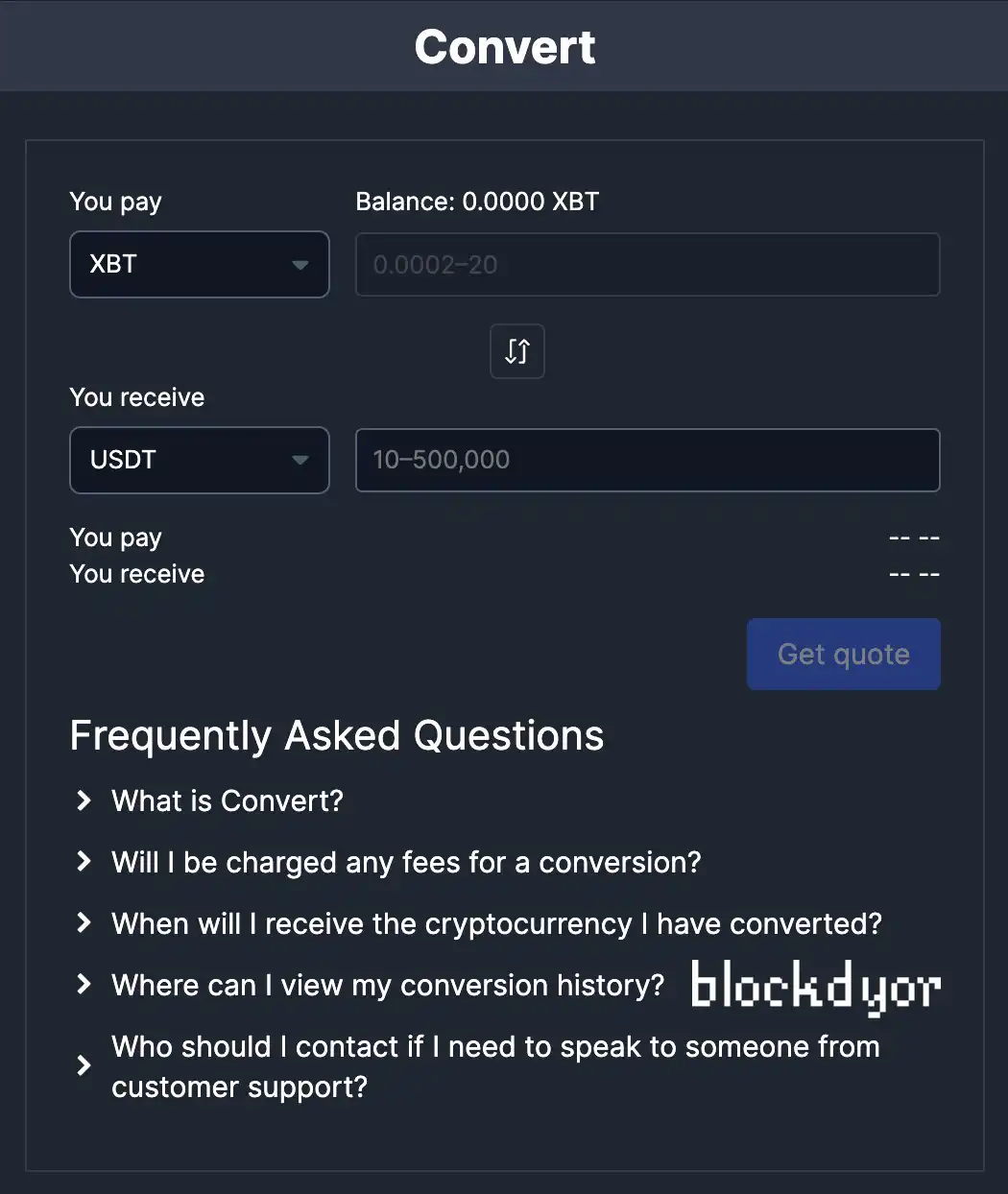

Convert

BitMEX's convert feature enables users to convert one cryptocurrency into another directly on the platform. This functionality can be useful for those looking to adjust their cryptocurrency holdings without the need for external exchanges.

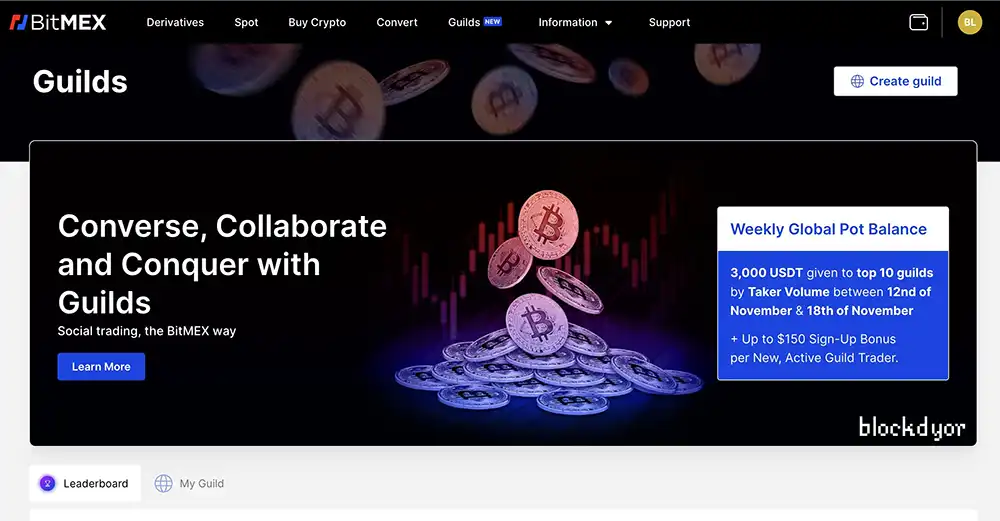

Guilds

Guilds on BitMEX serve as a unique and innovative platform feature that combines community collaboration with multi-account functionality. This integration is designed to offer significant benefits such as lower fees and substantial rewards exclusively for Guild members, referring to BitMEX users, whether they are newcomers, existing members, or returning traders.

Staking

BitMEX allows users to stake its native token, BMEX, in exchange for trading discounts. However, it appears that staking other cryptocurrencies, like Ethereum, is not currently supported on the platform.

Who Created BitMEX

Arthur Hayes is a figure in the cryptocurrency industry known for his role in founding BitMEX (Bitcoin Mercantile Exchange). In 2014, he established BitMEX, a cryptocurrency derivatives trading platform that became well-known for offering high leverage options.

Despite facing challenges in the early stages, including sleeping on a friend's couch to save money, BitMEX gained traction in the market.

Hayes, known for his sharp and handsome image, became a notable figure in the crypto industry. However, his journey took a turn when he faced legal scrutiny. In contrast to some counterparts who faced allegations of embezzlement, Hayes was not accused of stealing funds, lying to customers, or running a dishonest business. Instead, he faced charges related to violating banking laws, including failure to guard against money laundering and allowing Americans to trade on BitMEX without meeting certain obligations.

In April 2021, Hayes surrendered to federal agents and pleaded guilty to a single charge of violating the Bank Secrecy Act. He paid a $10 million fine and served a six-month term of house arrest. Despite this, Hayes has maintained a presence in the crypto community, expressing his commitment to changing the financial landscape through cryptocurrency. He has emphasized his desire to challenge traditional finance systems and provide alternatives for people to use.

Regardless of the controversy surrounding his legal situation, Hayes remains a notable figure in the crypto industry, expressing a vision for disrupting traditional financial systems and promoting the adoption of cryptocurrencies, especially bitcoin.

BitMEX Quick Review

This BitMEX review may be extensive, considering the comprehensive analysis of its essential aspects. Given the platform's multitude of functions, if you're short on time, you can refer to our quick review down here, which provides corresponding scores for each metric we employ to evaluate an exchange.

| Category | Feature | Score |

|---|---|---|

| 🔐 Privacy & Security (17/50) | ||

| 🕵️ Non-KYC | The exchange doesn't enforce the KYC to every user | 1/10 |

| 🔐 Non-Custodial | The exchange is non custodial, users can withdraw their funds | 1/10 |

| 👥 Peer To Peer | The exchange doesn't offer P2P trading | 1/5 |

| 🌐 Decentralization | The exchange is centralized | 1/5 |

| 🔒 Encryption | The exchange encrypts all confidential data transfers | 5/5 |

| 🌐 TOR Connection | It's not possible to connect to the exchange with TOR | 1/5 |

| 📂 Open Source | Some software used by the exchange is open source | 2/5 |

| 📱 2FA | The exchange offers two-factor authentication | 5/5 |

| 🚀 Features (39/50) | ||

| 🖥️ User-Friendly UX | At first might look too complicated | 3/5 |

| 💵 Fiat Onramp/Offramp | Plenty of onramp/offramp methods | 5/5 |

| 💸 Taker Fee | 0.0750% (XTB) | 5/5 |

| 💸 Maker Fee | 0.0200% (XTB) | 5/5 |

| 💸 Withdrawal Fee | Based on the Bitcoin network current mempool fees | 5/5 |

| ☎️ Customer Service | Available via chat and ticket | 4/5 |

| 📚 Documentation | Plenty of documentation on the official website | 5/5 |

| 🚮 Altcoins | Many altcoins supported | 5/5 |

| ⚡ Lightning Network Withdrawal/Deposit | The exchange doesn't support LN | 1/5 |

| 💧 Liquid Network Withdrawal/Deposit | Not possible to withdraw or deposit Bitcoin with the liquid network | 1/5 |

| 🧱blockdyor Score (56/100) |

How To Get Started On BitMEX

To start your journey with BitMEX, the first step involves preparing your identification document and proof of address. BitMEX strictly adheres to a 100% Know Your Customer (KYC) policy, even for the initial account opening process and dashboard exploration.

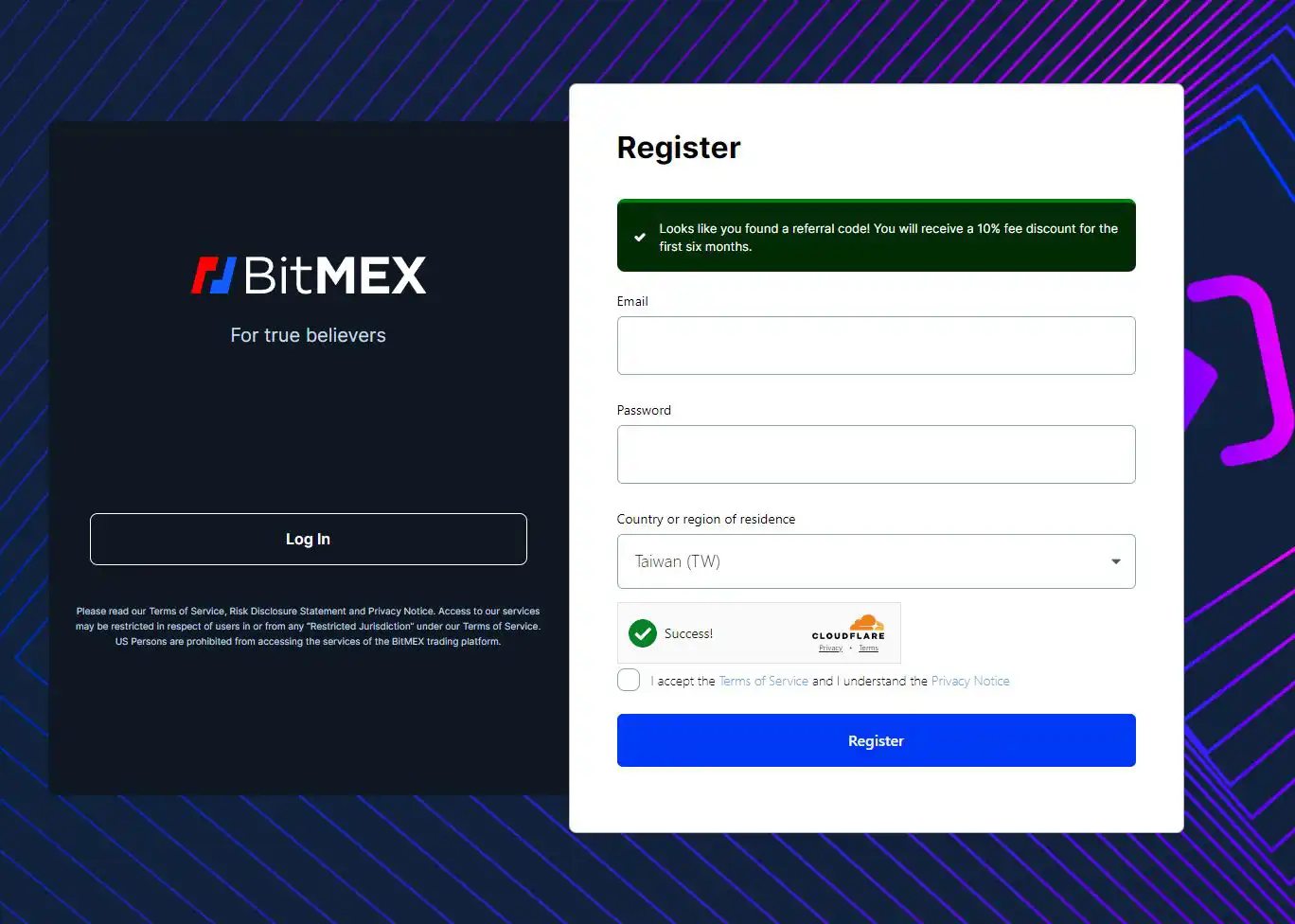

Sign Up and Verify

By clicking on the link provided below, you can access a special promotion that enhances your introduction to BitMEX, ensuring a favorable start to your experience on the platform.

👉 Click here to join BitMEX and receive a 10% fee discount for the first six months.

- Enter your email, set a password, and indicate your country. Agree to the terms and conditions, then proceed by clicking the "Register" button.

- Verify your email by clicking on the link sent to you by BitMEX.

- Complete the verification process by submitting photos of both the front and back of your identity card, along with proof of address.

- Alternatively, you can choose to utilize GPS geolocation, effectively bypassing the need for a separate proof of address.

After finishing the registration and KYC process, you can pass on the next step.

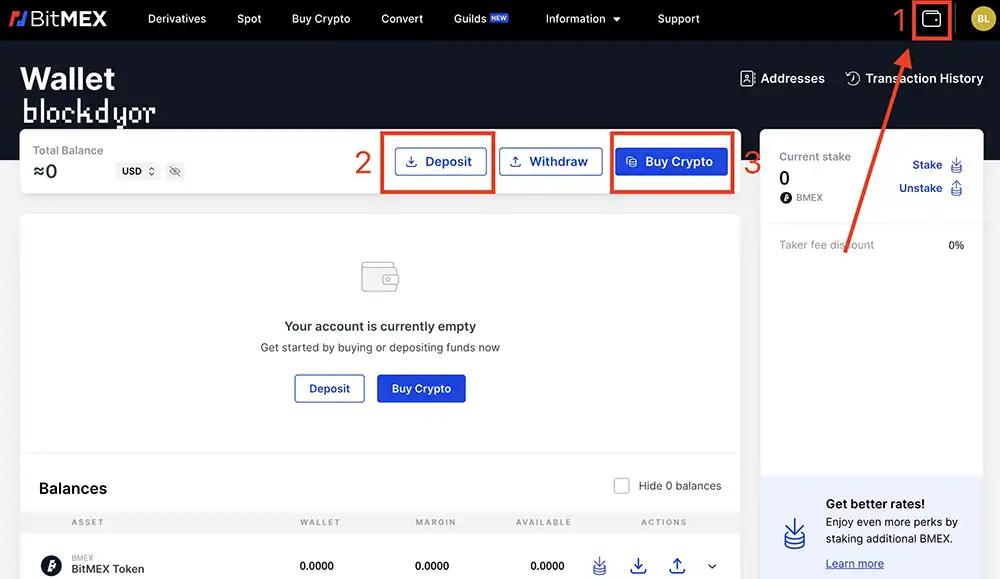

Deposit

As you begin using BitMEX, you'll notice one of distinctive features that set it apart from other platforms: high leverage. In fact, it includes perpetual contracts with a leverage of up to x100, a scenario that might not be advisable for beginners.

Furthermore, BitMEX primarily offers crypto-to-crypto trading, meaning there are no direct fiat pairs like BTC/USD. Consequently, if you lack cryptocurrency and wish to go long on BTC, you'll need to acquire a stablecoin like USDT, commonly associated with bitcoin.

- Upon logging in, navigate to the top-right corner and click on the wallet-shaped icon (1) to access the BitMEX wallet. In the wallet interface, you'll observe the option to deposit (2) the cryptocurrencies you currently hold on the exchange.

- For users with fiat currency and no existing cryptocurrency, BitMEX offers an onramp service, allowing you to Buy Crypto (3) directly.

- The deposit procedure aligns with standard practices on many other exchanges. Once you initiate a deposit, you'll be provided with a unique receiving address tailored to the chosen network and coin. After a few confirmations on the blockchain, the deposited cryptocurrency will reflect in your BitMEX account.

Familiarize with the platform

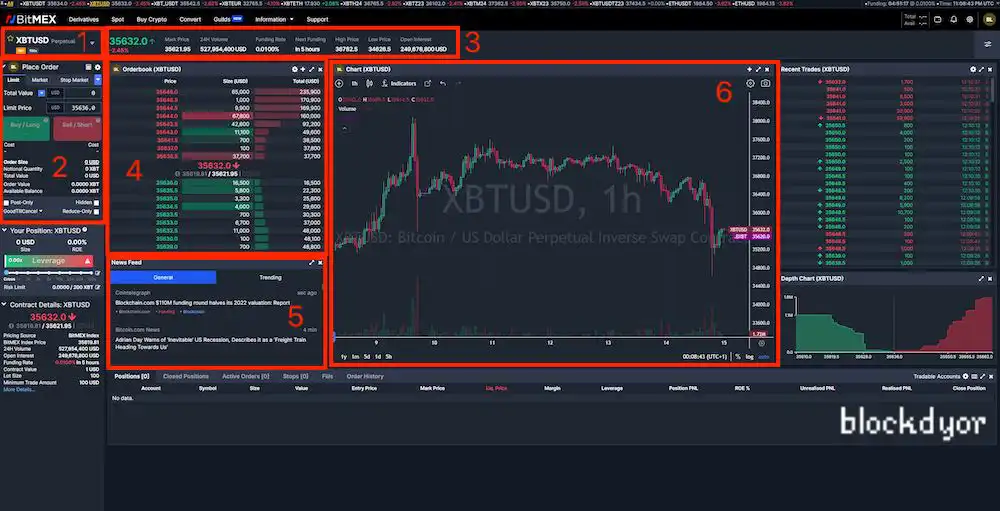

While the primary trading interface of BitMEX might appear daunting initially, it shares fundamental similarities with the trading platforms found on other prominent exchanges. The crucial components include:

- Trading Pair: This section allows users to select the specific trading pair they want to engage with, whether it involves cryptocurrencies or other digital assets.

- Order Buttons & Info: BitMEX's trading platform features intuitive order buttons that facilitate the execution of buy or sell orders. Associated information, such as order type and quantity, is displayed alongside, providing transparency and control over trading actions.

- Price and Other Market Information: Real-time market data, including current prices, trading volumes, and other relevant metrics, is prominently displayed. This information aids traders in making informed decisions based on the latest market dynamics.

- Orderbook: The order book provides a comprehensive view of existing buy and sell orders in the market. Traders can assess the demand and supply levels, enabling them to strategize and gauge potential market movements.

- News Feed: BitMEX integrates a news feed directly into the trading platform, delivering up-to-date information on market trends, developments, and other factors influencing the cryptocurrency space. Staying informed is crucial for making well-informed trading decisions.

- Chart: The chart section offers a graphical representation of price movements over a selected time frame. Traders can utilize various charting tools and indicators to perform technical analysis and identify potential entry or exit points for their trades.

BitMEX Fees & Limits

BitMEX employs a comprehensive fee structure for its trading platform, focusing on simplicity and offering discounted Taker Fees for high-volume traders.

The fee calculation is based on the rolling 30-day Average Daily Volume (ADV) measured daily at 00:00 UTC, the amount of BMEX staked, and participation in the VIP program.

Fees

ADV Trading Fees:

- Taker Fee (XBT): Ranges from 0.0750% to 0.0175%

- Maker Fee (XBT): Ranges from 0.0200% to -0.0150%

- Taker Fee (USDT): Ranges from 0.0750% to 0.0175%

- Maker Rebate (USDT): Constant at -0.0150%

BMEX Staking Discounts:

- By staking BMEX, traders can unlock additional discounts on Taker Fees and rebates on Maker Fees. Larger staked amounts guarantee a maximum fee level.

ADV and Staking Fee Tiers:

- ADV Tiers (USD):

- Ranges from Tier B (Less than USD 1,000,000) to Tier S (More than or equal to USD 1,000,000,000)

- BMEX Stake Tiers:

- Ranges from 0 BMEX (0% discount) to 1,000,000 BMEX (15% discount)

VIP Program:

- Total Market Share:

- Ranges from 0% to 10%

- Taker Fee (Total Market Share):

- Ranges from 0.0750% to 0.0175%

- Maker Market Share:

- Ranges from 0% to 10%

- Maker Fee (Maker Market Share):

- Ranges from 0.0200% to -0.0050%

Perpetuals Trading Fees:

- Offers leveraged trading with corresponding Maker and Taker Fees.

Futures Trading Fees:

- Offers a variety of futures contracts with varying leverages and corresponding fees.

Other Fees:

Funding:

- On Perpetual Contracts, funding is exchanged between longs and shorts over discrete Funding Intervals. BitMEX does not charge fees on funding paid or received.

Deposits / Withdrawals:

- BitMEX does not charge fees on Bitcoin deposits. Withdrawal fees are dynamically set based on blockchain load.

- BitMEX does not charge fees on Tether deposits. Withdrawal fees for Tether are available on the Withdrawal Page.

Order Type Exceptions:

- Hidden/iceberg orders: Hidden orders pay the taker fee until the hidden quantity is completely executed, after which they receive the maker fee for the non-hidden quantity.

| Fee Tier | 30D Rolling ADV (USD) | Taker Fee (XBT) | Maker Fee (XBT) | Taker Fee (USDT) | Maker Fee (USDT) |

|---|---|---|---|---|---|

| B | 0 | 0.0750% | 0.0200% | 0.0750% | -0.0150% |

| I | 1,000,000 | 0.0500% | 0.0100% | 0.0500% | -0.0150% |

| T | 5,000,000 | 0.0400% | 0.0000% | 0.0400% | -0.0150% |

| M | 10,000,000 | 0.0350% | 0.0000% | 0.0350% | -0.0150% |

| E | 25,000,000 | 0.0300% | 0.0000% | 0.0300% | -0.0150% |

| X | 50,000,000 | 0.0250% | 0.0000% | 0.0250% | -0.0150% |

| D | 100,000,000 | 0.0240% | -0.0030% | 0.0240% | -0.0150% |

| W | 250,000,000 | 0.0230% | -0.0050% | 0.0230% | -0.0150% |

| K | 500,000,000 | 0.0220% | -0.0080% | 0.0220% | -0.0150% |

| S | 1,000,000,000 | 0.0175% | -0.0100% | 0.0200% | -0.0150% |

Limits

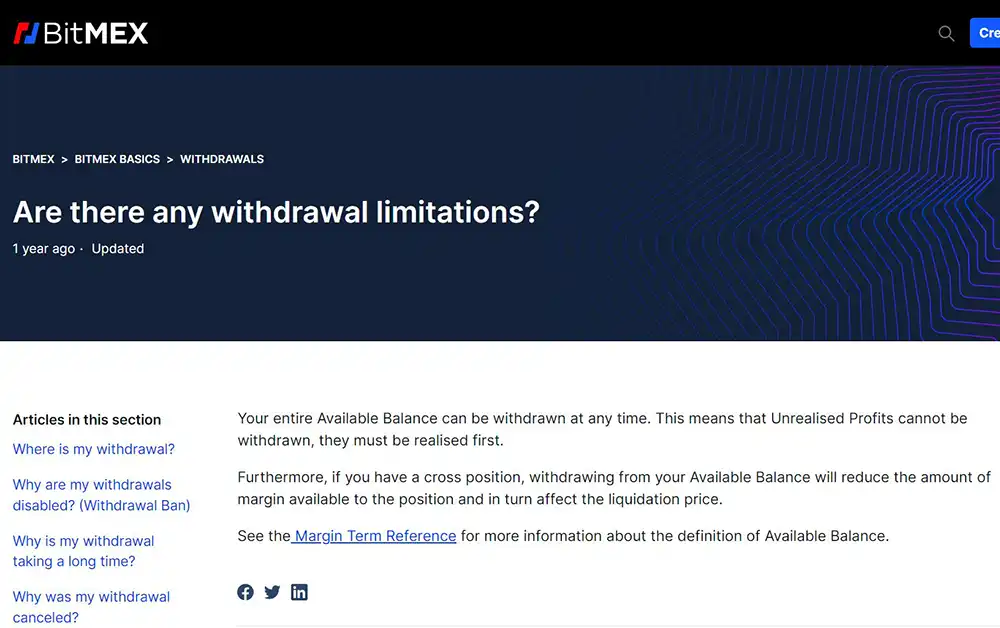

Currently, there are no notable restrictions on BitMEX accounts, including withdrawal limitations.

You have the flexibility to withdraw your entire Available Balance at any time. It's important to note that Unrealised Profits cannot be withdrawn; they must be realized first.

Nevertheless, risk limits are implemented on all trading accounts to mitigate the likelihood of substantial liquidations on margined contracts.

As users accumulate larger positions, there is a potential risk to other participants on the exchange, as they might face a deleveraging event if the position cannot be entirely liquidated.

For the latest information on risk limits, refer to the BitMEX Official account for updates.

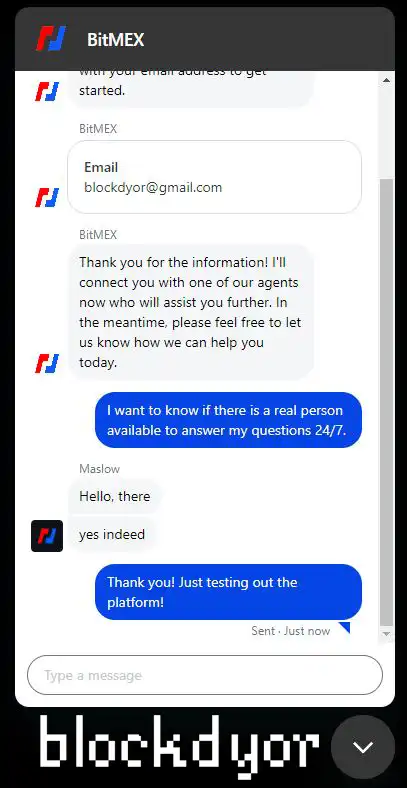

BitMEX Customer Service

BitMEX provides customer service through tickets and a 24/7 chat feature. In my personal experience, I found their customer service to be consistently responsive.

While the option for a phone line could enhance user experience by facilitating real-time communication, it's worth noting that the chat feature is staffed by real individuals, ensuring that issues can be addressed by a human agent.

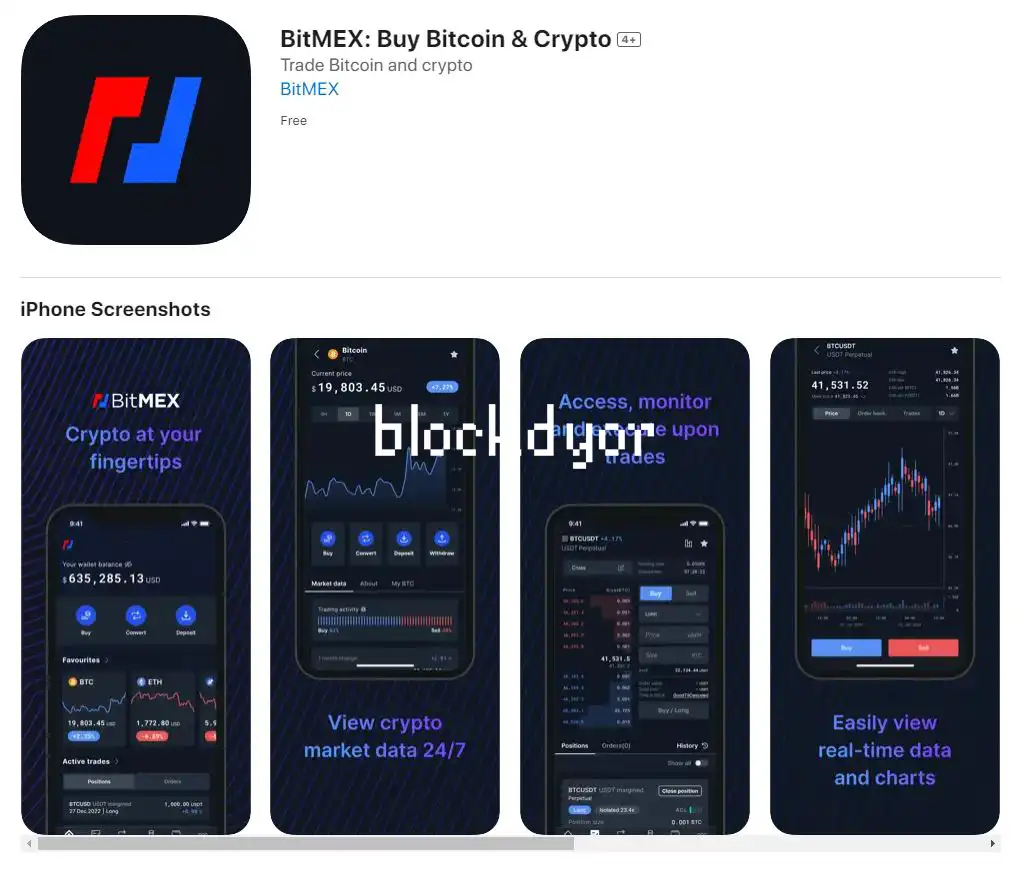

BitMEX Apps

BitMEX provides applications for both Android and iOS devices, allowing users the flexibility to trade on the go. While I haven't personally tested the app, I plan to explore its features in the future.

Based on the available screenshots, it appears to have most functions of the web app. Additionally, the app seems well-maintained, with regular updates being pushed out to ensure optimal performance.

BitMEX Opinions

While using BitMEX, I didn't encounter any specific issues as the entire process was smooth, and trading proved to be fast and straightforward.

However, the requirement to complete full KYC even before gaining access to the platform is somewhat inconvenient, especially considering the absence of a proprietary fiat onramp, relying instead on third-party applications.

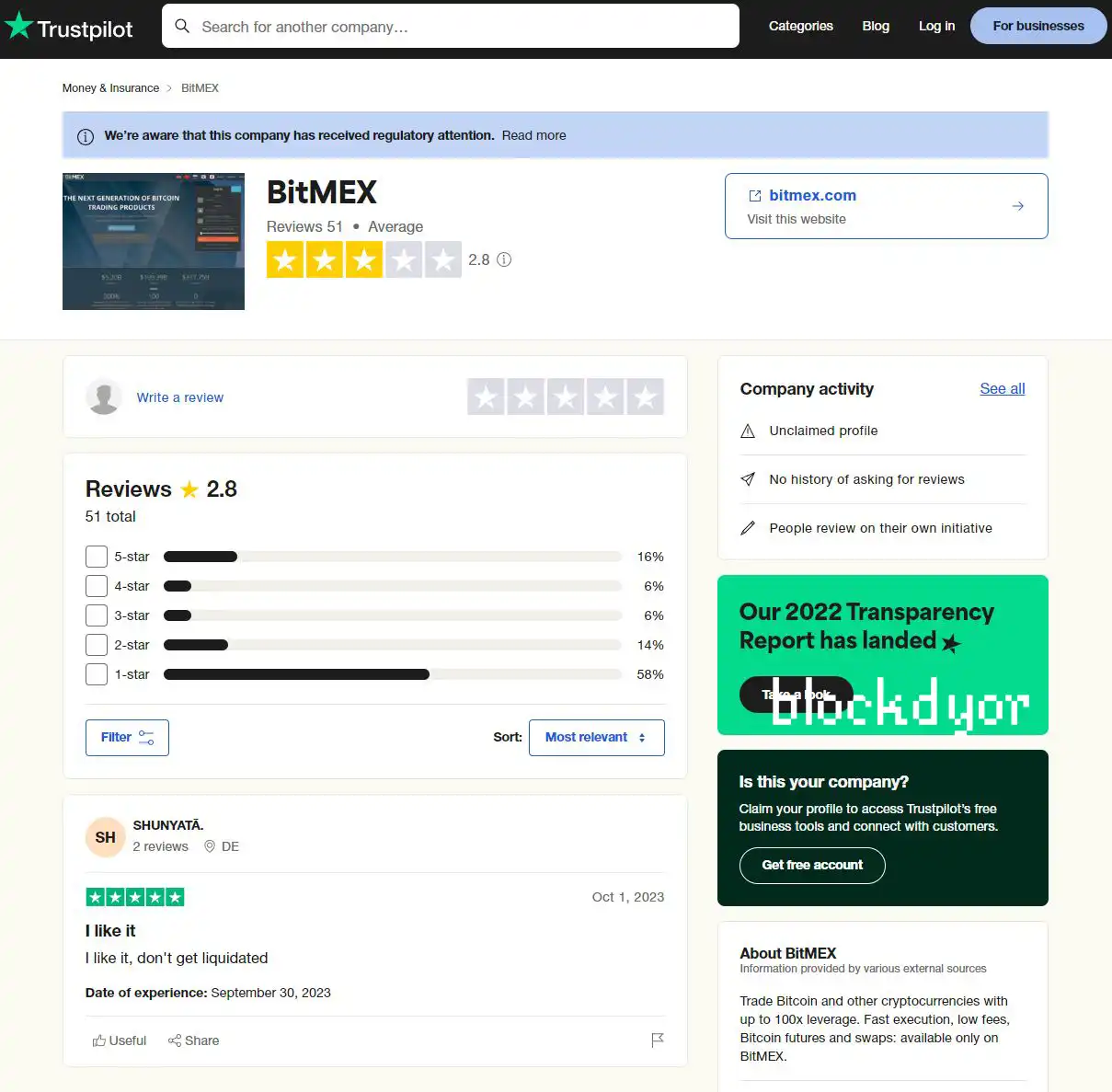

In an effort to gather diverse perspectives on BitMEX, I explored Trustpilot, and to my surprise, the reviews were not particularly favorable. With just over 50 reviews, the platform averaged a three-star rating.

BitMEX Alternatives & How They Compare

BitMEX functions as both an exchange and a trading platform with a focus on derivatives. To make a sensible comparison, one can consider similar platforms, with Bitfinex and KuCoin being notable alternatives. These platforms share the commonality of not being available in the United States and providing a variety of leverage options.

Bitfinex

Bitfinex operates as a cryptocurrency exchange and presents a trading platform akin to BitMEX. It encompasses features such as spot trading, algorithmic trading, historical pricing data, margin trading, derivatives trading, and a robust API tailored for developers. Known for its advanced capabilities, Bitfinex also adopts a fee structure similar to BitMEX.

KuCoin

KuCoin boasts a diverse asset portfolio, encompassing thousands of altcoins alongside Bitcoin. The platform offers Spot Trading, Futures Trading, Margin Trading, Bots, and a range of additional features, making it a comprehensive option in the cryptocurrency space.

| Feature | BitMEX | Bitfinex | KuCoin |

|---|---|---|---|

| Type | Exchange and Derivatives Trading | Cryptocurrency Exchange | Cryptocurrency Exchange |

| Available In | Worldwide, excluding the United States | Worldwide, excluding the United States | Worldwide, excluding the United States |

| Leverage Options | Yes | Yes | Yes |

| Trading Fees | Taker/Maker (XBT) from 0.0750% / from 0.0200% | Taker/Maker from 0.20%/0.10% | Taker/Maker Spot from 0.1% |

| Withdrawal Limits | None specified | Depends on user verification level | Depends on user verification level |

| Instruments | Derivatives (Futures and Perpetual) | Spot Trading, Derivatives, Margin | Spot Trading, Futures, Margin, Bots |

| KYC Requirements | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

| Customer Service | Chat, Ticket 24/7 | Chat, Ticket 24/7 | Chat, Ticket 24/7 |

| Additional Features | Advanced derivatives trading platform | Algorithmic trading, API for developers | Comprehensive altcoin portfolio, bots |

| Read Reviews | - | Read our Bitfinex review | Read our KuCoin review |

Is BitMEX Safe?

Ensuring the security of users funds is paramount for any exchange, and BitMEX takes this responsibility seriously. Notably, BitMEX has maintained an impeccable security record, having never experienced a breach thanks to its meticulous approach.

In fact, unlike many platforms, BitMEX operates without a hot wallet, minimizing the online presence susceptible to hacking attempts. Withdrawals are executed through a robust multisignature setup, further fortifying the protection of customer assets.

BitMEX's commitment to security extends to being awarded the ISO/IEC 27001 certification, reflecting the exchange's dedication to maintaining the highest standards.

Multisig

The unique BitMEX multisignature system requires two out of three partners to sign each withdrawal, enhancing security by preventing unauthorized fund access.

This process, performed on offline machines, includes manual review and signing by partners, with withdrawals executed once a day at 13:00 UTC to ensure a meticulous and secure transactional environment.

Proof of Reserves

Following the FTX incident, users began demanding proof of reserves—a document substantiating that their funds are supported by genuine reserves held by the exchange.

This serves as a safeguard in the event of a "bank run," assuring users that the exchange can fulfill fund withdrawals transparently and without any risk of a rug pull.

BitMEX has been proactive in adopting this practice since 2021, so even before it became commonplace. Currently, they do proof of reserves twice a week, demonstrating their commitment to transparency and financial integrity.

BitMEX Pros & Cons

| Pros | Cons |

|---|---|

| ✅ High Leverage: Offers high leverage, up to 100x. | ❌ Limited Cryptocurrency Options: BitMEX primarily supports Bitcoin derivatives. |

| ✅ Advanced Trading Features: Provides advanced trading tools, including futures and perpetual contracts. | ❌ Complex Interface: Interface may be overwhelming for beginners. |

| ✅ Liquidity: Generally has high liquidity, enabling large trades. | ❌ No Fiat Trading: BitMEX does not support direct fiat trading; users must buy crypto first. |

| ✅ Security: Known for a strong security track record. | ❌ Lack of Altcoins: Limited variety of supported cryptocurrencies compared to other exchanges. |

| ✅ Availability: Accessible to users around the world. | ❌ Controversies: BitMEX has faced regulatory scrutiny and legal issues in the past. |

| ✅ API Support: Offers API for algorithmic trading. | ❌ Identification: Strict KYC. |

Is BitMEX Right For You?

If you reside outside the USA, have an affinity for high leverage (and you know what you are doing), and seek advanced technical tools for your cryptocurrency trading, BitMEX is an ideal platform for you.

While it may not be the first choice for crypto beginners, BitMEX offers a dedicated section for purchasing cryptocurrencies with fiat through its onramp feature, making it accessible to users at various experience levels.

Bottom Line

BitMEX is a leading crypto exchange famous for its advanced trading features, pristine security track record and high leverage options, making it a preferred choice for experienced traders.

However, beginners might find its interface complex, and the limited cryptocurrency options, primarily focused on Bitcoin, might be a drawback for those seeking a broader range.

The exchange's past legal issues and controversies should be considered, but its global accessibility and liquidity make it a significant player in the crypto derivatives space. Users willing to navigate its intricacies can benefit from its powerful trading tools.

👉 Click here to join BitMEX and receive a 10% fee discount for the first six months.

BitMEX Overview

BitMEX stands as a substantial exchange boasting significant liquidity and an array of functions. However, its adoption remains limited to a select few due to its steep learning curve. Nevertheless, those who navigate this curve will greatly appreciate the cutting-edge technologies offered by the exchange. Despite its blockdyor Score of 56 out of 100, which may not be the highest globally, this rating is primarily influenced by the exchange's centralized nature and mandatory KYC requirements, aligning with current industry standards. If these factors pose no issue for you, it's certainly worth exploring BitMEX.

Reputation: BitMEX is a well-established cryptocurrency exchange with a strong reputation for security and reliability. It has maintained a clean record, having never experienced a security breach. Users generally trust BitMEX for its commitment to safeguarding their funds.

Technology: BitMEX's platform is built with a focus on advanced trading features and performance. The exchange provides a robust and efficient system, catering to both casual and professional traders.

Customer Service: BitMEX offers customer support through various channels, including email and a comprehensive knowledge base. While they strive to address user queries promptly, there might be occasional delays.

Fees: BitMEX has a transparent fee structure, with competitive trading fees. However, users should be aware of potential fees associated with withdrawals and specific transactions.

Ease of Use: BitMEX's platform is tailored for traders familiar with advanced features, making it more suitable for experienced users.