Coinbase Review 2024: Features, Fees And How It Works

Coinbase is a popular cryptocurrency exchange known for its wide selection of digital assets, user-friendly interface and educational resources. It also offers advanced trading features for experienced investors.

In addition to these features, Coinbase is known for its strong security measures, which have contributed to its status as one of the largest cryptocurrency exchanges in the world.

If you are considering using Coinbase, you may want to read our comprehensive review to determine if it is the right exchange for your needs.

👉 Click here to open an account on Coinbase and get a €/£/$10 bonus.

Coinbase Exchange Summary

| Description | Details |

|---|---|

| 🌐 Website | coinbase(dot)com |

| 🏙️ Location | San Francisco, California |

| 📅 Year Founded | 2012 |

| 💰 Primary Token | N/A |

| 📈 Listed Crypto | Over 3000 |

| 💱 Trading Pairs | Over 150 |

| 💵 Supported FIAT | USD, EUR, GBP |

| 🌍 Supported Countries | Over 100 |

| 💰 Minimum Deposit | $2, €1,99 |

| 💸 Deposit Fees | ACH – Free / Fedwire – $10 / Silvergate Exchange Network – Free / SWIFT – $25 / SEPA (EUR) €0.15 EUR / Swift (GBP) Free |

| 💰 Daily Buying Limit | $25,000 |

| 💱 Transaction Fees | Spread ≈ 0.5%. (Doesn't apply for orders placed with Advanced Trade) |

| 💸 Withdrawal Fees | 0.55% to 3.99% |

| 📱 Mobile App | iOS & Android |

| 💬 Customer Support | Email & Phone |

Coinbase: what is it?

Coinbase is a leading cryptocurrency exchange founded in 2012 and based in San Francisco, California.

It has a global presence with offices around the world and is fully licensed and regulated as a Bitcoin exchange. With a consistently growing list of supported cryptocurrencies.

Coinbase has become one of the largest exchanges in the world and is currently ranked #2 on Coingecko.

In September 2021, it achieved an important milestone by adding over 100 currencies to its asset directory for the first time.

Coinbase Features

In our Coinbase review, we will highlight some of the unique features that make this exchange one of the most popular:

- Coinbase has a developer platform that allows developers to build APIs for accessing historical and real-time price data of Coinbase-supported cryptocurrencies;

- The company has a commerce platform for businesses to accept cryptocurrency as payment for their products and services. API documentation is provided to help businesses set up a secure system for accepting cryptocurrency payments. This enables all Coinbase users to purchase coins using cryptocurrency;

- Coinbase offers an intuitive platform that is easy to use for checking prices, balances, and executing buy and sell orders. It is a popular starting point for traders entering the cryptocurrency market, as it offers a wide range of cryptocurrencies such as Bitcoin, Ether, Litecoin, and more;

- Coinbase fees are slightly higher than some other brokers, but they are considered worth it for the range of services offered. These fees include charges for buying, exchanging, and network fees for withdrawals, among others that may apply;

- The Coinbase mobile wallet allows traders to securely store their cryptocurrency assets and includes a seed phrase to access the keys for different cryptocurrencies in the wallet;

- The Coinbase card, is a prepaid card with an app available on the Google Play Store and Apple App Store. It allows users to efficiently buy multiple cryptocurrencies and traders can also request a Visa card to spend their cryptocurrencies on the exchange;

- The Coinbase affiliate program allows individuals to work as affiliates or advertising partners and earn trading fees for the first three months that a user trades on Coinbase through their referral link;

- Coinbase allows users to buy Bitcoin and other coins using fiat currencies such as credit card, debit card, and bank transfer. The "instant exchange" feature enables users to make instant transfers using fiat currencies rather than buying Bitcoin with fiat and sending it to the recipient;

- Users can upgrade to the GDAX platform for free to trade and sell coins. It offers a wide selection of cryptocurrencies for trading and allows users to trade between cryptocurrencies. It is easy to transfer between GDAX and Coinbase Pro;

- One of the most important features of Coinbase is its commitment to security. It keeps 99% of its assets in offline cold storage to protect against hackers and insures the 1% of assets that are available online. In the event of an unfortunate event, traders are compensated;

- Coinbase has a dedicated customer service team that is available anytime for assistance.

Coinbase Quick Review

If you're too busy to read the whole Coinbase review, just glance at this quick table. It sums up important things like privacy, security, and features to give Coinbase a blockdyor score.

| Category | Feature | Score |

|---|---|---|

| 🔐 Privacy & Security (18/50) | ||

| 🕵️ Non-KYC | The exchange enforces the KYC to every user | 1/10 |

| 🔐 Non-Custodial | The exchange is fully custodial, users can withdraw their funds | 2/10 |

| 👥 Peer To Peer | The exchange doesn't have any P2P trading | 1/5 |

| 🌐 Decentralization | The exchange is centralized | 1/5 |

| 🔒 Encryption | The exchange encrypts all confidential data transfers | 5/5 |

| 🌐 TOR Connection | It's not possible to connect to the exchange with TOR | 1/5 |

| 📂 Open Source | Some software used by the exchange is open source | 2/5 |

| 📱 2FA | The exchange offers two-factor authentication | 5/5 |

| 🚀 Features (42/50) | ||

| 🖥️ User-Friendly UX | Intuitive and easy to use | 5/5 |

| 💵 Fiat Onramp/Offramp | Several fiat onramp and offramp | 5/5 |

| 💸 Taker Fee | From 0.60%, it decreases as the trading volume increases | 5/5 |

| 💸 Maker Fee | From 0.40%, it decreases as the trading volume increases | 5/5 |

| 💸 Withdrawal Fee | For BTC (Bitcoin Network) the commission is 0.00000423 BTC | 5/5 |

| ☎️ Customer Service | Available via chat, phone and ticket | 5/5 |

| 📚 Documentation | Plenty of documentation on the official website | 5/5 |

| 🚮 Altcoins | Several altcoins supported | 5/5 |

| ⚡ Lightning Network Withdrawal/Deposit | Not possible to withdraw or deposit Bitcoin with the lightning network | 1/5 |

| 💧 Liquid Network Withdrawal/Deposit | Not possible to withdraw or deposit Bitcoin with the liquid network | 1/5 |

| 🧱blockdyor Score (60/100) |

How to open an account on Coinbase

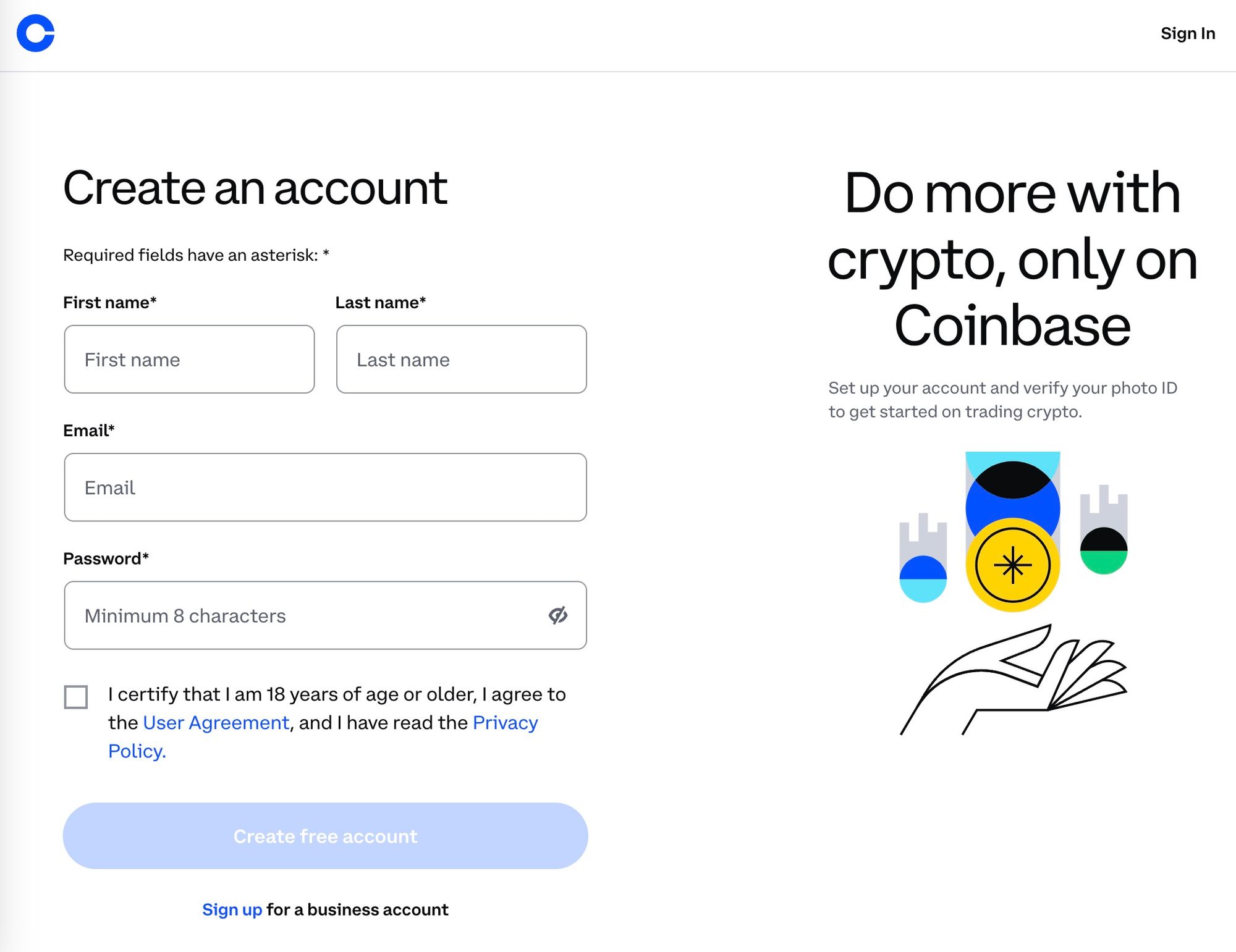

To create a Coinbase account, follow these steps:

- Go to the Coinbase website, find the Sign Up button and click on it. Then provide your first and last name, email, and a secure password. You will also need to confirm that you are 18 years or older.

- Check your email and verify it by clicking on the link sent by Coinbase.

- Add a phone number to your account. Coinbase will send you a 7-digit verification code via text message.

- Provide additional personal information, including your payment address and name. You will also need to verify your identity by providing a scan of a valid passport, driver's license, or photo ID.

After completing these steps, you should be able to purchase Bitcoin and other cryptocurrencies on Coinbase. Please note that there may be a short processing time before your account is fully activated.

Coinbase Fees

Coinbase Exchange has a maker-taker fee model for its trading fees, which means that the fees charged for orders that provide liquidity (maker orders) are different from those charged for orders that take liquidity (taker orders).

| Pricing Tier | Taker Fee | Maker Fee |

|---|---|---|

| $0 - $10K | 0.60% | 0.40% |

| $10K - $50K | 0.40% | 0.25% |

| $50K - $100K | 0.25% | 0.15% |

| $100K - $1M | 0.20% | 0.10% |

| $1M - $15M | 0.18% | 0.08% |

| $15M - $75M | 0.16% | 0.06% |

| $75M - $250M | 0.12% | 0.03% |

| $250M - $400M | 0.08% | 0.00% |

| $400M+ | 0.05% | 0.00% |

The fee you pay depends on the current pricing tier you are in when the order is placed, not on the tier you would be in after the trade is completed. If you place an order at the market price that is filled immediately, you are considered a taker and will pay a fee between 0.05% and 0.60%. If you place an order that is not immediately matched by an existing order, it will be placed on the order book.

If another customer places an order that matches yours, you are considered the maker and will pay a fee between 0.00% and 0.40%. If you place an order that is partially filled immediately, you will pay a taker fee for that portion and a maker fee for the remaining portion of the order when it is placed on the order book and matched with another order. The specific taker and maker fees for each pricing tier are listed in the table provided.

| Stablecoin Pairs | Taker Fee | Maker Fee |

|---|---|---|

| BUSD-USD | 0.001% | 0.00% |

| DAI-USD | 0.001% | 0.00% |

| GUSD-USD | 0.001% | 0.00% |

| GYEN-USD | 0.001% | 0.00% |

| MUSD-USD | 0.001% | 0.00% |

| PAX-USD | 0.001% | 0.00% |

| PAX-USDT | 0.001% | 0.00% |

| USDT-USD | 0.001% | 0.00% |

| USDT-EUR | 0.001% | 0.00% |

| USDC-EUR | 0.001% | 0.00% |

| USDC-GBP | 0.001% | 0.00% |

| USDT-USDC | 0.001% | 0.00% |

| USDT-GBP | 0.001% | 0.00% |

| WBTC-BTC | 0.001% | 0.00% |

| CBETH-ETH | 0.001% | 0.00% |

Stablecoin pairs, or pairs with a fixed exchange rate between two cryptocurrencies, also have their own taker and maker fees, as listed in the table. The taker fees you pay are based on your total USD trading volume over the past 30 days across all order books. Transactions made on non-USD books are converted to USD based on the most recent fill price on the respective book.

Coinbase Exchange also charges fees for fiat deposits and withdrawals, as well as network transaction fees for cryptocurrency transactions.

Fiat Deposit and Withdrawal Fees

| Deposit Fee | Withdrawal Fee | |

|---|---|---|

| ACH | Free | Free |

| Wire (USD) | $10 USD | $25 USD |

| SEPA (EUR) | €0.15 EUR | €0.15 EUR |

| Swift (GBP) | Free | £1 GBP |

Miner Fees

Coinbase Pro charges a fee based on its estimate of the network transaction fees that it anticipates paying for each transaction in order to provide a positive experience for its customers and reasonable transaction processing times. The actual fee paid by Coinbase Pro may differ from the estimate in some circumstances, and all fees will be disclosed at the time of the transaction.

Account Fees

There are no fees for creating a Coinbase account or for holding funds in your Coinbase account. You can hold assets in your account for as long as desired without incurring any fees.

Which is cheaper: Coinbase or Coinbase Pro?

Both Coinbase and Coinbase Pro have the same fees. Previously, Coinbase charged a flat or variable fee per transaction based on the payment method and transaction amount.

However, both services now use a maker-taker fee structure with a range of 0.05% to 0.60% for taker fees and 0.00% to 0.40% for maker fees. This means that the fees for orders that take liquidity (taker orders) are the same on both Coinbase and Coinbase Pro, and the fees for orders that provide liquidity (maker orders) are also the same on both platforms.

Coinbase Funding Options

Coinbase offers various funding options for users to add money to their Coinbase account or withdraw money from it. Some of the most common funding options include bank transfers, debit and credit card payments, and PayPal.

Each option has its own set of fees, speed, and availability, so it's important to carefully consider which option is the best fit for your needs.

| Payment Method | Buy | Sell | Days |

|---|---|---|---|

| Bank account | Yes | Yes | 4 to 5 Days |

| Debit card | Yes | No | Instant |

| Credit card | No | No | Not available |

| Wire transfer | No | Yes | 1 to 3 business days |

| Apple Pay | Yes | No | Instant |

| Google Pay | Yes | No | Instant |

| PayPal | Yes | Yes | Instant |

Coinbase vs Coinbase Pro

Both Coinbase and Coinbase Pro are digital platforms that allow users to buy, sell, send, receive, and exchange various cryptocurrencies. Coinbase was originally created to enable safe Bitcoin transactions, but has since expanded to offer support for a range of other cryptocurrencies as well.

| Coinbase | Coinbase Pro | |

|---|---|---|

| Mobile app | iOS, Android | iOS, Android |

| Fees | Fees for trading on this platform range from 0.00-0.40% for orders placed on the order book but not immediately filled (known as maker fees), and 0.05-0.60% for orders that are immediately matched with pre-existing orders (known as taker fees). There is no charge for using the ACH transfer method to deposit US dollars, but wire deposits cost $10 and wire withdrawals cost $25. PayPal withdrawals incur a 2.5% fee. | Fees for trading on this platform range from 0% to 0.40% for maker orders and 0.05% to 0.60% for taker orders. There is no cost to deposit US dollars via ACH transfer, but wire deposits will cost $10 and wire withdrawals will cost $25. |

| Available cryptocurrencies | Over 200 cryptocurrencies are currently supported in the U.S., including: Bitcoin (BTC) Bitcoin Cash (BCH) Cardano (ADA) Ethereum (ETH) Ethereum Classic (ETC) Litecoin (LTC) Uniswap (UNI) | Over 200 cryptocurrencies are currently supported in the U.S., including: Bitcoin (BTC) Bitcoin Cash (BCH) Cardano (ADA) Ethereum (ETH) Ethereum Classic (ETC) Litecoin (LTC) Uniswap (UNI) |

| Buy/deposit methods | Bank account (ACH) Debit card (buy only) Wire transfer (deposit only) PayPal | Bank account (ACH) Bank account (bank wire) Cryptocurrency deposit |

| Sell/withdrawal methods | Bank account (ACH) Debit card (withdraw only) Wire transfer (withdraw only) PayPal (withdraw only) | Bank account (ACH) Bank account (bank wire) |

| Order types | Buy, sell, exchange, send, and receive cryptocurrency | Buy, sell, trade, send, and receive cryptocurrency Advanced trading orders such as stop or limit orders |

| Other features | This platform offers the ability to set up recurring purchases on a schedule, vault protection with time-delayed withdrawals, secure offline storage, insurance coverage, and an address book for storing and whitelisting trusted addresses. It also provides API access for developing custom trading bots | Advanced tools and order types |

| Ideal for | People new to cryptocurrency | Experienced crypto traders, serious about investing |

| Visit Coinbase | 👉 Visit Coinbase and get a €/£/$10 bonus | 👉 Visit Coinbase Pro and get a €/£/$10 bonus |

Coinbase Card

The Coinbase Card it's a Visa debit card that is powered by your Coinbase account balance and accepted at millions of locations worldwide. With it you can use your cryptocurrency as easily as you use the money in your bank account.

You can pay with contactless, PIN, or withdraw cash from any ATM. The card is also secure with two-step verification and the ability to instantly freeze it if necessary. In the Coinbase Card app, you can easily choose which cryptocurrency you want to use and track your spending with summaries, receipts, and instant notifications.

In UK/EU the Coinbase Card has an issuance fee of £4.95 / 4.95 €.

It appears that Coinbase Card has recently reduced the crypto cashback rewards offered through its debit card program from 4% to 2% for the next rewards cycle. This change may impact the benefits and incentives offered to cardholders and makes the Coinbase Card less attractive, compared to other cards, such as the Plutus one, which offers 3% crypto cashback with no staking requirements.

Coinbase Alternatives

Suitable alternatives for big, KYC only exchanges like Coinbase, are solutions like Kraken and Bitstamp.

| Coinbase | Kraken | Bitstamp | |

|---|---|---|---|

| 🧱 blockdyor Total Score | 60/100 | 62/100 | 45/100 |

| 🕵️ Non-KYC | No | No | No |

| 🔐 Non-Custodial | No | No | No |

| 👥 P2P | No | No | No |

| 💵 Fiat Onramp/Offramp | Yes | Yes | Yes |

| 💸 Taker/Maker Fees | From 0.60%/0.40% | From 0.26%/0.16% | From 0.40%/0.30% |

Kraken: this solution stands out as a compelling alternative to Coinbase, boasting lower fees and an arguably superior user interface. Notably, it incorporates interesting features such as the ability to withdraw Bitcoin (BTC) using the Lightning Network, particularly advantageous during periods of elevated fees on the main chain. For a more in-depth analysis, delve into our comprehensive Kraken Review.

Bitstamp, an established broker with a lengthy track record, has earned a reputation for its high resilience in the market. It distinguishes itself by offering lower fees compared to Coinbase. Explore further insights in our detailed Bitstamp Review by clicking here.

Coinbase Pros and Cons

| Advantages | Disadvantages |

|---|---|

| The platform has an easy to use UX | Coinbase is not available in all countries |

| Coinbase supports a wide range of cryptocurrencies and fiat currencies | The trading and exchange fees may be higher compared to other exchanges |

| The website offers a specialized platform for advanced traders called Coinbase Pro | Wallet is custodial, means that the user does not have control over their wallet keys |

| The Coinbase mobile app has all the features of the desktop version | The Coinbase Card is not available in all countries |

| The exchange has high liquidity | |

| There is a good variety of altcoins available on the platform |

Coinbase Pros

Coinbase has a user-friendly design interface that is easy for traders of all levels to use and navigate. Signing up and purchasing cryptocurrencies is quick and new users can easily complete their first trade.

The exchange has high liquidity, which can protect investors in volatile market conditions. Coinbase is one of the most highly liquid exchanges.

There are over 200 crypto pairs available for investment, trading, and staking on Coinbase, providing a wider range of options than many other platforms.

Coinbase offers a variety of rewards programs for its users, including the ability to earn cryptocurrency through learning about crypto on Coinbase Earn, staking crypto holdings, or converting dollars into stablecoins. Users can also take advantage of Coinbase's referral program, which allows both the trader and the referral to earn bonuses.

The Coinbase website also provides educational resources, including video classes and interactive sessions, to help users learn about cryptocurrency trading and effectively navigate the market.

Coinbase Cons

Coinbase Exchange has a maker-taker fee model for its trading fees, which means that the fees charged for orders that provide liquidity (maker orders) are different from those charged for orders that take liquidity (taker orders). The fee you pay depends on the current pricing tier you are in when the order is placed, not on the tier you would be in after the trade is completed.

If you place an order at the market price that is filled immediately, you are considered a taker and will pay a fee between 0.05% and 0.60%.

If you place an order that is not immediately matched by an existing order, it will be placed on the order book. If another customer places an order that matches yours, you are considered the maker and will pay a fee between 0.00% and 0.40%.

If you place an order that is partially filled immediately, you will pay a taker fee for that portion and a maker fee for the remaining portion of the order when it is placed on the order book and matched with another order.

The specific taker and maker fees for each pricing tier are listed in the table provided. Stable pairs, or pairs with a fixed exchange rate between two cryptocurrencies, also have their own taker and maker fees, as listed in the table.

The taker fees you pay are based on your total USD trading volume over the past 30 days across all order books. Transactions made on non-USD books are converted to USD based on the most recent fill price on the respective book. Coinbase Exchange also charges fees for fiat deposits and withdrawals, as well as network transaction fees for cryptocurrency transactions.

Bottom line

Whether you want to invest in crypto or use it to make purchases, is a personal decision. If you do decide to invest in digital assets, you'll need to choose a platform for buying and selling cryptocurrency. Coinbase and Coinbase Pro are both popular options, but they cater to different types of users.

Coinbase is a good choice for new cryptocurrency investors who want an easy-to-use platform with low fees. On the other hand, Coinbase Pro is more suitable for experienced investors or traders who want access to more advanced features.

It's important to consider your financial goals and level of experience when deciding which platform is right for you.

👉 Click here to open an account on Coinbase and get a €/£/$10 bonus.

Coinbase Evaluation

With a blockdyor Score of 60 out of 100, Coinbase is definitely one of the KYC exchanges most respected in the space.

Reputation: Coinbase it's an huge company and one of the few exchanges that it's actually listed in the US stock exchange. It has build a reputation of trustable, reliable and secure crypto exchange, it published a regular proof of reserve and stores 90% of customers fund in cold storage.

Technology: With a platform just for professional trader and a more simple one, it's great for every type of users.

Customer Service: It has a responsive and supportive customer service team, primarily accessible via email.

Fees: Coinbase offers a range of services, and its fee structure is reasonable.

Ease of Use: Coinbase it's easy to use, but the plethora of altcoins might be confusing for who's just looking to trade bitcoin.