Crypto Travel Rule: What Is It And How Does It Work?

What exactly is the travel rule, or more specifically, the crypto travel rule that’s been making headlines? Why are major exchanges now requiring you to verify your wallet for transactions exceeding a certain threshold? Let’s break it down.

The Crypto Travel Rule has become a much discussed regulation in the bitcoin and the crypto industry in general. Its primary goal is to combat money laundering and terrorist financing by imposing stricter oversight on virtual asset transactions.

While this regulation aims to protect financial systems from abuse, its implementation has sparked debates about privacy, financial inclusion, and the foundational principles of Bitcoin.

| Term | Definition |

|---|---|

| Travel Rule | Regulation requiring VASPs to collect and share sender and receiver information for transactions. |

| Virtual Asset Service Provider (VASP) | Entities that provide services for the exchange, transfer, or safekeeping of virtual assets. |

| Crypto Asset Service Provider (CASP) | Equivalent to VASPs under the EU's MiCA regulation, focusing on crypto asset-related services. |

| Self-Hosted Wallet | A wallet managed directly by the user, giving them full control of their private keys and funds. |

| Peer-to-Peer (P2P) Transfer | A transaction conducted directly between individuals without involving a VASP or intermediary. |

| Decentralized Exchange | Platforms like Bisq and RoboSats that allow users to trade directly without intermediaries, often running on TOR. |

| Know Your Customer (KYC) | The process of verifying a customer's identity to comply with regulatory requirements. |

| Zero-Knowledge Proofs | Cryptographic tools that allow one party to prove information without revealing the information itself. |

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

What Is the Crypto Travel Rule?

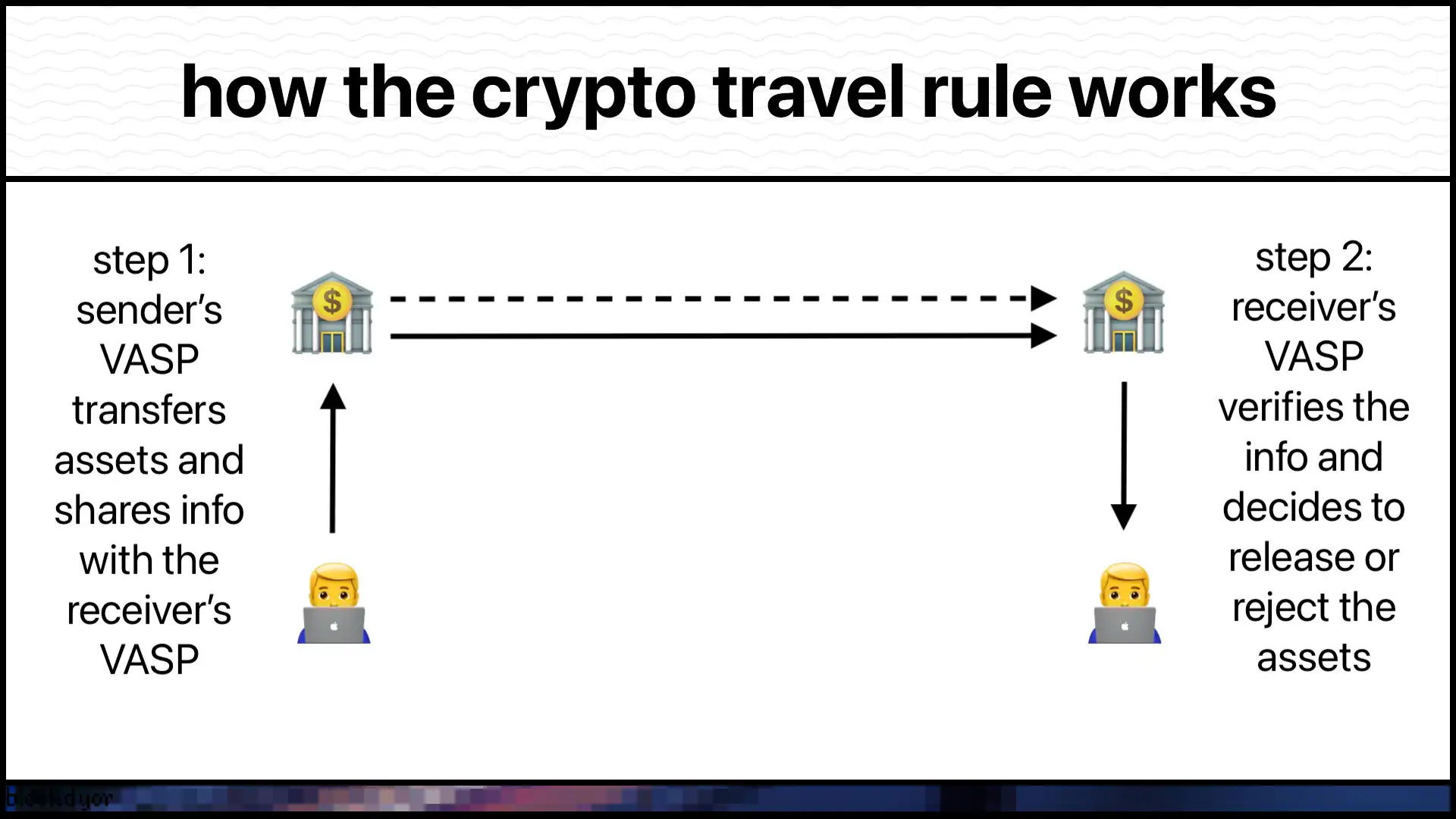

The Travel Rule, introduced by the Financial Action Task Force (FATF), mandates Virtual Asset Service Providers (VASPs), like cryptocurrency exchanges such as Coinbase or Relai, to collect and share information about the sender and receiver of transactions. Initially applied to traditional financial institutions in 2012, the rule was extended to cryptocurrencies in 2019, reflecting FATF’s growing focus on digital assets as a perceived risk to financial stability.

The rule applies during fiat-to-crypto or crypto-to-crypto exchanges conducted through VASPs. However, peer-to-peer (P2P) transactions and transfers involving non-custodial wallets (where users hold their private keys, such as the Coldcard or Sparrow) are generally exempt—unless they interact with a VASP.

What data is collected?

For transactions above certain thresholds, VASPs must gather information such as:

- Sender details: Full name, account number, address, or other identifying information.

- Receiver details: Full name and account number.

This information must be shared with other institutions involved in the transaction, ensuring that both sides comply with anti-money laundering (AML) and counter-terrorist financing (CFT) regulations.

How Is It Implemented in Europe?

In the European Union, the Travel Rule was formalized under the Transfer of Funds Regulation (TFR) in April 2023 and it became enforceable in December 2024. It complements the Markets in Crypto-Assets (MiCA) framework, creating a robust regulatory system for digital asset transfers. Key features include:

- Real-time data sharing: VASPs must transmit Travel Rule data before processing transactions.

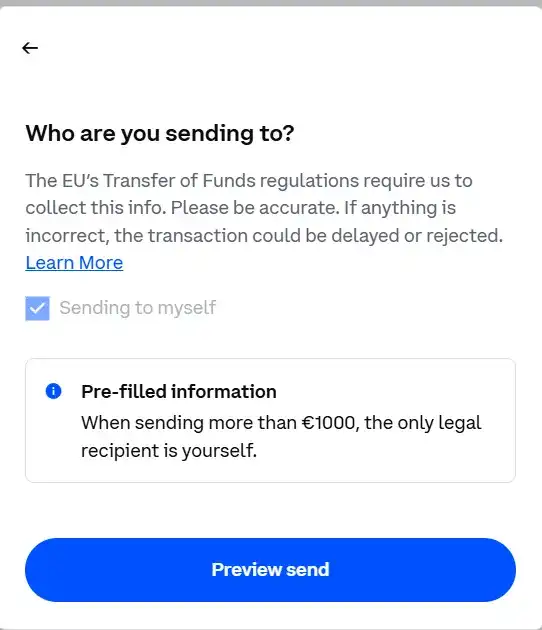

- Self-hosted wallet requirements: For transactions above €1,000, VASPs must verify ownership of non-custodial wallets.

- Privacy safeguards: All data sharing must comply with GDPR standards to protect user privacy.

While the EU’s approach seeks to enhance transparency, it imposes strict requirements that affect users, businesses, and smaller crypto startups.

Real-World Example of the Crypto Travel Rule

You might be wondering how the Crypto Travel Rule affects you in practice. Let’s break it down with a real-world scenario.

Major exchanges like Coinbase, Kraken, and Gemini are already enforcing this regulation in EU since the 1/1/2025. Here’s what that looks like:

- Sending Funds

Suppose you try to send Bitcoin from your Coinbase account to another wallet. If the recipient is not another Coinbase user, the platform may block the transfer unless you verify that the receiving address belongs to you. If it’s a self-custodial wallet, you may need to sign a message proving ownership before the transaction can proceed.

- Receiving Funds

Now, imagine you’re receiving Bitcoin from another exchange or wallet. You might be required to provide detailed information about the sender—even if you’re sending funds to yourself from a different platform. Some exchanges may ask for personal identification, such as a passport or government-issued ID, to verify the source of the funds.

What happens if you don’t comply? That varies by exchange, but in the worst case, your account could be restricted or even frozen. The level of enforcement depends on the exchange and the regulatory requirements in your jurisdiction.

This rule is already shaping how people move their Bitcoin, making compliance an unavoidable part of using regulated platforms.

Tensions Between Regulation and Bitcoin’s Principles

Bitcoin was created as a decentralized, censorship-resistant monetary network, allowing users to control their funds without intermediaries. Its pseudonymous nature provides accountability without revealing sensitive personal data. Critics argue that applying the Travel Rule to Bitcoin undermines these principles and poses several risks:

- Erosion of privacy: Requiring KYC data collection and wallet verification conflicts with Bitcoin’s goal of financial autonomy. Users are forced to surrender personal information, increasing exposure to hacks, surveillance, and identity theft.

- Exclusion of vulnerable populations: Stringent compliance measures create barriers for the underbanked and individuals in authoritarian regimes who rely on Bitcoin for financial freedom.

- Operational burdens: Smaller VASPs and startups face disproportionate costs to implement Travel Rule compliance, while larger institutions can absorb these expenses, creating an uneven playing field.

Global Impact and Criticism

The FATF’s influence goes beyond Europe. Countries that fail to adopt its recommendations risk exclusion from the global financial system. For instance, Pakistan has banned cryptocurrency entirely to comply with FATF standards, effectively stifling innovation and driving financial activity underground.

Despite its widespread adoption, the Travel Rule’s effectiveness remains questionable. Studies show that global money laundering continues unabated, accounting for 2–5% of GDP.

Additionally, centralized data collection introduces single points of failure, as seen in high-profile breaches like Equifax and Aadhaar, exposing millions to financial fraud.

Balancing Security and Privacy: The Path Forward

While regulatory oversight plays a role in curbing illicit activities, it’s essential to maintain a balance that respects both security and individual privacy. A promising path forward includes embracing solutions that preserve the principles of decentralization and financial freedom:

- Threshold Exemptions: Similar to practices in the United States, exempting smaller transactions from stringent reporting requirements could ease the burden on users and businesses, especially smaller entities.

- Decentralized Identity Systems: Blockchain-based KYC solutions can limit data exposure by allowing users to verify their identities without sharing sensitive information with multiple third parties, reducing risks associated with centralized databases.

- Innovative Cryptographic Solutions: Technologies like zero-knowledge proofs offer a way to comply with regulatory requirements without disclosing sensitive user data, striking a balance between privacy and oversight.

- Peer-to-Peer Bitcoin Exchanges: Decentralized exchanges like Bisq and Robosats are examples of platforms that inherently bypass the Travel Rule. They operate without intermediaries and run directly on users’ devices, often leveraging privacy-enhancing tools like TOR. This makes them resistant to censorship and aligns with Bitcoin’s ethos of financial sovereignty. These platforms allow users to trade Bitcoin in a way that is both private and secure, demonstrating that decentralization can coexist with responsible financial practices.

Ultimately, transparency and evidence-based policymaking remain essential. Regulations like the Travel Rule should aim to achieve their objectives without undermining the fundamental values of financial independence and privacy.

By supporting decentralized alternatives and innovative technologies, the crypto ecosystem can continue to thrive while addressing legitimate concerns about security.

Bottom Line

The Crypto Travel Rule shows the ongoing tension between innovation and regulation. While it aims to solve valid concerns like money laundering, its implementation raises critical issues around user privacy, financial inclusion, and the decentralized principles that define Bitcoin and other cryptocurrencies.

Decentralized and unstoppable platforms such as Bisq and Robosats offer a glimpse of how financial systems can thrive without compromising individual freedoms, proving that privacy and security need not be mutually exclusive. These platforms embody the resilience of decentralization, providing censorship-resistant alternatives in a regulatory landscape increasingly focused on oversight.