How To Buy Bitcoin Anonymously: The Complete Guide

Buying Bitcoin anonymously has become a challenge in a world of KYC rules and tighter regulations like MiCA. But it’s not impossible. From P2P platforms to decentralized exchanges, this guide shows you how to protect your privacy while entering the Bitcoin space.

How to buy Bitcoin anonymously? Buying Bitcoin without handing over personal documents, your home address, and even a detailed scan of your face has become a challenging task. This is largely due to KYC (Know Your Customer) and AML (Anti-Money Laundering) laws that most regulated exchanges and apps must follow to operate legally in many countries. One of the more recent developments tightening these regulations is the MiCA framework.

For Europeans, MiCA has made things even more restrictive. It expands existing AML rules to the crypto sector and removes thresholds for KYC requirements. This means even the smallest cryptocurrency transactions now require full KYC compliance. Not just exchanges, but even custodial and non-custodial wallets are impacted, as MiCA mandates KYC procedures across the board. The stated goal is to increase financial stability and investor protection in Europe, but it has also made privacy in bitcoin (and other cryptocurrencies) transactions much harder to maintain.

If you want to buy or sell Bitcoin today, you’ll likely need to use an exchange. Most of these are centralized, while the USA & other nations don't have a unified framework like MiCA, nearly all centralized exchanges enforce KYC/AML requirements to stay compliant. This is a sharp contrast to the early days of Bitcoin, when regulatory oversight was minimal, and many centralized exchanges bypassed KYC entirely due to legal gray areas. Now, nearly every centralized exchange enforces KYC rules, leaving users with fewer alternatives.

While centralized exchanges often offer a better user experience, the trade-off is a loss of privacy. But does wanting to protect your privacy make someone a criminal? Of course not. This guide isn’t about labeling centralized exchanges as “bad”—many are reputable and offer excellent services. However, for users who prioritize privacy, alternative solutions are worth exploring.

Unfortunately, finding such solutions has become more difficult, especially with the shutdown of platforms like LocalBitcoins and Agoradesk. But don’t worry—this guide is here to help. We’ll show you the best options for buying Bitcoin anonymously, ensuring you can maintain your privacy while still accessing the Bitcoin world.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Types of Anonymity in Bitcoin Exchanges

When exploring Bitcoin exchanges that don’t require KYC, it’s important to understand the varying levels of anonymity they offer. There’s always a tradeoff: the higher the level of anonymity, the more cumbersome the user experience tends to be. Let’s break down the types of non-KYC exchanges, ranked from the most anonymous to the least.

- Decentralized and Peer-to-Peer (P2P): These platforms are fully decentralized, meaning they operate without a central server. Transactions occur directly between users, making them resistant to shutdowns and censorship. Because there’s no central authority to oversee or collect user data, they offer the highest level of anonymity. However, navigating these platforms can be tricky for newcomers.

- Centralized and Peer-to-Peer (P2P): In this setup, users still transact with one another, but the exchange itself is centralized. This means you connect through a platform that facilitates P2P trades, acting as an intermediary. While less anonymous than purely decentralized options, these platforms often provide a balance between privacy and ease of use.

- Centralized and Not Peer-to-Peer (Light-KYC): These exchanges operate as legitimate businesses, offering direct buying and selling services without enforcing full KYC. While not as private as decentralized solutions, they still allow transactions without requiring extensive personal information, making them a practical choice for users seeking some level of anonymity without sacrificing usability.

Each type has its pros and cons, and the right choice depends on your priorities for privacy, ease of use, and legal compliance.

Best Decentralized and Peer-to-Peer (P2P) Exchanges

Let's start with the category of the exchanges that are able to provide the highest level of privacy and anonymity: the decentralized p2p exchanges. In this section I will describe the best ones.

Bisq

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bisq | 🇺🇸🇨🇦🇪🇺 + more | 1.15% / 0.15% | ⭐⭐⭐⭐⭐ 87/100 |

Why We Chose It

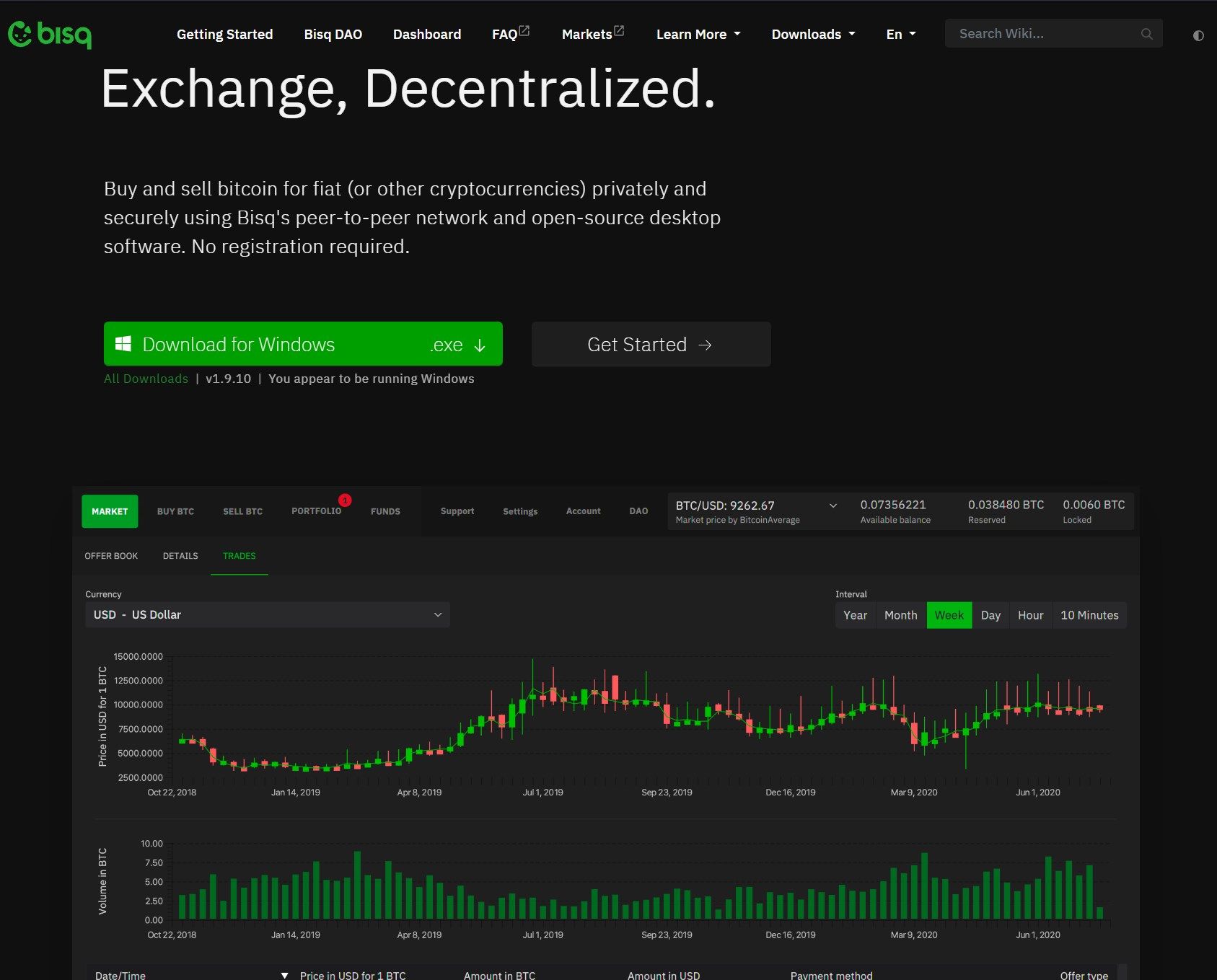

Bisq is a popular platform for buying and selling Bitcoin while maintaining a high level of privacy. As a decentralized exchange, it avoids KYC requirements entirely, offering users true control over their transactions. However, getting started can feel challenging, especially for newcomers.

One of the main hurdles is the need for a Bitcoin security deposit, which means users must already own some Bitcoin to start trading. This requirement can be a barrier for beginners but acts as a safeguard to ensure secure transactions. While this makes Bisq better suited for more experienced users, it’s a fair trade-off for the platform’s decentralized nature and variety of payment options.

To address accessibility concerns, the upcoming Bisq 2 introduces “Bisq Easy.” This new version eliminates security deposits, making the platform more approachable for beginners. While it sacrifices some security in favor of simplicity, it aims to attract a broader audience looking for a straightforward way to trade Bitcoin without compromising privacy.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low maker fees | ❌ In order to be able to buy Bitcoin, you need to already at least 0.001 BTC (100,000 sats) |

| ✅ High privacy | ❌ Too complex for beginners |

| ✅ The new Bisq Easy is the right direction | ❌ Security deposit needed |

Overview

Bisq is a well-established peer-to-peer (P2P) exchange celebrated for its strong privacy features and decentralized approach. By requiring all connections to go through Tor, Bisq ensures an additional layer of security for users, making it a standout choice for those seeking anonymity. The platform enables Bitcoin trading against national currencies and other cryptocurrencies without the need for any KYC compliance.

Available on Windows, Linux, and Mac, Bisq gives users full custody of their funds with its non-custodial wallet. Key privacy features like end-to-end encryption and Tor-only access further enhance its security. As one of the few genuinely decentralized exchanges, Bisq operates through a DAO, allowing its community to participate in governance and development decisions.

Despite its complex infrastructure, Bisq remains a cornerstone for traders who prioritize privacy and decentralization. Its open-source model and commitment to user autonomy embody the principles that Bitcoin was built on, making it a trusted platform for secure, private trades.

Full Review

Robosats

Key specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Robosats | 🇺🇸🇨🇦🇪🇺 + more | 0.175% / 0.025% | ⭐⭐⭐⭐⭐ 84/100 |

Why We Chose It

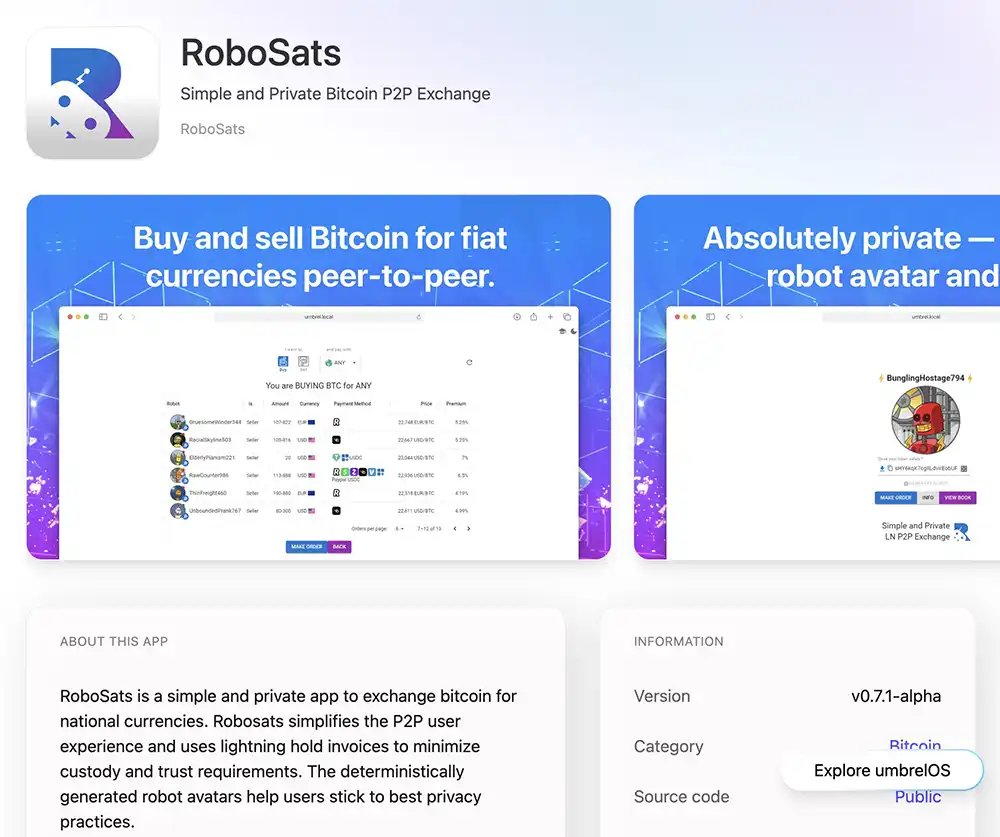

Robosats is an open-source platform designed for peer-to-peer Bitcoin trading, focusing heavily on privacy and decentralization. It leverages the Lightning Network for fast and private transactions while requiring all activity to occur over Tor, ensuring users’ anonymity.

One of Robosats’ standout features is the ability to self-host the platform on personal nodes, such as Citadel or Umbrel. This option enhances user control, allowing individuals to manage their trading environment independently.

Though it may lack the polished interfaces of centralized exchanges, Robosats compensates with minimal fees and robust privacy protections. Its commitment to keeping transactions confidential and secure makes it a valuable tool for those who prioritize anonymity and decentralization in their Bitcoin trades.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Super-low fees | ❌ Lightning only |

| ✅ Quick payments | ❌ For advanced users |

| ✅ Secure, Run it on your own node |

Overview

RoboSats, launched in 2022, is a peer-to-peer Bitcoin exchange that prioritizes privacy, decentralization, and user control. Unlike centralized platforms, trades on RoboSats occur directly between users, with the platform acting as a guarantor through its reliable escrow system to ensure secure transactions.

Focused exclusively on Bitcoin and the Lightning Network, RoboSats has carved out a niche as one of the leading platforms in the P2P trading space. It boasts exceptionally low fees—0.175% for takers and 0.025% for makers—making it an affordable choice for global users.

Accessing RoboSats requires Tor connectivity, enhancing privacy and anonymity for all participants. Users can also choose to run the platform on their own nodes, adding another layer of decentralization and control. With its privacy-first design and worldwide availability, RoboSats embodies the principles of censorship resistance and financial sovereignty.

Full Review

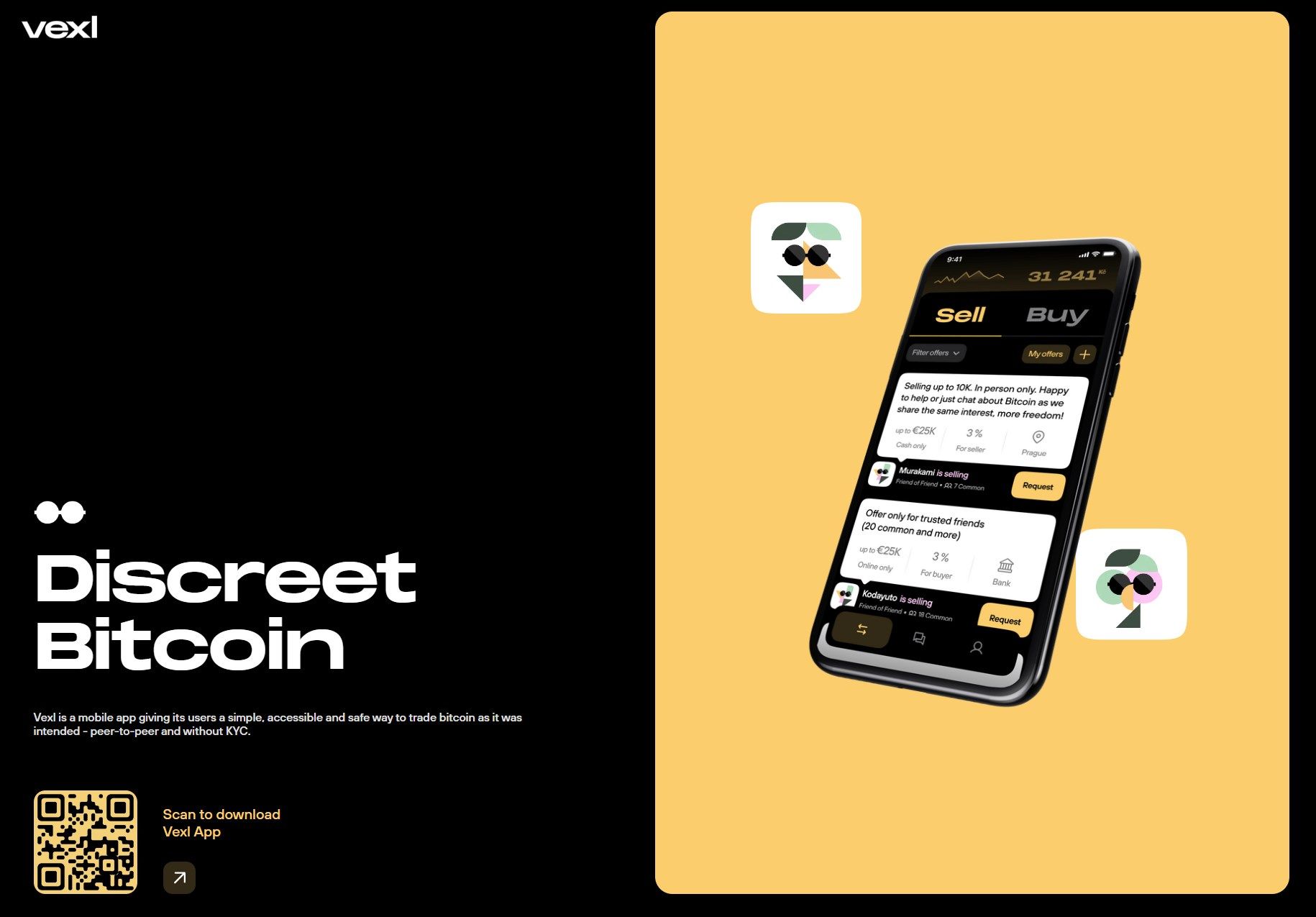

Vexl

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Vexl | 🇺🇸🇨🇦🇪🇺 + more | 0% / 0% | ⭐⭐⭐⭐ 77/100 |

Why We Chose It

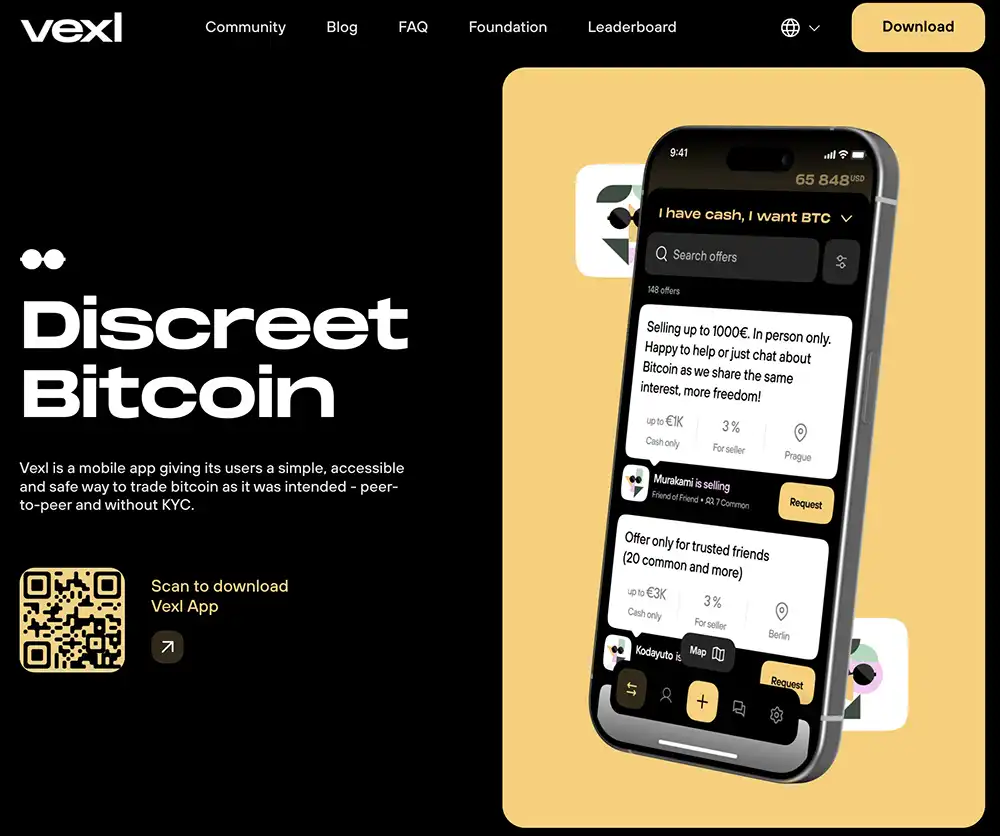

Vexl challenges the conventional model of Bitcoin exchanges by offering a non-KYC, peer-to-peer solution without relying on security escrows. Instead of centralized controls, it connects users through their phone’s address book (without storing any personal data), creating a trusted network of contacts and their extended connections.

The platform focuses on simplicity and privacy, catering to individuals who value confidentiality in their Bitcoin trades. Vexl is ideal for cash transactions, bank transfers, or other online payment methods, enabling direct, secure exchanges with minimal friction.

Designed as a true alternative to traditional KYC-heavy platforms, Vexl helps users find like-minded Bitcoiners nearby, fostering a privacy-first environment for buying and selling Bitcoin. It’s a practical solution for those seeking private transactions without surrendering sensitive personal information.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Original and different | ❌ No escrow |

| ✅ Open source | ❌ No specific Online Payments methods in the filtering tool |

| ✅ No KYC | ❌ iOS app needs Testflight to be downloaded |

Overview

Vexl is a Bitcoin peer-to-peer trading app that’s changing how users buy and sell cryptocurrency. Launched in 2021 and based in Prague, Czech Republic, Vexl takes a unique approach to P2P trading, with a strong emphasis on privacy and social connectivity.

Unlike traditional exchanges, Vexl skips the typical KYC process. Instead, it leverages your phone’s address book to connect you with trusted contacts and their networks. This social layer allows users to engage in transactions with people they know or their extended circles, enhancing security and trust in each trade.

The app features a clean, minimalist interface that highlights the most relevant information for an easy trading experience. It supports various trading pairs, including BTC/USD and BTC/EUR, and works with multiple fiat currencies. Vexl also offers a marketplace and group features, helping users find trading opportunities within their social network. This combination of privacy, simplicity, and social connectivity makes Vexl an attractive platform for privacy-conscious Bitcoin traders.

Full Review

Best Centralized and Peer-to-Peer (P2P)

Centralized p2p exchanges offer a smoother and more user-friendly experience, though this comes at the cost of reduced privacy. That said, they still provide more privacy compared to full-KYC platforms. Let’s explore some of the best options available.

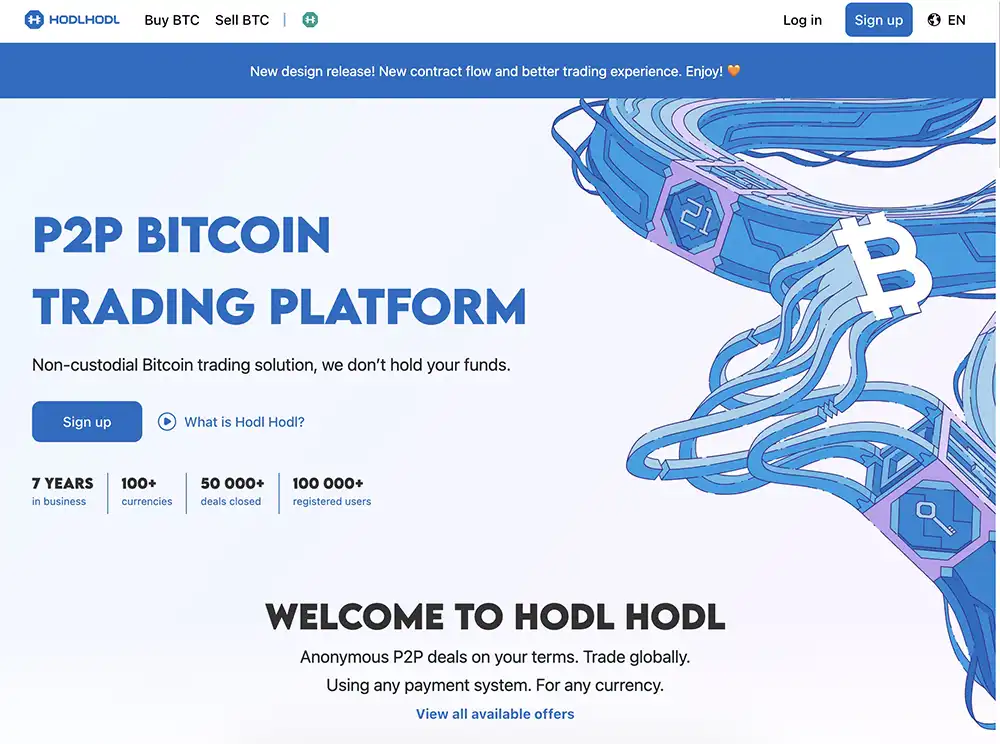

Hodl Hodl

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Hodl Hodl | 🇪🇺🇨🇦 + more | 0.30% / 0.30% | ⭐⭐⭐⭐⭐ 95/100 |

Why We Chose It

With over 7 years of experience, Hodl Hodl has established itself as a trusted Bitcoin-only, non-custodial peer-to-peer exchange. It offers a range of payment methods and currencies, making it one of the best platforms for buying and selling Bitcoin while maintaining a solid level of privacy thanks to its non-KYC structure.

Hodl Hodl’s non-custodial model ensures that users’ funds are never held by the platform. Instead, it utilizes a multisig escrow system that secures transactions, adding an extra layer of protection for all trades.

Beyond trading, Hodl Hodl also functions as a peer-to-peer lending platform, allowing users to lend or borrow funds anonymously. For each lending transaction, a unique multisig escrow address is created to maintain security. With its strong focus on privacy, security, and flexibility, Hodl Hodl provides an all-in-one solution for Bitcoin enthusiasts who value control and confidentiality in their financial transactions.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low fees | ❌ Not available in the USA |

| ✅ Easy to use | ❌ No web based or mobile apps |

| ✅ Many offers for several currencies/payment methods |

Overview

Founded in 2016, Hodl Hodl is one of the pioneering platforms in the peer-to-peer Bitcoin exchange space. It offers a unique approach to trading by allowing users to transact directly without any middleman. Supporting both Bitcoin on-chain and the Lightning Network, Hodl Hodl provides a secure way for users to buy and sell Bitcoin.

What sets Hodl Hodl apart is its non-custodial nature; rather than holding user funds, it uses a multisig escrow system to secure transactions, ensuring both parties have control over the funds until the trade is complete. This approach enhances security and reduces risk.

Hodl Hodl supports various payment methods and currencies, enabling fast and secure trades over multisig smart contracts. Importantly, the platform does not require KYC/AML verification, making it an attractive option for privacy-conscious users. It also features low fees (0.6%, split between the trading parties), further solidifying its appeal.

In addition to trading, Hodl Hodl offers a peer-to-peer lending service, allowing users to lend or borrow Bitcoin anonymously. With its focus on security, privacy, and user control, Hodl Hodl remains a reliable platform for Bitcoin enthusiasts globally.

Full Review

👉 Sign up on Hodl Hodl now for a lifetime discounted trading fee of just 0.45%.

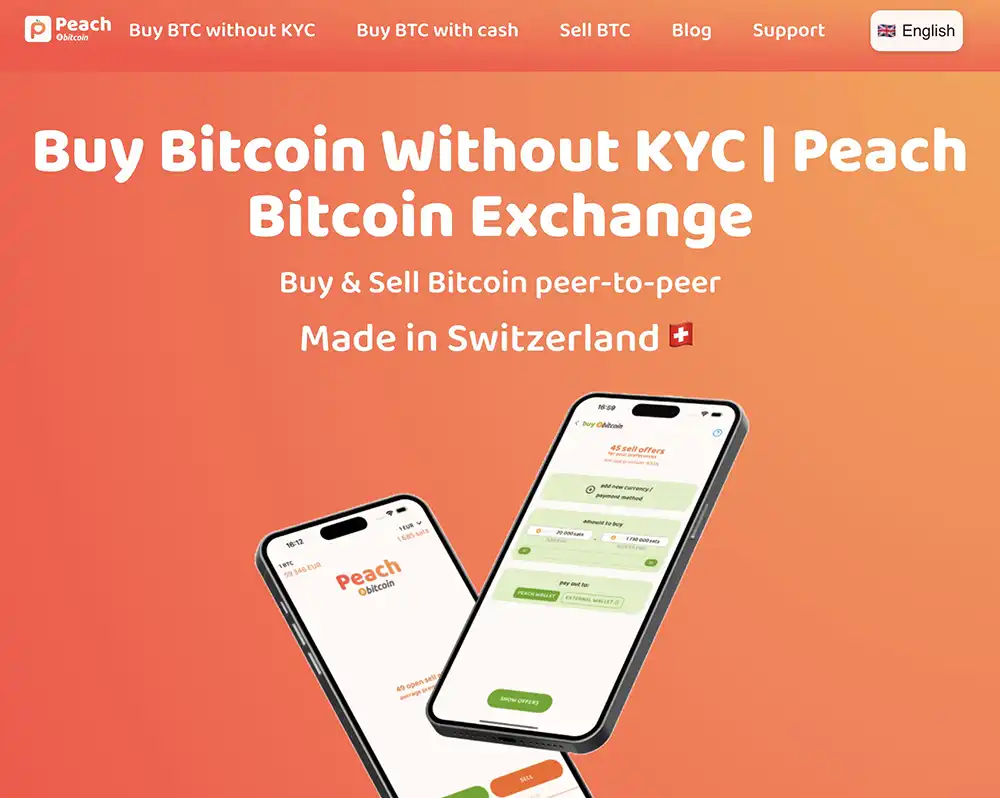

Peach Bitcoin

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Peach Bitcoin | 🇪🇺🇨🇭 + more | 2% / 2% | ⭐⭐⭐⭐ 74/100 |

Why We Chose It

Peach Bitcoin is a peer-to-peer, non-KYC Bitcoin-only app designed for users in Switzerland and Europe. It stands out for its user-friendly interface and a wide range of offers available in its marketplace. Trades conducted on the platform are safeguarded by a secure escrow service, ensuring that both buyers and sellers can transact with confidence.

One of the unique features of Peach Bitcoin is its conference mode, which facilitates seamless connections between buyers and sellers at Bitcoin conferences, promoting a more direct and secure exchange of Bitcoin.

Available on both iOS (Testflight only) and Android, Peach Bitcoin also includes an integrated wallet for smooth transactions. For those who prefer self-custody, the app allows users to add their cold storage addresses, requiring them to sign a message for verification of ownership. This feature enhances control over assets, making it easier for users to manage their Bitcoin securely. With its focus on privacy, usability, and user control, Peach Bitcoin offers a reliable and efficient platform for Bitcoin enthusiasts in Europe and Switzerland.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ No KYC | ❌ USD Not Supported |

| ✅ Intuitive and easy to use | ❌ High fees (2%) |

| ✅ Escrow system | ❌ iOS version needs an invitation |

Overview

Peach Bitcoin steps in to fill the gap left by Localbitcoins’ closure, providing a peer-to-peer marketplace where users can buy and sell Bitcoin and other cryptocurrencies. Founded in 2022 and based in Neuchâtel, Switzerland, Peach Bitcoin places a strong emphasis on user privacy and control, offering non-custodial wallet integration for added security.

The platform supports multiple fiat currencies and includes some unique payment options, like Amazon Gift Cards, making it easy to enter and exit the Bitcoin market. Whether you’re looking to buy or sell, Peach Bitcoin provides an accessible mobile app for iOS and Android, ensuring users can trade from anywhere.

While some might raise concerns about fees and decentralization, Peach Bitcoin stands out with its non-KYC approach and self-custody options. This makes it an ideal choice for privacy-conscious individuals who want a straightforward, secure way to trade Bitcoin without compromising on control or anonymity.

Full Review

👉 Click here to download Peach and get 100 free Peach Points.

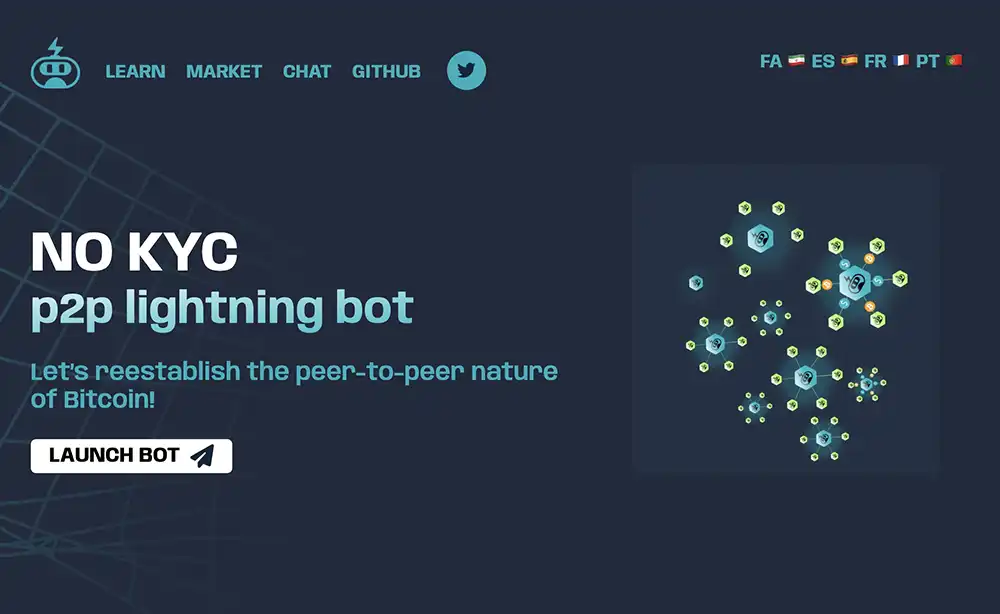

lnp2pBot

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| lnp2pBot | 🇪🇺🇨🇭 + more | 0.6% / 0.6% | ⭐⭐⭐⭐⭐ N/A |

Why We Chose It

LNp2pBot is a straightforward and privacy-focused way to trade Bitcoin. It works entirely on Telegram, requiring only a username—no KYC or detailed registration. Its non-custodial design, using hold invoices, ensures funds are only released when both buyer and seller confirm the transaction, keeping users in control.

The bot is open-source, allowing transparency and community-driven improvements. It’s also globally accessible and can integrate with Telegram groups, creating private trading hubs where admins can earn commissions or offer fee discounts. LNp2pBot’s simplicity and focus on privacy make it a strong choice for anonymous Bitcoin trading.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ No KYC | ❌ Premium is higher than market price |

| ✅ Intuitive and easy to use | ❌ Only available on Telegram |

| ✅ Escrow system | |

| ✅ Low fees |

Overview

LNp2pBot is a Telegram-based tool designed to make peer-to-peer Bitcoin trading simple and accessible. With no need for identity verification (KYC), it allows users to connect and trade using only their Telegram username. This bot leverages the Lightning Network to enable fast, low-cost transactions while maintaining privacy.

Built with a non-custodial approach, LNp2pBot uses hold invoices to ensure that funds are securely managed during the trade process. Neither party’s payment is finalized until both confirm the transaction. This creates a trust-minimized environment that reduces risks for both buyers and sellers.

Beyond individual trades, LNp2pBot supports group trading by allowing admins to integrate it into their Telegram communities. Group owners can earn commissions or provide fee discounts to encourage activity within their networks.

As an open-source project, LNp2pBot welcomes contributions from the community, fostering transparency and collaboration. Its development is supported entirely through voluntary donations, reflecting its grassroots commitment to promoting decentralized financial tools.

LNp2pBot provides a practical and private way to buy and sell Bitcoin, catering to users who value simplicity and anonymity in their transactions.

Centralized and Not Peer-to-Peer (Light-KYC)

This category includes centralized exchanges that don’t request any personal information but require you to use a bank account for buying Bitcoin. Let’s explore some of the top-rated options.

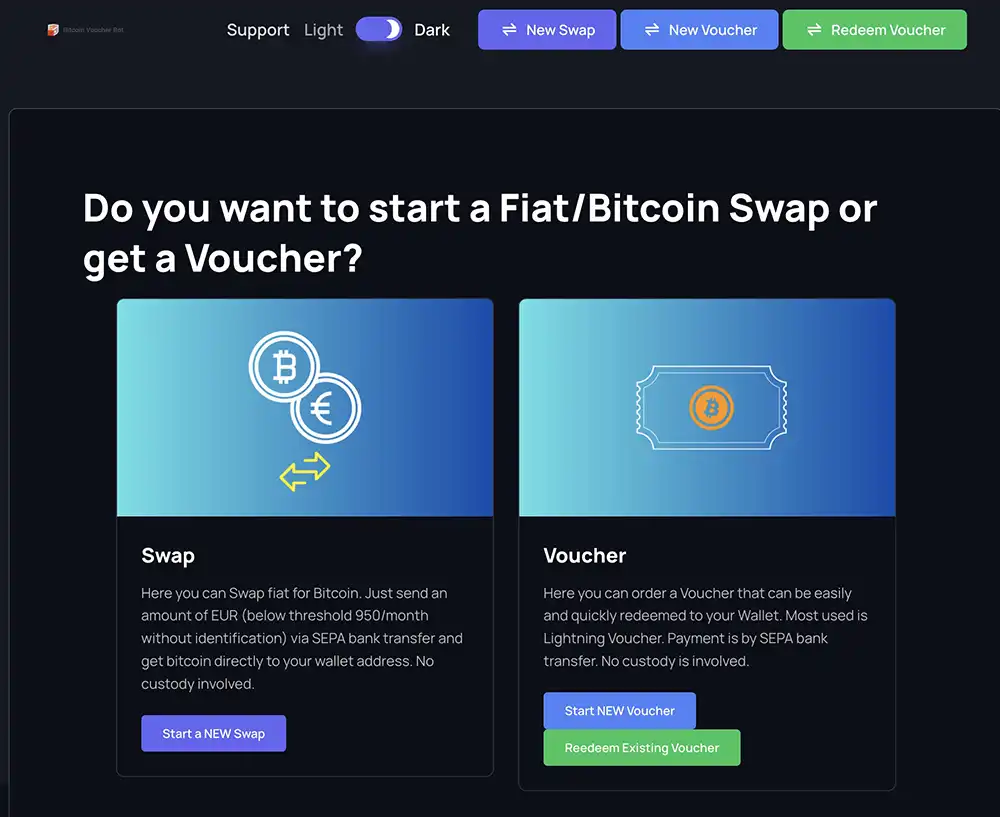

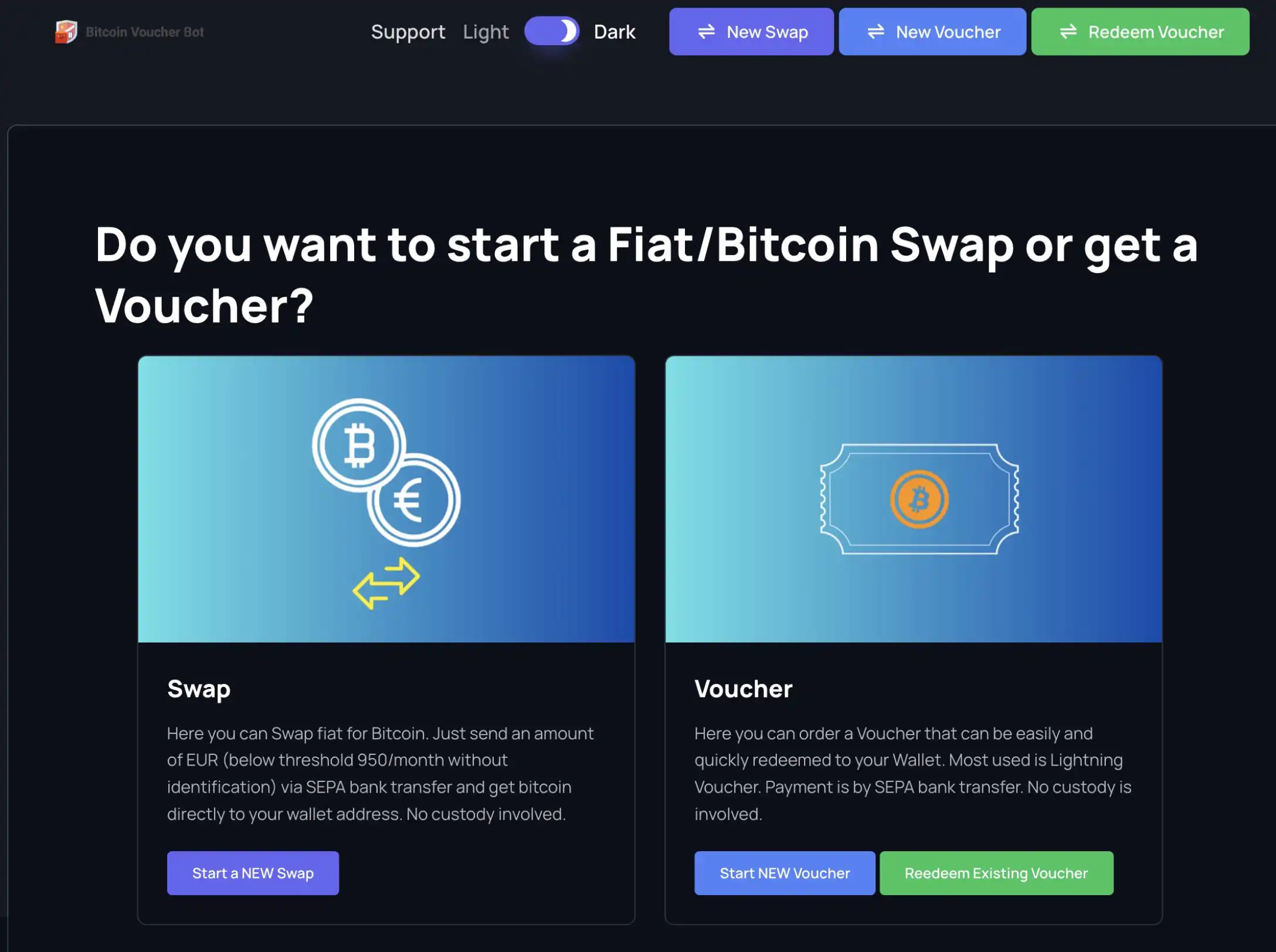

Bitcoin Voucher Bot

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Bitcoin Voucher Bot | 🇪🇺🇨🇭 + more | 2.5% / 2.5% | ⭐⭐⭐⭐ 80/100 |

Why We Chose It

Bitcoin Voucher Bot stands out as a no-KYC, privacy-focused option for acquiring Bitcoin through a Telegram-based platform. It offers users Bitcoin vouchers that can be redeemed on their own wallets and supports features like Euro-Bitcoin swaps, Mullvad VPN discounts, and accumulation plans.

This platform is ideal for privacy-conscious individuals who value non-custodial services and a streamlined user experience without app reliance or tracking. Its versatility and emphasis on privacy make it a top choice for acquiring Bitcoin securely.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Non-KYC | ❌ EUR voucher feature temporarily unavailable |

| ✅ Wide range of privacy tools |

Overview

Bitcoin Voucher Bot is a Telegram-based service offering privacy-enhanced Bitcoin solutions. It allows users to purchase Bitcoin via vouchers, swap EUR for BTC, or access additional features like VPN discounts and Lightning payments—all without requiring KYC or custodial accounts.

The platform operates with minimal tracking, ensuring privacy by avoiding apps, IP tracking, or cookies. Users benefit from features such as recurring purchases, instant transactions, and a refill function for added convenience.

With a blockdyor score of 80/100, Bitcoin Voucher Bot remains a trusted and flexible option for privacy-focused Bitcoin users.

Full Review

👉 Click here to start buying No-KYC BTC with Bitcoin Voucher Bot.

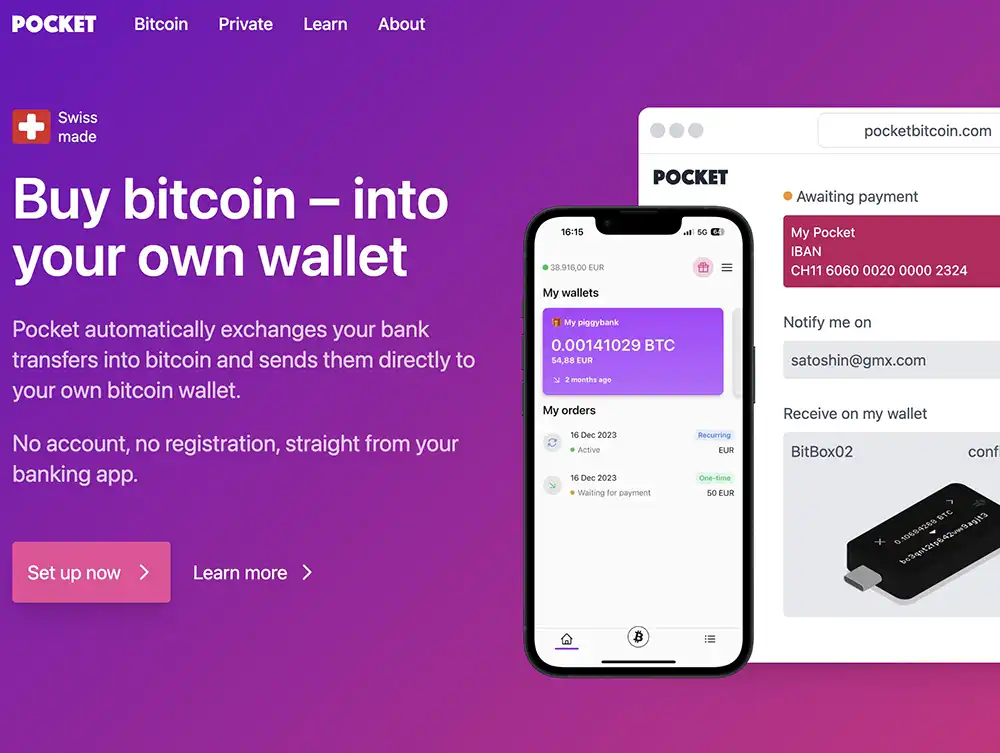

Pocket Bitcoin

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Pocket Bitcoin | 🇪🇺🇨🇭 + more | 1.5% / 1.5% | ⭐⭐⭐⭐ 72/100 |

Why We Chose It

Pocket Bitcoin is a simple and user-friendly fiat-to-Bitcoin exchange that allows users to buy Bitcoin via bank transfer with minimal KYC requirements. One of the standout features is that funds are directly deposited into your personal Bitcoin wallet, without the need to create an account—everything is handled automatically, including recurring purchases.

This makes Pocket Bitcoin a great choice for individuals who prioritize self-custody and are focused on accumulating Bitcoin. It also offers a sell option for those who wish to cash out into fiat, providing more flexibility for users. Whether you’re new to Bitcoin or just looking for a straightforward way to buy and hold, Pocket Bitcoin offers an efficient, no-fuss solution.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Low fees | ❌ No desktop app |

| ✅ Kraken quotes | |

| ✅ Vast Hardware wallet support |

Overview

Pocket Bitcoin is a web-based and mobile service (iOS/Android) that makes buying Bitcoin with fiat currency (EUR or CHF) easy and seamless. It enables users to directly transfer funds from their bank accounts, with the Bitcoin being deposited straight into their software or hardware wallets.

What sets Pocket Bitcoin apart is its completely non-custodial experience. When you purchase Bitcoin, it’s immediately sent to your specified Bitcoin address, ensuring your assets remain secure. There’s no need for KYC/AML verification or account creation—just a straightforward bank transfer to the provided Pocket Bitcoin account.

The service focuses on privacy and user convenience, with features like recurring payments and quick transactions as soon as the payment is received. It’s an ideal choice for users in Europe looking for a simple, secure, and private way to purchase and store Bitcoin. Whether you’re new to crypto or looking for a more streamlined approach, Pocket Bitcoin offers a hassle-free experience.

Full Review

👉 Click here to join Pocket Bitcoin and get € 5.00 in free BTC with the code BLOCKDYOR.

Tips for Peer-to-Peer Bitcoin Trading

If you’re using peer-to-peer (P2P) platforms for Bitcoin trading, here’s a quick guide to keep your experience smooth and safe. Most P2P apps rely on a security escrow system. Essentially, when you buy Bitcoin, the seller locks their coins in a multisignature (2-of-2) escrow to ensure they can’t vanish with your money after you’ve paid. Once the coins are secured, you send the payment. The seller then confirms receipt, and the coins are released to you.

While this setup gives buyers an edge, there are still some shady sellers out there. Here are some practical tips to protect yourself:

Verify Escrow Before Sending Payment

Only send your payment after the seller locks the Bitcoin in escrow (or whatever security system the platform uses). Follow the app’s instructions carefully to avoid mistakes and eventual disputes.

Pick Reliable Sellers

Look for sellers with at least 5–6 reviews and an active presence for several months. Scammers often use new or “burner” accounts with no profile photo or reviews—red flags to watch for.

Avoid Suspicious Offers

Be wary of sellers offering Bitcoin at very low premiums (or even below market price). Scammers use these “too good to be true” deals to lure unsuspecting buyers. Stick to fair market prices from trusted sellers.

Use Privacy Features

If the platform supports TOR (like Robosats), use it. Brave browser has a TOR service integrated. Also, don’t share personal details in chat, during registration, or elsewhere.

Be Cautious with Payment Methods

Some payment platforms, like Wise, frown on cryptocurrency transactions. If you use these services frequently for P2P trades, your account might raise red flags. Wise, for instance, may ask you to justify your transactions, require additional verification, or even suspend your account. Stick to payment methods that align with your trading frequency and privacy needs and before using it, read their terms & conditions and verify if they allow crypto transactions or not.

By sticking to these steps, you can minimize risks and make your P2P Bitcoin trading experience much safer.

OpSec When Buying/Selling Bitcoin

When using platforms that don’t require KYC, it’s best to avoid registering with your real name, primary email, or even exposing your IP address. For the latter, a VPN can help. One option we’ve mentioned in the past is IVPN, a service that doesn’t require registration and accepts Bitcoin and Monero for payment. Using private payment methods like these adds an extra layer of privacy.

If you’re paying with a service like Revolut—sending money from one revtag to another—it might initially seem unlinkable to your Bitcoin transaction. However, there’s always a chance that Revolut or another entity could question the transaction later, so it’s something to keep in mind.

For truly untraceable transactions, cash is often the best choice. That said, it comes with risks. Meeting someone in person for a trade can compromise your anonymity and even expose you to physical danger, especially if the person has bad intentions (e.g., a $5 wrench attack).

The Vexl app offers a potential solution to this issue by connecting you with friends of friends, reducing the risks involved in cash transactions with strangers.

Learn more on how to protect your privacy in the following guide:

Bottom Line

Buying Bitcoin anonymously isn’t the easiest route, especially with the convenience of custodial KYC exchanges that streamline the process with appealing interfaces and frictionless experiences. The appeal of these platforms is obvious: simple registration and easy-to-use interfaces. But what most people overlook is the ongoing hassle of the KYC process. Once you’re registered, you’re often asked to submit documents again and again, sometimes as frequently as every few months. That’s a major inconvenience—and a privacy risk.

On the other hand, non-KYC solutions provide a refreshing contrast: they don’t require invasive personal information, respect your privacy, and allow you to maintain control of your assets without constant checkpoints. While the UX might not always be as smooth, the trade-off is worth it, offering more freedom and genuine privacy in your Bitcoin transactions.