Wirex Card Review 2023 An 8% Cashback Card

Wirex is a crypto exchange and card that lets users earn up to 8% back in WXT on every in-store or online purchase, making it a great way to earn rewards while using cryptocurrency in your everyday life.

Wirex has been a prominent solution in the realm of cryptocurrency debit cards for a considerable length of time.

Its origin dates back to 2014, and it has maintained its services throughout various market fluctuations. In the United States, Wirex has now expanded its offerings to include also the Wirex Visa.

The Wirex Card, much like other crypto debit cards, utilizes a unique token, WXT (in USA they are called X-points), which can be exchanged for digital currencies.

To determine whether the Wirex Card is a suitable choice for you, read our complete review. During the end of the review, we will also compare the card with other popular alternatives.

👉 Click here to open an account on Wirex and get up to a $15 bonus.

| DESCRIPTION | DETAILS |

|---|---|

| 💳 Card Name | Wirex Card |

| 💼 Company | Wirex |

| 💳 Type | Visa Debit |

| 💰 Cashback Token | WXT (X-Points in US) |

| 📈 Staking | Yes |

| 🌍 Issuing Country | Global (Accepted in most countries) |

| 💱 Currency | Multiple (68 fiat and cryptocurrencies supported by Wirex) |

| 💸 Fees | No annual or monthly fees, transaction fees may apply |

| 🔗 Linking | Linked to Wirex account |

| 💰 Reward Programs | Yes (Earn up to 8% Cryptoback rewards on eligible purchases) |

| 💳 ATM Withdrawal Limit | Depends on issuing country and account status |

| 📲 Signup | Through Wirex App or website |

| 🔒 Security | Chip and PIN protected, secure encrypted transactions. |

Wirex: Overview

The Wirex Card is not just a standalone crypto debit card but is part of a larger Wirex application designed for individuals who frequently travel to different parts of the world and require access to various currencies.

With the Wirex app, users can exchange currencies and transfer funds to their card account, which can then be accessed through the Wirex card. This versatile card offers a cashback rewards program that can reach up to 8%, although the rewards are paid out in Wirex’s proprietary WXT token, which must be converted to cryptocurrency.

Furthermore, Wirex's multicurrency Mastercard allows users to spend both fiat and cryptocurrencies seamlessly, with automatic conversion to the local currency at the point of sale using the best live and Over-the-Counter (OTC) rates. With support for 68 fiat and cryptocurrencies, including BTC, ETH, LTC, XRP, and XLM, among others, Wirex caters to a wide range of users.

In addition, users can earn up to 8% in Cryptoback rewards on all purchases, whether in-store or online, making the Wirex card an attractive option for savvy spenders. With fiat accounts in EUR, GBP, CAD, CZK, HUF, PLN, RON, HRK, and USD, and crypto accounts in a wide range of digital currencies, including ADA, XTZ, EOS, DOGE, and more, Wirex provides a comprehensive solution for managing multiple currencies in one place.

Wirex Card: How Does it Work?

The Wirex Card is a cryptocurrency debit card that works like a traditional debit card. It allows you to spend your cryptocurrencies, such as Bitcoin and Ethereum, as well as traditional fiat currencies, like USD and EUR, at millions of locations worldwide that accept Visa.

To use the Wirex Card, you'll first need to sign up for a Wirex account and order a physical or virtual card. Once you receive your card, you can activate it and load it with funds from your Wirex account. You can load your card with both cryptocurrencies and fiat currencies, and the Wirex app automatically converts your cryptocurrencies to the local currency when you use your card to make purchases.

When you use the Wirex Card to make a purchase, the funds are deducted from your card balance. If you don't have enough funds in the currency you're trying to use, the app will automatically convert the funds from another currency in your account.

The Wirex Card also offers cashback rewards in the form of its proprietary X-Points token, which can be converted to cryptocurrencies. Depending on the country you're in and your account status, there may be limits on how much you can withdraw from ATMs using your Wirex Card.

Overall, the Wirex Card provides a convenient way to spend your cryptocurrencies and fiat currencies in the real world, and it offers some unique features, such as the ability to earn cashback rewards in cryptocurrencies.

Wirex Fees

Wirex is a crypto exchange and digital payment platform that offers a range of services to its customers, including the ability to buy, sell, and exchange cryptocurrencies, as well as to store and manage digital assets. As with any financial service, Wirex charges fees for its services and sets limits on various transactions. Below are the fees and limits for Wirex in various categories:

Card Top-up Charges

- External Debit/Credit Card: Crypto account: 3.24%, Fiat/stable account: 1.99%;

- Bank Transfer: Free;

Card Transaction Charges

- Crypto Exchange Services: OTC rates + commission;

- Fiat Exchange Services: Free;

- Internal Transfer (between Wirex users): Free;

- External Transfer (Crypto);

- Blockchain;

- Bitcoin: $10.00 (EEA and UK);

- Stellar: $1.00 (EEA and UK);

- Avalanche CChain for WXT and NXUSD: $1.00 (EEA and UK);

- Ethereum ERC-20: Variable (EEA and UK);

- Nano: $0.10 (EEA and UK);

- Algo, Solana for BRZ: $1.00 (EEA and UK);

- Other Blockchains: $5.00 (EEA and UK).

Card Limits

- Fiat Exchange: Unlimited;

- Crypto Exchange: Limit varies depending on the currency from which the conversion is performed;

- Crypto Transfer Out: Limit varies depending on the currency from which the conversion is performed;

- Credit/Debit Card Top-up (Confirmed): $25k per day (EEA and UK);

- Credit/Debit Card Top-up (Unconfirmed): $2k per day (EEA and UK);

- Maximum Account Balance: Unlimited.

It is important to note that these fees and limits are subject to change and that users should always check the current fees and limits before conducting any transaction on the platform.

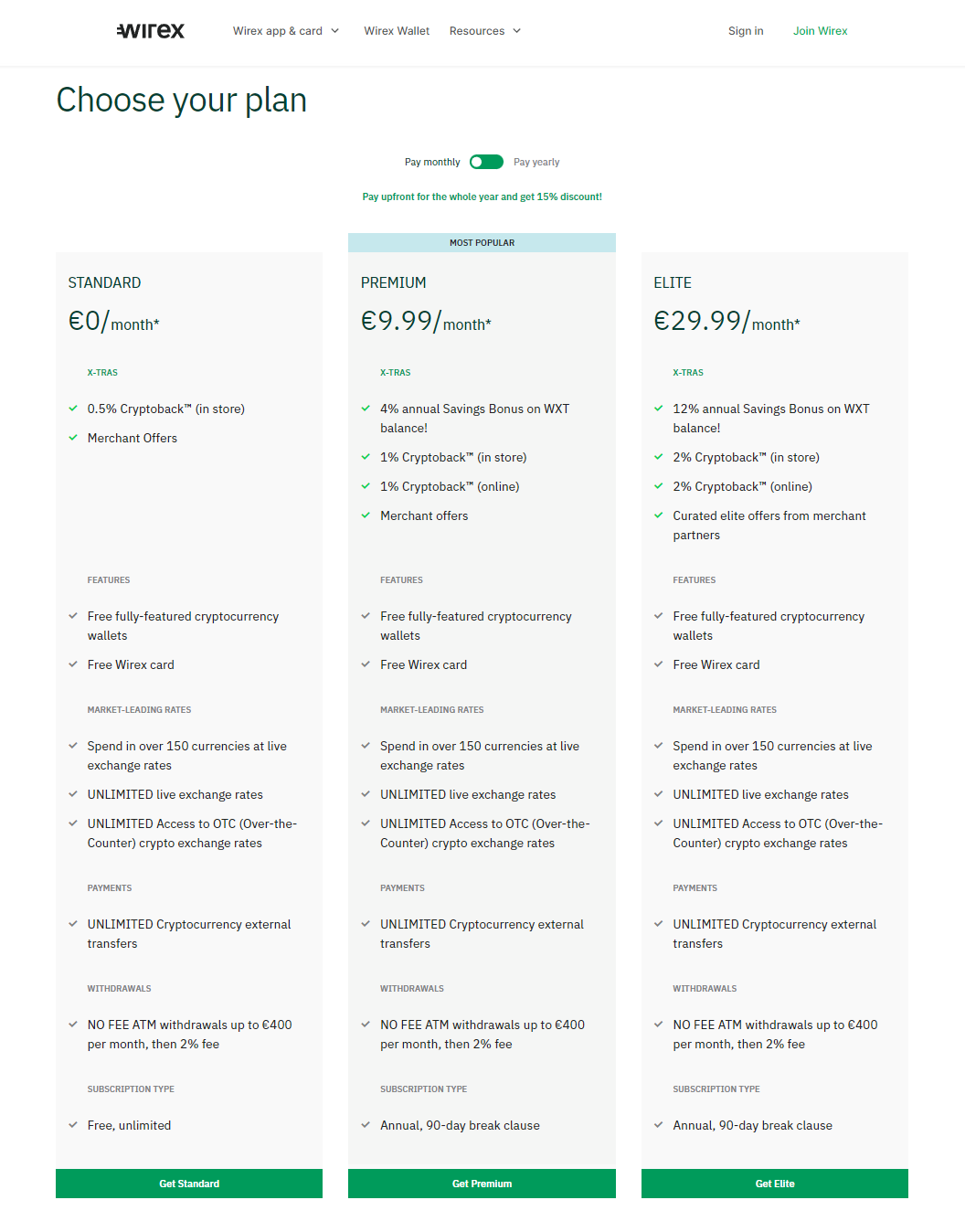

X-tras Fees and Limits

X-tras is a subscription-based plan offered by Wirex that provides additional benefits to its users. In addition to the standard services offered by Wirex, X-tras members receive enhanced transaction limits, higher Cryptoback rewards, and other exclusive features. Below are the fees and limits associated with X-tras:

Subscription Plan Related Pricing

- Standard: 0 EUR

- Premium: 9.99 EUR per month or 102 EUR per year

- Elite: 29.99 EUR per month or 306 EUR per year

Cryptoback Limits

- Max Cryptoback per month

- Standard: 10,000 WXT

- Premium: 50,000 WXT

- Elite: 150,000 WXT

- Max Cryptoback per transaction

- Standard: 1,000 WXT

- Premium: 5,000 WXT

- Elite: 15,000 WXT

Overall Fees & Limits

- Transactional Limits

- Minimum Transaction Amount: 300 USD

- Maximum Transaction Amount

- External Transfer (Send): 10,000 USD

- Internal Transfer (Send): 2,000 USD

- Exchange (WXT → Fiat, WXT → Crypto): 20,000 USD

- Exchange (Fiat → WXT): Unlimited

- Daily Amount Limit

- External Transfer (Send): 50,000 USD

- Internal Transfer (Send): Unlimited

- Fees

- External Card Top-up: 0%

- Crypto Exchange Services: OTC rates + commission

Please note that the subscription payment is charged from a WXT account by default. If the funds in the account are insufficient, an additional fee may be applied.

It is important to note that these fees and limits are subject to change, and users should always check the current fees and limits before conducting any transaction on the platform.

Wirex Card Cashback Rewards & Benefits

The most important features of the Wirex Card ecosystem is the cashback program, trademarked as Cryptoback, which allows users to earn crypto rewards for every transaction made with their Wirex card.

This program is designed to offer users an important opportunity to earn rewards by spending money online or in shops with their Wirex card, where the more they spend, the more they get back. With the Cryptoback program, users can now earn up to 8% Cryptoback rewards on every purchase made.

The rewards are paid out in WXT, Wirex's native token, and are instantly credited to users' X-tras accounts within the Wirex app. The amount of rewards earned depends on the user's selected price plan.

Wirex Card Plans

Wirex offers three price plans – Standard, Premium, and Elite, each with different maximum Cryptoback limits per month and per transaction. The maximum Cryptoback rewards per month range from 10,000 WXT for the Standard plan to 150,000 WXT for the Elite plan, while the maximum Cryptoback rewards per transaction range from 1,000 WXT for the Standard plan to 15,000 WXT for the Elite plan.

The Cryptoback program is available for both online and in-store purchases, but it does not apply to ATM withdrawals, peer-to-peer fund transfers, or tax payments. The rewards earned are calculated against the transaction amount, excluding any commissions or fees.

As soon as users start spending with their Wirex card, they begin to get a 0.5% Cryptoback rewards. To earn more rewards, users can upgrade their price plan by simply tapping on "Upgrade" in the app and choosing a new plan that suits their needs.

It's essential to note that Cryptoback rewards are not distributed for transactions with exceptional Merchant Category Codes (MCC). This measure ensures that the program only rewards users for genuine transactions, thereby providing a transparent and reliable rewards program. Overall, the Wirex Cryptoback program is an excellent opportunity for users to earn rewards and take advantage of the many benefits that Wirex has to offer.

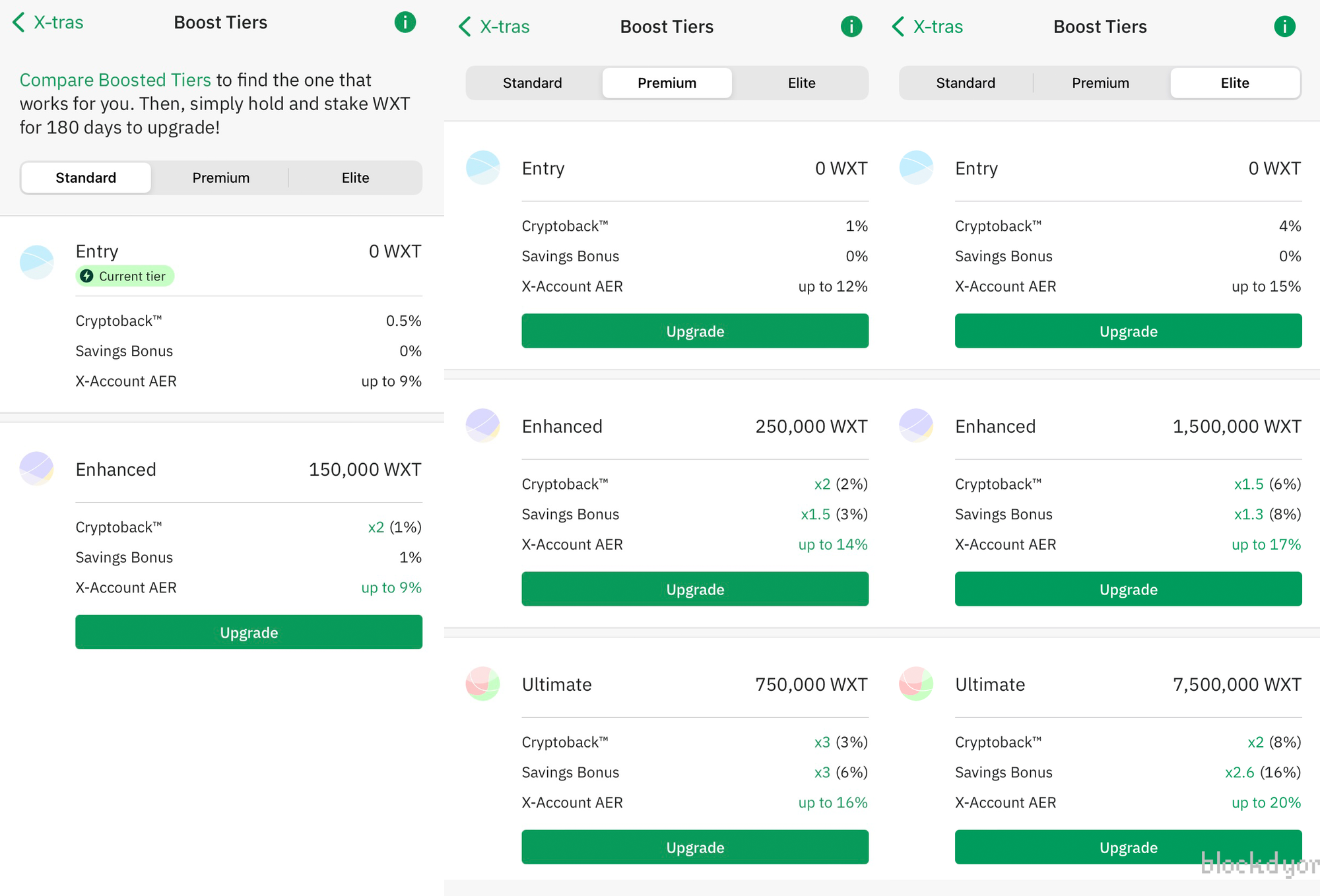

Wirex X-tras Boosted Tiers

Wirex has an additional function called Boosted Tiers, which offers users the chance to unlock even greater rewards. By locking a certain amount of WXT in their X-tras account, users can activate X-tras Boosted Tiers and enjoy a range of boosted perks that are tailored to their specific price plan.

Each price plan now has its own set of tiers, which includes the Entry tier, Enhanced tier, and Ultimate tier. Users subscribed to the Standard plan can choose between the Entry and Enhanced tiers, while those subscribed to the Premium or Elite plan can choose between the Entry, Enhanced, or Ultimate tiers. To upgrade to a Boosted Tier from the Entry tier, users need to lock a minimum amount of WXT for 180 days.

For users looking to earn even more rewards, there are several options available. Upgrading to the Wirex Premium or Elite plan allows users to earn up to 4% Cryptoback rewards on in-store and online purchases, up to 6% Savings Bonuses on their WXT balance, and exclusive merchant offers. Additionally, inviting friends to join Wirex via the Refer-a-Friend program can earn users even more WXT rewards.

By locking more WXT and upgrading to a Boosted Tier, users can enjoy even greater rewards, including up to 16% Savings Bonus and up to 8% Cryptoback rewards. Overall, the Boosted Tiers feature provides an exciting opportunity for users to earn more rewards and take full advantage of the benefits that Wirex has to offer.

How to Order the Wirex Card

To order a Wirex card, you must first verify your Wirex account successfully. If you don't have enough funds in your account, you might need to top up before ordering your card. The required amount may vary by region, but it will be displayed in the app (usually it's no more than 5/15 €/$).

If you're using the Wirex web app, you can order a card by scrolling down to "Order cards" on the Dashboard. Then, click "Get the card" in the Order new card window. Review your personal details and the billing address, and if you need to make any changes, click "Contact Support." Choose your delivery options and click "Place order." You will see a success message, and you can click "Back to Dashboard" to return to using the application.

If you're using the Wirex iOS or Android application, tap "Order a card" on the Dashboard. Check your delivery address on the Card order screen, and if you want to change it, contact customer support. Choose your delivery options and tap "Order card" to confirm your order. You will see a success message, and you can tap "Back to Dashboard" to return to using the application.

Please note that the delivery options available depend on your region, and there may be a fee for expedited delivery. Standard delivery is usually free but untrackable, while expedited delivery is trackable but comes with a delivery fee. Once you receive your card, you will need to activate it before you can use it.

If you can't order a new card, there may be several reasons for this. If you have a negative balance on one of your cards, you will need to top it up before you can order a new one. If you have never used a card, you can't order a new one until you have at least one transaction on your current card. Additionally, you will need to have a minimum amount of funds in your account to order a card, and the exact amount will be displayed in the app.

If you have ordered a card but never activated it, you won't be able to order a new one until you cancel the previous one. Finally, if you have ordered a card but never received it, you can reorder it from the delivery screen. If you've tried all of these steps and still can't order a new card, please contact support for assistance.

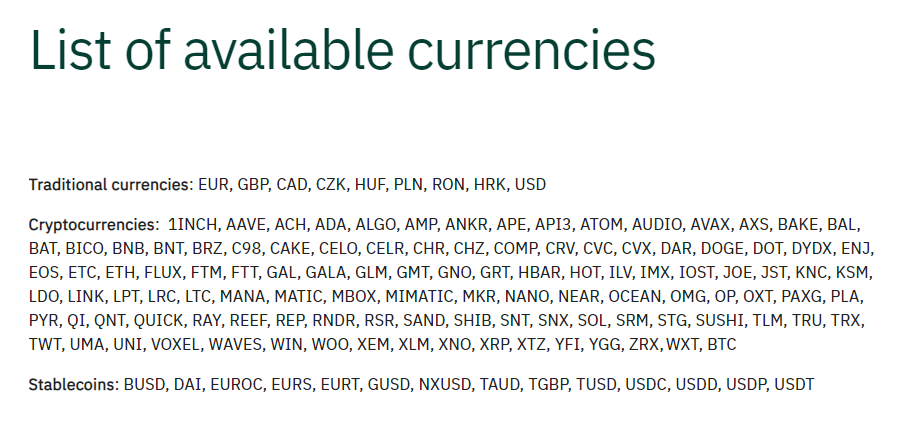

Wirex Supported Crypto

Your Wirex account offers access to a vast selection of top cryptocurrencies, including perennial favorites such as Bitcoin (BTC) and Ether (ETH), as well as emerging Decentralized Finance (DeFi) tokens like Maker (MKR) and Aave (AAVE).

Also, Wirex supports traditional currencies such as the Euro (EUR), British Pound (GBP), Canadian Dollar (CAD), Czech Koruna (CZK), Hungarian Forint (HUF), Polish Zloty (PLN), Romanian Leu (RON), Croatian Kuna (HRK), and US Dollar (USD).

Additionally, Wirex supports various stablecoins, including Binance USD (BUSD), USD Coin (USDC) and Tether (USDT).

You can check the full list in the pic down here.

Wirex Supported Countries

Wirex it's not just available in Europe and USA, but it also partnered in 2023 with Visa to expand its footprint in Asia-Pacific (APAC) and the U.K.

This expands Wirex's ability to directly issue crypto-enabled debit and prepaid cards to over 40 countries.

Although Wirex's largest customer-base is in the U.K., the company previously withdrew from the U.K. Financial Conduct Authority's temporary registration regime and will now serve U.K.-based customers via a subsidiary licensed in Croatia.

Some of the countries where Wirex and its services are supported:

| Country | Wirex account | Crypto account | X-Accounts | Local card top-up | Card |

|---|---|---|---|---|---|

| United States | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| United Kingdom | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Canada | N/A | N/A | N/A | N/A | N/A |

| Australia | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Germany | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| France | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

We have condensed the table to showcase the top six countries, but for the complete listing, we suggest referring to the Wirex official website.

Wirex Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Available in many countries | ❌ High fees for some transactions |

| ✅ Supports multiple cryptocurrencies | ❌ Limited customer support |

| ✅ Offers local card top-up | ❌ Limited number of supported coins |

| ✅ Provides virtual and physical cards | ❌ Some users report issues with app |

| ✅ Earns rewards through its WXT token |

Is the Wirex Card Safe?

Indeed, the Wirex Card offers a level of security that inspires confidence. This is due to the fact that in the USA it is issued by Sutton Bank and provides up to $250,000 in FDIC insurance on prepaid card funds, assuring users that their funds are safe and protected.

Furthermore, the company provides additional security measures in the form of the Wirex Wallet and X-Account, which are both designed to offer enhanced protection for your digital coins. The Wirex Wallet provides a secure environment for users to store their cryptocurrency assets, while the X-Account offers a higher interest rate than traditional savings accounts, with the added benefit of being fully insured.

Overall, Wirex has made it a priority to offer their users a secure and reliable platform for managing their funds, both online and offline.

Wirex Alternatives

There are other options to the Wirex Card. We previously reviewed the Plutus Card and Binance Card, so let's compare them briefly to the Wirex Card.

| 💳 Wirex Card | 💳 Plutus Card | 💳 Binance Card | |

|---|---|---|---|

| Free Tier Cashback | 0.5% | 3.00% | 0.1% |

| Max Cashback | 8.00% | 8.00% | 8.00% |

| Card Order Fee | 5/15 €/$ | Free (need to deposit 20€/$ first) | Free |

Plutus

Plutus may be less attractive to some due to its lack of an exchange-like experience (it has only a very limited DEX), unlike Wirex. However, its card cashback program is noteworthy, as it can provide up to 8% cryptocurrency cashback in Pluton.

This utility token is notably stable and has a maximum supply of 20 million coins, issued directly by Plutus. Additionally, Plutus offers multiple subscription plans and stacking levels, unlocking more benefits and increased cashback rates. Notably, it is non-custodial, allowing users to move their stake at their discretion and obtain added rewards.

Binance Card

Undeniably intriguing is Binance Card's proposal, emerging from the world's largest cryptocurrency exchange. Their card provides BNB Cashback, commencing at 0.1% with the free plan (without any staking).

The level of the cashback rises proportionally with the amount of BNB staked. While the staking demands are much greater than Plutus, the offered cashback is noteworthy. Notably, Binance Card allows for payment both in-store and online with cryptocurrencies, not solely fiat currency, which sets it apart from Plutus.

Bottom Line

In conclusion, Wirex offers a comprehensive solution for users seeking to manage their digital assets with ease and convenience. With the Wirex card and secure wallet options, users can securely store and spend their cryptocurrency (or fiat) both online and in physical stores, while getting generous amounts of cashback.

The additional FDIC insurance coverage provides peace of mind for US users concerned about the safety of their funds. Wirex's commitment to innovation and security make it a compelling option for those looking to seamlessly integrate cryptocurrency into their daily lives.

👉 Click here to open an account on Wirex and get up to a $15 bonus.