Liquid Network: What Is It And How Does It Work?

Amidst the recent surge in fees on Bitcoin's base layer, much discussion has centered around the potential of the Liquid Network as a solution. But what exactly is this network? Our guide delves into the workings of the Liquid Network, weighing its advantages and drawbacks.

What is the Liquid Network?

The Liquid Network is a layer-2 network built on top of the Bitcoin blockchain that offers faster, more private, and secure transactions.

Bitcoin's minimal throughput limits its widespread adoption because it can process only 5-7 transactions per second, which sometimes can be discouraging for institutional investors and retail buyers.

Layer-1 solutions, in fact, needs a rewriting of the blockchain protocol, but Layer-2 solutions operate instead on top of the main blockchain without rewriting the network protocol.

The Liquid Network is a sidechain designed to enable fast, private, and secure issuance, transfer, and exchange of cryptocurrencies, stablecoins, digital assets, and security tokens on the Bitcoin blockchain.

Essentially, what Liquid Network does with Bitcoin is issue a "wrapped" version of BTC called L-BTC (Liquid Bitcoin) that can be used on its chain. Liquid Network uses different methods to achieve higher throughput and more confidential transactions.

Liquid Network primarily serves institutional investors, exchanges, cryptocurrency traders, and other enterprise clients who desire a higher level of privacy and faster transactions.

The advantages of using Liquid Network include faster transactions and greater privacy. Liquid Network uses Signed Blocks, which cut down the time it takes to validate and process transactions, and Confidential Transactions to hide key transaction information from outsiders, increasing privacy.

When it comes to getting started with the Liquid Network, one of the best and most cost-effective solutions is to utilize exchanges like Bitfinex. With Bitfinex, users have the opportunity to obtain L-BTC on the Liquid Network with zero fees simply by converting their BTC.

This seamless conversion process allows users to tap into the benefits of the Liquid Network without incurring any additional costs. By choosing Bitfinex as their platform of choice, users can efficiently and economically explore the possibilities offered by the Liquid Network.

👉 Click here to open an account on Bitfinex with a 6% rebate.

| Symbol | L-BTC |

|---|---|

| 🪙 Platform | Liquid Network |

| 🚉 Consensus | Federated Byzantine Agreement (FBA) |

| ⚖️ Total Supply | Variable, pegged 1:1 to BTC |

| 📈 Circulating Supply | Varies based on user demand |

| 🛠️ Use Case | L-BTC is a native asset on the Liquid Network and serves as a fast, private, and interoperable form of Bitcoin. It's mainly used for several different applications, including lending, trading, and accessing DeFi services. |

| 🔥 Token Burn | N/A, L-BTC maintains a 1:1 peg to BTC |

| 💼 Custodial Control | Custody of L-BTC is handled by Liquid Federation members, ensuring security and proper asset management |

How Does the Liquid Network Work?

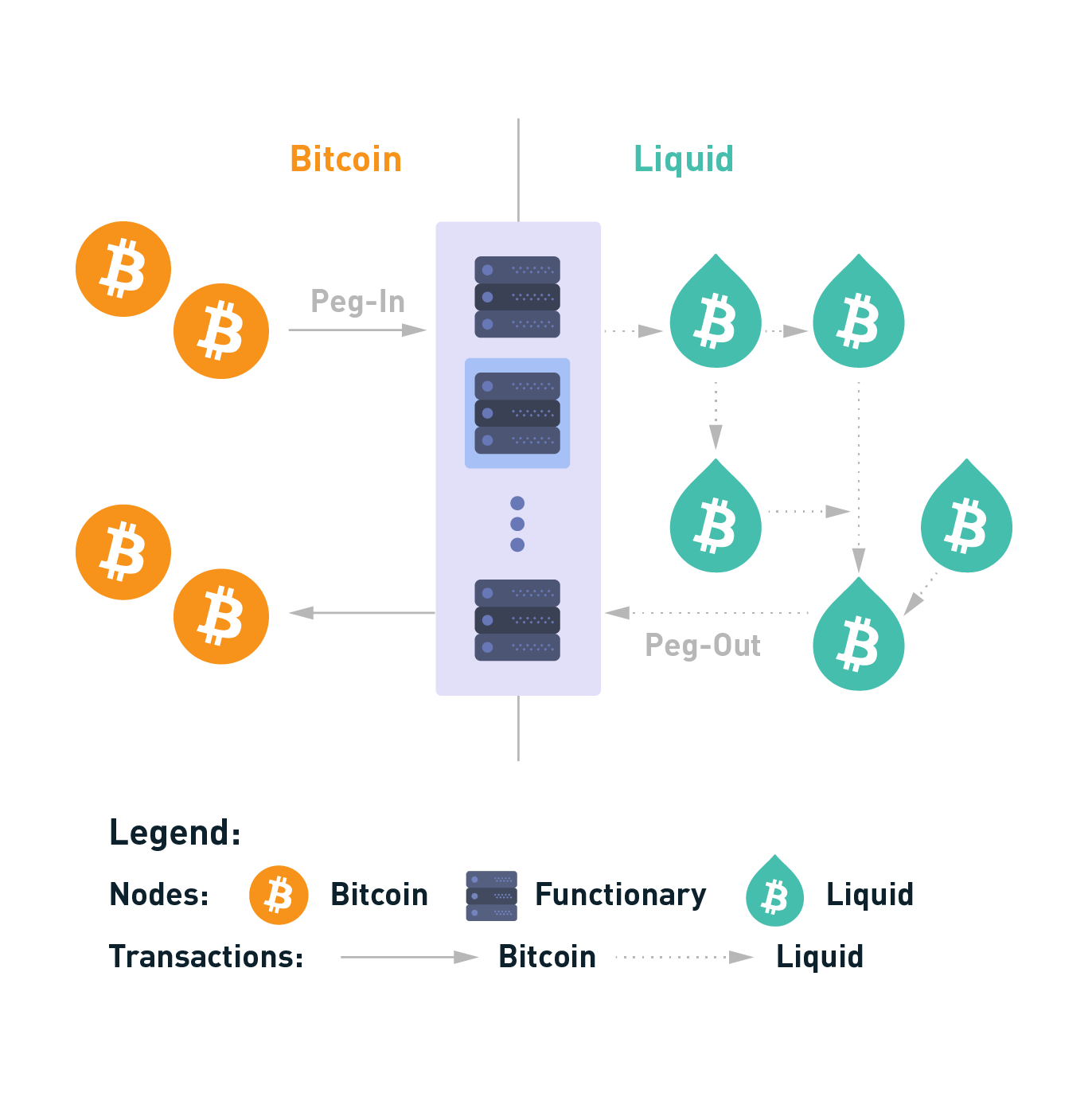

The Liquid Network is faster and has more privacy because it creates a separate blockchain that operates in parallel to the Bitcoin blockchain, allowing users to move funds between the two chains using a two-way peg.

In fact, the two-way peg enables that the same amount of funds is locked on the Bitcoin blockchain as is released on the Liquid Network, maintaining a constant 1:1 ratio between the two.

The Liquid Network has several features that make it particularly useful for certain use cases. One of its key features is that transactions on the Liquid Network are confidential, meaning that they are not visible on the public Bitcoin blockchain. This can be important for businesses and individuals who require privacy in their transactions.

Another feature of the Liquid Network is that transactions are processed quickly, with a block time of only two minutes. This allows users to transact with each other in near-real-time, which can be especially important for traders who need to move funds quickly between exchanges.

In addition to these features, the Liquid Network also includes a number of other tools and services, such as a native token (L-BTC) that can be used to pay for transaction fees on the network, and the ability to issue and trade other digital assets.

Its two-way peg to the Bitcoin blockchain ensures that users can move funds between the two chains in a secure and trustless manner, while its fast block time and privacy features make it an attractive alternative to the Bitcoin blockchain for certain use cases.

Peg-in

Transferring Bitcoin to the Liquid Network requires users to undergo a "peg-in" process. This involves sending BTC to a Bitcoin address managed by the Liquid Federation. Once the Federation confirms receipt of the BTC, they will send out an equivalent amount of L-BTC in return. Once a user has obtained L-BTC, they can engage with the Liquid blockchain and its ecosystem with ease.

While users can manually initiate a peg-in, several more convenient methods exist for obtaining L-BTC. These include centralized exchanges, over-the-counter (OTC) platforms, and swap platforms.

Peg-out

When a user wishes to swap their L-BTC back to BTC on the Bitcoin network, they can initiate a "peg-out" process. The first step in this process involves sending L-BTC to a burn address, which removes the funds permanently from the Liquid Network. Once this transaction is confirmed, the Liquid Federation will release an equivalent amount of BTC on the Bitcoin network and send it back to the user.

Only members of the Liquid Federation have the ability to execute a peg-out (it's not permissionless), but users can also use Bitcoin exchanges or peer-to-peer swaps to convert L-BTC to BTC.

Liquid Federation: What Is It?

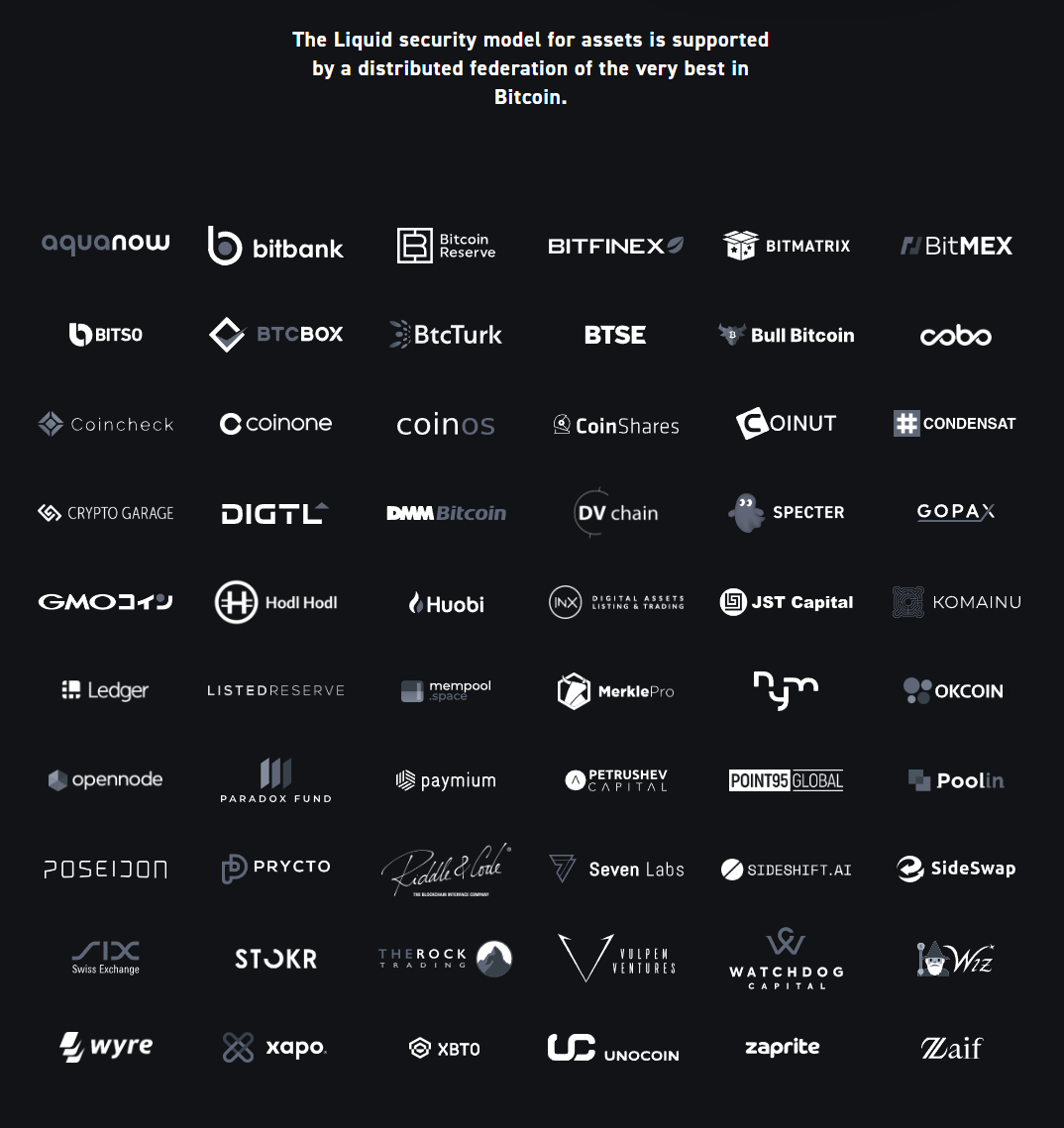

Liquid Network opted to forego the costly proof-of-work consensus mechanism employed by Bitcoin and other blockchain networks. Instead, Liquid leverages the Liquid Federation, a group of cryptocurrency organizations comprising exchanges, trading desks, and developers, to create new blocks.

With approximately 60 members, 15 of which serve as functionaries, the Liquid Federation performs critical functions for the network. These functions include verifying new blocks and safeguarding the Bitcoin assets held in the network's multi-signature wallet.

The Federation members also exercise voting rights in selecting board representatives who lead decision-making processes related to the maintenance and operation of Liquid Network.

By implementing this consensus mechanism, Liquid Network achieves several benefits, including enhanced efficiency, speed, and lower costs associated with block validation. Additionally, the Liquid Federation's involvement bolsters the network's security and reduces the possibility of 51% attacks and other security vulnerabilities.

The Benefits of Using the Liquid Network

Liquid Network has several benefits to its users. Here are some of the key advantages of using the Liquid Network:

- Faster Transactions: The Liquid Network is designed to facilitate faster and more efficient transactions. It can process a high volume of transactions per second, which helps to reduce waiting times and increase efficiency.

- Confidentiality: The Liquid Network offers enhanced privacy features that enable users to carry out transactions in a confidential manner. This is particularly beneficial for businesses that want to keep their financial activities confidential.

- Security: The Liquid Network is built on a highly secure blockchain platform that provides robust protection against fraud and hacking. The network is maintained by a network of trusted nodes, which helps to ensure the integrity of transactions.

- Lower Transaction Fees: The Liquid Network offers lower transaction fees compared to other payment systems, which can help businesses and individuals save money on their transactions.

- Interoperability: The Liquid Network is designed to be interoperable with other blockchain platforms, which means that it can be used to facilitate transactions between different networks. This can help to simplify cross-border payments and make them more efficient.

Overall, the Liquid Network offers many benefits that make it an interesting solution for businesses and individuals who want to carry out secure, efficient, and cost-effective transactions. It can be a viable solution for users looking for alternative solutions to the increasing fees on the main Bitcoin network chain.

Liquid Network Wallets

For those who own L-BTC or other assets on the Liquid Network, there are several non-custodial wallets that are compatible:

- Blockstream Green - A Bitcoin and Liquid wallet that offers advanced functionalities, including hardware support, Tor support, and multisig. Green is accessible on various platforms such as iOS, Android, MacOS, Windows, and Linux.

- Blockstream Jade - An hardware wallet for Bitcoin and also Liquid that gives offline security and works seamlessly with Blockstream Green.

- AQUA - An entry-level mobile wallet accessible on iOS that allows users to store and manage Bitcoin and Liquid Network assets.

Liquid Network Projects

The Liquid Network already supports various projects, with two notable platforms such as Sideswap and Hodl Hodl.

Sideswap

SideSwap is a platform that allows users to seamlessly send, receive, and swap Liquid tokens.

Users can exchange digital assets using SideSwap atomic swaps, which provide peer-to-peer trading and eliminate counterparty risk. Atomic swaps on Liquid are designed for users to maintain control of their assets throughout the entire trading process.

Users hold the keys to all their Liquid assets through the self-custodial SideSwap wallet, which also offers convenient onboarding options to Liquid through swaps between BTC and L-BTC.

The SideSwap app is user-friendly and available for download on most desktop and mobile platforms.

Hodl Hodl

Hodl Hodl is a peer-to-peer Bitcoin trading app that uses multisig escrow smart contracts instead of custodial methods.

Hodl Hodl was among the first platforms to incorporate Liquid features, enabling users to easily swap BTC in and out of Liquid.

Lend at Hodl Hodl offers users the ability to lend out L-BTC and Liquid USDT, taking advantage of Liquid's faster transaction times, lower transaction fees, and improved privacy measures.

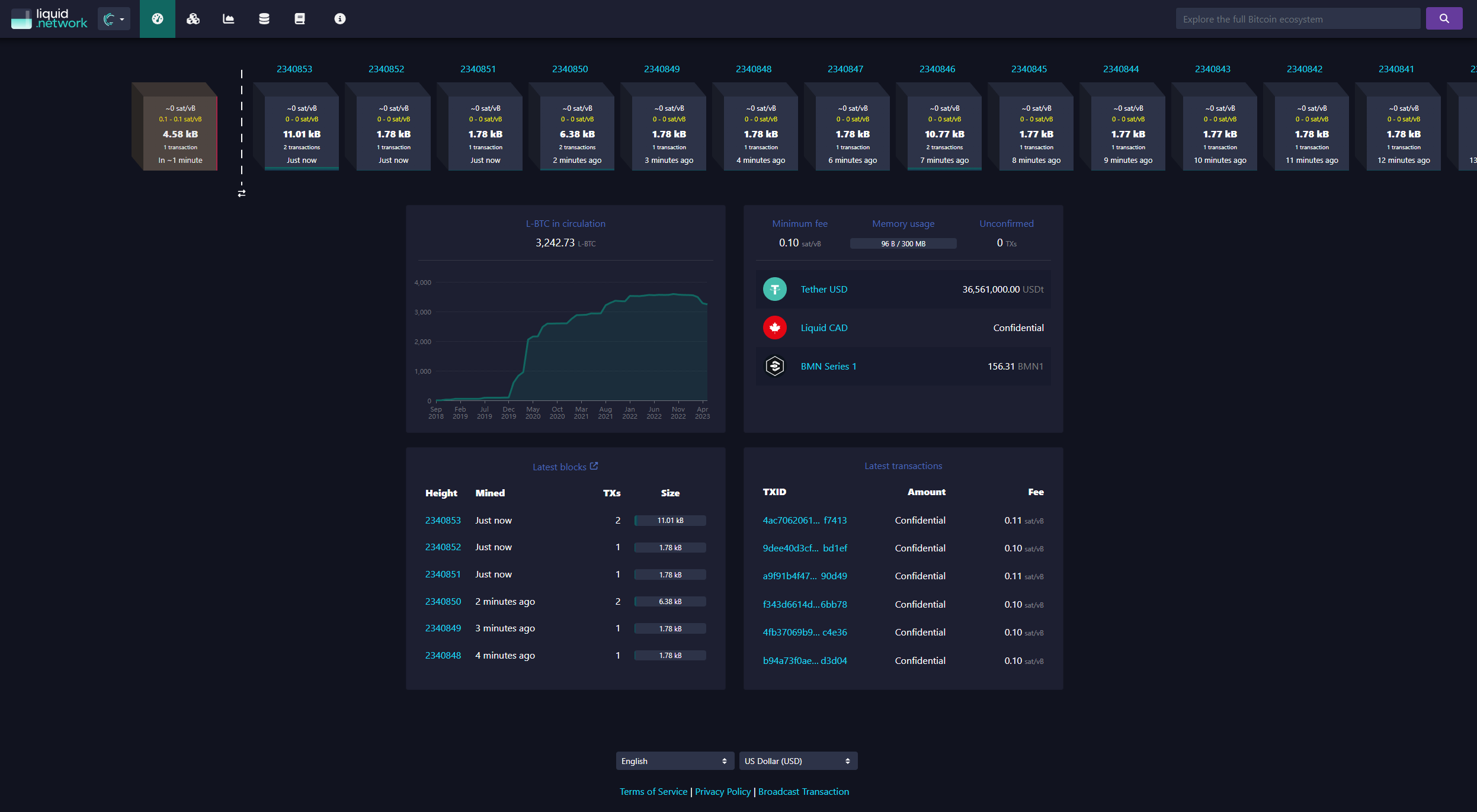

Liquid Network Blockchain

The Liquid Network blockchain is a public sidechain of the Bitcoin blockchain, which means that it can be explored freely.

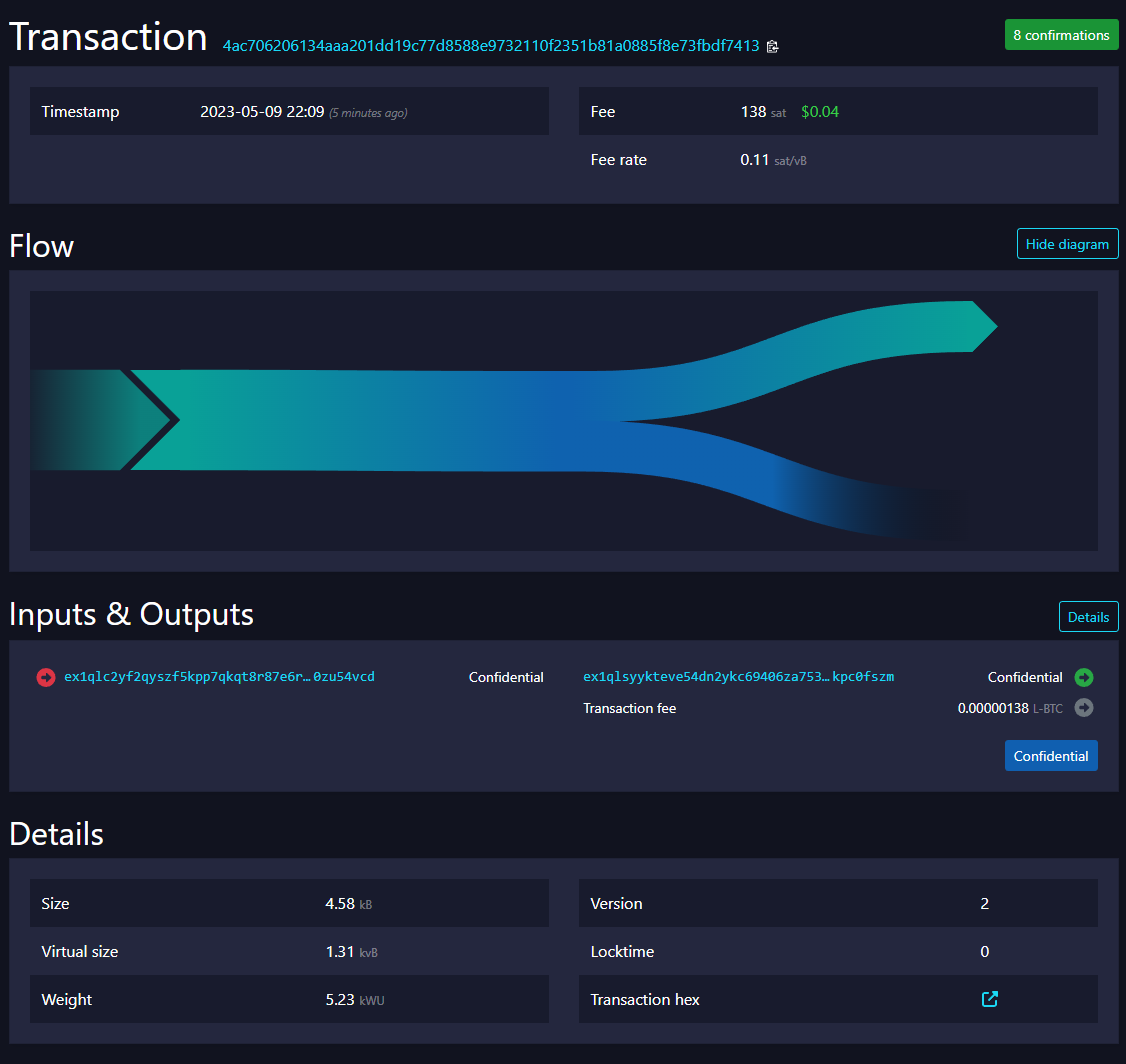

While these transactions hide the type and amount of assets being transacted from third parties, certain details such as transaction IDs, sender and receiver addresses, and transaction fees are still visible on the Liquid blockchain.

However, only parties involved in a transaction and users with the blinding key can see the asset type and amount transacted, ensuring complete privacy for users.

Also, users have the option to share their blinding key with third parties, such as auditors or regulators, if they choose to reveal their transaction data.

Maintaining privacy is important for users as it helps to prevent the revelation of sensitive financial information to 3rd parties.

The Liquid Network's design resolves these issues by providing users with a safe and, at the same time, transparent network.

Getting Started with the Liquid Network

Utilizing an exchange is perhaps the simplest, cost-effective and most efficient way to get started with the Liquid Network.

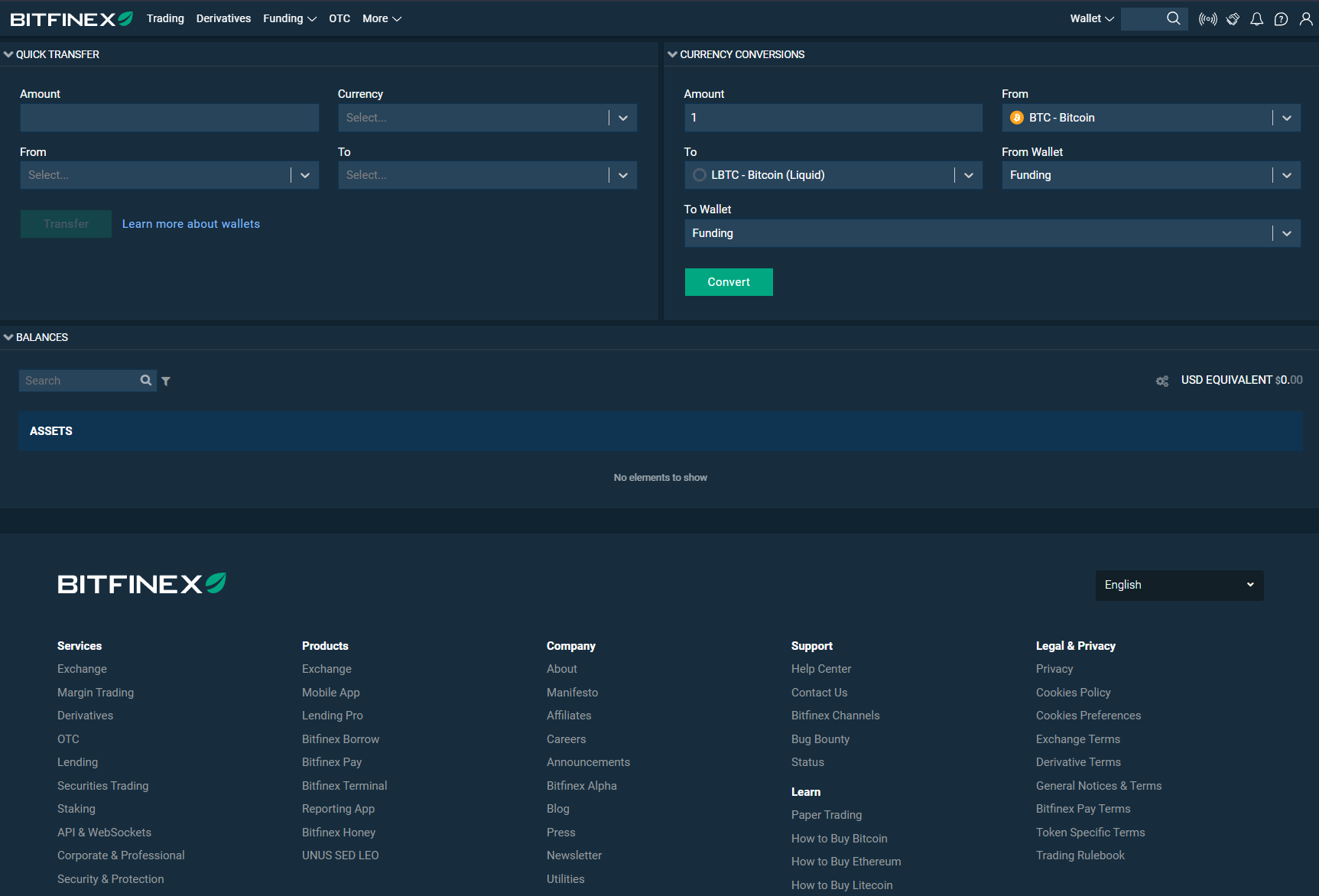

Bitfinex, one of the most renowned exchanges that supports the Liquid Network and L-BTC, offers conversion services for and from L-BTC.

To obtain L-BTC, BTC must be converted to L-BTC on the Bitfinex platform before initiating a Liquid withdrawal.

Bitfinex converts BTC and L-BTC at a 1:1 ratio and does not charge any fees. It is important to note that subsequent L-BTC deposits to Bitfinex must be converted to BTC before they can be utilized for trading.

The process for acquiring L-BTC on Bitfinex involves sending bitcoins to the exchange wallet and waiting for at least 3 confirmations.

Next, navigate to the Currency Conversions section under the Wallets page and fill in the necessary fields. Confirm the conversion details and select "Convert." The updated L-BTC balance can then be viewed on the Wallets page.

To withdraw L-BTC, generate an L-BTC receiving address using Blockstream Green wallet (or other compatible wallets) and input the required information on the LiquidBTC withdrawal page on Bitfinex.

Confirm the withdrawal and wait for the Liquid wallet's balance to update - funds will be available immediately for spending.

👉 Click here to open an account on Bitfinex and get a 6% rebate fee.

Liquid Network vs. Other Blockchain Solutions

The Liquid Network offers several advantages over other blockchain solutions. First and foremost, it is designed specifically for rapid, confidential, and secure transactions of liquid assets such as cryptocurrencies and digital assets. This means that transactions on the Liquid Network are faster and cheaper than on other blockchain networks like Bitcoin or Ethereum.

Another advantage of the Liquid Network is its support for confidential transactions. This means that users can transact on the network without making public sensitive information like the amount or type of assets being transferred. This is particularly important for enterprises and financial institutions that need to protect the privacy of their transactions.

Additionally, the Liquid Network is interoperable with other blockchains, meaning that users can move assets between the Liquid Network and other networks like Bitcoin or Tether Dollar. This creates a more seamless experience for users who need to transact across different networks.

In addition, the Liquid Network is highly secure and resistant to attacks due to its use of a federated consensus model. This means that transactions are validated by a group of trusted members rather than relying on the computing power of anonymous miners. This results in a network that is highly resistant to double-spending attacks and other security threats.

Overall, the Liquid Network offers a unique set of advantages that make it an attractive solution for users and institutions looking for fast, secure, and confidential transactions of liquid assets.

Liquid Network Disadvantages

While the Liquid Network has numerous advantages, it's also important to discuss its drawbacks.

The Liquid Network can be considered custodial to some extent, depending on how the peg-in and peg-out transactions are processed by the federation members.

The Liquid Federation uses an 11-of-15 multisig wallet to process peg-ins and peg-outs and secure bitcoin held in the federation wallet. So this means that Liquid Network is not always permissionless, and users have to trust the federation members to manage the funds and operate the network.

Some federation members may require mandatory KYC (Know Your Customer) checks before allowing users to peg in or peg out, which could compromise user privacy.

Additionally, some federation members may convert the user's BTC balance to LN liquidity, which means that users do not have full control over their BTC balance while it is on the Liquid Network.

However, there are alternatives to avoid these issues, such as using Sideswap instead of pegging in and out, which can provide a non-custodial option for using the Liquid Network.

Also, due to the federation structure, the Liquid Network can be considered more centralized compared to the classic Bitcoin main chain, where decisions are taken by consensus all over the network's miners and users.

Basically, while the Liquid Network may be considered custodial and less decentralized to some extent, so it's important to understand the specifics of how it works and the options available to users.

Liquid Network Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Transactions are faster and cheaper | ❌ Liquid Network is custodial depending on federation member |

| ✅ Enhanced privacy features | ❌ No permissionless peg-outs |

| ✅ Issuance of assets on Liquid Network | ❌ Limited adoption and usage |

| ✅ Atomic swaps with other networks | ❌ Controversies around centralization |

The Future of the Liquid Network

The success of the Liquid Network is largely dependent on its adoption rate. While some Bitcoin purists may be hesitant to utilize the Liquid Network due to its centralized nature, it is undeniable that sidechains offer a way for Bitcoin to evolve without directly impacting the main chain.

With the on-chain fees of Bitcoin continually increasing, and occasional weeks of extremely high sat/vb, alternative solutions like the Liquid Network and other layer-2 solutions such as the Lightning Network are becoming increasingly attractive options for users.

As adoption rates increase, it is likely that the Liquid Network will become a key player in the Bitcoin ecosystem, enabling faster and more confidential transactions while maintaining the security and integrity of the main chain.

Bottom line

Wrapping up, the Liquid Network is a promising technology that enables fast, confidential settlement and issuance of digital assets on top of the Bitcoin blockchain.

As a sidechain, it offers a viable solution to Bitcoin's scalability and speed issues without having to make changes to the main chain. The potential of the Liquid Network is still largely untapped, but with more adoption, it could become a game-changer in the crypto space.

The ability to join L-BTC with solutions like Bitfinex with zero fees is a major advantage that makes it an attractive option for traders and investors alike. Cold storage solutions like the Blockstream Jade makes the Liquid Network suitable for medium to long term holders.

Adoption it's still very low, but as the network continues to grow and evolve, it will be exciting to see what new use cases and innovations will emerge.