Bitcoin Halving 2024: What It Is And How It Works

The Bitcoin halving is a pivotal event, anticipated for years, that significantly increases scarcity by halving the production of new supply. This guide explores the intricacies of the halving and its impact in detail.

What Is The Halving?

The Bitcoin halving is an event that occurs approximately every four years, during which the reward for mining new Bitcoin blocks is halved. This event is programmed into the Bitcoin protocol and is designed to control the issuance of new coins, thereby contributing to its scarcity and potentially impacting its value.

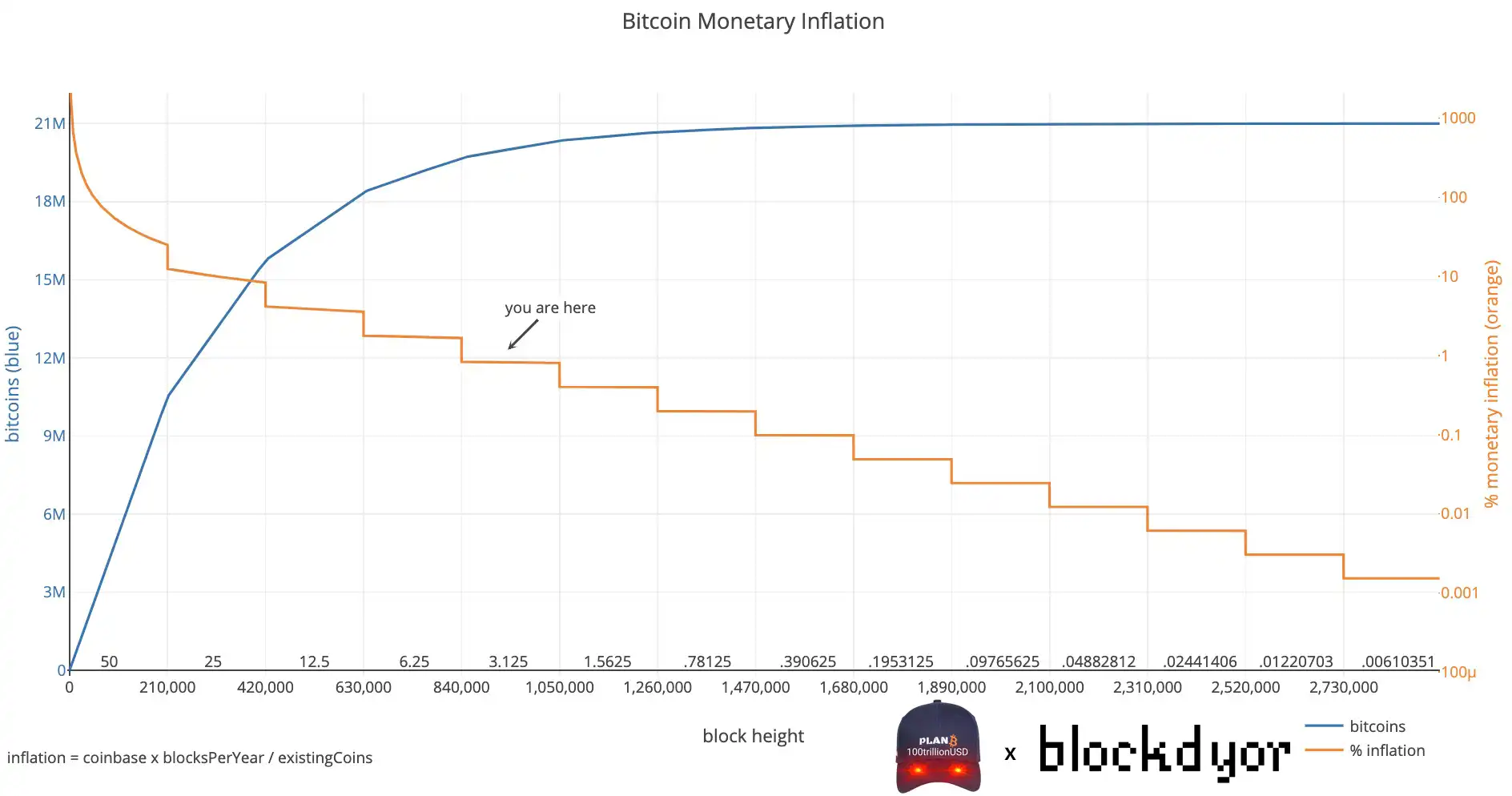

To ensure Bitcoin's scarcity, Satoshi Nakamoto implemented a limit set in stone of 21 million bitcoins that will ever exist. However, fair distribution posed a challenge. That's why the Bitcoin Halving was introduced. Every 210,000 blocks, roughly every 4 years, miner rewards halve, ensuring a gradual and equitable distribution of all 21 million bitcoins until the year 2140.

When Bitcoin was initially introduced, miners were rewarded with a quite generous fixed amount of bitcoins whenever they successfully mined a new block, typically occurring every ten minutes. This reward started at 50 bitcoins per block from the genesis block to the 210,000 block.

However, as part of its design, the Bitcoin protocol incorporates a built-in mechanism that automatically reduces this reward by half after a predetermined number of blocks have been mined. This reduction in the block subsidy is what is referred to as the "halving event."

How The Bitcoin Halving Works

The Bitcoin halving works by reducing the reward given to miners for validating transactions and adding them to the blockchain. Initially set at 50 bitcoins per block, the reward is halved approximately 210,000 blocks (approx. every four years), leading to a reduction in the rate at which new Bitcoins are created.

The halving is an inherent feature of Bitcoin's protocol, managed automatically by participating clients like Bitcoin Core or Bitcoin Knots. It marks also the transition to a new epoch. As of April 2024, we've entered the 5th mining epoch, which will extend until approximately 2028. During this period, block rewards are set at just 3.125 BTC. Users don't need to take any action; the halving process unfolds seamlessly within the Bitcoin network.

The Block Reward, a key component of Bitcoin mining, comprises two elements: the Block Subsidy and Transaction Fees. Block Subsidy refers to newly minted bitcoins allocated to miners upon successfully adding a valid block to the Bitcoin Blockchain through Proof-of-Work (PoW).

On the other hand, Transaction Fees represent the payments users make to prioritize their transactions in blocks, utilizing bitcoins already in circulation. Together, these components incentivize miners and facilitate the secure and efficient operation of the Bitcoin network.

| Block | Date | Subsidy (BTC) |

|---|---|---|

| ⛓️ 0 | 3 Jan 2009 | 50 |

| ⛓️ 210000 | 28 Nov 2012 | 25 |

| ⛓️ 420000 | 9 July 2016 | 12.5 |

| ⛓️ 630000 | 11 May 2020 | 6.25 |

| ⛓️ 840000 | April 2024 | 3.125 |

This reduction in the supply of new Bitcoins plays a crucial role in maintaining scarcity and, according to the Stock-to-Flow model (we'll see this in depth next up), has a direct impact on Bitcoin's value. As the supply decreases due to halving events, the model predicts that Bitcoin's value will increase, reflecting its increased scarcity and potentially leading to higher market prices.

Bitcoin Halving And The Stock To Flow Model

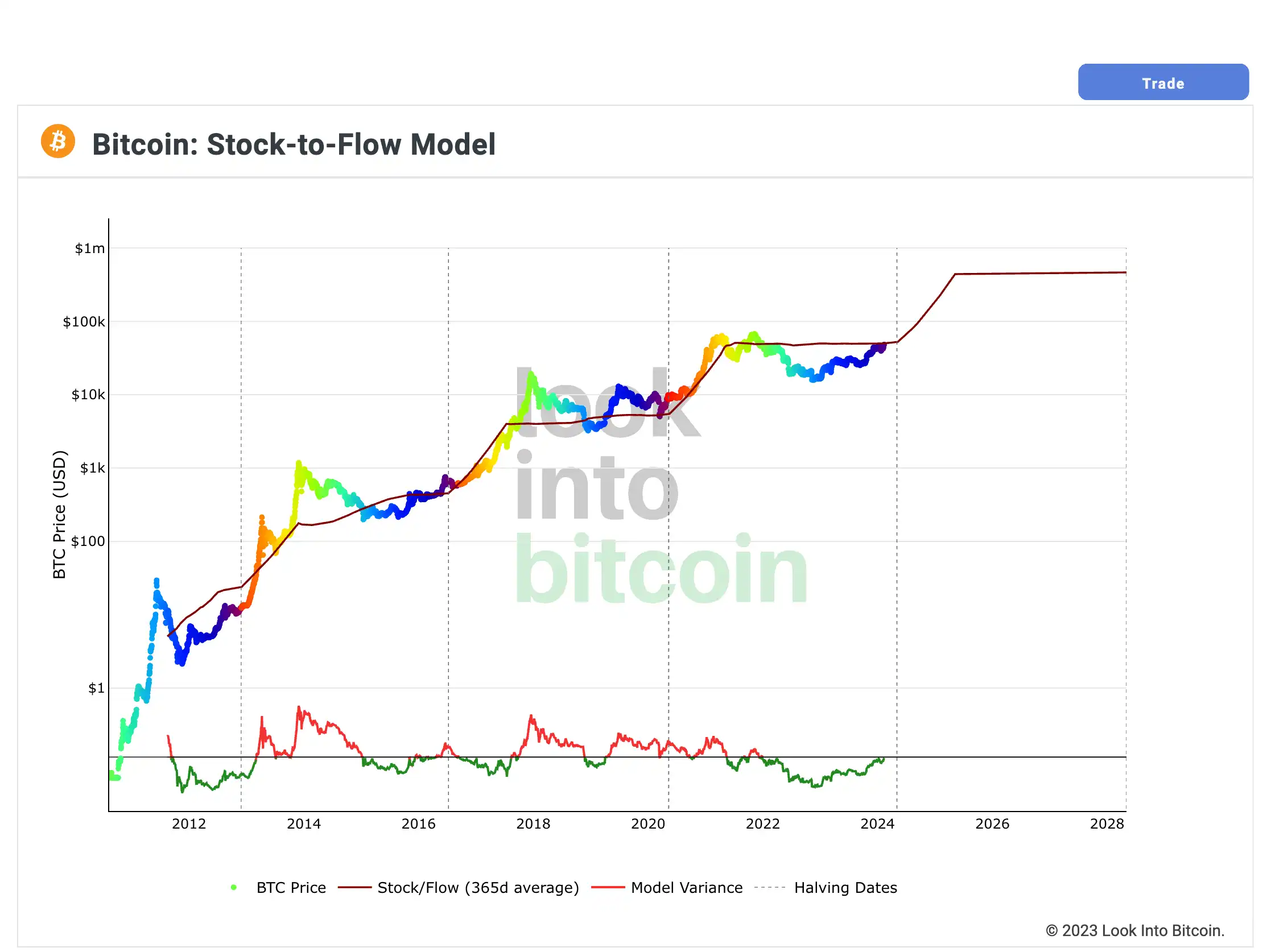

In the world of economics and finance, the concept of "stock-to-flow" (SF) serves as a crucial metric for assessing the scarcity of commodities and their potential value. Derived from the ratio of existing stockpiles (stock) to the annual production (flow) of a commodity, SF provides insights into the relative abundance or scarcity of a particular asset.

Bitcoin, hailed as the first scarce digital asset, embodies the principles of scarcity and "unforgeable costliness". Satoshi Nakamoto, the mysterious creator of Bitcoin, embedded within its protocol a mechanism that mimics the scarcity traits of precious metals like gold and silver. By requiring significant computational resources to "mine" new bitcoins, Bitcoin achieves a level of unforgeable costliness, making it resistant to duplication or counterfeit.

The stock-to-flow ratio serves as a quantifiable measure of an asset's scarcity, with higher SF ratios indicative of greater scarcity. In the case of commodities like gold and silver, which possess high SF ratios, the production of new supply is relatively insignificant compared to the existing stockpiles. This characteristic contributes to their historical roles as stores of value.

Created by PlanB (@100trillionUSD on X) Bitcoin's Stock-to-Flow ratio got a significant attention within the cryptocurrency community due to its resemblance to traditional store-of-value assets like gold.

With a fixed supply cap of 21 million bitcoins and a predetermined issuance schedule dictated by halving events, Bitcoin exhibits scarcity dynamics akin to precious metals. As such, Bitcoin's SF ratio has been steadily increasing over time, positioning it within the category of monetary goods alongside gold and silver.

The relationship between Bitcoin's SF ratio and its market value has sparked numerous analyses and models aimed at predicting its future trajectory. By employing statistical methods and regression analysis, researchers like PlanB have proposed models that correlate Bitcoin's SF ratio with its market value. According to these models, as Bitcoin's SF ratio increases over time, its perceived scarcity strengthens, potentially leading to higher market valuations.

Calculating Bitcoin Stock-to-Flow Ratio

The Stock-to-Flow (SF) Ratio is a measure obtained by dividing the existing stock of a commodity by its flow rate.

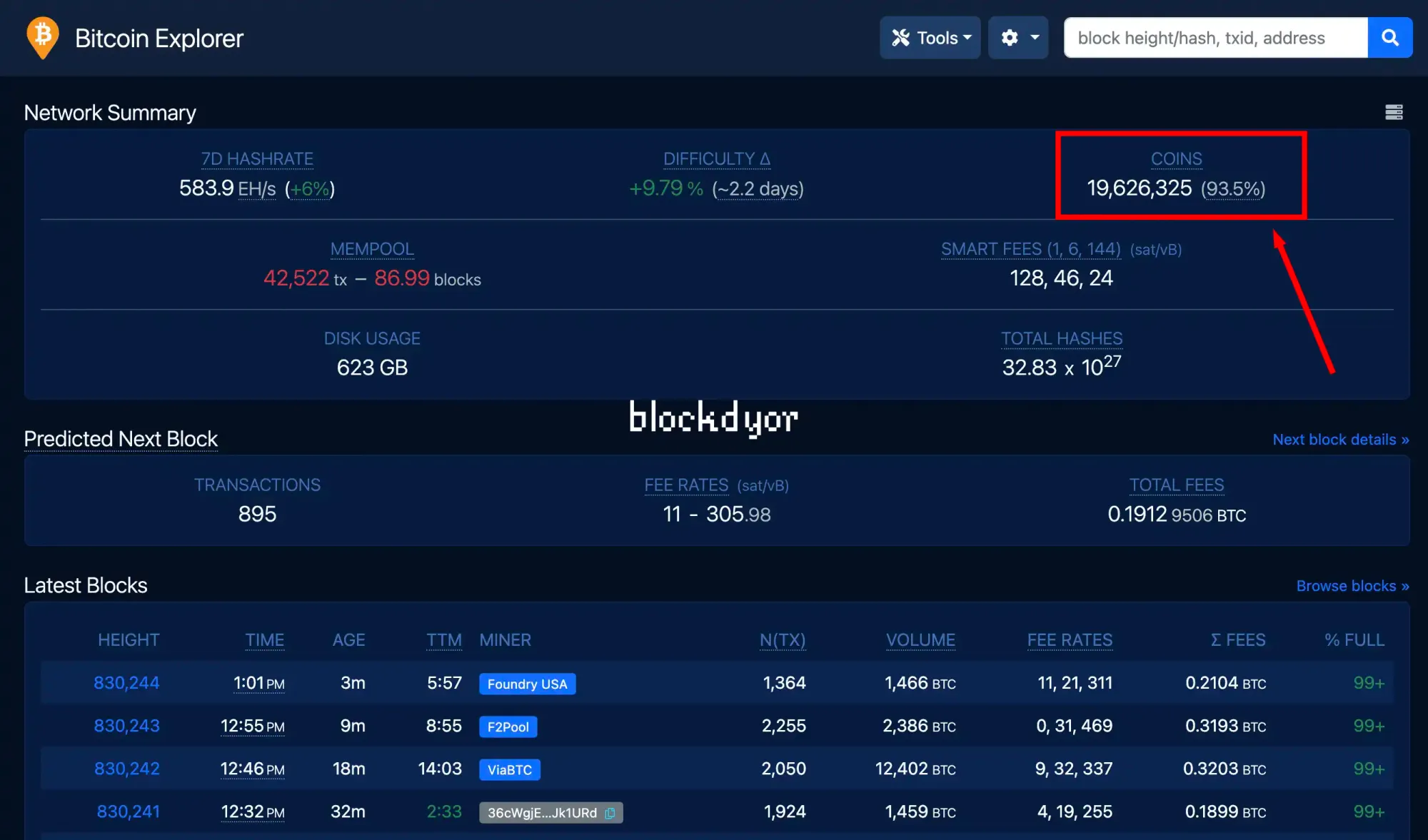

As of the current moment, the circulating supply of Bitcoin stands at approximately 19,624,731 BTC. Following the Bitcoin halving in April 2024, which reduced the issuance of new bitcoins by half, the scarcity of Bitcoin intensified. Now, about 3.125 new bitcoins are mined every 10 minutes since April 2024, equating to approximately 52,560 new blocks per year (assuming one block every ten minutes, which translates to 144 blocks per day), resulting in a flow of bitcoin of 164,250.

Consequently, Bitcoin's Stock-to-Flow ratio is calculated as 19.6 million / 164,250 = 119.3. This represents a significantly higher stock-to-flow ratio compared to the previous epoch, which stood at 57.5. Following the 2024 halving, Bitcoin surpassed Gold to become the number one asset in terms of stock-to-flow.

Gold, for comparison, has a stock-to-flow ratio of 65, indicating that it would take 65 years to produce the current stock of gold at the present rate. With approximately 185,000 tons of gold circulating globally and an annual production rate of 3,000 tons, the stock-to-flow for gold is calculated by dividing the supply by the flow, yielding a value of roughly 65.

Meanwhile, Silver boasts a stock-to-flow ratio of 22, while commodities such as zinc, copper, and palladium typically exhibit a stock-to-flow ratio closer to one, indicating their relative abundance and replaceability.

Why The Halving?

The Satoshi Nakamoto's decision to implement halving events aligns with Bitcoin's broader objective of establishing itself as a deflationary currency. Unlike fiat currencies, which are subject to inflationary pressures due to central bank policies, Bitcoin's issuance schedule is pre-programmed and predictable. This predictability fosters trust among users and investors, who can rely on a controlled supply that diminishes over time.

By adhering to a predetermined issuance schedule, Bitcoin offers transparency regarding its future supply dynamics. Individuals can accurately forecast the rate at which new bitcoins will enter circulation, providing valuable insights into market behavior and investment decisions. Moreover, the halving events serve as pivotal moments for evaluating Bitcoin's value proposition, often sparking discussions and analyses about its scarcity and potential impact on market prices.

Is The Halving Good For The Bitcoin Price?

Undoubtedly, the Stock-to-Flow model exhibits significant bullish sentiment surrounding each halving event, and thus far, it has roughly captured the price dynamics. However, one notable limitation of the Stock-to-Flow model is its exclusive focus on supply-side analysis for generating Bitcoin price forecasts.

The impact of halving events on Bitcoin pricing is a subject of ongoing debate. Some argue that the market has already factored in the effects of halving, resulting in no significant price movements.

Conversely, proponents of the model suggest that the reduction in supply, coupled with stable or increased demand for bitcoins, should logically lead to a price increase due to the principle of price equilibrium. This divergence of opinions highlights the complexity and uncertainty inherent in predicting bitcoin's price dynamics surrounding halving events.

However, it's imperative to recognize that a surge in Bitcoin's price following halving events is not 100% guaranteed. Due to the high anticipation surrounding these events, if an increase in price were inevitable, rational investors would likely enter the market beforehand, driving up prices prior to the halving.

This casts doubt on frameworks like the Stock-to-Flow model, which, while visually compelling, may overlook the predictability and widespread awareness of scarcity well before the halving occurs. Evidence from other cryptocurrencies with similar halving mechanisms, such as Litecoin, which has not consistently experienced price appreciation post-halving, further supports this notion, indicating that while scarcity may influence price, additional factors are at play.

Instead of only attributing post-halving price increases to the halvings themselves, it appears that these periods coincide also with significant macroeconomic events. Here's some of the most important from the past:

- 2012 - European Debt Crisis: Amidst the European debt crisis, Bitcoin emerged as a potential alternative store of value during economic turmoil. This contributed to its surge from $10 to $1,100 by November 2013.

- 2016 - Initial Coin Offering (ICO) Boom: The ICO boom injected over $5.6 billion into altcoins, indirectly benefiting Bitcoin. This propelled its price from $650 to $20,000 by December 2017.

- 2020 - COVID-19 Pandemic: Extensive stimulus measures during the COVID-19 pandemic heightened concerns about inflation. This potentially drove investors toward Bitcoin as a safe haven. Resulting in its price surge from $8,000 to $69,000 by November 2021.

The Impact Of The Halving On Bitcoin Market Dynamics

The Stock-to-Flow model offers an optimistic outlook on Bitcoin's future, yet uncertainties persist, particularly surrounding the fifth epoch, where the halving event may already be priced in into market expectations.

Nevertheless, the halving's implications reverberate throughout the Bitcoin ecosystem, directly influencing various facets of its market structure. Let's have a look at some of them.

Mining

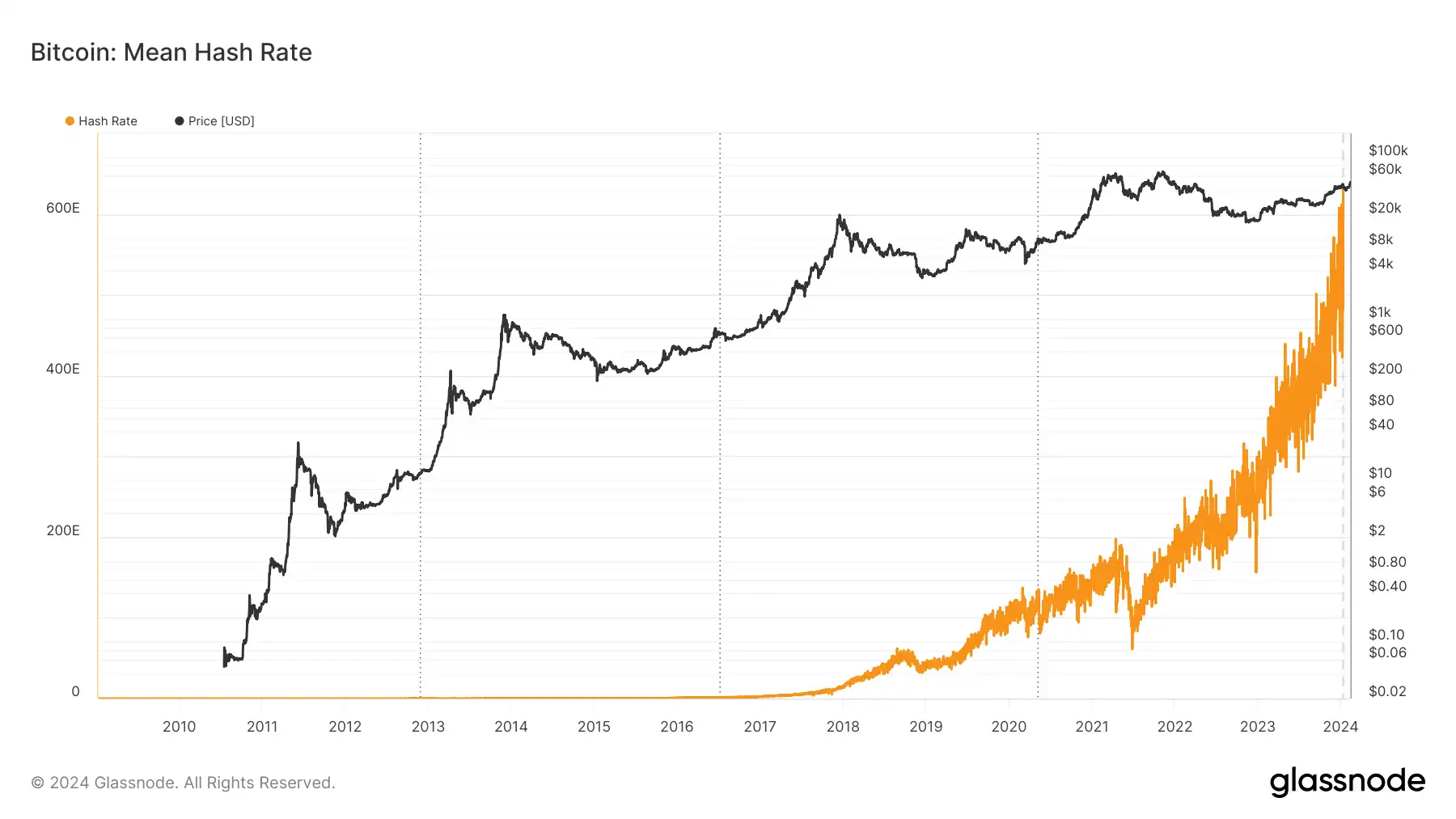

Transitioning from the fourth to the fifth epoch, the halving exacts a significant reduction in Bitcoin's supply issuance, halving the block subsidy from 6.25 BTC to 3.125 BTC/block.

This substantial reduction in miner rewards alters the economic landscape for miners, potentially mitigating the downward pressure on Bitcoin prices exerted by the influx of newly minted coins. However, as mining expenses escalate alongside the surging hash rate, the post-halving environment presents formidable challenges for miners.

While some mining entities proactively upgrade their hardware in anticipation of the halving, the concurrent rise in hash rates intensifies operational costs, possibly leading to diminished profitability, particularly for smaller-scale miners.

Notably, beyond block subsidies, miners derive revenue from transaction fees, which include fees from emerging phenomena like ordinals or inscriptions, presenting additional income streams amidst the halving's effects.

Ordinals/Inscriptions

The advent of ordinals/inscriptions introduces a new era to Bitcoin's ecosystem, whereby digital collectibles and NFT tokens are "inscribed" on the Bitcoin blockchain.

This emergent trend has witnessed remarkable growth, with millions of assets inscribed, culminating in substantial transaction fee earnings for miners.

Despite resistance from certain mining pools, ordinals have emerged as a significant revenue source, comprising a notable proportion of transaction fees during specific periods.

However, the proliferation of ordinals exacerbates scalability concerns on the main chain, leading to heightened transaction fees for regular users.

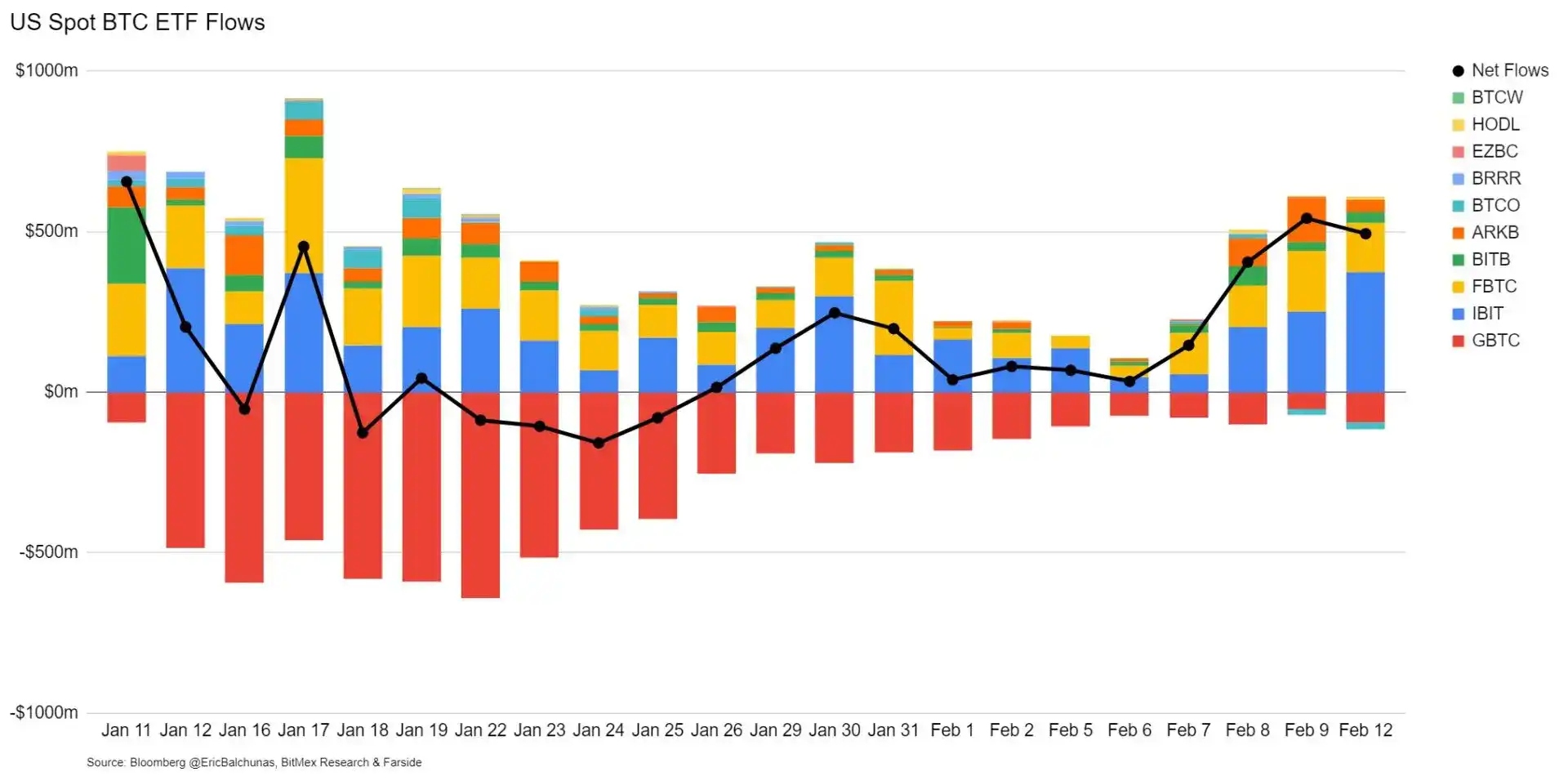

ETFs

The approval of the first Bitcoin Spot ETFs in 2024 marks a pivotal milestone in Bitcoin's institutional adoption journey. Since the initial application by the Winklevoss brothers in 2013, spot ETFs have catalyzed enduring institutional demand for Bitcoin, with major financial institutions actively acquiring significant quantities.

Institutional inflows from ETFs offer a potential buffer against post-halving sell pressure from miners, contributing to market stability. While the initial enthusiasm surrounding ETF approval propelled BTC prices above $50k, future inflows could serve as a counterbalance to ongoing selling pressure from newly minted coins, fostering a more balanced market dynamic.

How To Verify The Bitcoin Halving

Have you verified Bitcoin's supply schedule yourself or are you just confident in it because you believe enough other people verify it?

— Jameson Lopp (@lopp) February 11, 2024

Checking Bitcoin's supply schedule directly within Bitcoin Core is an excellent approach, aligning with the principle of "Don't trust, verify." This method allows you to personally validate the authenticity and accuracy of Bitcoin's supply data, empowering you with firsthand knowledge and ensuring transparency in the Bitcoin network.

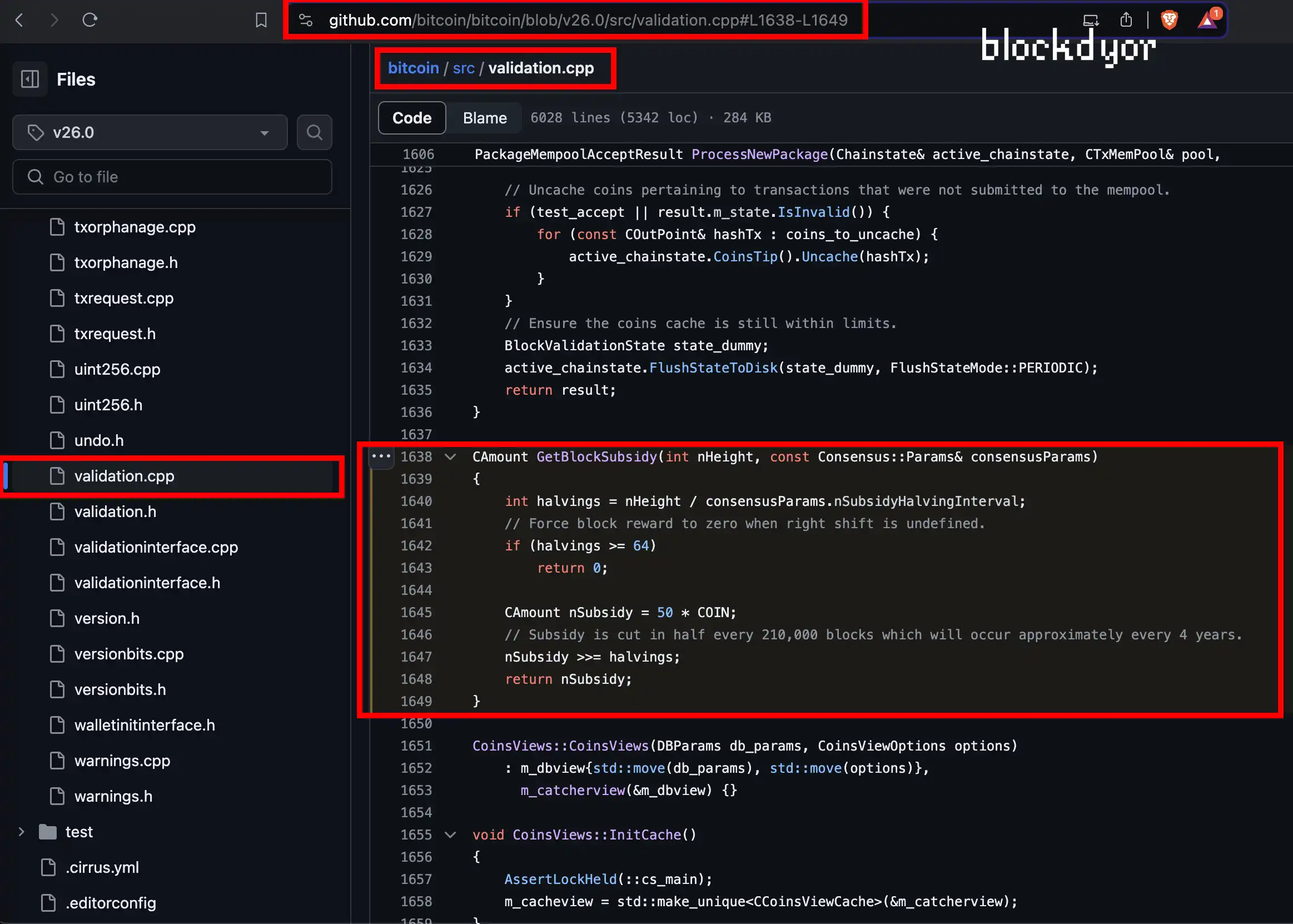

In the source code of Bitcoin lies a vital function called GetBlockSubsidy(), which you can find it in the public Bitcoin github in src/validation.cpp. This seemingly simple function plays a pivotal role in orchestrating the magic behind the Bitcoin reward halving event.

CAmount GetBlockSubsidy(int nHeight, const Consensus::Params& consensusParams)

{

int halvings = nHeight / consensusParams.nSubsidyHalvingInterval;

// Force block reward to zero when right shift is undefined.

if (halvings >= 64)

return 0;

CAmount nSubsidy = 50 * COIN;

// Subsidy is cut in half every 210,000 blocks which will occur approximately every 4 years.

nSubsidy >>= halvings;

return nSubsidy;

}How The GetBlockSubsidy() Function Works

int halvings = nHeight / consensusParams.nSubsidyHalvingInterval;

The function begins by calculating the number of halvings that have occurred based on the current block height and the predefined subsidy halving interval. This interval, typically set at 210,000 blocks, signifies the frequency at which halving events occur.

if (halvings >= 64)

return 0;An important check is performed here to ensure that the shift operation doesn't lead to undefined behavior. If the number of halvings exceeds 64, indicating a potential overflow, the block subsidy is forced to zero to prevent any computational anomalies.

CAmount nSubsidy = 50 * COIN;

// Subsidy is cut in half every 210,000 blocks which will occur approximately every 4 years.

nSubsidy >>= halvings;

return nSubsidy;

The heart of the function lies in adjusting the block subsidy based on the number of halvings. Initially set at 50 bitcoins per block, this reward undergoes halving every 210,000 blocks, effectively reducing it by half. The bitwise right shift operation elegantly handles this reduction, ensuring a smooth transition in the reward structure.

The Bitwise Operations

nSubsidy >>= halvings;

An interesting aspect of the function lies in the utilization of bitwise operations, particularly the right shift operator (>>=). This operation facilitates the division of the block subsidy by 2^n, where n corresponds to the number of halvings. This efficient mechanism ensures accurate adjustment of the reward without relying on traditional arithmetic operations.

Simple Way To Bitcoin Supply Check

If you operate a node, you have the option to install a tool known as BTC RPC Explorer. This self-hosted Bitcoin explorer eliminates the need for a database and offers a straightforward user interface, enabling you to verify the Bitcoin supply with ease.

The unique feature of this explorer lies in its offline functionality. Instead of relying on internet connections, it calculates all blockchain data locally by connecting solely to your Bitcoin Core node instance via RPC (Remote Procedure Call). This ensures that all calculations are performed securely within your own environment, enhancing privacy and control over the verification process.

Simply access your own full node, navigate to the app store, and search for "BTC RPC." You'll easily locate this application. Download and install it, then open the app. The entire process should only require a few minutes of your time.

Upon opening the BTC RPC explorer, you'll find the data you're seeking in the first row of the Network Summary section, labeled "Coins." This section provides a concise overview of the Bitcoin supply, allowing you to quickly access the information you need.

Another Quick Way To Bitcoin Supply Check Via Command Line (If You Run A Full Node)

Running a full Bitcoin Node entails syncing the node from its genesis block, which results in the node retaining and constructing a comprehensive audit trail of every coin ever spent.

This audit trail ensures the integrity of the Bitcoin supply, as any attempt to manipulate it would be rejected by the node. To conduct a thorough audit of the entire coin supply at any given time, one can utilize the gettxoutsetinfo command.

In my own node, I executed the following command to initiate a full audit of every spent coin:

/home/citadel/citadel/bin/bitcoin-cli gettxoutsetinfo

This command references the path to the Bitcoin-cli executable, ensuring the proper execution of the audit. While the audit process may take several minutes or even hours to complete, depending on various factors such as system resources and network conditions, the node eventually provides comprehensive data for analysis. This data enables us to gain insights into the state of the Bitcoin supply and verify its integrity.

To confirm the integrity of the Bitcoin supply, the output generated after executing the specified command should resemble the following format:

"height": 825324,

"total_amount": 19595561.74589185

Bitcoin Halving Dates

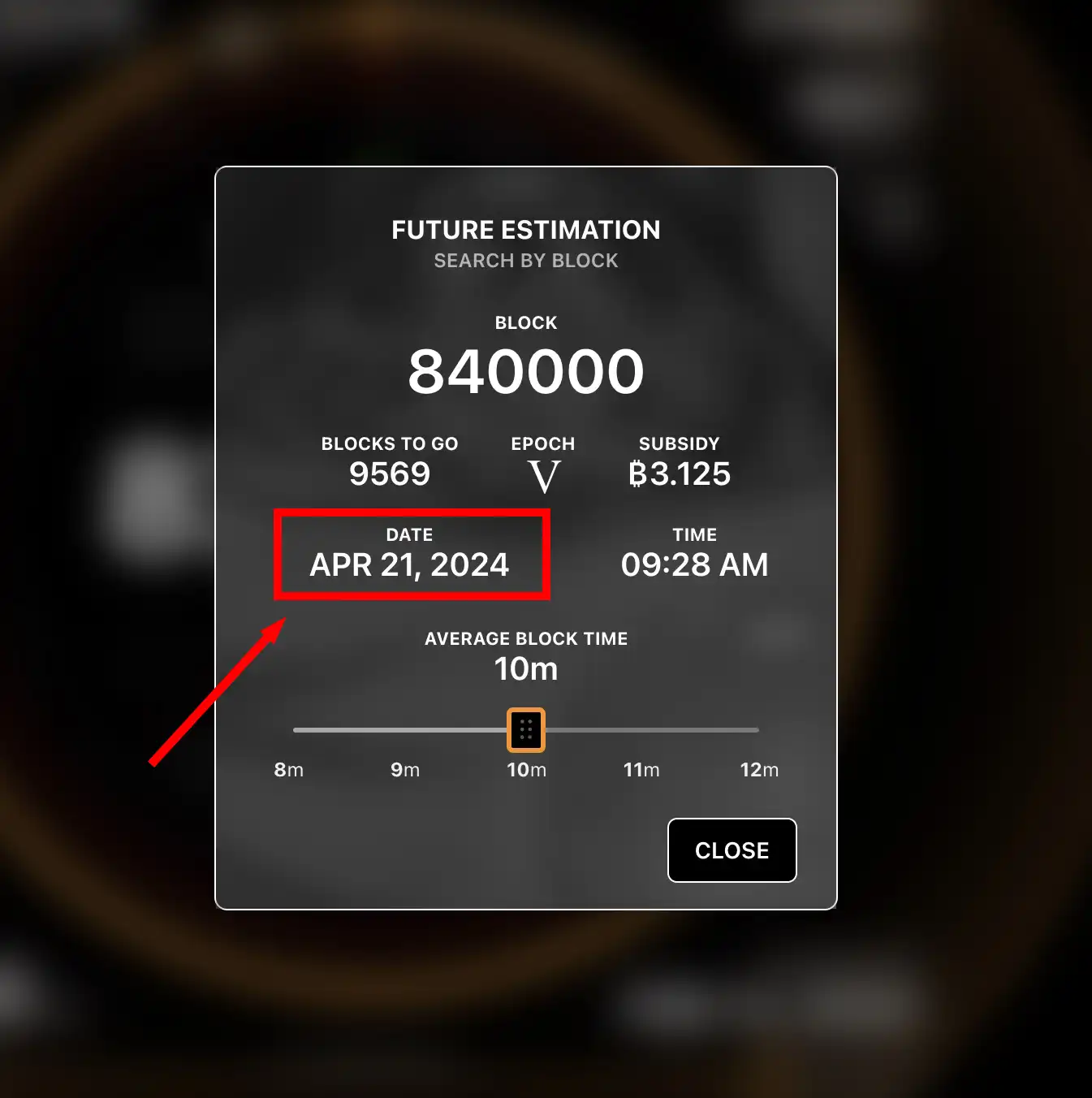

As of now, we are approximately two months away from the estimated time of the halving event. Pinpointing the exact date is challenging due to variations in block creation times, despite knowing that it will occur at block 840,000.

Unlike human time measurements, Bitcoin's blockchain measures time in blocks. With each block taking around ten minutes to mine, a complete epoch of 210,000 blocks spans roughly four years. This equates to 21,000,000 minutes, 35,000 hours, or ≈ 3.99 years.

Past and Future Bitcoin Halvings

Here's a chronological list of Bitcoin halvings. They happen roughly every 210,000 blocks, or about every four years, and will persist until approximately 2140, marking the final halving.

Beyond 2140, the Block Subsidy will drop to 0, and the Block Reward will solely comprise transaction fees. Please note that the halving dates from 2024 to 2140 are estimates.

| Era | Date | Block Height | Block Subsidy |

|---|---|---|---|

| 2009 | 3rd Jan, 2009 | 0 (Genesis Block) | 50 BTC |

| 2012 | 28th Nov, 2012 | 210,000 | 25 BTC |

| 2016 | 9th Jul, 2016 | 420,000 | 12.5 BTC |

| 2020 | 11th May, 2020 | 630,000 | 6.25 BTC |

| 2024 | 27th Apr, 2024 | 840,000 | 3.125 BTC |

| 2028 | 6th Apr, 2028 | 1,050,000 | 1.5625 BTC |

| 2032 | 16th Feb, 2032 | 1,260,000 | 0.78125 BTC |

| 2036 | 27th Dec, 2035 | 1,470,000 | 0.390625 BTC |

| 2040 | 6th Nov, 2039 | 1,680,000 | 0.1953125 BTC |

| 2044 | 17th Sep, 2043 | 1,890,000 | 0.09765625 BTC |

| 2048 | 27th Jul, 2047 | 2,100,000 | 0.04882813 BTC |

| 2052 | 5th Jun, 2051 | 2,310,000 | 0.02441406 BTC |

| 2056 | 15th Apr, 2055 | 2,520,000 | 0.01220703 BTC |

| 2060 | 25th Feb, 2059 | 2,730,000 | 0.00610352 BTC |

| 2064 | 6th Jan, 2063 | 2,940,000 | 0.00305176 BTC |

| 2068 | 16th Nov, 2067 | 3,150,000 | 0.00152588 BTC |

| 2072 | 27th Sep, 2071 | 3,360,000 | 0.00076294 BTC |

| 2076 | 7th Aug, 2075 | 3,570,000 | 0.00038147 BTC |

| 2080 | 16th Jun, 2079 | 3,780,000 | 0.00019073 BTC |

| 2084 | 27th Apr, 2083 | 3,990,000 | 0.00009537 BTC |

| 2088 | 6th Mar, 2087 | 4,200,000 | 0.00004768 BTC |

| 2092 | 15th Jan, 2091 | 4,410,000 | 0.00002384 BTC |

| 2096 | 24th Nov, 2095 | 4,620,000 | 0.00001192 BTC |

| 2100 | 5th Oct, 2099 | 4,830,000 | 0.00000596 BTC |

| 2104 | 14th Aug, 2103 | 5,040,000 | 0.00000298 BTC |

| 2108 | 25th Jun, 2107 | 5,250,000 | 0.00000149 BTC |

| 2112 | 5th May, 2111 | 5,460,000 | 0.00000074 BTC |

| 2116 | 14th Mar, 2115 | 5,670,000 | 0.00000037 BTC |

| 2120 | 23rd Jan, 2119 | 5,880,000 | 0.00000018 BTC |

| 2124 | 3rd Dec, 2123 | 6,090,000 | 0.00000009 BTC |

| 2128 | 12th Oct, 2127 | 6,300,000 | 0.00000005 BTC |

| 2132 | 21st Aug, 2131 | 6,510,000 | 0.00000002 BTC |

| 2136 | 1st Jul, 2135 | 6,720,000 | 0.00000001 BTC |

| 2140 | 10th May, 2139 | 6,930,000 | 0.00000000 BTC |

Certainly, early miners who participated during the first epoch from 2009 to 2012 enjoyed a significant advantage over later entrants. However, it's essential to recognize that mining bitcoin in those early years was filled with uncertainties and risks. During its infancy, bitcoin lacked a concrete market price, making mining endeavors inherently speculative and uncertain.

Fast forward to the present, mining bitcoin has become substantially more challenging, with a significantly reduced block subsidy. Despite this, the price per Bitcoin has soared over the years, compensating for the diminished block rewards. This evolution has balanced the trade-offs associated with mining, offering a more stable and predictable environment for participants.

Bitcoin Halving Pros & Cons

The Bitcoin Halving is inevitable, bringing both advantages and drawbacks. While generally positive for Bitcoin, it's not without its challenges.

| Pros | Cons |

|---|---|

| ✅ Scarcity hedge against inflation | ❌ Reduced miner profitability |

| ✅ Predictable supply growth | ❌ Smaller or unprepared miners might go out of business |

| ✅ Milestones in Bitcoin's history | ❌ As smaller miners leave, hashrate might drop |

| ✅ Reinforces Bitcoin's value | |

| ✅ Stimulates innovation in mining technology | |

| ✅ Decreases sell pressure from miners | |

| ✅ Potential NGU (Number go up) |

Bottom Line

In conclusion, the Bitcoin Halving represents a pivotal moment in the cryptocurrency's lifecycle, marked by both advantages and disadvantages. On the positive side, it enforces Bitcoin's deflationary nature, enhancing its scarcity and potentially increasing its value over time.

Moreover, it ensures a predictable monetary policy, instilling confidence among investors and users. However, there are drawbacks, including the potential for reduced miner profitability and increased operational challenges due to diminishing block subsidy. Despite these concerns, the halving remains a crucial mechanism that shapes Bitcoin's economic landscape and contributes to its long-term sustainability and resilience.