Fold App & Card Review 2025: Buy, Earn, and Spend Bitcoin

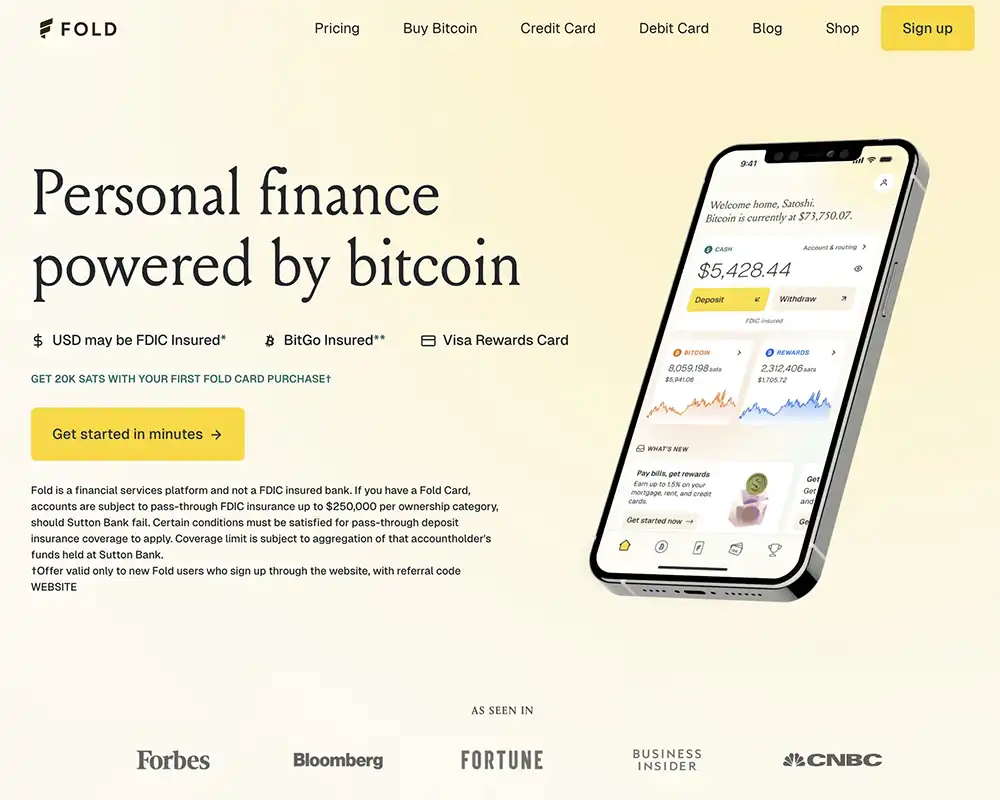

Fold offers a unique way to earn Bitcoin with every purchase through its Debit and Credit Cards. Spin for additional rewards, shop at top retailers, and stack sats effortlessly. With no annual fee, Fold makes Bitcoin accessible through everyday spending.

Fold is a Bitcoin-focused company that offers a unique way for users to earn BTC through everyday spending. It provides a rewards program where users can receive Bitcoin cashback, known as “sats back,” on purchases made with the Fold card or via the app. The company also features a gamified spin wheel that allows users to earn additional Bitcoin rewards, discounts, and other perks.

Fold’s mission is to make Bitcoin more accessible by integrating it into daily life, allowing users to accumulate Bitcoin without directly buying it. The platform partners with various merchants, enabling users to earn Bitcoin rewards when shopping at popular retailers. It also supports Lightning Network transactions, aligning with the broader goal of promoting Bitcoin adoption.

Fold offers both a Debit Card and a Credit Card, each designed to reward users with Bitcoin on everyday spending. Both cards integrate seamlessly with the Fold app, making it easy to track rewards and use Bitcoin for everyday expenses.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

| DESCRIPTION | DETAILS |

|---|---|

| 💳 Card Name | Fold Card |

| 💼 Company | Fold Holdings Inc. |

| 💳 Type | Visa Debit/Credit |

| 💰 Cashback Token | Bitcoin (BTC) |

| 📈 Staking | No |

| 🌍 Issuing Country | United States |

| 💱 Currency | USD |

| 💸 Fees | No annual fee, but some transaction fees may apply |

| 🔗 Linking | Linked to Fold account |

| 💰 Reward Programs | Yes (Earn Bitcoin rewards on eligible purchases) |

| 💳 ATM Withdrawal Limit | Varies by account type |

| 📲 Signup | Through Fold App |

| 🔒 Security | Chip and PIN protected, secure encrypted transactions |

Fold Brief History

Founded in 2014 by Will Reeves, it started as a simple app for buying gift cards with Bitcoin but has since grown into a complete financial service. The platform is best known for its gamified approach to earning rewards, including the Fold Spin Wheel, where users can spin for Bitcoin cashback on purchases.

Fold has expanded its offerings with both a debit card and a credit card, allowing users to earn Bitcoin rewards directly through their spending. The Fold Debit Card works like a prepaid card, offering Bitcoin rewards on every transaction, while the Fold Bitcoin Rewards Credit Card, issued by Sutton Bank in partnership with Visa, provides up to 2% back in Bitcoin for Fold+ members.

Fold Holdings became the first Bitcoin financial services company to trade on Nasdaq on February 19, 2025, following its merger with FTAC Emerald Acquisition Corp. The company is listed under the ticker symbols “FLD” for common stock and “FLDDW” for warrants.

With over 600,000 users, Fold has positioned itself as a top choice for those looking to passively accumulate Bitcoin through everyday spending. Whether you’re shopping, paying bills, or buying gift cards, Fold turns routine transactions into an opportunity to stack sats effortlessly.

How Fold Works?

Fold let's its users earn Bitcoin easily by integrating rewards into everyday spending. Users can earn Bitcoin in three main ways: buying gift cards, using the Fold Debit Card, and using the Fold Bitcoin Rewards Credit Card.

- Gift Cards – Fold offers a marketplace where users can purchase gift cards for popular retailers and earn Bitcoin back instantly. Some brands provide up to 10% back in Bitcoin, making it one of the easiest ways to accumulate sats.

- Fold Debit Card – A prepaid card that rewards users with Bitcoin on every purchase. Instead of traditional cashback, you receive Bitcoin, which can be held, transferred, or spent as you choose.

- Fold Bitcoin Rewards Credit Card – A credit card issued by Sutton Bank in partnership with Visa. Fold+ members can earn up to 2% back in Bitcoin, along with extra bonus rewards and fee-free Bitcoin trading within the Fold app.

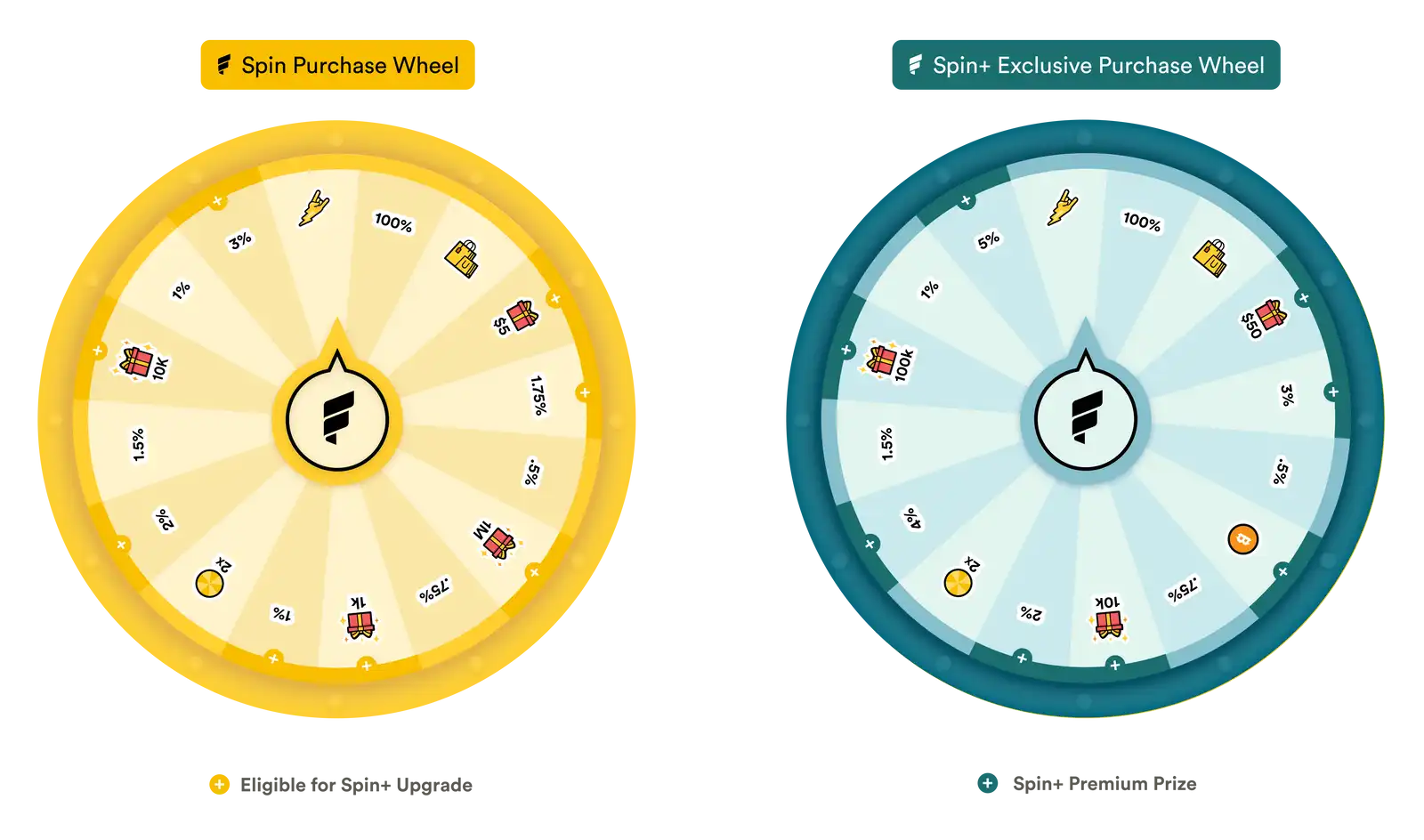

Additionally, Fold features a Spin Wheel that gamifies rewards. After each purchase, users can spin for a chance to earn extra Bitcoin, boosting their rewards potential. With its seamless approach, Fold turns everyday transactions into an opportunity to passively stack sats.

Fold Features

Fold offers an easy way to earn Bitcoin rewards on everyday spending, whether through its app or its debit and credit cards. Key features include:

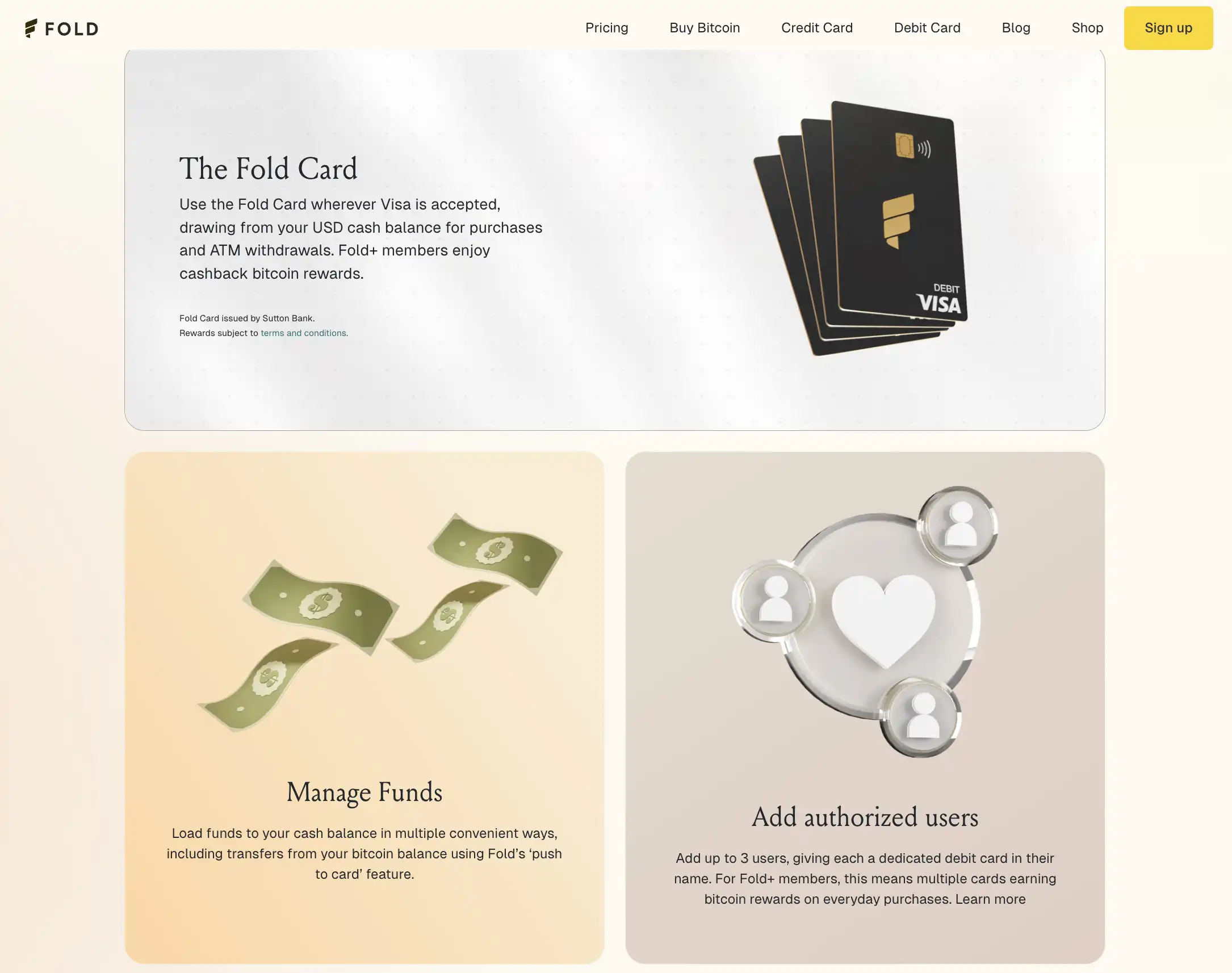

The Fold Card

Available as both a debit and a credit card, the Fold Card allows users to earn Bitcoin back on every purchase. The debit card lets users spend from their account balance, while the credit card offers up to 2% back in Bitcoin for Fold+ members.

Spin Wheel Bonuses

Each purchase gives users a chance to spin a rewards wheel, unlocking additional Bitcoin prizes, multipliers, or full purchase reimbursements.

Zero-Fee Bitcoin Trading

Users can buy and sell Bitcoin within the Fold app without incurring fees.

Merchant Discounts & Offers

Exclusive deals from partner brands provide extra savings and bonus Bitcoin rewards.

With these features, Fold makes earning and using Bitcoin both effortless and rewarding.

How To Get The Fold Card

Getting the Fold card is super simple and only takes a few minutes. Check out this guide to see how it’s done.

Register an account

To get a Fold Card, the first step is to register an account through the Fold App. This requires providing an email and creating a password.

Before applying for the card, users must complete identity verification by submitting their name, date of birth, and address, along with a government-issued ID.

This process complies with the USA PATRIOT Act, which mandates financial institutions to verify customer identities.

Request the card

Once the verification is complete, users can navigate to the Fold Card tab in the app and fill out a short application.

There’s no credit check involved, and once submitted, the account is ready to be funded immediately.

The physical Fold Card is shipped within ten business days, and activation is done through the app, allowing users to start earning Bitcoin rewards right away.

Fold Card Limits

| Limit Type | Amount |

|---|---|

| Max Account Balance | $30,000 |

| Max Spend Per Debit Card Transaction | $15,000/day |

| Max Spend Per ACH Transaction | Current Settled Account Balance |

| Max Spend Per Day | $15,000/day |

| Max Spend Per Month | $50,000/month |

| International Transactions | Yes |

| Max Load Per Calendar Day | $15,000 |

| Max Cash / ATM Withdrawal Per Transaction | $250 |

| Max Cash / ATM Withdrawal Per Day | $1,000 |

| Max Cash / ATM Withdrawal Per Month | $1,000 |

| Instant Debit Transfer Limits | |

| - Max Transfer Per Deposit | $1,500 |

| - Max Daily Deposit | $10,000 |

| - Max Deposit Per Rolling 30 Days | $20,000 |

| - Max Transfer Per Withdrawal | $125 |

| - Max Daily Withdrawal | $250 |

| - Max Withdrawal Per Rolling 30 Days | $500 |

| Astra In-App ACH Transfer Limits | |

| - Max Load Per Rolling 30 Days | $40,000 |

Fold Fees

Fold offers two membership tiers: Fold Member (free) and Fold+ Member ($10/month or $100/year). Each tier provides different benefits, including varying Bitcoin transaction fees, cashback rates, and additional perks.

Fold+ members enjoy zero fees on Bitcoin buys, sales, and direct deposit conversions, while standard members pay fees for these services. Both tiers get access to merchant rewards and cashback, but Fold+ members receive higher rates.

Here’s a breakdown of Fold’s fee structure:

| Feature | Fold Members (Free) | Fold+ Members ($10/month) |

|---|---|---|

| Fold Debit Card | ✅ Yes | ✅ Yes |

| Authorized Users | Up to 3 | Up to 3 |

| Insured Bitcoin Deposits | ✅ Yes | ✅ Yes |

| Send & Receive Bitcoin (On-Chain) | ✅ Yes | ✅ Yes |

| Gift Card Rewards | Up to 20% back | Up to 20% back |

| Amazon Gift Card Cashback | 2.25% back | 2.25% back |

| ACH Bill Pay Rewards | ❌ No | ✅ Up to 1.5% back |

| Buy Bitcoin Instantly | 1.5% Fee | No Fees |

| Sell Bitcoin Instantly (Push to Card) | 1.0% Fee | No Fees |

| Auto-Stack (DCA Bitcoin Buys) | 1.0% Fee | No Fees |

| Direct Deposit Bitcoin Conversions | 1.0% Fee | No Fees |

| Round Up Spare Change into Bitcoin | ❌ No | ✅ Yes |

| Top Category Boosts | 1.5% back | 1.5% back |

| Merchant Boosts | Up to 15% back | Up to 15% back |

| Other Eligible Purchases Cashback | 0.5% back | 0.5% back |

| International Fees | None | None |

| ATM Fees | None | None |

| Bitcoin Rewards Potential | Win up to 1 BTC | Win up to 1 BTC |

Fold+ membership is designed for those who frequently buy Bitcoin and want to maximize rewards while avoiding fees. Standard members can still earn cashback and use the card but will face transaction fees on Bitcoin purchases and sales.

Is Fold Reliable?

While Fold itself is not an FDIC-insured bank, your Fold Card account benefits from pass-through FDIC insurance through Sutton Bank, up to $250,000 per ownership category. That means if Sutton Bank were to fail, your funds could still be covered by FDIC insurance, but only if certain conditions are met.

It’s also worth noting that this coverage is aggregated with any other funds you may have at Sutton Bank, so if you hold multiple accounts, the $250,000 limit applies across all those accounts combined. So, while there’s a safety net, it’s always smart to keep an eye on your balances and understand how the insurance coverage works in case of unexpected events.

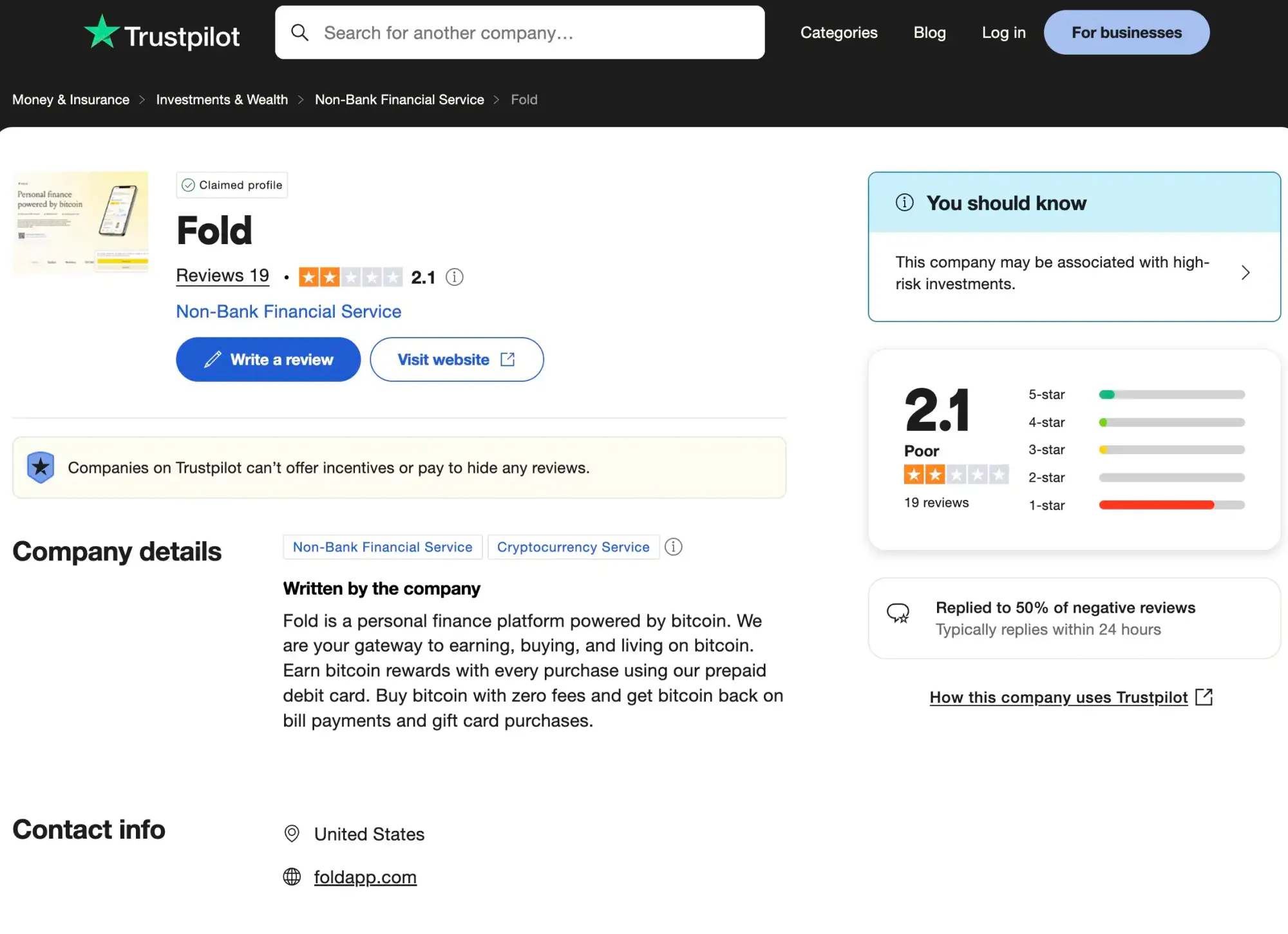

Fold has a TrustScore of 2.1 out of 5 on Trustpilot, based on 19 reviews. The overwhelming majority of users—79%—have given it a 1-star rating, signaling widespread dissatisfaction.

Though 11% of reviews are 5-star, even positive users mention slow withdrawals and difficulty earning rewards. Fold responds to about 50% of negative reviews but often without real resolution.

Many see it as unreliable, with risks of frozen funds, fraud, and poor support. Because of this, users should proceed with caution.

Fold Alternatives

While there are several crypto cashback cards, few focus solely on Bitcoin like Fold. However, some alternatives stand out:

| Feature | Fold Card | Gemini Credit Card | Wirex Card |

|---|---|---|---|

| 💰 Rewards | Bitcoin (BTC) | Bitcoin (BTC) or crypto | WXT (X-Points in US) |

| 📈 Max Cashback | Up to 2% BTC | Up to 4% BTC | Up to 8% WXT |

| 💸 Fees | No annual fee | No annual fee | No annual fee, transaction fees may apply |

- Gemini Credit Card (US Only): Earn up to 4% back in Bitcoin. Rewards include 4% on gas and EV charging (up to $200 per month, then 1% after), 3% on dining, 2% on groceries, and 1% on everything else.

- Wirex Card: Offers Cryptoback rewards, letting users earn WXT on purchases. Depending on spending levels, rewards can reach up to 8% per transaction.

Fold Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Bitcoin rewards on everyday spending | ❌ Reports of account restrictions and lost funds |

| ✅ No annual fee for the standard card | ❌ Available only in the US |

| ✅ Spin-to-win feature adds bonus rewards | |

| ✅ Integration with Fold app for easy management | |

| ✅ Option to earn higher rewards with Fold+ membership | |

| ✅ Available in the US with Visa network support | |

| ✅ Potentially valuable for Bitcoin enthusiasts |

Bottom Line

Fold is a straightforward and fun way to earn Bitcoin through everyday spending, whether you’re using its debit or credit cards or buying gift cards. With the added bonus of the Spin Wheel, it makes earning Bitcoin feel like a game, while offering real benefits like zero-fee Bitcoin trading and merchant discounts.

While Fold’s Trustpilot score suggests some user dissatisfaction, it’s still a solid option for those looking to passively accumulate Bitcoin. Whether you opt for the free membership or the Fold+ upgrade, you can stack sats while enjoying perks at your favorite retailers. Just be mindful of the mixed reviews and weigh your options before jumping in.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Fold Evaluation

Ease of Use: The Fold Card is designed for simplicity, with a user-friendly app that makes managing funds and earning Bitcoin rewards easy. There’s no credit check required, and users can start using the virtual card instantly while waiting for the physical one to arrive. The card can be funded through bank transfers or direct deposits, making the process seamless. 4/5

Security: Fold ensures security through encrypted transactions and fraud monitoring. Since it operates in partnership with Sutton Bank, it follows standard banking security practices. However, some users have reported issues with account restrictions and slow fraud response times, which may be a concern. 4/5

Fees & Limits: The Fold Card has no annual or monthly fees, making it cost-effective for Bitcoin enthusiasts. However, ATM withdrawals incur a $2.50 fee, and foreign transactions have a 3% charge. The card has a daily spending limit of $10,000, which should be sufficient for most users. 4/5

Rewards & Cashback: Fold offers Bitcoin rewards on every purchase, with rates ranging from 1% to 2% for standard users and up to 3% for Fold+ members. The rewards structure has changed over time, leading to some user dissatisfaction, but it remains one of the few Bitcoin-only cashback programs available. 4/5

Supported Countries: The Fold Card is only available in the U.S., limiting its global appeal. While the app itself is accessible worldwide for earning sats through other features, non-U.S. residents cannot apply for the card. 3/5

Final Rating: The Fold Card is a strong option for those looking to earn Bitcoin rewards on everyday purchases. It offers an easy-to-use interface, no annual fees, and a straightforward rewards system. However, fees for ATM withdrawals and foreign transactions, along with limited global availability, may be drawbacks. Overall: 4/5