Fiscozen Review 2024: Crypto Taxes In Italy Done Right

In this Fiscozen Review we will analyze this platform for simplifying tax processes, VAT management, and invoicing, it's a game-changer for freelancers and crypto holders.

What Is Fiscozen?

Living as a foreigner in Italy with a VAT number (Partita IVA) due to either running a business or being self-employed can pose challenges when it comes to understanding how to declare the earnings and also managing crypto holdings such as bitcoin.

This is where Fiscozen comes into play. It's a Software as a Service (SaaS) solution that seamlessly connects business owners or individuals to the tax authorities. It simplifies the process of generating invoices, declaring them, documenting crypto transactions, and provides real-time insights into tax liabilities.

More than just software, Fiscozen facilitates direct communication with a dedicated accountant, offering assistance and guidance in navigating the intricacies of daily tax responsibilities.

👉 Claim your free consultation with Fiscozen for VAT number registration and unlock a €50 discount.

How Fiscozen Works?

Fiscozen offers a comprehensive platform and a team of accountants to guide you through all aspects of your business activities and tax responsibilities. This support ranges from advising on selecting the ideal ATECO code for your business type to assistance with invoicing and tax returns.

Once you complete the information request form, a specialist will promptly reach out to you. This initial consultation is entirely free of charge, during which the expert will ask you a series of questions, such as:

- What is your profession or business?

- What product or service do you intend to sell?

- What annual revenue do you anticipate?

Based on your responses, the expert will provide tailored recommendations, directing you toward the most suitable solutions for your specific situation.

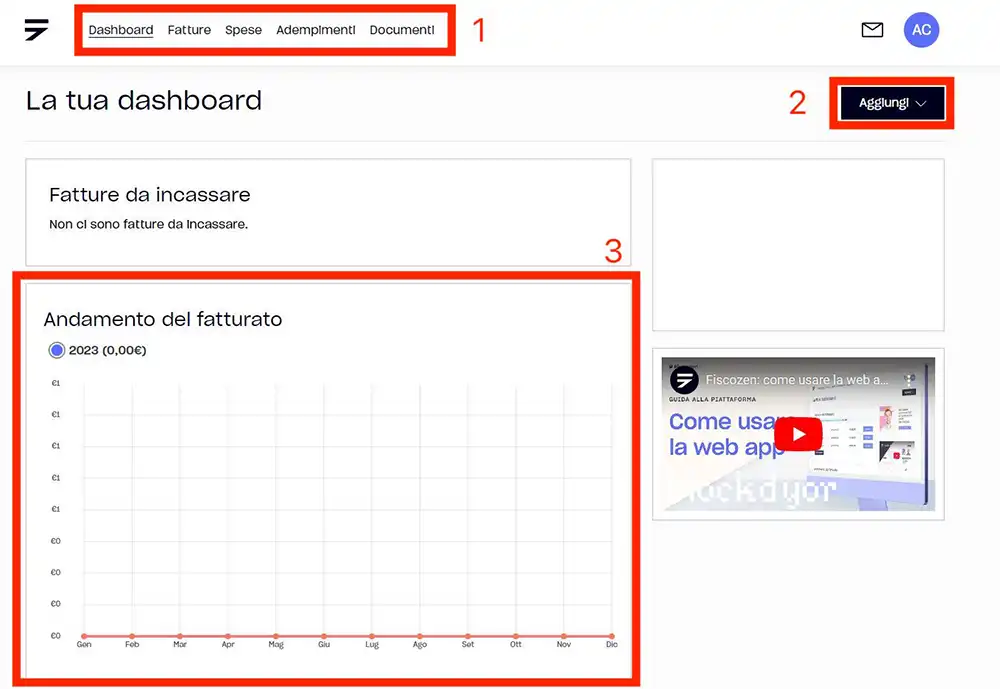

Upon opening an account, you gain complete control through a straightforward menu featuring a dashboard, invoices, expenses, compliance documents (1), the ability to add new invoices (2), and a comprehensive overview of your revenue (3) along with a clear indication of your tax liabilities.

For Who Is Fiscozen?

Now, you might have a couple of entirely valid questions:

- Is Fiscozen the right fit for me?

- If it's an online service, won't I risk inadequate support?

- What exactly does Fiscozen offer?

- What is the cost of obtaining a VAT number?

Fiscozen caters to all professionals looking to embark on business ventures under the flat-rate or simplified regime. It provides a comprehensive service for managing all aspects of your business, including documentation, invoicing, and a unique feature often absent with traditional accountants: the ability to estimate your impending tax obligations.

If you are a professional aiming to initiate your freelance journey, Fiscozen emerges as an ideal solution, offering an all-in-one platform and the expertise of an accountant who will guide you and address any uncertainties you may have.

In particular, Fiscozen is well-suited for the following professionals:

- Professionals and consultants (web designers, marketing consultants, social media managers, photographers, videomakers).

- Registered professionals (architects, lawyers, doctors, psychologists, etc.).

- Wellness practitioners (osteopaths, massage therapists, naturopaths, etc.).

- Artisans (window and door fitters, plumbers, beauticians, hairdressers, etc.).

- Merchants (engaged in both online and offline sales of physical and digital products).

I've used Fiscozen, and it doesn't just solve the problems of understanding how to declare the earnings and pay the taxes, but it also helps saving time and resources that can be redirected toward establishing your professional presence.

Fiscozen and Crypto

Fiscozen proves to be particularly advantageous for business owners and individuals engaged in activities within Italy, especially for those who aim to transparently declare their cryptocurrency holdings and manage all crypto-related aspects. The suitability of Fiscozen depends on the nature of your activities:

- Investing in Crypto:

- No need to open a VAT number.

- No requirement to engage an accountant, as cryptocurrency investment is treated similarly to foreign currency investment.

- Simply indicate the value of your cryptocurrencies in the "RW" box of your tax return.

- Consultants:

- Essential to open a VAT number.

- Requires the support of an accountant to initiate and oversee business operations.

- When opening as a freelancer, use the ATECO code 70.22.09 for "other entrepreneurial consultancy activities and other administrative-management consultancy and business planning."

- Open the VAT number through the revenue agency (Agenzia delle Entrate) website (using form AA9/12), directly at the revenue agency counter, or with the assistance of an accountant or online consultancy service.

When setting up your VAT number, specify the business regime among:

- Ordinary (Ordinario): Taxes range from 23% to 43% on the taxable amount, calculated by deducting business expenses from income.

- Flat Rate (Forfettario): Pay a standard rate of 15% tax (or 5% for the first 5 years for new businesses). The percentage is applied to the taxable amount, determined by multiplying total income by a profitability coefficient and subtracting previous year contributions. The consultant's coefficient is 78%, for instance, paying taxes only on €13,600 if you earned €20,000, paid €2,000 in contributions last year.

- Additionally, enroll in the INPS separately managed social security fund, with 2023 contributions set at 26.23% of the taxable amount.

For consultants in the crypto field, having an accountant is crucial for navigating the complexities. You can avail yourself of a free, no-obligation tax consultation with a Fiscozen expert by clicking on the link down below.

If you have a VAT Number, engage in Bitcoin or crypto investments/savings, and require a tax accounting software, Fiscozen stands out as the perfect solution, addressing all these needs seamlessly.

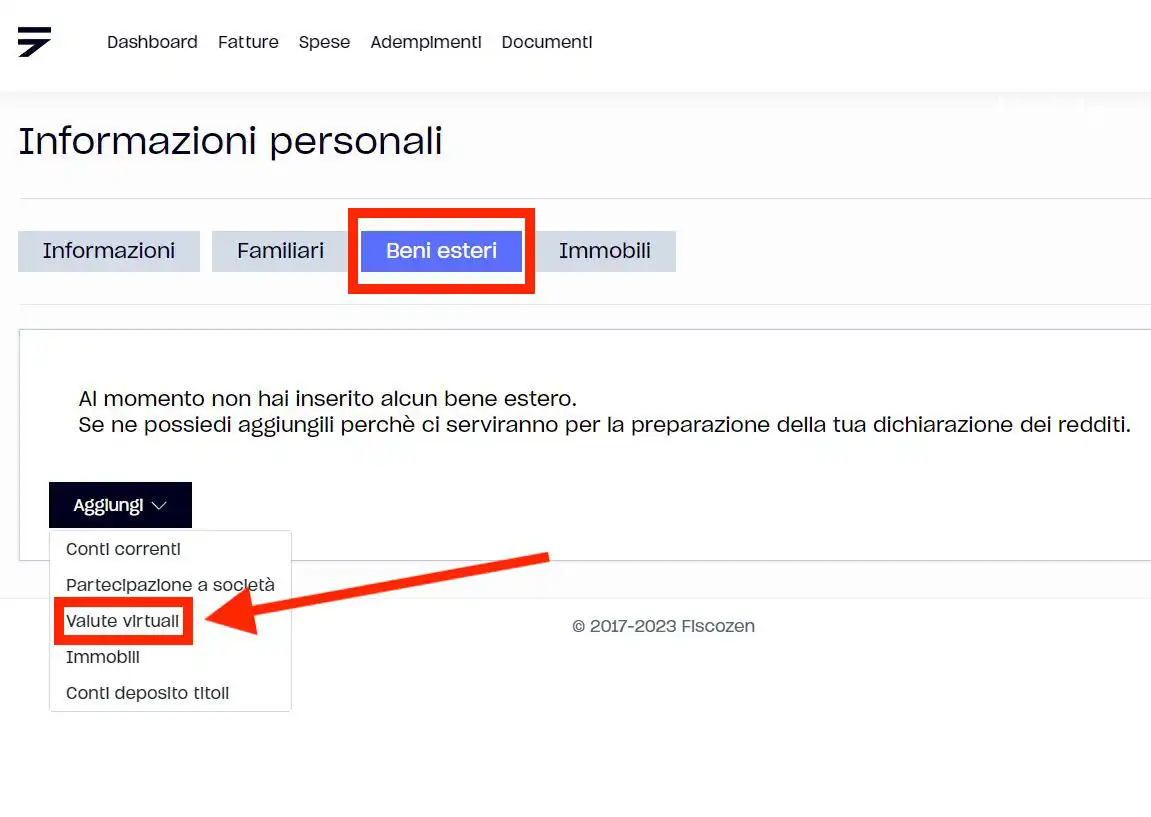

Fiscozen How To Report Crypto In Your Taxes

Declaring your cryptocurrency holdings for taxes on Fiscozen is a straightforward process. Navigate to Personal Information > Foreign Assets > Add and choose Virtual Currencies. From there, you can add various cryptocurrencies, and Fiscozen will handle the declaration process for you.

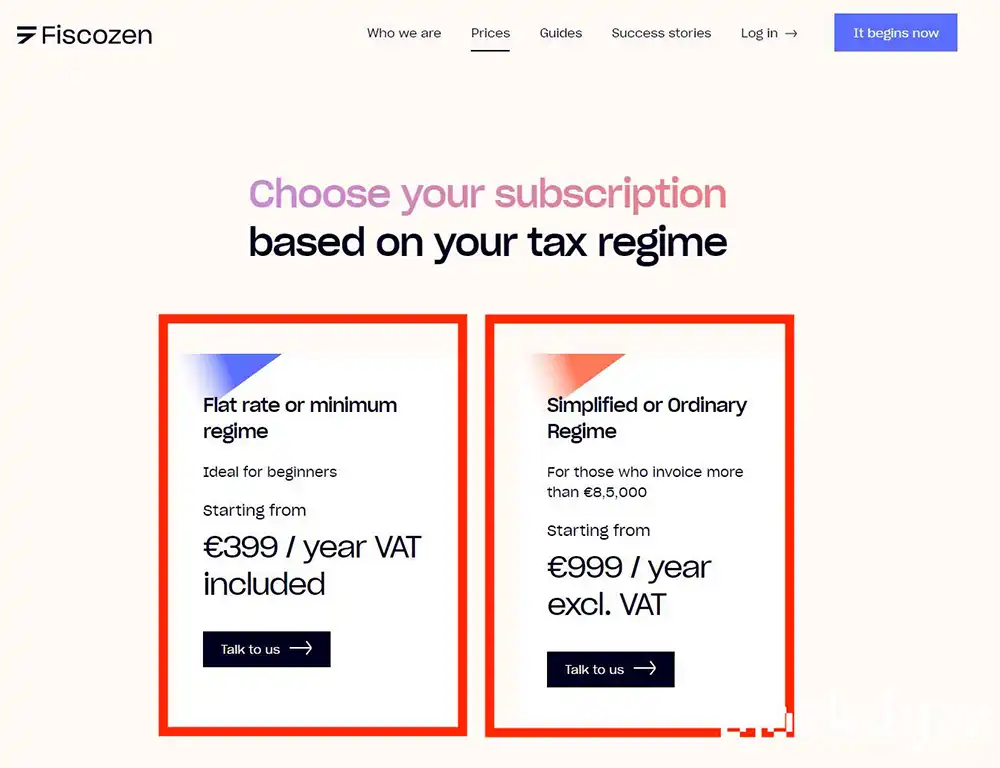

Fiscozen Prices

Fiscozen has two main plans that are based on your tax regime.

- Flat Rate or Small (Regime Forfettario o Minimi) - Ideal for Beginners. Starting from €399 / year, VAT included.

- Simplified or Ordinary (Regime Semplificato o Ordinario) - For those Invoicing Over €85,000. Starting from €999 / year, VAT excluded.

Included Services

- Accountant:

- Dedicated accountant, specialized in your business.

- The price includes a contract with a Fiscozen partner accountant of your choice, addressing all your VAT-related queries.

- Platform:

- Web and mobile application to manage your VAT Number.

- Send electronic invoices, automatically record expenses. Keep track of taxes to be paid, with forecasts up to 24 months.

- Compliance:

- Income tax declaration and all other deadlines.

- Your accountant will prepare your income tax declaration and handle other compliance matters throughout the year, ensuring you stay compliant.

Additional Services for Beginners

- VAT Number Opening for Professionals:

- For those engaged in predominantly intellectual activities.

- Within 24 hours, we open your VAT Number with the Revenue Agency and register you with the Separate INPS Management.

- Included in the subscription.

- VAT Number Opening for Sole Proprietorships:

- For businesses requiring registration with INPS for artisans or merchants.

- Includes stamps and 1 year of registration with the Chamber of Commerce.

- Cost: €200 + VAT

- Income Tax Declaration for the Previous Year:

- For newcomers to Fiscozen requiring preparation and submission of the income tax declaration for the previous year.

- Cost: €150 + VAT

| Subscription Type | Description | Price |

|---|---|---|

| Flat Rate (Regime Forfettario o Minimi) | Ideal for Beginners | €399 / year (VAT incl.) |

| Simplified or Ordinary (Regime Semplificato o Ordinario) | For those Invoicing Over €85,000 | €999 / year (VAT excl.) |

| Included Services | ||

| Accountant | Dedicated accountant, specialized in your business. | Included |

| Platform | Web and mobile application to manage your VAT Number. | Included |

| Compliance | Income tax declaration and all other deadlines. | Included |

| Additional Services for Beginners: | ||

| VAT Number Opening (Professionals) | Opening VAT Number for intellectual activities. | Included |

| VAT Number Opening (Sole Proprietorships) | Opening VAT Number for businesses requiring INPS registration for artisans or merchants. | €200 + VAT |

| Tax Declaration (Previous Year) | Income Tax Declaration for newcomers needing preparation and submission for the previous year. | €150 + VAT |

How To Get Started On Fiscozen

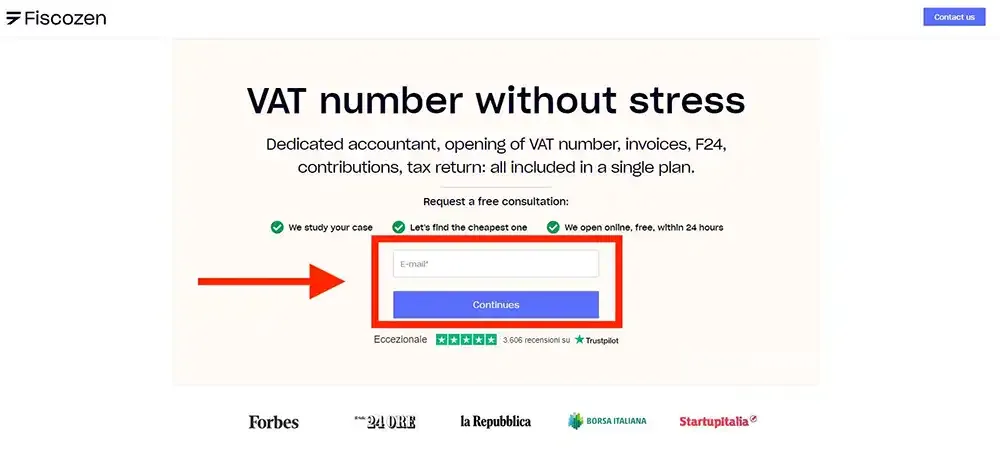

You can schedule your initial consultation with a Fiscozen accountant at no cost by simply clicking on the link below. Additionally, this link will entitle you to a €50 discount if you decide to proceed with opening an account.

👉 Claim your free consultation with Fiscozen for VAT number registration and unlock a €50 discount.

- Enter your email and click on "Continue."

- Subsequently, you'll be prompted to provide your name and surname, followed by your phone number. This process is designed to facilitate a callback for the free consultation.

- After a few hours, you will receive a call from one of the experts at Fiscozen. He will ask all the general informations about your activity, and in the suggest you which is the correct plan to get started.

Fiscozen Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Comprehensive dashboard and menu | ❌ Limited support for non-Italian activities |

| ✅ Dedicated accountant support | ❌ May not suit businesses with complex needs |

| ✅ Real-time overview of tax liabilities | ❌ Initial learning curve for new users |

| ✅ Easy management of invoices and expenses | ❌ Some features may require additional fees |

| ✅ Streamlined process for VAT number opening | ❌ Limited customization options |

| ✅ Free initial consultation |

Bottom Line

Fiscozen offers a comprehensive platform with numerous advantages, including a dedicated accountant, real-time tax insights, and user-friendly management of invoices and expenses. However, its focus on Italian activities may limit its suitability for businesses with international operations.

While the platform simplifies the VAT number opening process and provides a free initial consultation, users should be aware that some features requires additional fees. However, the price is in line with the annual cost of a traditional accountant.