UTXO Consolidation: What Is It And How To Do It

In this guide we will discover how to optimize and consolidate your UTXO (Unspent Transaction Outputs) for enhanced efficiency and lower fees.

What is UTXO Consolidation?

UTXO, short for Unspent Transaction Output, is a term that refers to the unused outputs of a Bitcoin transaction (or even other alternative cryptocurrencies). When we talk about UTXO consolidation, we're essentially discussing the process of combining multiple UTXOs into a single output. People opt for this approach to reduce transaction fees.

The idea behind UTXO consolidation is rather straightforward. Instead of having scattered and unutilized many previous transactions lying around, users can gather and merge them into a single output.

With Bitcoin, transaction fees are also calculated based on the number of Unspent Transaction Outputs (UTXOs) involved. Essentially, the more UTXOs there are, the higher the fees. This is where UTXO consolidation comes into play, as it aims to safeguard your wallet against potential increases in mempool fees by consolidating your Bitcoin holdings into a single output.

Now that we've delved into the concept of UTXO consolidation, let's take a step back and explore what exactly an UTXO is before diving further into its consolidation process.

| Term | Definition |

|---|---|

| 🔒 UTXO Consolidation | The process of combining multiple Unspent Transaction Outputs (UTXOs) into a single UTXO, reducing the number of individual transaction outputs in a wallet. |

| 🧐 UTXO Set | The collection of all unspent transaction outputs on the Bitcoin blockchain. It represents the available funds that can be spent in future transactions. |

| 💻 Coin Selection | The algorithm or method used by a wallet to choose which UTXOs to include in a transaction when sending Bitcoin. Efficient coin selection is crucial for optimizing fees and transaction size. |

| 👥 CoinJoin | A privacy-enhancing technique that allows multiple users to combine their UTXOs into a single transaction, making it difficult to trace individual UTXOs and enhancing anonymity. |

| 🪙 Fee Optimization | The process of selecting the right fee level for a transaction to ensure prompt inclusion in a block without overpaying. Consolidating UTXOs can help optimize fees by reducing the number of inputs in a transaction. |

| 💰 Fee Savings | The potential cost savings achieved by consolidating UTXOs. By reducing the number of inputs in transactions, UTXO consolidation can lead to lower transaction fees, especially during periods of high network congestion. |

| 💸 Transaction Size | The size of a transaction in kilobytes (KB), which depends on the number of inputs (UTXOs) and outputs involved. UTXO consolidation reduces the number of inputs, resulting in smaller transaction sizes and lower fees. |

| 📈 Network Congestion | The state of the Bitcoin network when there is a high volume of pending transactions, leading to increased competition for block space. UTXO consolidation can help mitigate the impact of network congestion by reducing the number of transactions needed to spend funds. |

| 💹 Opportunity Cost | The potential benefits or gains that could have been obtained by investing or utilizing funds elsewhere. UTXO consolidation allows users to maximize the value of their Bitcoin holdings by minimizing the impact of fees and optimizing transaction efficiency. |

| 🔄 Repeat Consolidation | The practice of periodically reviewing and consolidating UTXOs to maintain an optimized wallet structure. Regular UTXO consolidation can help prevent the accumulation of excessive and fragmented UTXOs, leading to more efficient and cost-effective transactions. |

What is an UTXO?

Unspent transaction outputs (UTXOs), plays a vital role in the Bitcoin and crypto world in general.

When doing a cryptocurrency transaction, the outputs involved remain "unspent" until they're utilized as inputs in another transaction. These unspent transaction outputs, or UTXOs, serve as a fundamental component of the cryptocurrency ecosystem, tracking the ownership of funds across multiple blockchains.

To draw a parallel in the world of traditional fiat currency, think of UTXOs as the equivalent of "change" or "balance" you receive after making a purchase.

Imagine you have a Bitcoin balance of 1 BTC and you fancy buying something that costs 0.1 BTC. You'd send 0.1 BTC to the seller, leaving you with an unspent transaction output of 0.9 BTC. This remaining UTXO becomes your funds for future purchases or transfers.

Now, let's talk storage. All these UTXOs find their place on the blockchain, a public ledger accessible to anyone. Every single one UTXO has a unique identifier called an "outpoint." This identifier comprises the hash of the previous transaction and the index of the output within that transaction, acting as a digital fingerprint of sorts.

When it's time to create a new transaction, you hold the power to choose one or more UTXOs to utilize as inputs.

For instance, let's say you have two UTXOs worth 2.5 BTC and 2 BTC left from a previous Bitcoin transaction. You stumble upon an item that costs 3 BTC, which means you must combine both UTXOs to cover the bill. The transaction reaches completion when you receive "change" in the form of a fresh UTXO worth 1.5 BTC.

It's crucial to note that the sum of the UTXOs must be equal to or greater than the amount being sent (plus any transaction fees). Once a transaction uses a UTXO, it becomes a one-time deal. No re-use allowed.

Each UTXO has its unique address, ensuring that coins don't suffer from the dreaded "double spending" dilemma. When you receive a UTXO after a transaction, it's common to encounter two addresses associated with it: one for the recipient and another for the change address. The change address serves as the destination for your leftover UTXO.

UTXO Example

Bitcoin (but also several others types of blockchains) employs the unspent transaction output (UTXO) model to keep track of coin ownership.

When someone sends Bitcoin to another individual, they transfer one or more Bitcoin UTXOs to the recipient's public key. These UTXOs act as tangible representations of digital currency, akin to physical coins. Just like handing over a coin to someone, once a UTXO is used in a transaction, it ceases to be in your possession.

It finds a new address on the blockchain, forever etched in the annals of transaction history. If there's any remaining balance after the transaction, you'll receive back a fresh UTXO.

To truly understand this concept, let's use another example.

John, is a Bitcoin enthusiast who wants to send 2.5 BTC to his friend Sarah. John opens his Bitcoin wallet and discovers a couple of available UTXOs.

The first UTXO stems from a previous transaction where John received 1.5 BTC. Another UTXO, acquired from a different transaction, adds 2 BTC to his funds. To send the 2.5 BTC, John must utilize both of these UTXOs as inputs.

Once the transaction is finalized, two outcomes materialize. Sarah, the fortunate recipient, will be the proud owner of 2.5 BTC. She'll possess a shiny new UTXO worth that amount.

The surplus between John's total input value (3.5 BTC) and the amount sent (2.5 BTC) stands at 1 BTC. This remaining balance is returned to John as a fresh UTXO, ready to facilitate other transactions in the future.

How UTXO Consolidation Works

Now, let's get a but more inside of the UTXO consolidation world. In the ever-evolving landscape of blockchain technology, this process offers an help to minimize complexity and optimize transactions.

But how exactly UTXO consolidation works? Well, think of it as an amalgamation of unspent transaction outputs into a single output.

When conducting a transaction, you must incorporate all your UTXOs as inputs. Consequently, the greater the number of UTXOs you have, the more inputs you'll need, inevitably inflating your transaction fees. In fact, in Bitcoin fees are calculated not on the amount of BTC sent, but rather on the dimensions of the transaction (more inputs = more virtual bytes).

By consolidating your UTXOs, you streamline the process, diminishing the number of inputs and economizing on fees.

Furthermore, UTXO consolidation paves the way for the creation of smart contracts, injecting a touch of sophistication into the digital landscape. By consolidating multiple UTXOs into a single output, you can establish an output that can only be spent under specific predetermined conditions. This feature opens the door to a myriad of possibilities, such as the implementation of escrow contracts, bolstering trust and security in transactions.

Now, let's explore the consolidation techniques at your disposal: manual and automatic consolidation.

- Manual consolidation empowers you to take the reins of your transaction destiny. You craft a new transaction, carefully selecting your desired UTXOs as inputs, and channel the entire sum to yourself in one seamless motion.

- Automatic consolidation provides a hands-off approach to streamlining your UTXOs. Your wallet takes charge, periodically generating new transactions that consolidate multiple UTXOs into a single output. This autonomous consolidation process occurs without requiring any input from you.

Why UTXO Consolidation Is Important?

In Bitcoin, UTXO consolidation finds its prime spot on the main chain. Unfortunately, the steadily rising fees that have cast a shadow over the network are a problem for who has many UTXOs.

As these fees soar to unprecedented heights during some specific periods, it becomes crucial to keep the number of UTXOs in your wallet to a minimum. By minimizing the UTXO count, you set the stage for reduced fees when the time comes to spend your BTC.

Now, let's explore a common scenario that many Bitcoin users find themselves in: cold storage on the main chain, or "hodling". It involves safeguarding your private keys for years on end, patiently waiting for the right moment to unlock the vault of your digital wealth, or also pass it to your heirs.

But here's a thought-provoking question: why burden yourself with a multitude of UTXOs when a streamlined approach through UTXO consolidation promises to alleviate future headaches?

In fact, consolidating your UTXOs today means you will not have to deal with the high possibility of higher fees in the future. It's a strategic move that shields you from the turbulence of high transaction costs. By consolidating your UTXOs now, you're essentially putting your wallet "in order" for the future.

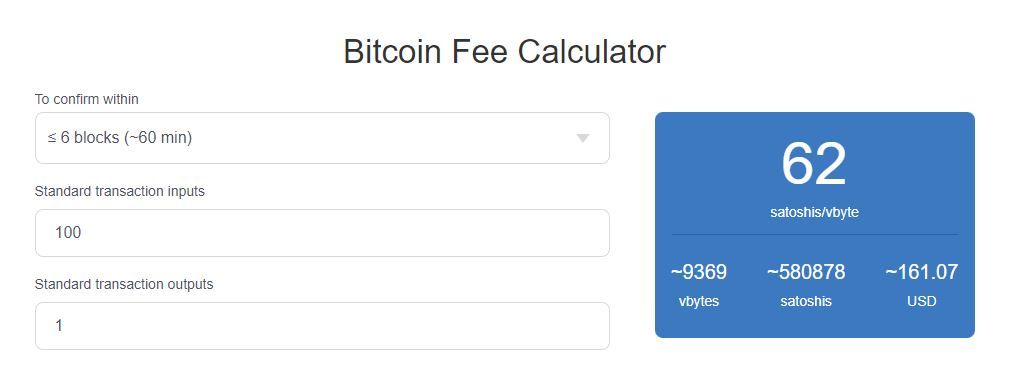

Example: Bitcoin Fees for an UTXO Consolidation with 100 UTXOs

Imagine you find yourself in possession of a staggering 100 UTXOs, accumulated over some years of buying and hodling. The time has come to transfer all your hard-earned Bitcoin to another destination, but the task at hand is not as straightforward as it seems.

At the time of writing, the average fee rate stands at a daunting 62 satoshis/vbyte, and with the weight of these numerous UTXOs, the total cost of this transaction would be a mind-boggling $161 USD. This same transaction in BTC value, but with just 10 UTXOs would be of around $16 USD, or $2 USD with only one UTXO.

Considering also the recent Ordinals craze, experts suggest that fees on the main chain are expected to climb even higher in the coming years. So not only will you face the challenge of shelling out $161 USD in fees just to spend/send your BTC, but this figure could potentially skyrocket to even greater heights.

How To Consolidate UTXOs in Practice

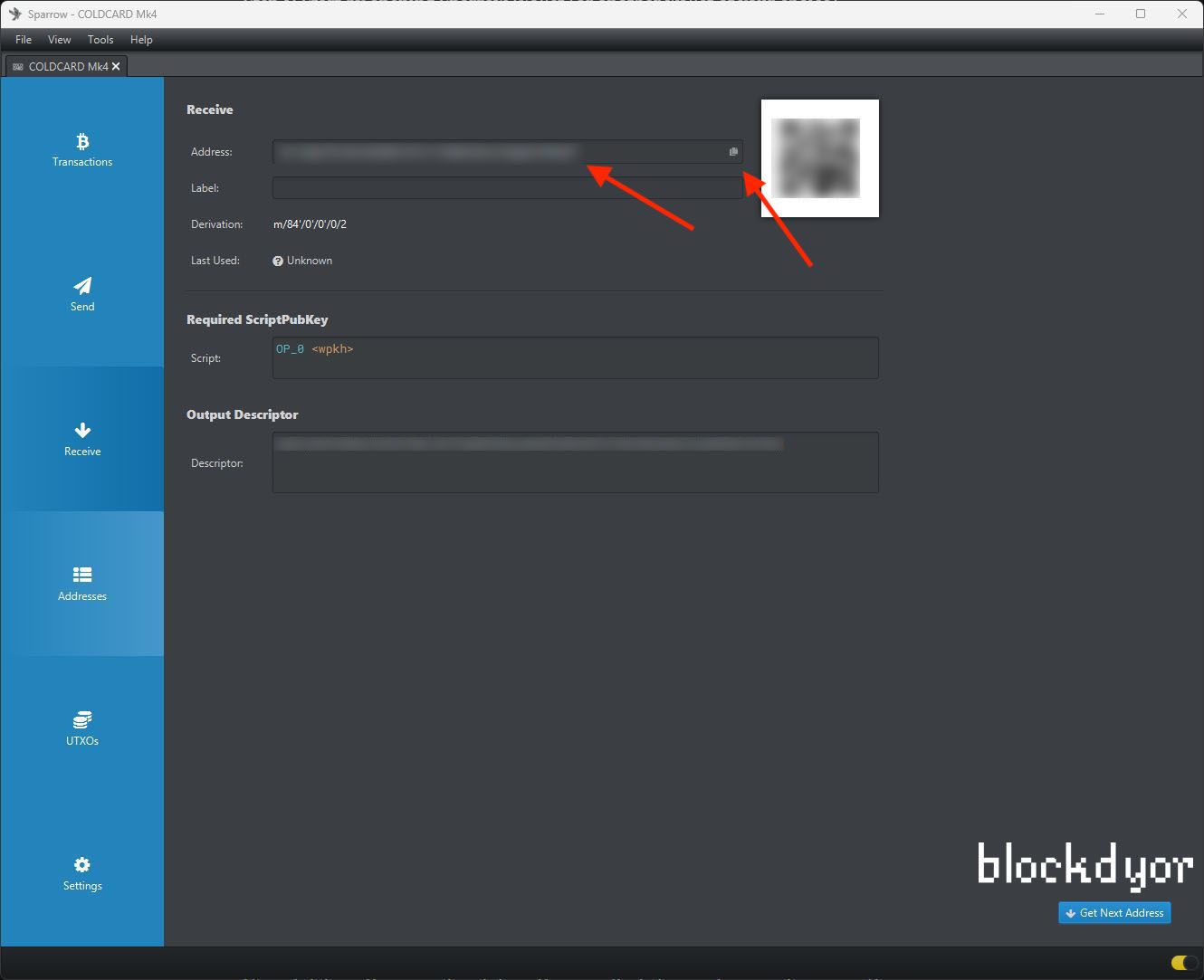

To begin, you'll need to generate a fresh receiving address within the wallet you wish to consolidate your UTXOs to.

This receiving address will serve as the destination for the UTXOs you aim to consolidate. It doesn't matter whether you create this receiving address from the same wallet you're sending from. Once the UTXOs are sent and received at this address, they will merge into a single UTXO, representing your consolidated balance.

Now, here's the crucial point: ensure that you include all your UTXOs as inputs when initiating the transaction. This step is paramount to the consolidation process. By including every single UTXO as an input, you merge them into a unified output, effectively consolidating your funds into a single entity.

Be aware that this process incurs a transaction fee, just like any other transaction. It's important to keep in mind that the aim is to send your total balance to the new address, leaving no UTXO behind. Failure to include all outputs would result in a regular transaction rather than a consolidation.

Technically speaking, the optimal moment for UTXO consolidation would be when fees plummet to a mere 1 sat/vbyte. However, those times may be a distant memory, so it's essential to be flexible and willing to accept higher fees, considering the current fee landscape.

UTXO Consolidation With Sparrow Wallet: Step By Step Guide

When it comes to UTXO consolidation, virtually all wallets offer this functionality. However, in this particular example, I have chosen to highlight the user-friendly nature of Sparrow Wallet.

- Start by opening Sparrow Wallet (or another wallet of your choice).

- Within Sparrow Wallet, locate the "Receive" button and click on it. Get the latest unused receiving address, and copy it.

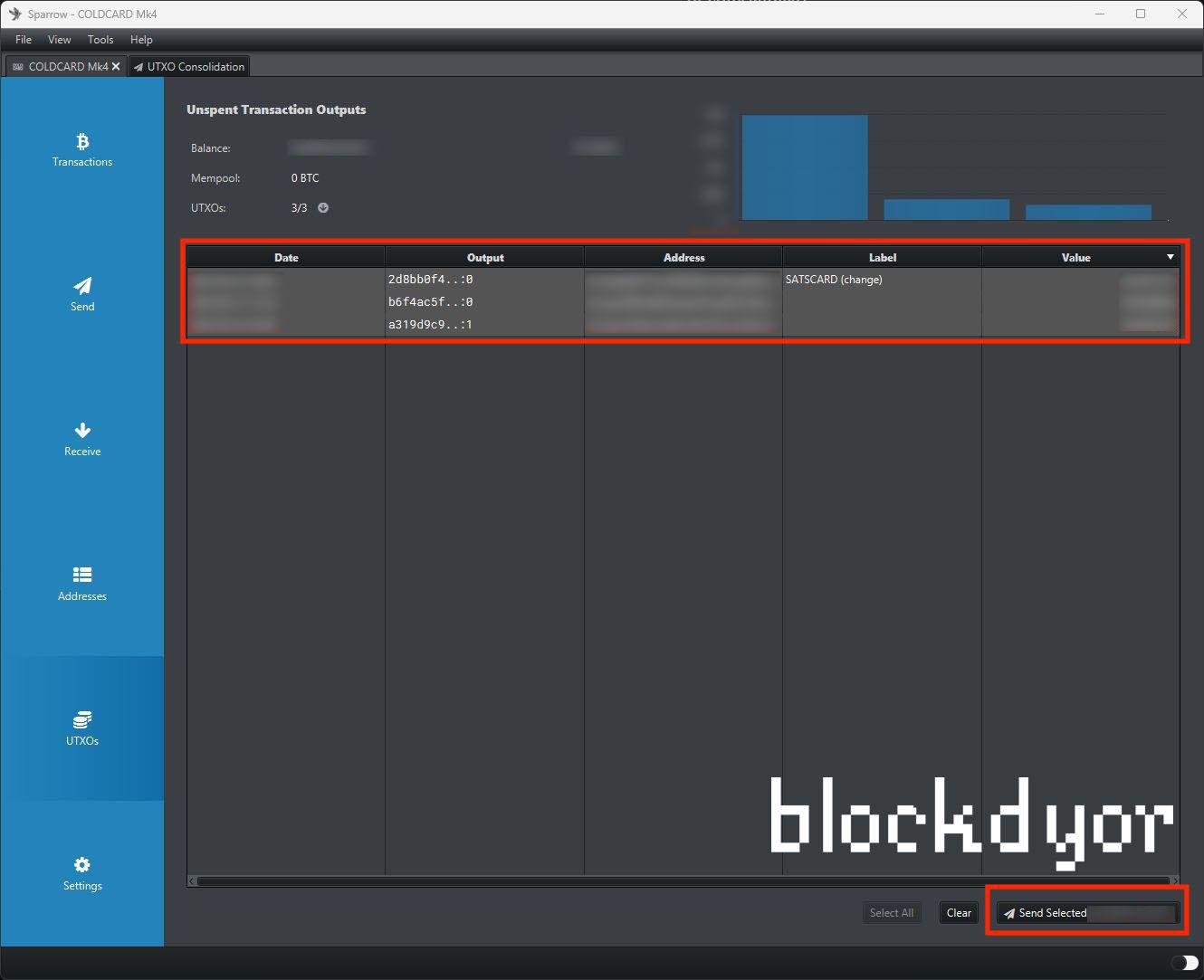

- Navigate to the UTXOs section of Sparrow Wallet, and with a simple click, select all the UTXOs you wish to consolidate. Then click on the button "Send Selected".

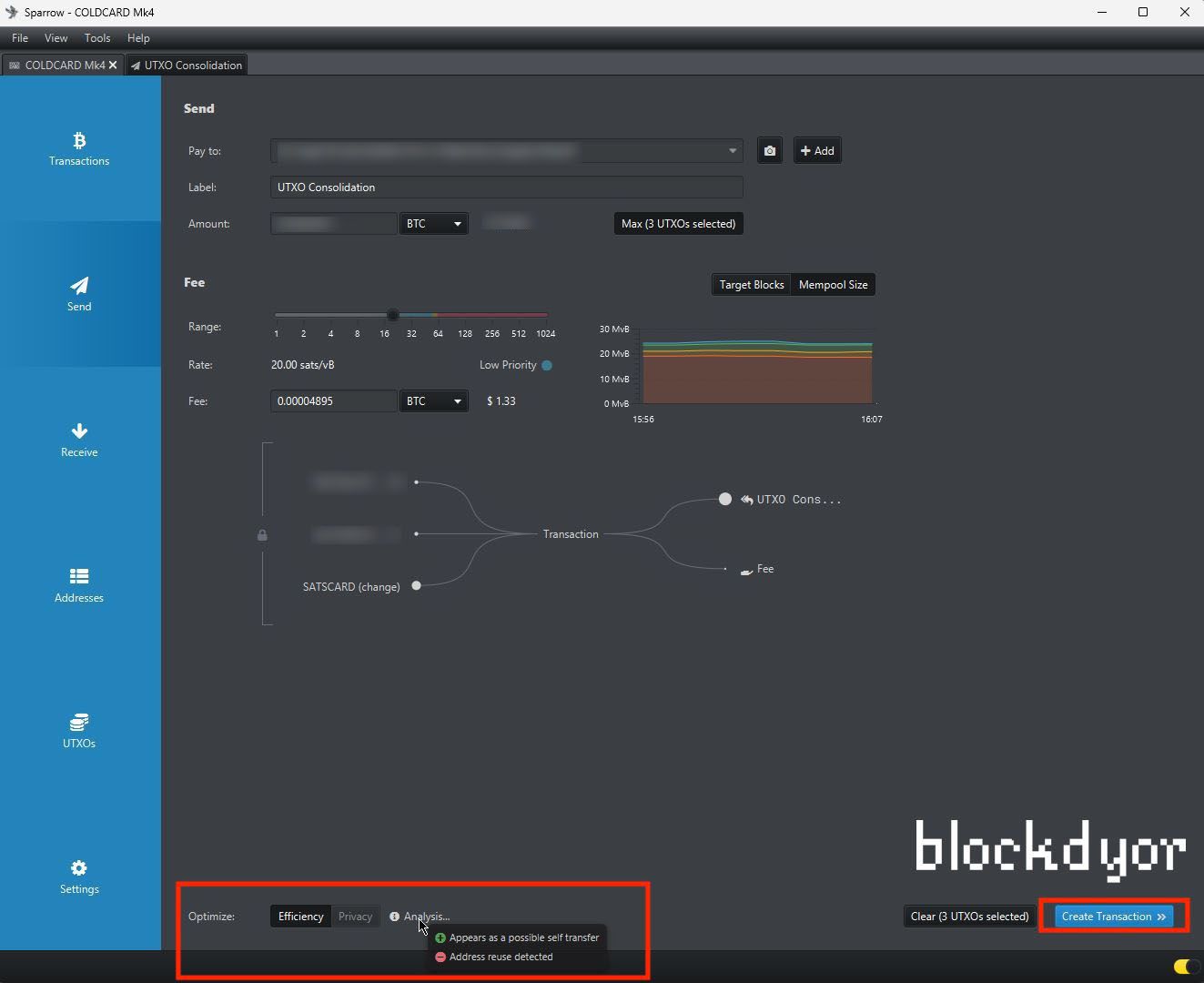

- The time has come to consolidate your UTXOs. Paste the previously copied receiving address into the designated "Pay To" field. Add a label of your choice, fine-tune the fees range. Notice also that Sparrow recognizes the transaction as a "Self transfer". Click on "Create Transaction".

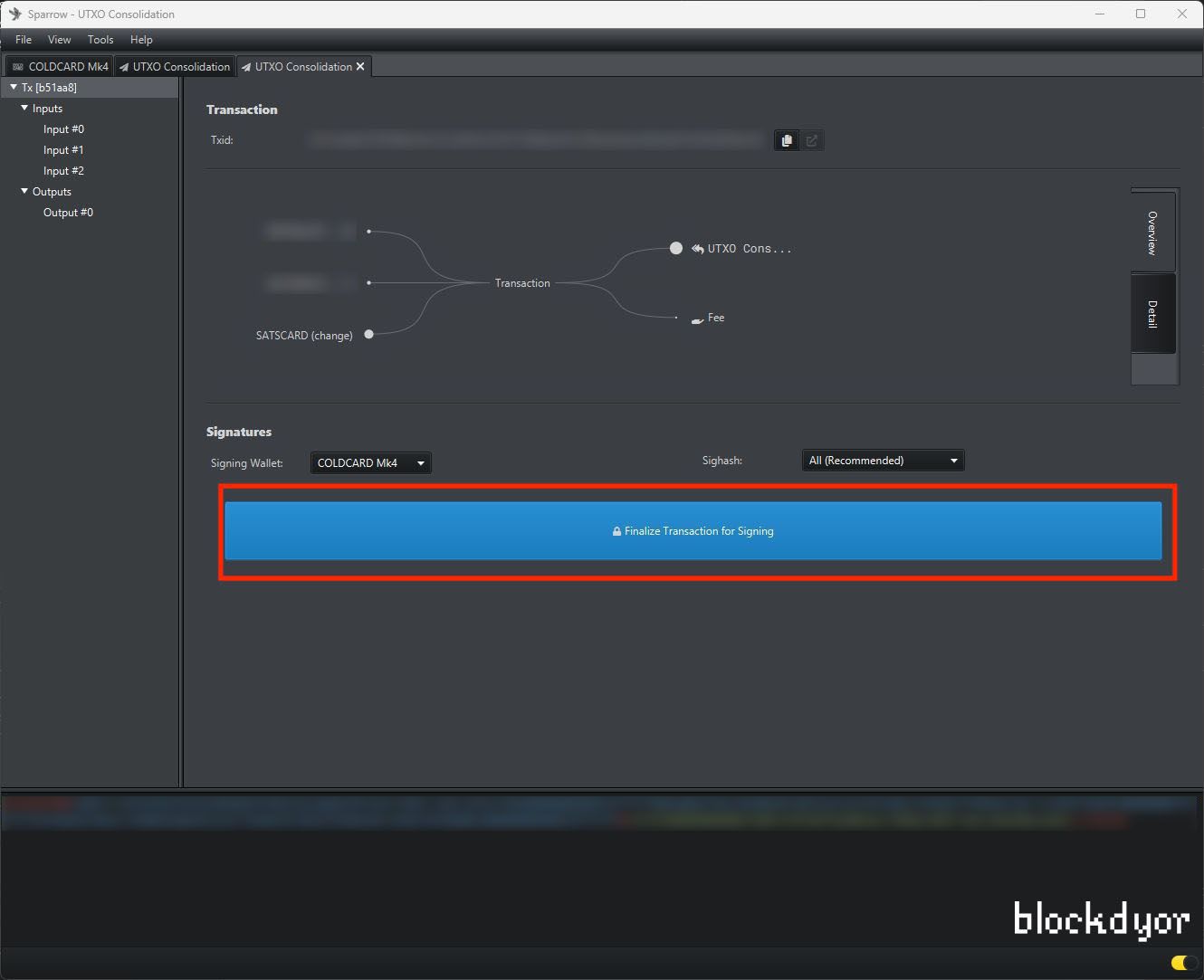

- You can verify that in this example, we are proceeding to consolidate 2 UTXOs as input into just one UTXO as an output (and 1 change). After reviewing all the details, you can proceed to sign the transaction by clicking on "Finalize the transaction for Signing".

- Wait a few blocks for confirmation. You have just consolidated your UTXOs!

UTXO Consolidation and Privacy

Now, let's address a significant concern surrounding UTXO consolidation: privacy.

When you consolidate UTXOs, all those previously existing UTXOs become linked to the new single address. Picture it as a convergence of transactions. Each time you receive some Satoshis, a transaction is created, and under each address, you have one or more transactions.

Consolidation, then, involves taking these multiple transactions and merging them into a single transaction, thus uniting all Satoshis under one umbrella.

While this consolidation optimizes fees when spending your funds, it comes at a cost to privacy, as all transactions become connected with each other.

Another privacy challenge linked to consolidation arises when, after consolidating all your Unspent Transaction Outputs (UTXOs), you decide to make a purchase, such as buying goods or services, using that specific UTXO. If your entire Bitcoin holdings are within that UTXO, the seller can essentially view your total capital or, at the very least, your entire worth within that wallet, even if you are only spending a portion of that UTXO.

Pros and Cons of the UTXO Model

The key difference between the unspent transaction output (UTXO) model and the account-based model lies in how transactions are tracked and managed.

In the account-based model, commonly used by fiat banks (and some blockchains), all transactions are recorded and tracked within the account balance. It operates on the principle of a single account per user, where the balance represents the total amount of currency associated with that account. The account model maintains a continuous record of each user's balance, and any transaction activity affects that balance directly.

On the other hand, the UTXO model takes a different approach. Instead of tracking transactions within an account balance, it tracks each individual transaction separately. In this model, currency is treated as discrete objects or "unspent transaction outputs".

Each UTXO retains a history of its transaction origins and can be spent individually as needed. Ownership verification is required only when the UTXO is sent to someone else.

| Pros | Cons |

|---|---|

| ✅ Scalability: High transaction processing speed | ❌ Higher transaction fees |

| ✅ Authentication: Tracing inputs for identifying double-spends | ❌ Inefficiency in space utilization |

| ✅ Off-chain transactions with security and verifiability | ❌ Significant data storage requirements |

| ✅ Support for language-agnostic smart contracts |

Bottom Line

In conclusion, UTXO consolidation plays a crucial role in optimizing your Bitcoin (and also other altcoins) transactions and minimizing fees. By following a few key steps, you can "unite" your UTXOs and minimize costs in the future.

It's important to choose a reliable wallet that is "UTXO consolidation friendly". Consider options like Sparrow Wallet, Blue Wallet or other popular wallets that provide user-friendly consolidation features.