Roxom Review 2025: Trade The Global Markets With Bitcoin

Who said that Bitcoin is not a medium of exchange, when there is actually, right now in this moment an exchange with Bitcoin-denominated market for global assets, combining centralized and decentralized elements for seamless trading?

What is Roxom?

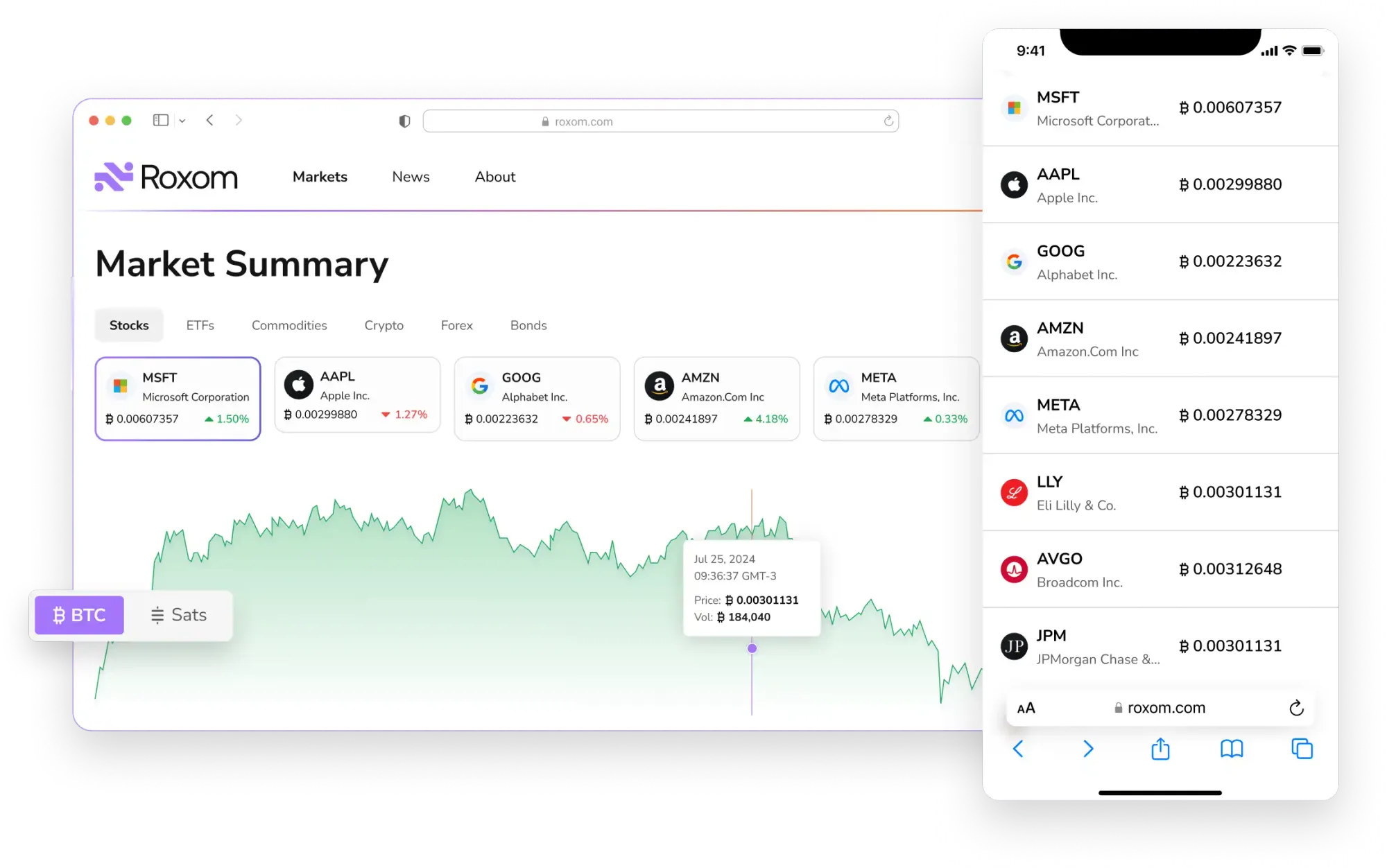

Roxom is a Bitcoin-denominated financial platform designed to integrate traditional and crypto markets under a single, borderless system. It provides a trading ecosystem where stocks, commodities, bonds, and derivatives are all priced and settled in Bitcoin, without any dependence on fiat currencies.

Backed by prominent investors, Roxom secured $4.3 million in seed funding led by Tim Draper, a well-known Bitcoin advocate and founding partner of Draper Associates. This investment underscores confidence in Roxom’s vision of reshaping financial markets with a Bitcoin-based trading infrastructure.

Inspired by historical financial powerhouses like the Amsterdam and London Stock Exchanges, Roxom envisions a decentralized, permissionless marketplace driven by Bitcoin’s neutrality and global accessibility.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

How Roxom Works?

Roxom is a trading platform where all assets—stocks, commodities, and more—are priced in Bitcoin. Instead of using dollars or euros, you trade directly in BTC.

Think of it like buying a car. In a traditional market, a car might cost $10,000. In a Bitcoin-denominated market, that same car would be priced in BTC, say 0.25 BTC. No conversion, no fiat—just Bitcoin as the standard unit of account.

Roxom applies this concept to financial markets. You can buy and sell assets without needing a bank or fiat currency. Right now, the platform is in paper trading mode, allowing users to practice with virtual Bitcoin. Once live trading begins, Roxom will let people trade real assets using Bitcoin from anywhere in the world.

Core Features of Roxom

Roxom offers a comprehensive suite of tools and financial instruments to create an easy to use Bitcoin-based trading environment.

Roxom Terminal

Roxom offers a real-time terminal/dashboard that converts conventional asset prices into Bitcoin terms. This tool helps investors analyze long-term trends and rethink asset valuations beyond fiat-based perspectives. For instance, it showcases how many traditional assets have experienced long-term devaluation against BTC, urging a paradigm shift in financial analysis.

Hybrid Exchange Model

Roxom’s exchange model balances centralized efficiency with a path toward decentralization:

- Centralized Phase: Initially, Roxom operates as a regulated exchange for BTC-denominated trading of stocks, ETFs, and commodities, ensuring smooth onboarding and liquidity.

- Decentralized Evolution: The platform aims to transition toward a Bitcoin Layer 2 solution, Roxolid, enabling permissionless trading through technologies like rollups or the Lightning Network.

Bitcoin-Native Financial Instruments

Roxom introduces innovative BTC-denominated financial products:

- Options & Derivatives: Contracts settled in Bitcoin, providing risk management tools tailored to BTC volatility.

- Bonds (B.ROM): Monthly bond auctions where investors fund Roxom’s market-making algorithms (ROMMA) in exchange for Bitcoin-denominated returns.

- Bitcoin IPOs & Dividends: Companies can list shares on Roxom and issue BTC-based dividends. Roxom itself pioneers this model, with its own IPO priced via a Dutch auction system.

Market-Making via ROMMA

Roxom’s proprietary algorithm, ROMMA (Roxom Options Market Making Algorithm), facilitates liquidity by issuing bonds and managing options trading. Investors who deposit BTC receive yields, while ROMMA ensures deep liquidity in BTC-denominated markets.

Roxolid Layer 2 Scaling Solution

To enhance efficiency and scalability, Roxom is developing Roxolid, a Bitcoin Layer 2 solution. Key features include:

- Optimistic & ZK Rollups for high-throughput trading.

- Cross-Chain Interoperability to enable seamless asset transfers.

- Decentralized Governance via a future DAO model.

How To Start Trading On Roxom

Getting started with Roxom is quite simple, because it looks like any other trading platform, with the only difference that all the securities and commodities are denominated in Bitcoin. This is the first thing you have to wrap around your head before getting to know Roxom.

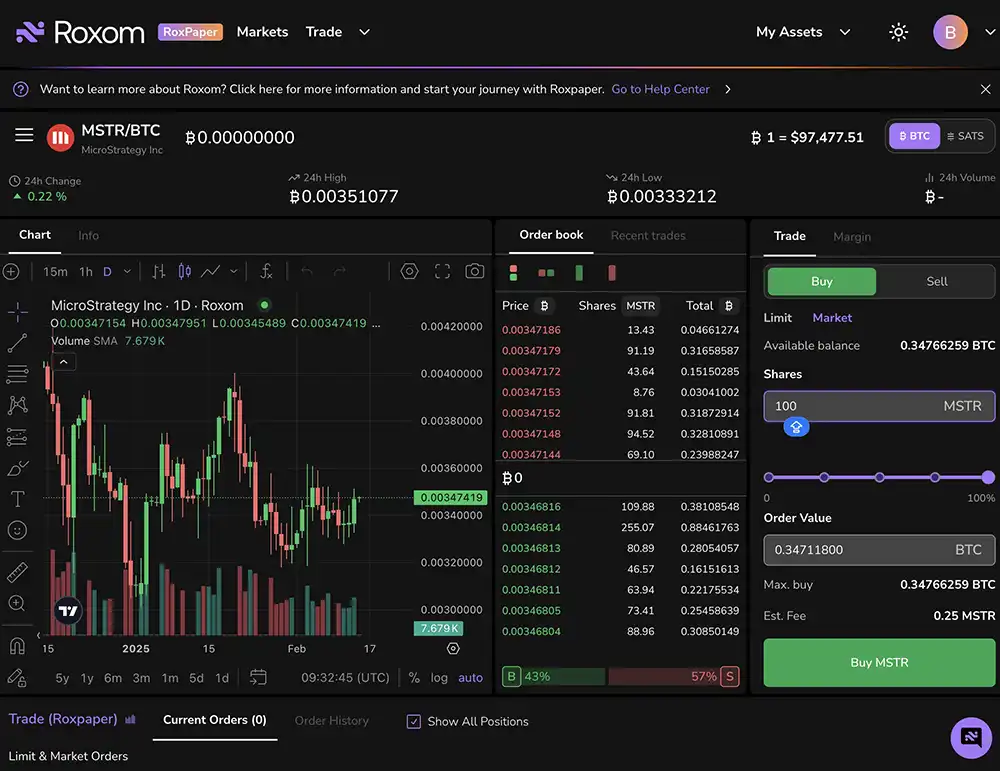

On the main trading page, you’ll find an overview of the markets, your assets, and a section called “RoxPaper,” which likely provides information about the platform. There’s also a help center for users who need guidance.

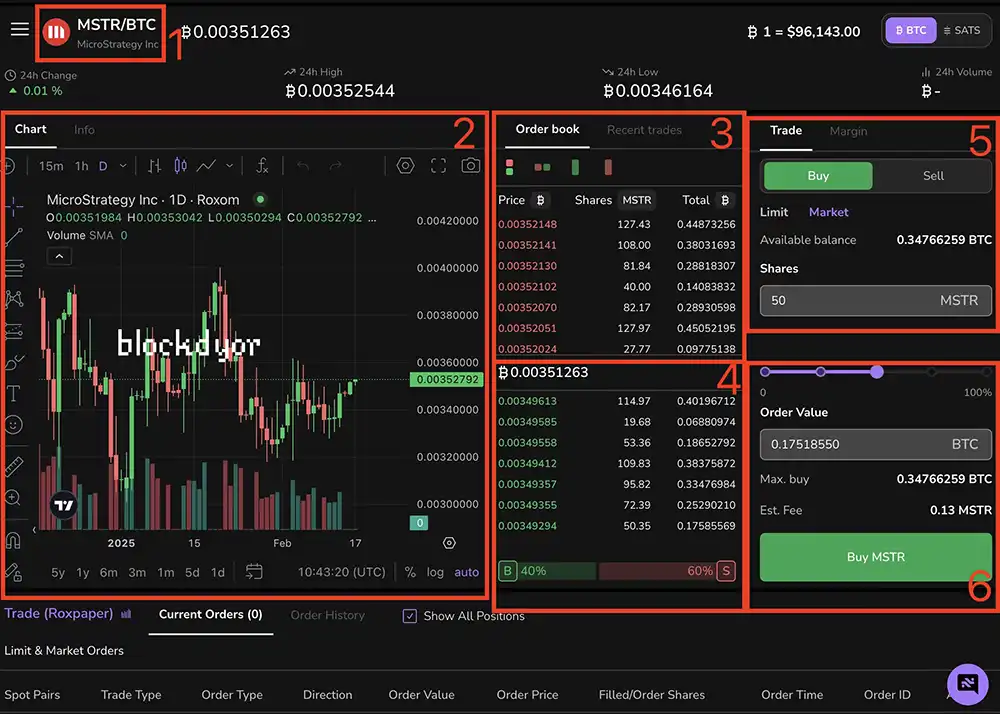

The trading interface itself is straightforward. At the top, you can see the price of an asset (1)—in this case, MicroStrategy (MSTR)—and its value in BTC. You’ll also find stats like how much the price has changed in the past 24 hours, the highest and lowest prices of the day, and recent trading activity (2).

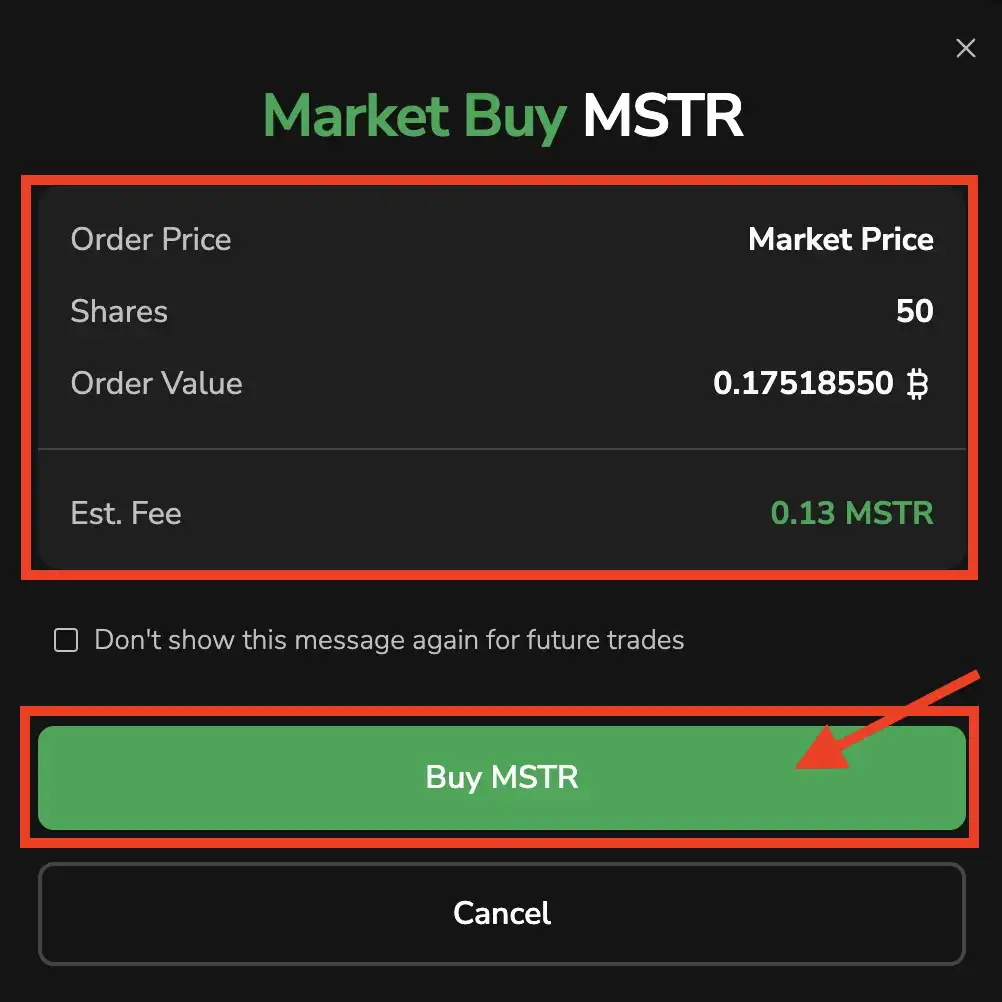

Below that, there’s an order book, which shows buy (3) and sell offers (4) from other traders. If you want to place a trade, you can choose between two types of orders: a market order, which buys or sells immediately at the best available price, or a limit order, where you set your own price and wait for someone to match it. There’s also an option for margin trading, meaning you can trade with borrowed funds to increase potential profits (or losses).

Your available Bitcoin balance is displayed, and you can decide how much to spend. Once you enter the amount of shares or BTC you want to trade (5), the system will estimate the order value and any fees before confirming the transaction (6).

At the bottom of the page, you can track your active orders and see past trades. This section keeps a record of your trading activity, making it easy to manage positions and adjust strategies as needed.

Overall, Roxom works like a traditional stock trading platform but operates entirely in Bitcoin. It’s designed for users who prefer to keep their investments in BTC while gaining exposure to assets like stocks and commodities.

Roxom Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Bitcoin-denominated trading for stocks and commodities | ❌ Currently in paper trading, not live yet |

| ✅ No need to convert BTC to fiat | ❌ Limited asset selection at launch |

| ✅ Inherits Bitcoin’s permissionless nature | ❌ Unclear regulatory status |

| ✅ No capital gains tax on inherited assets | ❌ Liquidity may be low at first |

| ✅ Potential for decentralized ownership | ❌ Requires a solid understanding of Bitcoin trading |

| ✅ Built-in order book and margin trading options | ❌ New platform with an untested track record |

| ✅ Transparent fees and real-time price tracking | ❌ Unknown withdrawal and deposit methods |

The Future of Roxom

Roxom isn’t just another exchange—it’s an attempt to redefine financial markets through Bitcoin. By denominating assets in BTC, it challenges fiat hegemony and offers an alternative to inflationary monetary systems.

If successful, Roxom could establish itself as the premier Bitcoin-native marketplace, akin to the NYSE but built entirely around Bitcoin’s neutrality and censorship resistance.

Conclusion

With its focus on a Bitcoin-settled financial ecosystem, Roxom brings an innovative approach to trading, investing, and capital markets. By integrating traditional assets, derivatives, and decentralized technology, it aims to become a global financial hub where Bitcoin is the common denominator.

Whether you’re an investor, trader, or entrepreneur, Roxom offers a glimpse into a future where Bitcoin is at the heart of global finance.

Roxom Evaluation

With virtually no competition, Roxom is positioning itself as the go-to platform for Bitcoin-denominated asset trading. Backed by major investors like Tim Draper, it aims to redefine how stocks and commodities are traded using BTC.

Reputation: Although still in its early stages, Roxom has gained attention for introducing Bitcoin-based trading for stocks and commodities. The involvement of prominent investors signals confidence in its potential.

Technology: Roxom enables direct trading of financial assets using Bitcoin, eliminating the need for fiat conversion. The platform is designed to be transparent and efficient, with an integrated order book and margin trading options.

Customer Service: Currently, support is limited, as the platform is still in paper trading mode. As Roxom moves toward live trading, its ability to provide reliable assistance will be key to user trust.

Fees: While specific fee details have yet to be fully disclosed, Roxom aims to offer competitive and transparent pricing. Since trading is in BTC, users avoid hidden fiat conversion costs.

Ease of Use: The platform is built for seamless Bitcoin trading, with a user-friendly interface that mirrors traditional stock trading platforms. The biggest adjustment for users is thinking in BTC instead of fiat, but Roxom simplifies the process with clear pricing and trading tools.