Buying Bitcoin with the Lowest Fees: The Ultimate 2025 Guide

Why fees matter when buying bitcoin? The concept is straightforward: lower fees mean you get more satoshis for the same amount of fiat. This makes choosing an app, exchange, or service with minimal costs a critical factor for anyone trying to maximize their Bitcoin holdings.

Sometimes buying Bitcoin with the lowest fees is the only thing that matters. Not everyone is focused on using privacy-focused exchanges, such as non-KYC platforms, which often come with higher premiums for Bitcoin in exchange for anonymity. For some, privacy isn’t the top concern—they simply want the best value for their money. Their goal is straightforward: to get the highest number of satoshis for the amount of fiat they’re willing to spend.

In this review, we’ll break down the best options for purchasing Bitcoin at the lowest cost. We’ll highlight exchanges and apps that offer the best deals, considering spreads, fees, and total expenses, so you can make an informed decision.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

What Contributes to the Total Cost?

The “fee” you see listed on an exchange is only part of the story. The total cost also includes something less obvious—called the spread—which can significantly impact the final price you pay.

Fee

This is the explicit charge you see. It might be a fixed rate or a percentage, and some platforms offer discounts or even waive fees entirely for recurring purchases (e.g., dollar-cost averaging). Fees are a primary way exchanges generate revenue.

Spread

The spread is trickier because it’s not always "transparent". It’s essentially the difference between the buy price and the sell price of Bitcoin on the platform. To simplify, it’s a premium added by the exchange. The spread can vary based on market volatility, your location, and the exchange’s policies. Since it’s not clearly listed, it can feel like a hidden cost, making it harder to calculate and compare across services.

So, to get the best deal, it’s important to consider not just the fees but also the spread. This helps you avoid paying more than necessary when purchasing Bitcoin.

Where to Buy Bitcoin with the Lowest Fees

Here’s a list of top exchanges and apps that focus solely on Bitcoin as their primary offering. These platforms tend to provide better services and often have lower fees compared to multi-asset platforms.

River

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| River Financial | 🇺🇸 + more | 1.00% / 1.00% | ⭐⭐⭐⭐ 61/100 |

👉 Click here to join River Financial and earn up to $100 in bonus Bitcoin when you buy.

Why We Chose It

River is a platform designed for Bitcoin-only transactions. It offers users the ability to buy Bitcoin without any fees on recurring orders and a competitive 1.00% fee on one-time purchases. Bitcoin can also be sold for fiat on the platform.

The platform is well-crafted, providing a seamless experience through its web app as well as iOS and Android apps. With a strong emphasis on security, full reserve custody, and smooth integration with the Lightning Network, River offers a solid choice for both new and experienced Bitcoin investors.

Fees Breakdown

In addition to the spread, which is variable, a River Fee is applied, which is a percentage-based fee that depends on the order size. The fee schedule for both buy and sell orders is outlined below:

| Order Size | River Fee |

|---|---|

| Up to $1,000,000 | 1.00% |

| >$1,000,000 to $5,000,000 | 0.70% |

| >$5,000,000 to $15,000,000 | 0.40% |

| >$15,000,000 | 0.25% |

| All recurring buy orders | 0.00% |

For recurring buy orders, fees are waived starting seven days after the order is set up. For daily or hourly recurring orders, the 8th day and onward will be fee-free. For weekly recurring orders, the second order and onward will have no fees. The initial order of a recurring purchase will follow the standard fee schedule (see above).

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ User-friendly interface | ❌ Limited availability outside the USA |

| ✅ 100% full reserve custody | ❌ Does not support certain US states like New York, Nevada, and Idaho |

| ✅ Wide range of payment methods | ❌ Fees (and spread) may be higher compared to some other platforms |

| ✅ Available via web-based & apps |

Overview

River Financial is focused on providing an efficient and cost-effective way to invest in Bitcoin, with a clear emphasis on fees and overall costs. Launched in 2019 and based in San Francisco, River caters to both new users and experienced investors, offering a Bitcoin-only platform. This focus helps keep fees competitive while ensuring a dedicated approach to Bitcoin transactions.

One of the platform’s key selling points is its fee structure, which is transparent and easy to understand. River’s Dollar Cost Averaging (DCA) feature stands out, as it allows users to make regular Bitcoin investments without paying any fees, helping to reduce the impact of price fluctuations over time. This can be especially valuable for users looking to minimize transaction costs.

In addition to its low-cost investment options, River also integrates the Lightning Network, enabling fast and affordable global Bitcoin transactions. The ability to set Target Price Orders further enhances the platform’s appeal, as users can automate their purchases based on specific price targets without additional fees.

While River is currently available only in the United States, its clear focus on providing a straightforward, cost-conscious approach to Bitcoin investment, coupled with features like self-custody automation and inheritance planning, makes it a strong contender for anyone looking to enter or continue in the Bitcoin market.

Full Review

Strike

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Strike | 🇺🇸 🇪🇺 🇬🇧 + more | 0.99% / 0.99% | ⭐⭐⭐⭐ 73/100 |

👉 Join Strike with our referral code J4D4TJ and get $100 in fee-free Bitcoin trading.

Why We Chose It

Strike is an excellent choice for those looking to minimize fees while trading Bitcoin. With trading fees starting as low as 0.99%, the platform remains competitive, especially for active traders. The fee structure is straightforward, and users benefit from fee-free auto-withdrawals once a set threshold is met, allowing for easy access to their funds without extra costs. This makes it a cost-effective solution for those who prioritize low fees.

Additionally, Strike offers zero fees on recurring buy orders for Dollar-Cost Averaging (DCA) after the first week (for hourly and daily purchases) or the second purchase (for weekly and monthly purchases). This feature is a great advantage for long-term investors who want to avoid transaction fees eating into their regular investments. Whether you’re buying, selling, or transferring Bitcoin, Strike delivers transparent and fair pricing, making it a top choice for cost-conscious Bitcoin users.

Fees Breakdown

Strike keeps its fees low and predictable. Fees are calculated as a percentage of the trade size and are determined by different tiers based on your monthly trading volume. Generally, the more you trade, the lower your fees will be. In addition to the fees, there is also a spread, which is variable and may differ depending on the country.

| Monthly Trading Volume | Fee |

|---|---|

| <$250 | 0.99% |

| $250 - $2,000 | 0.95% |

| $2,000 - $5,000 | 0.89% |

| $5,000 - $50,000 | 0.79% |

| $50,000 - $500,000 | 0.69% |

| $500,000 - $5,000,000 | 0.59% |

| $5,000,000 - $15,000,000 | 0.49% |

| >$15,000,000 | 0.39% |

Bitcoin trading fees are waived for recurring purchases (also known as “DCA”) after the first week for hourly and daily purchases, or after the second purchase for weekly and monthly purchases.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Cheap remittances with low fees through the Lightning Network | ❌ Only a small part of the Strike app code is open source |

| ✅ Ability to send/receive Bitcoin and fiat | ❌ USDT on Tron might be controversial |

| ✅ No fees for recurring Bitcoin purchases (DCA) | ❌ No PC/MacOS or Web App |

| ✅ Free transfers within the Strike network |

Overview

Strike is a global Bitcoin platform designed with simplicity and accessibility in mind. Available in multiple countries, including the U.S., Europe, and select regions in Latin America, Strike provides an easy way to buy, sell, and send Bitcoin. Users can purchase Bitcoin using credit or debit cards, bank transfers, or Apple Pay. With zero fees on recurring purchases (after the initial period), it offers an excellent way for users to automate their Bitcoin investments.

The platform also supports both Bitcoin and stablecoins like USDT, depending on the region. For users in areas like Argentina or Brazil, the ability to use USDT adds flexibility, catering to those who prefer to avoid Bitcoin’s volatility. Strike also integrates seamlessly with the Lightning Network, making global transactions quick and affordable, ideal for users looking to move funds across borders.

Strike’s fee structure is designed to be transparent and fair, with competitive rates starting at 0.99% for trading fees. Users can also enjoy fee-free withdrawals to their Bitcoin address once a threshold is met. Overall, Strike provides an efficient and cost-effective way to interact with Bitcoin and stablecoins, with features like Dollar-Cost Averaging and easy global transfers enhancing its appeal.

Full Review

Swan

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Swan Bitcoin | 🇺🇸 + more | 0.99% / 0.99% | ⭐⭐⭐⭐ 66/100 |

👉 Click here to join Swan Bitcoin and get $10 of free Bitcoin in your account.

Why We Chose It

Swan is a prominent US-based Bitcoin-only exchange, designed exclusively for buying Bitcoin. Known for its straightforward fee structure, Swan offers a competitive option for individuals looking to invest in Bitcoin. Its platform is non-custodial, ensuring users maintain control over their holdings, and features tools like collaborative custody and IRA options to cater to diverse needs.

Dedicated solely to Bitcoin, Swan has stayed focused on enhancing its offerings while keeping fees transparent and reasonable. Recently, the platform expanded into mining services, adding another dimension to its ecosystem. For US users who are comfortable with KYC, Swan remains a top-tier choice, offering a robust set of features with a strong emphasis on cost efficiency.

Fees Breakdown

In addition to the spread, which is variable, Swan keeps its fee structure straightforward, ensuring transparency for its users. Below is a detailed breakdown of the costs.

| Category | Fee |

|---|---|

| First $10,000 in Buys | Free – Zero fees on your first $10,000 of Bitcoin buys, including single, recurring, and IRA purchases. |

| Bitcoin Buys (After $10k) | 0.99% – A flat fee for all Bitcoin purchases beyond the initial $10,000. |

| Bitcoin Withdrawals | Free – No fees for withdrawing Bitcoin. Users can also set up automated withdrawals at specific balance thresholds. |

Additional Notes

- Funding Options: Connect your U.S. bank account for automatic funding, or use direct deposits and international wire transfers for greater flexibility.

- Control: Strike emphasizes user control, allowing withdrawals without hidden costs and providing tools for automation when reaching specified balances.

This simplified structure makes Strike an appealing option for users who value clear and predictable fees.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ User-Friendly Interface | ❌ Swan Personal Not Available in Europe |

| ✅ Easy Bitcoin Accumulation | ❌ No "Sell" Option, Focused on Savings |

| ✅ Strong Sense of Community | ❌ There is a "Locking Period" for the Bitcoin buys |

Overview

Swan Bitcoin simplifies Bitcoin accumulation with a straightforward, user-centric platform tailored to those focused on buying and holding. By eliminating the sell button, Swan emphasizes its mission as a Bitcoin-only service, making it an ideal choice for users looking to build their Bitcoin savings securely and efficiently. The platform offers a seamless way to convert fiat currencies, such as USD, into Bitcoin, serving as both a hedge against inflation and an entry point into Bitcoin’s fixed supply economy.

Promoting self-custody as a priority, Swan empowers users to manage their Bitcoin independently while also providing optional custodial services through trusted partnerships. Its intuitive interface accommodates a broad spectrum of users, from beginners to seasoned investors and businesses. Swan supports both one-time purchases and recurring buys, allowing flexibility to align with various financial goals and investment preferences.

With its commitment to security, simplicity, and Bitcoin-only operations, Swan Bitcoin positions itself as a reliable platform for building long-term Bitcoin savings.

Full Review

Relai

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Relai | 🇪🇺🇨🇭 + more | 0.9% / 0.9% | ⭐⭐⭐⭐ 65/100 |

👉 Click here to join Relai. Use code BLOCKDYOR to lower the fees by 10%.

Why We Chose It

Relai is a Bitcoin-only platform that allows you to buy and sell Bitcoin while also enabling self-custody. It operates on a non-custodial model, ensuring that users maintain control over their funds.

Once you make a purchase, your coins are transferred to Relai’s integrated non-custodial wallets throughout the day, where you can later move them to your own cold storage wallets. Alternatively, users have the option to send funds directly to cold storage after signing a message with their private keys. Relai’s fees are competitive, and you can reduce them further to just 0.99% by using a referral code.

Fees Breakdown

Relai’s fee structure provides clarity and flexibility, ensuring users understand costs upfront while benefiting from competitive rates.

| Category | Fee |

|---|---|

| Bitcoin purchase (standard) | 1.0% |

| Bitcoin purchase (with invite) | 0.9% |

| First 100 CHF/EUR each month | Free |

| Credit card payment fee | 3.0% |

| Network fee (for buying) | Covered by Relai |

| Network fee (for selling) | Paid by the user (variable) |

| Relai Private (large volume) | Starting at 1%, as low as 0.1% |

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Easy-to-use app | ❌ Limited availability outside Europe, UK, and Switzerland |

| ✅ Secure non-custodial wallet | ❌ Higher fees for recurring buys |

Overview

Relai is gaining traction across Europe with its Bitcoin-only service, thanks to its bitcoin-only focus and non-custodial approach. Based in Switzerland, it caters to most EU countries, offering compelling advantages that differentiate it from its competitors.

The platform is ideal for Bitcoin enthusiasts, especially those interested in Dollar-Cost Averaging (DCA) over time, thanks to its low fees and seamless conversion between fiat and Bitcoin.

Available on iOS and Android, Relai emphasizes simplicity and user privacy, ensuring that transactions remain linked to self-custodial wallets through mnemonic phrases. This ensures ease of access to funds while maintaining high security, offering users a clear and safe path to grow their Bitcoin holdings.

Full Review

How Spreads and Fees Affect Your Purchase Power

In this guide, we’ve outlined the best options for purchasing Bitcoin at the lowest possible cost. Most of the platforms we’ve discussed operate on a pricing model that combines two key components: a fee and a spread. While the fee is usually straightforward and prominently displayed, the spread is less obvious and can be much harder to anticipate.

Let’s have a look at an example with Bitcoin priced at $100,000 and see how the fee and spread affect your total cost when spending $1,000.

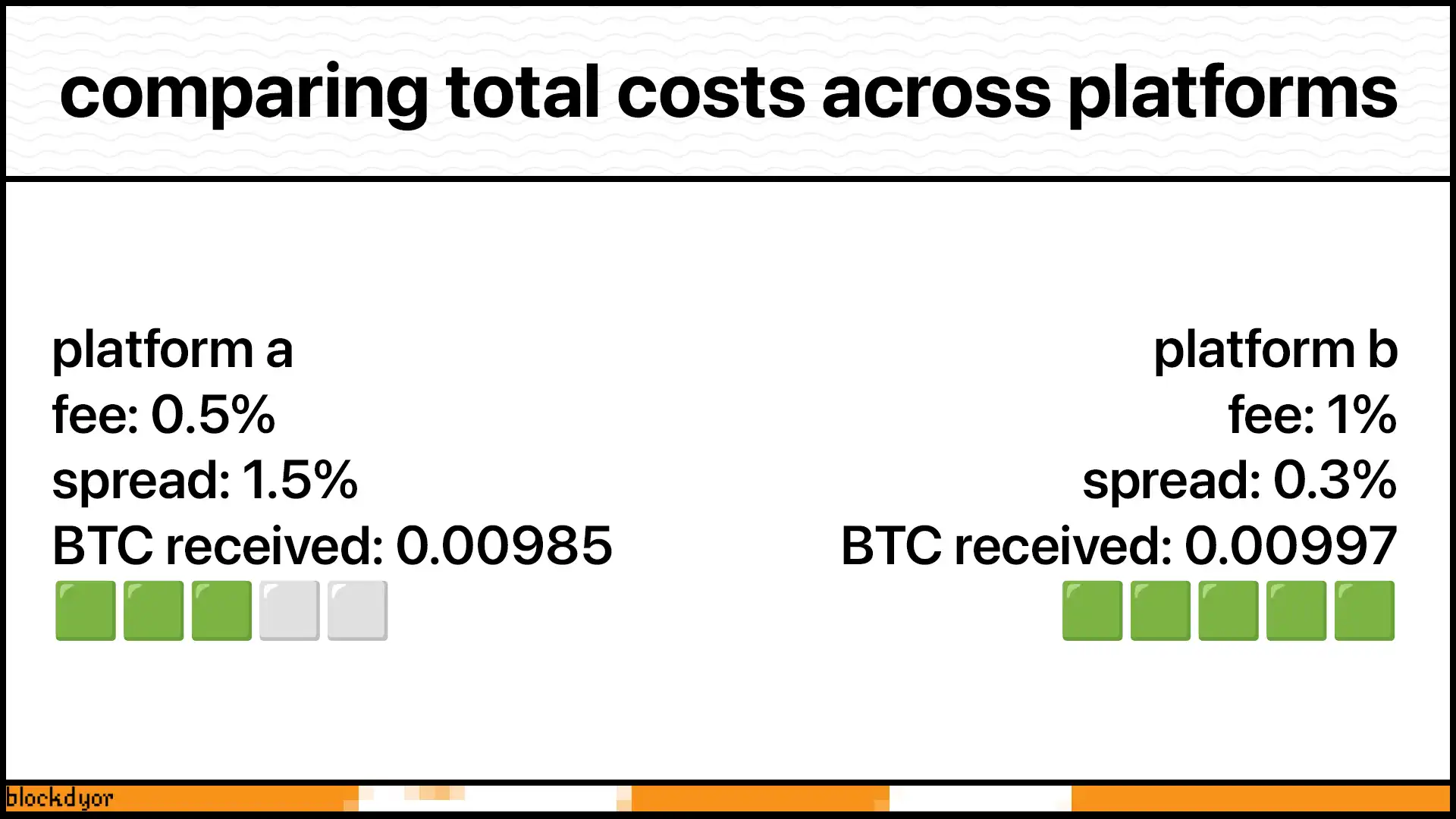

Example: Comparing Total Costs Across Platforms

Imagine two platforms, A and B, both offering Bitcoin purchases:

- Platform A charges a 0.5% fee but has a wide spread of 1.5%.

- Platform B charges a 1% fee but has a narrower spread of 0.3%.

Let’s say Bitcoin is trading at $100,000, and you want to spend $1,000.

Platform A

- Fee: 0.5% of $1,000 = $5

- Effective Buy Price: $101,500 (1.5% markup on $100,000)

- Bitcoin Received: $1,000 ÷ $101,500 ≈ 0.00985 BTC (or 985,000 Satoshis)

Platform B

- Fee: 1% of $1,000 = $10

- Effective Buy Price: $100,300 (0.3% markup on $100,000)

- Bitcoin Received: $1,000 ÷ $100,300 ≈ 0.00997 BTC (or 997,000 Satoshis)

Results

Here’s the breakdown:

- On Platform A, you receive 0.00985 BTC for $1,000.

- On Platform B, you receive 0.00997 BTC for $1,000.

Although Platform A has a lower fee, its wider spread results in a higher overall cost. The difference in Bitcoin received between the two platforms is 0.00012 BTC, or approximately $12 when Bitcoin is priced at $100,000.

Takeaway

Even small variations in fees and spreads can significantly impact the Bitcoin you receive, especially as the price of Bitcoin increases. Always evaluate both the fee and spread to ensure you’re maximizing the value of your purchase.

Hidden Costs Beyond Fees and Spreads

When buying Bitcoin, there are some other extra costs that aren’t always obvious. Here are a few things to watch out for:

Payment Method Costs

- Bank Transfers: Usually cheaper with low or no extra fees. However, they can take a few days to process.

- Credit Cards: Fast but expensive. Most exchanges charge 1-3% extra, and some treat crypto purchases as cash advances with even higher fees.

Conversion Rates

If you’re using a currency like the Indian Rupee (INR) or the Australian Dollar (AUD), exchanges might offer worse conversion rates than the market price. This means you get less Bitcoin for your money. Always check the exchange rate before buying.

Network Fees for Withdrawals

Bitcoin transactions require network fees, which can vary depending on how busy the network is. During high traffic times, withdrawal fees can be high. Some exchanges add their own fees on top of these. Always check the withdrawal fees before transferring.

Inactivity Fees

Some exchanges charge a fee if you don’t use your account for a while. These can be monthly or yearly, so if you’re not trading often, make sure you avoid them by staying active.

Tips To Avoid Hidden Fees

For a new user, it can be tough to avoid hidden fees or save money, but a good starting point is to use the exchanges listed in this guide.

If possible, go for dollar-cost averaging (DCA), choose automatic withdrawals (usually free), and avoid using cards for payments. Also, steer clear of withdrawing during high-fee periods, along with the other tips mentioned down below.

- Use invite codes or promotions (like the ones linked in this guide).

- Use bank transfers over credit cards to save on fees.

- Watch out for poor conversion rates when using currencies other than USD or EUR.

- Check network fees before withdrawing Bitcoin, especially in busy times.

- Be aware of inactivity fees if you’re not using the platform regularly.

By keeping an eye on these extra costs, you can avoid surprises and make smarter Bitcoin purchases.

Bottom Line

As you can see, there’s no single exchange with the absolute lowest fees, but there are several solid Bitcoin-only platforms offering great options, especially if you’re looking to buy Bitcoin on a regular schedule using techniques like Dollar Cost Averaging (DCA).

In this guide, we’ve highlighted some of the best Bitcoin-focused solutions with low fees, and we hope you find them useful.