Bitcoin Inheritance: How to Securely Pass Your BTC to Loved Ones

This guide will walk you through the easiest ways to ensure your Bitcoin is safely passed down. You’ll learn how to secure it for the long haul while making sure your heirs can access it, even in the worst-case scenario.

Sometimes, we get questions from readers like: “What’s the best way to secure my Bitcoin so that my family can access it when I’m gone?”

The short answer is a multi-signature cold storage setup with a separate key for the beneficiary. However, this needs careful planning. Many solutions emerged in the last years, but not all are user-friendly or worth their price.

Before we begin, I want to introduce you to the best solution for Bitcoin inheritance. One that’s completely free, simple, easy to use and it was named one of TIME’s Best Inventions. It’s a bitcoin-only multisig hardware wallet called Bitkey, and it comes with a built-in inheritance feature that prevents premature access while ensuring your heirs can securely claim your Bitcoin when the time comes.

Unlike traditional multisig setups that require technical knowledge and ongoing management, Bitkey makes everything easy with an intuitive mobile app and a time-delayed claim system. Best of all, it’s 100% free: you just need to ensure your beneficiary has their own Bitkey wallet.

So, if you’re looking for the easiest and most secure way to set up Bitcoin inheritance, Bitkey is the best option available today. Click the link below and use our exclusive coupon code to get a special discount on your Bitkey wallet!

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Why Bitcoin Inheritance Matters

Once you move your BTC off an exchange, you’re in full control. No one can access your coins without your private keys, that’s the essence of self-custody. But inheritance doesn’t automatically "just work".

If you don’t plan ahead, your heirs might find a piece of paper with some words on it and mistake it for something unimportant. Even if they recognize it as a BTC seed phrase, will they know what to do without exposing the funds to risk?

Leaving Bitcoin inheritance to chance is dangerous. But simply handing over your seed phrase before death can be just as risky.

Why You Shouldn’t Share Your Seed Phrase Before Death

Some people think the easiest solution is to just give their seed phrase (so basically the actual backup of the hardware wallet) to a trusted relative in advance. That’s almost always a mistake. Here’s why:

- Disputes over ownership – Without a clear will, a beneficiary might keep all the Bitcoin for themselves, refuse to share it, or claim it was lost. Even if you trust your family, it’s wise to remove any chance for this to happen.

- Security risks – Even if a beneficiary follows instructions, they might unknowingly enter the seed phrase into a compromised wallet, leading to total loss.

- Leaks and coercion – If a beneficiary shares the seed phrase with a close friend, that information could spread, putting your Bitcoin at risk. Worse, they could be pressured into revealing it.

- Premature access – A curious beneficiary might check the wallet balance before your death. That could lead to mistakes—or even theft.

- Theft accusations – If Bitcoin goes missing, suspicion could fall on the beneficiary, even if they weren’t responsible.

For a safe inheritance plan, access should only be possible after your passing, possibly after a certain waiting period and verified through legal means. This isn’t simple, but the right approach ensures your wealth stays secure while reaching the right hands at the right time.

How To Choose Your Bitcoin Inheritance Plan

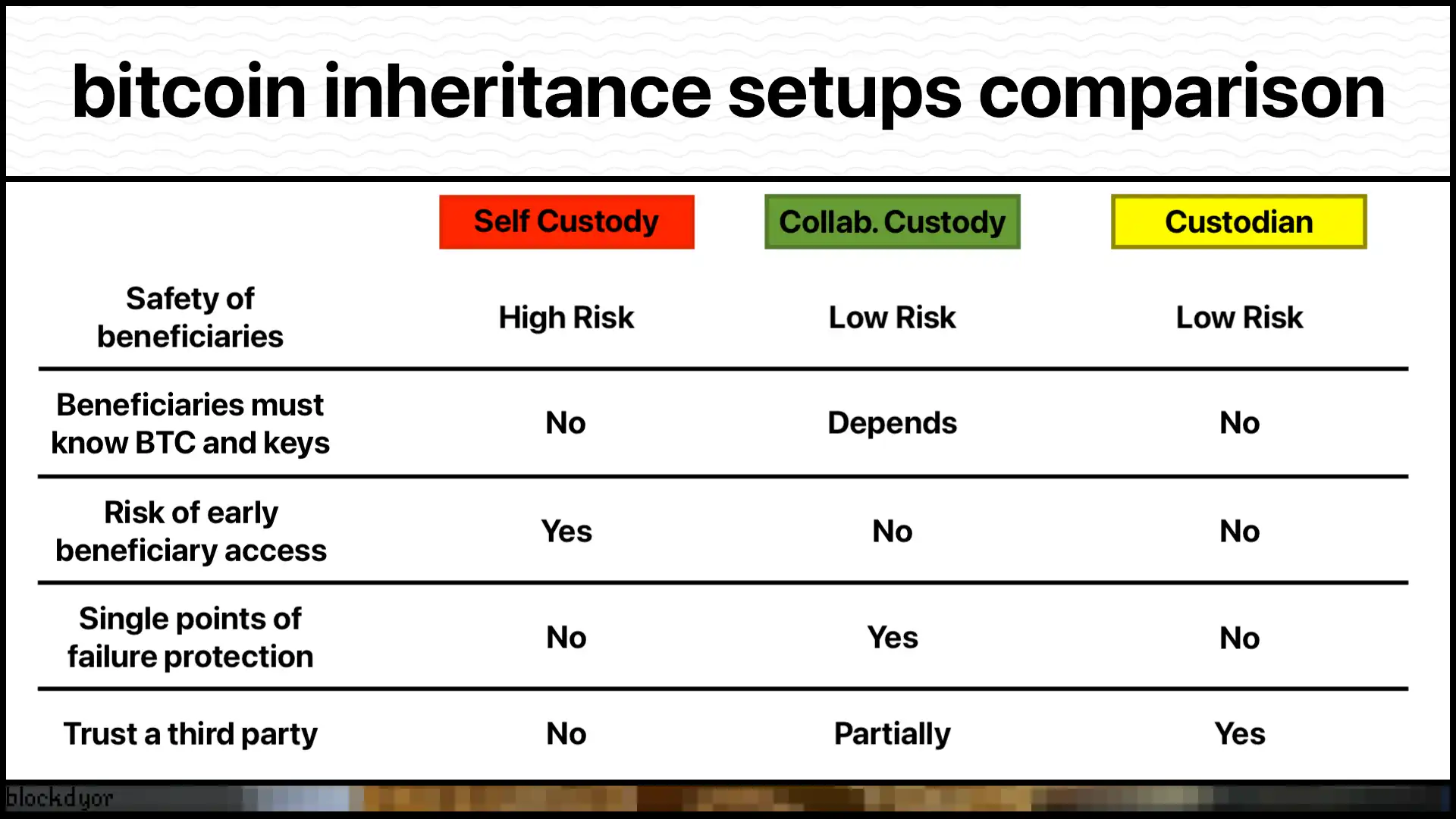

There are three main categories for setting up a Bitcoin inheritance plan. I’ve compared them in the table below, and then we’ll go over the differences.

Option 1: Self Custody

This option involves keeping full control of your Bitcoin, but it carries the highest risk. While it avoids third-party fees and trust issues, if the seed phrase or access to the Bitcoin is lost or misused, there’s no backup.

Some try creating a multisig setup by themselves by using different hardware wallets to reduce risk, but it requires technical knowledge, and if the software used becomes unsupported, it can lead to issues in the long run.

Option 2: Collaborative Custody (The Best Option)

This option uses a multisig setup, where multiple keys are required to move the Bitcoin. The owner holds one key, the beneficiary holds another, and a service provider holds the third.

This setup ensures that the Bitcoin cannot be accessed or stolen prematurely, and protects against mistakes or theft with one key, as the other two must collaborate to move the funds. Many service providers make this setup easy to use, though they charge a fee for the service. There are, however, simple solutions that use a 2-out-of-3 multisig setup with inheritance, like Bitkey, which works really well and we’ll explore in more detail later.

Option 3: Custodial Services

In this option, a trusted company holds your Bitcoin in cold storage. While this removes the responsibility from beneficiaries to manage a private key, it introduces the risk of the company losing access to the funds due to errors/hack.

This setup is simpler for beneficiaries, who only need to prove the owner’s death to inherit the Bitcoin, but it requires a high level of trust in the company.

So, basically self custody offers the lowest cost but high risk, while custodial services are simpler but depends entirely on the trustworthiness of the service provider. At the end of the day, a collaborative multisig, is the most secure and balanced choice, combining self-custody and professional safeguards.

Bitkey: The Best Bitcoin Inheritance Solution

Since Collaborative Custody is the most secure and practical way to handle Bitcoin inheritance, the best tool available right now for this purpose is Bitkey.

Why Bitkey?

Bitkey, a wallet created by the Proto Team at Jack Dorsey’s Block ($XYZ), is one of the newest Bitcoin hardware wallets on the market and has already earned a TIME Best Invention award. Is a Bitcoin-only hardware wallet with a 2-out-of-3 multisig setup, making it inherently more secure than a traditional singlesig hardware wallet. Unlike many multisig solutions that require writing down a seed phrase, Bitkey instead uses an encrypted backup of one key, simplifying security. If you lose the hardware wallet, you can still access your funds using your phone and the backup.

But most importantly, Bitkey has a built-in inheritance feature that ensures your Bitcoin can be passed on safely, without requiring third-party services or complicated legal arrangements.

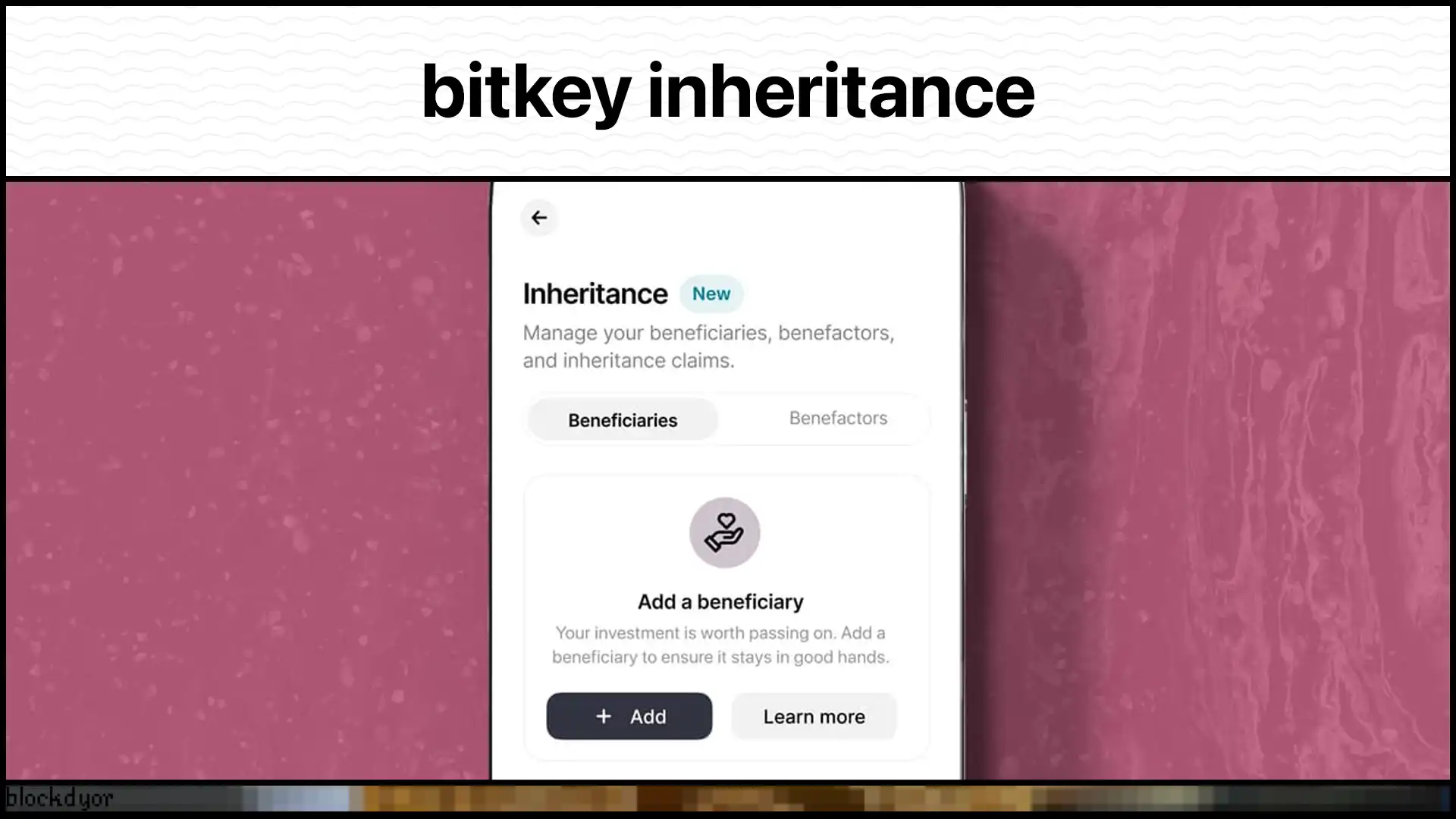

How Bitkey Inheritance Works

Your Bitcoin isn’t just an investment—it’s part of your legacy. Bitkey’s inheritance function allows you to designate another Bitkey owner as your beneficiary, while safeguards protect against unauthorized claims.

1. Setting It Up

- Invite a beneficiary through the Bitkey app by sending them a secure message containing an invite link and code.

- The beneficiary must have their own Bitkey device to accept the invitation.

- Once they accept, you complete the setup and activate the inheritance plan.

2. How It’s Claimed

- After your passing, the beneficiary initiates a claim via their Bitkey app.

- A six-month waiting period begins, during which notifications are sent to your app and other enabled channels.

- If you do not dispute the claim within six months, the claim is approved.

- The encrypted mobile key linked to your wallet is then transferred to the beneficiary.

- The Bitkey app decrypts the key and, in coordination with the Block server key, transfers the Bitcoin to the beneficiary’s wallet.

This process ensures that your heirs can access your Bitcoin securely while protecting against premature or fraudulent access.

Completely Free (Except for Your Beneficiary’s Device)

Unlike other Bitcoin inheritance services that charge ongoing fees, Bitkey’s inheritance function is free. The only requirement is that your beneficiary must have their own Bitkey device to receive the funds.

Want to set up your Bitcoin inheritance plan the right way? Learn more and grab a Bitkey using our exclusive discount at the link below.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Other Bitcoin Inheritance Solutions

Bitkey is one of the newer Bitcoin inheritance solutions, but it’s far from the only one. There are plenty of alternatives out there, though most require signing up with a third party and paying a subscription fee for a multisig setup that typically involves more than three keys. Let’s take a look at some of the most popular ones.

Nunchuck Bitcoin Inheritance

Nunchuk offers an inheritance protocol that stays true to Bitcoin’s self-sovereign principles. Their multisig approach ensures that heirs can access funds without relying on a third party, but also without the risk of a single point of failure. It’s built around smart contracts and timelocks, meaning access to Bitcoin can be automatically granted after a set period of inactivity. This eliminates the need for legal structures while keeping everything on-chain.

Unchained Bitcoin Inheritance

Unchained, on the other hand, integrates legal clarity into the process. Their trust-based vault system ensures that heirs don’t just inherit access to Bitcoin but also have a legally recognized claim to it. This avoids legal disputes and simplifies the transition, especially for those dealing with larger estates. Their inheritance protocol ensures that heirs don’t need to be Bitcoin experts, as Unchained provides guidance and structured access.

Casa Bitcoin & Crypto Inheritance

Casa focuses on accessibility and ease of use, removing much of the complexity from the inheritance process. Their approach relies on a 3-key multisig vault, where the user retains full control but can designate a trusted recipient. Casa’s system includes a six-month waiting period, during which the original owner can confirm they’re still around. If needed, Casa’s recovery key and the recipient’s mobile key can unlock access, making it a more user-friendly option for heirs unfamiliar with Bitcoin’s technical details.

The Challenges of Using Timelocks for Bitcoin Inheritance

Some Bitcoin holders have tried to improve self-custodial inheritance by using timelocks, a built-in Bitcoin feature that delays fund movement until a predetermined number of blocks have been mined. The idea is to prevent premature access while ensuring that the bitcoin is eventually released to heirs.

However, relying on timelocks for inheritance is risky. A single misconfiguration could permanently lock the funds. Since Bitcoin transactions are irreversible, a poorly set up timelock script could mean the bitcoin is never accessible to anyone—not even the intended beneficiary.

Another major issue is unpredictable future transaction fees. Since a timelocked transaction is created in advance, there’s no way to adjust the fee later to account for changing network conditions. If fees skyrocket, the transaction might never confirm, effectively trapping the bitcoin indefinitely.

While proposals like Bitcoin Vaults aim to bring more advanced recovery and security mechanisms to Bitcoin’s protocol, they do not address the core challenges of self-custodial inheritance. Even if vaults were implemented, a beneficiary would still need a strong technical understanding to access the funds—something that remains a major hurdle for most people.

Bottom Line

Bitcoin inheritance can be complicated, and there are many ways it can go wrong. The key is to choose a setup that balances security, accessibility, and legal clarity. Without a solid plan, beneficiaries may struggle to access funds, or worse, lose them entirely.

Solutions like Bitkey offers a built-in inheritance feature that removes much of the guesswork. Instead of relying on complex multisig self-custody setups or risky workarounds, Bitkey provides a super-easy, free and verifiable inheritance process—ensuring that heirs can access the funds only after a waiting period, giving the original owner time to dispute fraudulent claims.

This approach eliminates the need to share seed phrases while still allowing beneficiaries to securely inherit bitcoin. Plus, the process is simple: invite a trusted person to be your beneficiary, and when the time comes, they can claim the funds through their own Bitkey device.

Planning for inheritance isn’t just about choosing the right technology—it’s also about clear communication and legal preparation. While Bitkey simplifies the technical side, having a will in place remains a smart move to avoid disputes.

Get started with Bitkey’s inheritance feature today and ensure your bitcoin is safely passed on to the next generation.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.