Bitcoin Dollar Cost Averaging (DCA): The Complete Guide

Learn about Dollar Cost Averaging (DCA) for Bitcoin, a strategy to invest steadily over time, reducing risk and emotional bias. Discover its benefits, platforms that support it, and tips for maximizing your investment while minimizing costs.

When it comes to investing or saving in Bitcoin, the unpredictable nature of its price can make decision-making a challenge. Should you wait for a dip or buy now? These questions can lead to hesitation or even costly mistakes. That’s where dollar-cost averaging (DCA) comes in: a straightforward approach to building a Bitcoin position over time without stressing about market timing.

Before we jump into the guide, did you know that with Bitkey, the Bitcoin wallet created by Jack Dorsey, you can store your BTC safely using a multisig model? It’s not only more secure than single-sig wallets like Ledger and Trezor, but also easier to use. No need to write seed phrases on paper. No need to hide your wallet behind the wall or under the mattress. Even if you lose the wallet, you can still access your funds using your phone and backup (it’s a 2-out-of-3 multisig). Learn more through the link below and take advantage of our exclusive discount.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy that involves dividing a set amount of money into regular, smaller purchases over a specific period. Instead of buying an asset all at once, you spread out your investment. This method helps reduce the impact of short-term price volatility, making it easier to stay consistent.

For example, instead of investing $2,500 in Bitcoin in one go, you could invest $50 every week for 50 weeks. This not only spreads your exposure to price changes but also simplifies the process of entering the market.

Why Use Dollar-Cost Averaging for Bitcoin?

The main idea behind DCA is consistency. It takes emotion out of the equation by sticking to a regular investment schedule regardless of price swings. Trying to predict Bitcoin’s movements, even for experienced investors, is notoriously tough.

Bitcoin’s long-term potential often comes with periods of intense volatility. By committing to DCA, you gradually build a position over time without getting caught up in daily market drama.

Additionally, as you accumulate Bitcoin, you can also take time to deepen your understanding of its technology and implications, making it a great strategy for beginners and seasoned investors alike.

Dollar Cost Averaging Bitcoin

Dollar-cost averaging makes sense under the assumption that the chosen asset will increase in value long-term, but will experience volatility along the way. Bitcoin is a relatively volatile asset today, and also a relatively new asset.

Many investors who get involved still have a lot to learn about the technology and its implications for the world. As an investor dollar-cost averages into Bitcoin, they can also gradually continue to level up their knowledge over time, along with their bitcoin holdings.

Top Exchange for Easy Dollar-Cost Averaging

Now that you understand Dollar-Cost Averaging and how it works, you might be wondering where to easily apply this strategy to buy Bitcoin. You’re definitely in the right place! Let’s have a look at some of the best Bitcoin-focused exchanges that make Dollar-Cost Averaging simple, automated and effective.

Strike

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Strike | 🇺🇸 🇪🇺 🇬🇧 + more | 0.99% / 0.99% | ⭐⭐⭐⭐ 73/100 |

👉 Join Strike with our referral code J4D4TJ and get $100 in fee-free Bitcoin trading.

Why We Chose It

Strike is an excellent choice for those looking to DCA automatically with low fees. With trading fees starting as low as 0.99%, the platform remains competitive, especially for active traders. The fee structure is straightforward, and users benefit from fee-free auto-withdrawals once a set threshold is met, allowing for easy access to their funds without extra costs. This makes it a cost-effective solution for those who prioritize low fees.

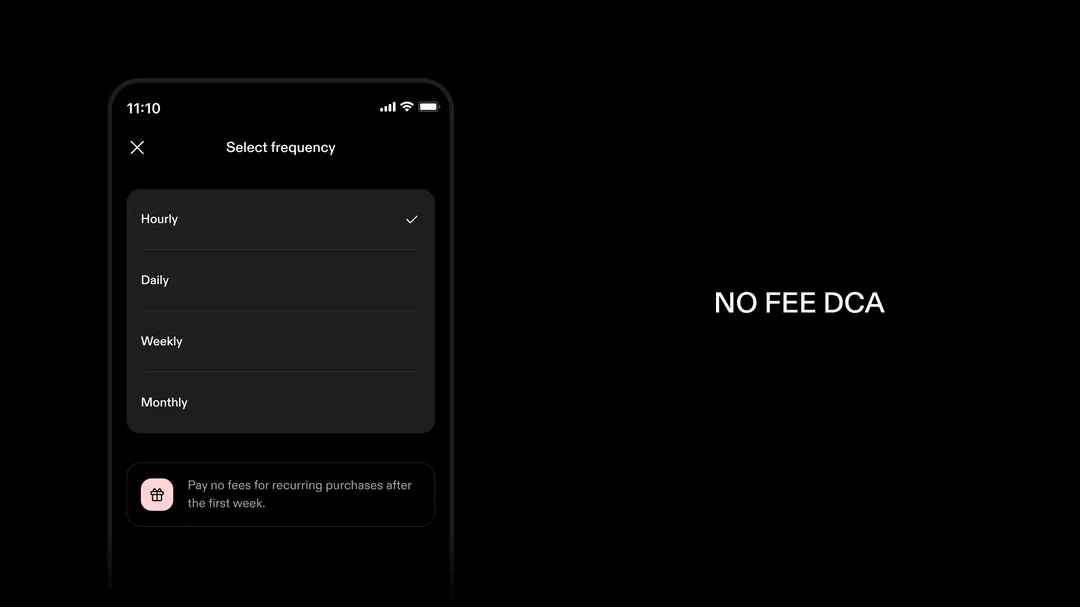

Additionally, Strike offers zero fees on recurring buy orders for Dollar-Cost Averaging (DCA) after the first week (for hourly and daily purchases) or the second purchase (for weekly and monthly purchases). This feature is a great advantage for long-term investors who want to avoid transaction fees eating into their regular investments. Whether you’re buying, selling, or transferring Bitcoin, Strike delivers transparent and fair pricing, making it a top choice for cost-conscious Bitcoin users.

DCA Breakdown

Strike has set itself apart in the Bitcoin investment space by offering one of the most flexible and accessible ways to dollar-cost average (DCA) into Bitcoin. Unlike many exchanges that limit you to only a few options, Strike allows you to set up recurring purchases at varying frequencies—daily, weekly, monthly, or even hourly. This range of options gives you control over how you want to invest, making it easy to tailor your DCA strategy to fit your needs and preferences. Whether you’re looking to invest in small, frequent amounts or larger sums on a less frequent basis, Strike can accommodate.

One of the standout features of Strike’s DCA offering is the ability to do it fee-free. After the initial setup, you can continue making hourly or daily DCA purchases without incurring any fees after the first week. For weekly and monthly purchases, the fee is waived starting from the second transaction. This is a rare feature among Bitcoin exchanges, making Strike an especially appealing choice for those looking to minimize the costs associated with their DCA strategy.

The process of setting up your recurring purchase is incredibly easy. Simply go to your Bitcoin screen, tap “Set a recurring purchase,” choose your frequency, enter the amount you want to invest, and confirm your payment method. Once set, your purchase will be automatically executed at the same time according to your selected frequency, and you’ll receive a notification whenever a market buy takes place. This makes the process as hands-off as possible, allowing you to focus on the long-term growth of your Bitcoin portfolio without having to track market movements constantly.

In summary, Strike offers a highly flexible, fee-free, and automated way to implement Dollar-Cost Averaging. Whether you’re a beginner or experienced investor, Strike simplifies Bitcoin investing with its easy-to-use platform and cost-effective strategy.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Cheap remittances with low fees through the Lightning Network | ❌ Only a small part of the Strike app code is open source |

| ✅ Ability to send/receive Bitcoin and fiat | ❌ USDT on Tron might be controversial |

| ✅ No fees for recurring Bitcoin purchases (DCA) | ❌ No PC/MacOS or Web App |

| ✅ Free transfers within the Strike network |

Overview

Strike is a user-friendly Bitcoin platform available in multiple countries, including the U.S., Europe, and parts of Latin America. It makes buying, selling, and sending Bitcoin simple, with options to use credit or debit cards, bank transfers, or Apple Pay. What sets it apart is the fee-free recurring purchases (after the initial period), making it a great choice for automating Bitcoin investments.

The platform also supports stablecoins like USDT in select regions, offering flexibility for those who prefer avoiding Bitcoin’s price swings. For users in places like Argentina or Brazil, this feature is especially valuable.

Strike integrates with the Lightning Network, enabling fast and affordable global transactions, ideal for cross-border transfers. Its fee structure is transparent and competitive, starting at 0.99% for trading fees, with fee-free Bitcoin withdrawals once you reach a certain threshold.

In short, Strike is an efficient, cost-effective way to manage Bitcoin and stablecoin transactions, with features like Dollar-Cost Averaging and seamless international transfers boosting its appeal.

Full Review

https://blockdyor.com/strike-review/

River Financial

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| River Financial | 🇺🇸 + more | 1.00% / 1.00% | ⭐⭐⭐⭐ 61/100 |

👉 Click here to join River Financial and earn up to $100 in bonus Bitcoin when you buy.

Why We Chose It

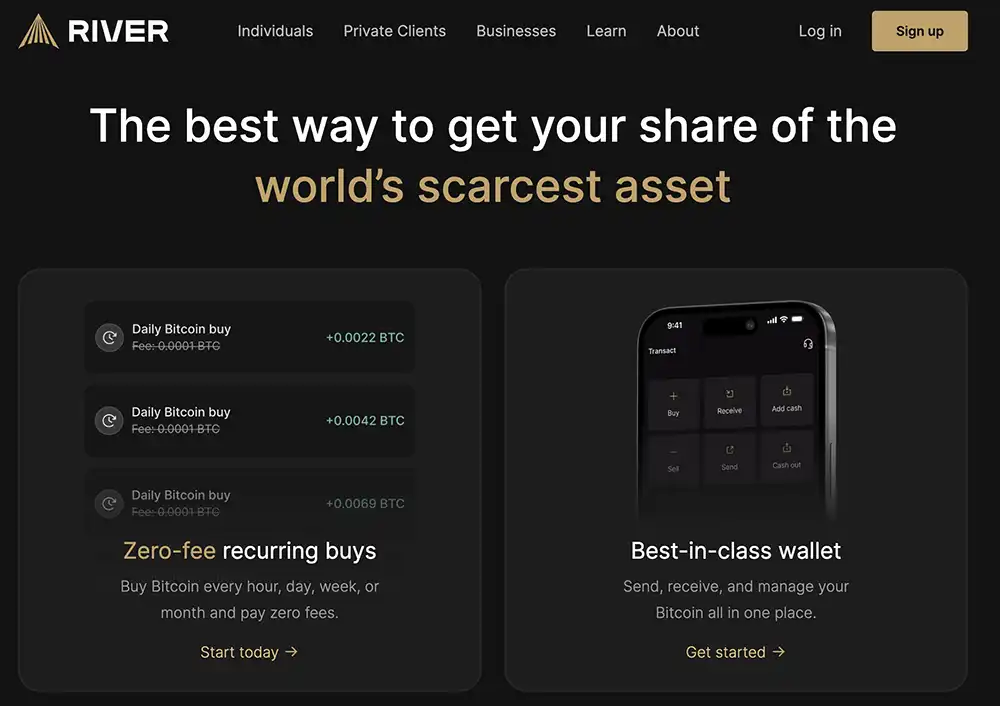

River is a Bitcoin-only platform that allows users to buy Bitcoin with no fees on recurring orders and a competitive 1.00% fee for one-time purchases. Users can also sell Bitcoin for fiat directly on the platform.

The platform provides a seamless experience through its web app, along with iOS and Android apps. With a strong focus on security, full reserve custody, and smooth integration with the Lightning Network, River is a reliable option for both new and experienced Bitcoin investors.

DCA Breakdown

River offers a flexible approach to Dollar-Cost Averaging (DCA) with its Zero-Fee Hourly Recurring Buys feature. This allows users to purchase Bitcoin up to 24 times a day, taking advantage of short-term price fluctuations that might be missed with less frequent buys.

One of the key benefits of this feature is the zero-fee structure after the initial setup. Once activated, users can make recurring purchases without paying additional fees, making it an attractive option for those looking to accumulate Bitcoin regularly.

The process is simple, with recurring buys available on both River’s web and mobile platforms. Users can set the frequency of their purchases, whether hourly, daily, weekly, or monthly, providing flexibility to tailor their strategy.

Overall, River’s Zero-Fee Hourly Recurring Buys feature offers a cost-effective and convenient way for users to automate their Bitcoin investments, especially for those looking to benefit from frequent market dips.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ User-friendly interface | ❌ Limited availability outside the USA |

| ✅ 100% full reserve custody | ❌ Does not support certain US states like New York, Nevada, and Idaho |

| ✅ Wide range of payment methods | ❌ Fees (and spread) may be higher compared to some other platforms |

| ✅ Available via web-based & apps |

Overview

River Financial is dedicated to providing an efficient and cost-effective way to invest in Bitcoin. Established in 2019 and based in San Francisco, River serves both new users and experienced investors with its Bitcoin-only platform. This approach helps keep fees competitive while ensuring a streamlined focus on Bitcoin transactions.

One of the standout features of River is its transparent and easy-to-understand fee structure. The platform’s Dollar-Cost Averaging (DCA) option allows users to invest regularly in Bitcoin without paying any fees, reducing the impact of market volatility over time. This is particularly beneficial for those looking to minimize transaction costs.

Additionally, River integrates with the Lightning Network, allowing for fast, low-cost global Bitcoin transactions. The platform’s Target Price Orders feature further enhances its offering, letting users automate purchases based on specific price targets with no extra fees.

Currently available only in the United States, River’s clear focus on cost-conscious Bitcoin investment, combined with features like self-custody automation and inheritance planning, makes it a strong choice for those looking to enter or expand their presence in the Bitcoin market.

Full Review

Relai

Key Specs

| Exchange | Availability | Taker / Maker Fees | blockdyor Score |

|---|---|---|---|

| Relai | 🇪🇺🇨🇭 + more | 0.9% / 0.9% | ⭐⭐⭐⭐ 65/100 |

👉 Click here to join Relai. Use code BLOCKDYOR to lower the fees by 10%.

Why We Chose It

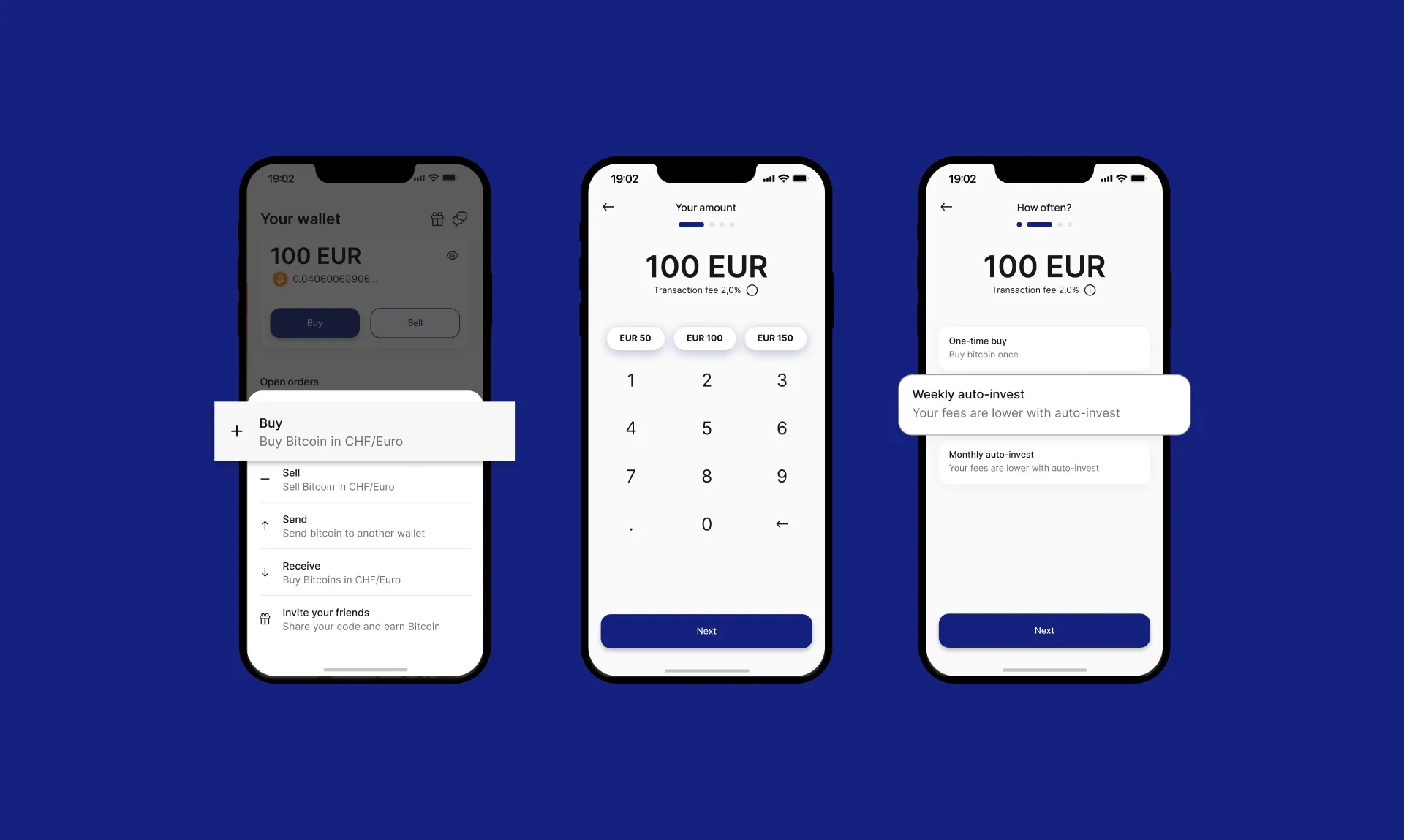

Relai is a Bitcoin-focused app that allows users to buy, sell, and manage their Bitcoin while promoting self-custody. With its built-in non-custodial wallet, the app ensures users retain full control of their funds. When purchasing Bitcoin, coins are transferred to Relai’s integrated wallet the same day, and users can later move them to their preferred cold storage.

Alternatively, funds can be sent directly to cold storage by signing a message with their keys, offering added convenience and flexibility. The same approach applies when selling Bitcoin. Relai offers a fair fee structure, and users can lower fees further by using the code BLOCKDYOR.

DCA Breakdown

Relai simplifies dollar-cost averaging (DCA) for Bitcoin, making it accessible to anyone. The app allows users to automate recurring Bitcoin purchases with just a few steps. Here’s how it works:

- Download the Relai App: Available on both iOS and Android.

- Set Your Amount and Frequency: Choose how much Bitcoin you want to buy in euros (EUR) or Swiss francs (CHF), and decide between weekly or monthly purchases.

- Automate Your Payments: Configure a recurring bank transfer through your banking app. Relai automatically links the transfer to your account using your IBAN, so there’s no need for extra transaction references.

This approach ensures you invest consistently without worrying about market timing. By spreading purchases over time, you average out price volatility—sometimes buying during dips and other times at peaks. Additionally, the compounding effect on your investments can lead to significant growth over time.

Whether you’re investing €50 weekly or a larger amount monthly, Relai’s automated process makes building a Bitcoin portfolio seamless and beginner-friendly.

Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Easy-to-use app | ❌ Limited availability outside Europe, UK, and Switzerland |

| ✅ Secure non-custodial wallet | ❌ Higher fees for recurring buys |

Overview

Relai is gaining popularity across Europe with its Bitcoin-only service, blending features of both peer-to-peer and centralized platforms. Based in Switzerland, it supports most European Union countries and offers unique advantages that make it stand out.

The app is particularly appealing to Bitcoin enthusiasts who prefer Dollar-Cost Averaging (DCA) for long-term accumulation. With competitive fees and a seamless fiat-to-Bitcoin conversion process, Relai makes building your Bitcoin holdings simple and efficient.

Available on iOS and Android, the app emphasizes user privacy. Transactions are tied to self-custodial wallets secured with mnemonic phrases, ensuring easy access and strong security. Relai provides a straightforward way to buy, sell, and manage Bitcoin while maintaining full control of your funds.

Full Review

Dollar-Cost Averaging Calculator

A great way to understand the effectiveness of a Dollar-Cost Averaging (DCA) strategy with Bitcoin is by using a simulator. These tools can calculate the returns of a DCA approach based on daily, weekly, or monthly purchase intervals over a specific number of years.

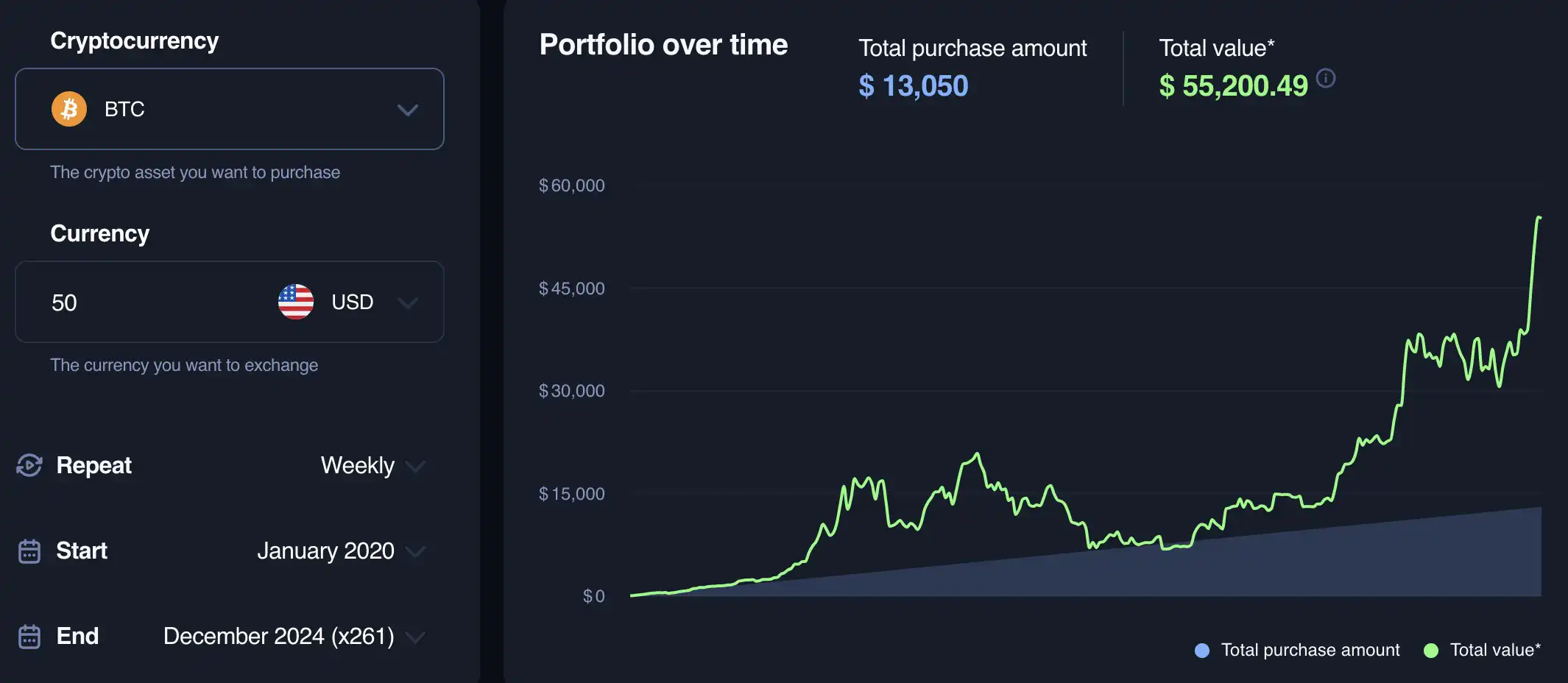

In the image above, you can see a DCA calculation of a weekly $50 purchase over approximately 4 years (261 weeks). During this time, a total investment of $13,050 was made, resulting in a final total value of $55,200.49. This represents an approximate gain of 323.00%. The weekly Compound Growth Rate (CGR) is approximately 0.72%, while the annualized Compound Annual Growth Rate (CAGR) is around 44.27%, reflecting the consistent growth of the investment over the period.

This proves that a DCA strategy can be really effective, even through both bear and bull markets, like we saw from 2020 to 2024. However, it’s definitely a long-term approach that demands a lot of patience. The good news is, there are plenty of exchanges, like the one I shown before, that let you automate the DCA process, taking away the stress and uncertainty that often come with market highs and lows.

Dollar-Cost Averaging Pros & Cons

Dollar-cost averaging is undoubtedly a great strategy for anyone getting started, but its biggest downside is that during a bull market, you could miss out on potentially larger gains.

| Pros | Cons |

|---|---|

| ✅ Automates investing for convenience. | ❌ Slower capital deployment. |

| ✅ Lowers the risk of buying at peak prices. | ❌ May miss large gains from lump-sum buys. |

| ✅ Simplifies the process—no market timing. | ❌ Small transactions can lead to more fees. |

| ✅ Reduces emotional decision-making. | ❌ Doesn’t protect against market declines. |

| ✅ Suitable for beginners and busy investors. | ❌ Returns may be moderate over the long term. |

Bottom Line

In the end, dollar-cost averaging offers a simple yet powerful way to gradually build a Bitcoin position while navigating its price swings. It removes the stress of timing the market and helps you stay focused on the long-term potential.

Whether you’re just starting or have been around the block for a while, DCA lets you invest at your own pace, easing the emotional rollercoaster of daily fluctuations. With the right exchange, it becomes a seamless strategy, allowing you to take consistent steps toward your financial goals—one satoshi at a time.