Bitcoin Cold Storage: How To Protect Your Coins In 2025

If you’re looking to safely self-custody your Bitcoin, Bitcoin Cold Storage is a must. This involves using a hardware wallet to move your coins off exchanges and the internet. In this guide, I’ll walk you through how to do it easily and securely.

Bitcoin is often compared to digital gold (or money, depending on how you see it), but keeping it safe is more like securing physical assets in a vault. If you leave it on an exchange, you’re trusting a third party, much like how you’d trust a bank. That opens the door to risks like hacks, fraud, and even government seizures.

Unless you want to use a custodial service, like an exchange or an ETF (which come with their own significant trade-offs), self-custody is usually the best option. It’s free of charge, protects you from third-party security vulnerabilities, and, most importantly, it aligns with Bitcoin’s core principle: self-sovereignty. In fact, this is how Bitcoin was meant to work—empowering individuals and solving issues like fractional reserve banking.

Cold storage is the most secure way to store Bitcoin because it keeps your private keys offline, away from online threats. In this guide, we’ll show you everything you need to know about setting up and securing your Bitcoin in cold storage.

Looking for an easy to use and highly secure cold storage solution? Bitkey, a Bitcoin-only hardware wallet, uses multisig for maximum security—no seed phrases needed. Your key is split into three parts (hardware wallet, phone, and cloud), and you only need two to access your Bitcoin. Get yours at a discount with the code below!

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

What Is Bitcoin Cold Storage?

Bitcoin cold storage refers to the practice of securing your private keys—the crucial elements that allow you to sign Bitcoin transactions and prove ownership of the bitcoins on the Bitcoin timechain. Essentially, having Bitcoin means you control the private keys, which lets you spend it. Without the private key, you can’t spend/send bitcoin from a particular UTXO (Unspent Transaction Output) to another address; the bitcoin remains locked and unspendable.

“Storing” BTC refers to managing and protecting these private keys from unauthorized access. It’s about ensuring they’re kept secure from third-party threats, both digital and physical.

There are a variety of methods for storing Bitcoin private keys, each with its own trade-offs. Some are simpler and more convenient, while others are more complex but offer stronger security. Each method comes with its own set of advantages and disadvantages, particularly when balancing convenience, security, and potential threats like forgetfulness, physical damage, or hacking.

Given the importance of private keys, many Bitcoin companies, banks, and financial institutions provide custodial services, where they store Bitcoin keys on behalf of clients. However, some individuals opt to hold their private keys personally, using self-custodial key storage methods for better control and security.

Why Cold Storage Matters?

Cold storage is essential because Bitcoin was designed to work hand in hand with self-custody, embracing the idea of "being your own bank". For long-term security, it’s the safest and most reliable approach. Here are the three main reasons why.

- Prevents Hacks: Exchanges and internet-connected wallets are prime targets for attacks. Cold storage eliminates this risk.

- Avoids Exchange Failures: If an exchange collapses (like FTX or Mt. Gox), you could lose everything. With cold storage, you own your Bitcoin directly without trusted third parties.

- Gives You Full Control: No company, government, or hacker can take your Bitcoin if you store it correctly.

Cold Storage vs Hot Storage

Your first Bitcoin wallet was probably custodial and most likely a hot wallet, meaning it was always connected to the internet. Hot wallets are generally easier to use and great for onboarding new users, but as your Bitcoin holdings grow, transitioning to cold storage becomes essential for security and peace of mind. Let’s break down the key differences between hot and cold storage below.

| Criteria | Cold Storage | Hot Storage |

|---|---|---|

| Security | Private keys never exposed to the internet, making it highly secure. | More vulnerable to hacks and theft due to online connectivity. |

| Ease of Use | Requires connecting hardware devices, making it more complex to use. | Easier to set up and access with internet-connected devices. |

| Cost | Typically costs $50 - $250 for hardware wallets. | Usually free, but may include transaction fees. Some wallets offer interest on deposits. |

| Use Cases | Best for long-term storage and holding large amounts. | Suitable for regular trading, transactions, and daily use. |

| Recovery | Private keys can be recovered using the seed phrase, except for paper wallets. | Private keys can be recovered using the seed phrase. |

| Examples | Bitkey, Coldcard – Popular hardware wallets for cold storage. | BlueWallet, Phoenix – Well-known mobile wallets for hot storage. |

Best Cold Storage Options

On the market, there are different types of Cold Storage solutions, however, the one that is considered the best compromise between ease of use and security is the Bitkey.

Bitkey

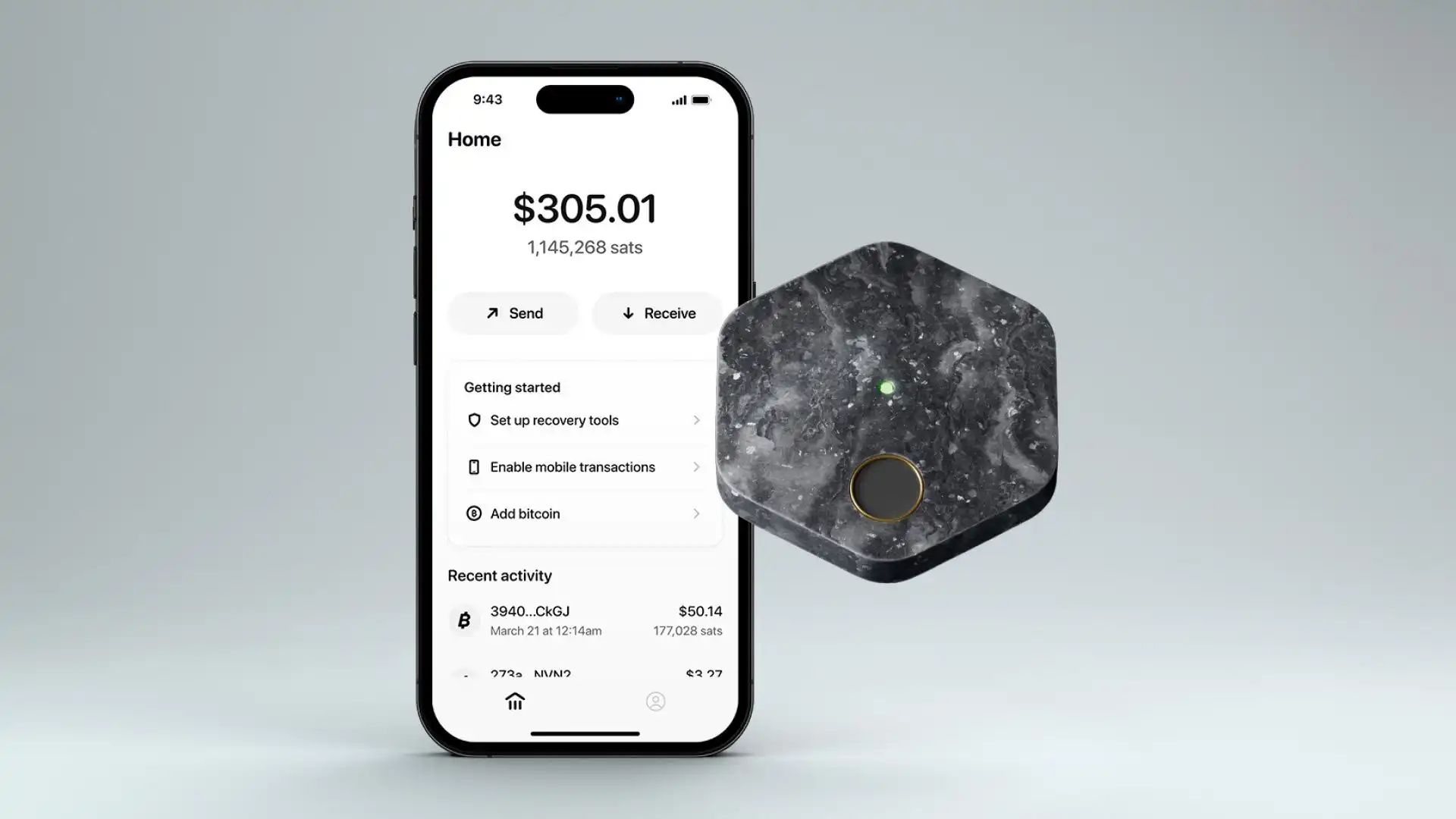

Bitkey isn’t just another hardware wallet—it’s a self-custody solution built for real people, not just tech-savvy Bitcoiners. Created by Block, the company behind Cash App and led by Jack Dorsey, Bitkey is designed to make self-custody secure, easy, and stress-free.

Unlike exchanges or custodial wallets that hold your Bitcoin for you, Bitkey puts you in full control. Its unique 2-of-3 multisig system splits your private key into three parts: one in cold storage on the hardware wallet, one in the mobile app, and a backup held securely by Bitkey. You only need two out of three to access your funds, meaning you stay protected even if you lose a device.

What really sets Bitkey apart is its simplicity. There are no complicated seed phrases to manage, and the mobile app feels like a familiar finance app, making it easy to send, receive, and verify transactions. Plus, it integrates directly with exchanges like Cash App and Coinbase, so moving Bitcoin into self-custody is quick and hassle-free.

Worried about losing access? Bitkey has you covered with built-in cloud backups and a trusted contacts feature, so you can recover your funds without stressing over lost passwords or hardware failures. It even offers a free inheritance planning tool, ensuring your Bitcoin can be passed on to loved ones if something happens to you.

With Bitkey, self-custody doesn’t have to be complicated. It’s secure, easy to use, and built by a team that believes in financial freedom. Plus, you can get 10% off your Bitkey hardware wallet using the exclusive promo code BITKEYBLOCKDYOR at checkout.

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Types Of Cold Storage

There are three main types of cold storage, each with its own advantages and drawbacks. Several options are available for storing Bitcoin securely. Most Bitcoin wallets are designed so that you can still receive Bitcoin while keeping your private keys offline. By using a watch-only wallet or by even just re-using a receiving address multiple times, you can keep your public keys accessible and share addresses with others to receive Bitcoin directly into cold storage.

Single-Sig (Single Signature)

This is the simpler option, where a single private key controls access to your Bitcoin. While easy to use, it comes with a major risk: if you lose your key or device, your funds are gone. There’s no backup or redundancy, making it a single point of failure.

Multi-Sig (Multiple Signatures)

A more secure approach, multi-sig requires multiple keys to approve transactions, eliminating the risk of losing everything if one key is compromised. In the past, setting up multi-sig was complex, but Bitkey by Block—the company founded by Jack Dorsey—has made it simple and user-friendly. Now, multi-sig security is accessible to anyone, with no technical expertise required. Get Bitkey with an exclusive 10% discount using the official store link and code below. Ships to 95+ countries!

👉 Click here to get the Bitkey. Use code BITKEYBLOCKDYOR at checkout for an exclusive 10% discount.

Paper Wallets (Obsolete Method)

Before BIP-39 passphrases and hardware wallets, people used paper wallets—printed copies of their private and public keys, generated through sites like BitAddress. While it was a creative early solution, paper wallets are highly insecure by today’s standards. They’re easy to lose, vulnerable to damage, and lack proper backup options. Not recommended.

How To Setup An Hardware Wallet

Setting up an hardware wallet like the Bitkey wallet is simple and only takes a few steps. You’ll need both the Bitkey app and the Bitkey hardware device to get started. Follow these steps:

- Download the Bitkey App

Install the Bitkey app on your phone from the App Store or Google Play.

- Open the App & Start Setup

Launch the app and select “Set up new wallet.”

- Pair Your Hardware Device

- Hold your Bitkey hardware device LED facing up against the back of your phone.

- It should connect automatically using NFC (no need to charge it beforehand).

- If pairing fails, check if NFC is enabled on your phone in settings.

- Enroll Your Fingerprint

- Follow the on-screen prompts to scan and save your fingerprint.

- After setup, you can add more fingerprints in the settings.

- Create a Cloud Backup (Required)

- iPhone Users: Sign in to iCloud and enable iCloud Drive if you haven’t already.

- Android Users: Sign in to your Google account to enable backups.

- Enable Critical Alerts

- These alerts notify you of any security-sensitive actions related to your wallet.

- Email alerts are required, but enabling all channels is recommended.

- Set Up Transaction & Product Notifications

- Customize which notifications you want to receive for activity on your wallet.

- Accept the Terms of Service

- Review and agree to the terms to complete the setup.

That’s it! Your Bitkey wallet is now ready to use.

Good Cyber Hygiene Practices For Your Cold Storage

With multi-signature wallets like Bitkey, you eliminate the single point of failure. Your hardware wallet can stay at home without worry. If someone steals it, they can’t access your funds without your phone or cloud backup. There’s also no seed phrase to hide, as backups are encrypted in the cloud. This makes multi-sig a more secure and low-maintenance option compared to less secure single-sig wallets.

If you choose a single-signature wallet like Ledger or Coldcard, security is all on you. You must follow strict precautions to protect your seed phrase and hardware device. Here’s how:

Cold Storage Security Tips (for single-sig hardware wallets)

- Verify Your Backup – After setup, send a small amount of Bitcoin, wipe the device, and restore from your seed phrase to confirm it works.

- Keep Private Keys Safe – Store seed phrases securely, away from your signing device. Never keep them in the same place.

- Use Secure Storage – Consider safes, hidden compartments, or specialized products like Crypto Cloaks.

- Think Long-Term – Bitcoin’s value can increase quickly. Secure it now, so you’re not scrambling later.

- Separate Hardware & Keys – Never store your hardware wallet and seed phrase together. Keep backups fireproof, waterproof, and offline.

- Consider Geographic Distribution – Splitting and storing parts of your seed phrase in different locations adds another layer of protection.

For ultimate security, multi-sig reduces risks and simplifies storage, while single-sig requires extra caution and maintenance. Choose wisely based on your needs.

Cold Storage Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Full control over your Bitcoin | ❌ Requires careful backup management |

| ✅ Protected from online hacks | ❌ Risk of losing funds if seed phrase is lost |

| ✅ Multi-sig cold storage removes single points of failure, making it far more secure | ❌ Multi-sig can be slightly more complex to set up, but Bitkey simplifies this |

| ✅ Immune to exchange failures | ❌ Less convenient for frequent transactions |

| ✅ No reliance on third parties | ❌ Hardware wallets can be expensive |

| ✅ Resistant to malware and phishing attacks | ❌ Recovery can be complex for beginners |

| ✅ Can be stored in secure, hidden locations |

Bottom Line

In conclusion, Bitcoin cold storage is one of the most reliable ways to safeguard your assets, offering protection from online threats and long-term security. Whether using a simple single-sig setup or a more secure multi-sig configuration, it’s essential to follow best practices like secure backups and proper physical security.

While it may require more effort to set up and maintain, the peace of mind knowing your Bitcoin is safe from hacks and theft is invaluable. By taking the necessary precautions, cold storage ensures your Bitcoin is protected for years to come.

Frequently Asked Questions (FAQ) - Bitcoin Cold Storage

What is Bitcoin Cold Storage?

Why is cold storage important?

What are the different types of cold storage?

- Hardware Wallets

- Paper Wallets

- Multi-Signature Wallets